Investing is like a dance party; the person who teaches you the steps may not accompany you until the end. When you realize that time is a thief, it has already stolen your right to think seriously. Relaxed strings will never produce beautiful melodies, and trades that miss the rhythm will only cause funds to falter in their doubling steps. Whether it's a lion or an antelope, both must run—one to find food, the other to survive. Regardless of whether trading is about taking profits or cutting losses, it must be faced. Just don't let occasional losses ruin your trading mood. The sun sometimes fails to show up, but the night comes every day!

On the news front, analysts from Bank of America stated that the non-farm payroll data for September is good news for the market, but it gives investors more reasons to prepare for the latest inflation data.

Analysts at JPMorgan pointed out that the crypto market will be influenced by several key factors in the coming months, including the seasonal "Uptober" trend, potential interest rate cuts by the Federal Reserve, and the Ethereum "Pectra" upgrade. They mentioned that historical data shows over 70% of "Uptober" months have positive Bitcoin returns, which could have a positive impact on market behavior. Although the Federal Reserve's interest rate cuts have not yet significantly driven the crypto market, analysts believe that the market remains highly sensitive to macroeconomic factors and needs clearer catalysts for sustained growth. Additionally, the approval of Bitcoin ETF options could deepen market liquidity and attract more investors.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for 10.8

"Next year" will be a bull market, and it will be a big bull market. I hope everyone does not lose all their principal before the bull market arrives. You must take care of the USDT in your account; it is very precious. Only if you cherish it enough will the market reward you more. Don't think about making too much; always going all in and taking excessive risks will lead to disaster. Always thinking about making a big profit is heartbreaking to say; if you don't lose, that's already good enough. In the leveraged market, 90% of people lose money because they want to make big profits when they open positions, yet they only have dreams of making big money without the understanding and ability to do so.

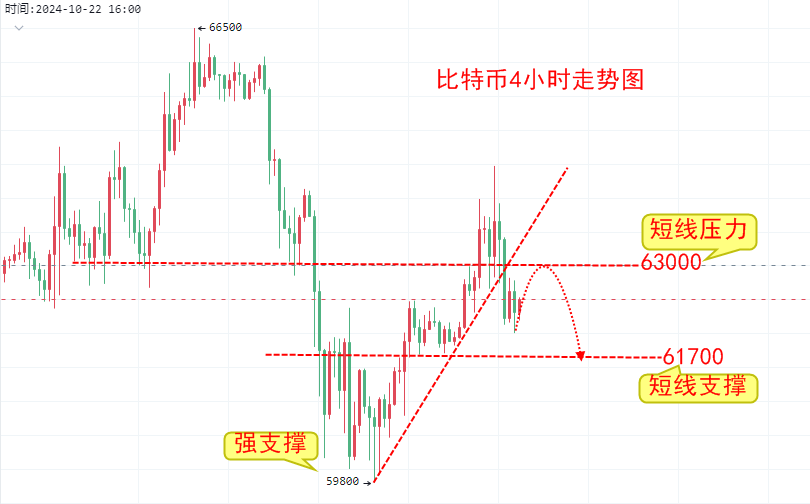

Returning to Bitcoin, the market has basically taken a roller coaster ride in the past two days, rising from around 61,700 on October 6 to about 64,450 last night, then starting to decline, continuing a downward trend today and giving back most of the gains, with the current price fluctuating around 62,500. Today's market is definitely dominated by bears, with short-term pressure around 62,800—63,000. When the market slightly rebounds to this level, we can enter short positions, with a stop loss at 63,500 and a take profit at 61,800. We will observe whether the 61,700 level will be effectively broken; if it breaks, it is likely to continue attempting to break below 60,000. If it does not, then it will rebound and consolidate. Meanwhile, if there is an opportunity around 60,000, we should still enter long positions, with a stop loss at 59,000 and a take profit at 62,000.

The same reasoning applies to ETH; the trend is basically the same as Bitcoin. The reference points are short-term resistance at 2,460 and strong resistance at 2,520, with short-term support at 2,390 and strong support at 2,300. In terms of operations, we can set up short positions around 2,460, with a stop loss at 2,520 and a take profit at 2,390. If it breaks below 2,390, we will follow up with short positions, targeting the 2,300 level. If ETH gives an opportunity around 2,300, we can enter long positions, with a stop loss at 2,250 and a take profit at 2,390.

Specific Operation Suggestions (based on actual market prices)

For Bitcoin around 62,800—63,000, when the market slightly rebounds to this level, we can enter short positions, with a stop loss at 63,500 and a take profit at 61,800.

Set up short positions around 2,460, with a stop loss at 2,520 and a take profit at 2,390. If it breaks below 2,390, we will follow up with short positions, targeting the 2,300 level.

Before the market moves, any analysis is correct and has its reasons, but no trade will be absolutely accurate; there are risks involved. Therefore, the premise for making money is to manage risk well. The market changes in real-time, and strategy points are for reference only and should not be used as entry criteria. Investing carries risks, and profits and losses are your own responsibility.

Many individual investors find it difficult to enter the trading door, often simply because they lack a guide. The questions you ponder may be easily resolved with a single prompt from an experienced person. Daily real-time market analysis, along with guidance from experience-sharing groups, and evening practical trading guidance groups are available for real-time support. Evening live broadcasts explaining real-time market conditions will be held irregularly.

For more real-time market analysis, please follow the public account: Chu Yuechen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。