On October 1st at 21:38 Beijing time, the White House stated that Iran is preparing to attack Israel, causing BTC to break below the upward trend line that had persisted for nearly a month since September, and it quickly accelerated its decline, subsequently testing the $60,000 level multiple times. The situation in the Middle East remains tense, with the Iranian military claiming to have prepared at least 10 plans to respond to Israeli military strikes.

On September 24th, the People's Bank of China announced the establishment of structural monetary policy tools to support the financial market, lowering the reserve requirement ratio by 0.5 percentage points and reducing the main policy interest rate by 20 basis points to provide long-term liquidity to the A-share market. The A-share index responded by rising, having increased by 26.95% by the close of today, as both China and the U.S. compete for global capital liquidity.

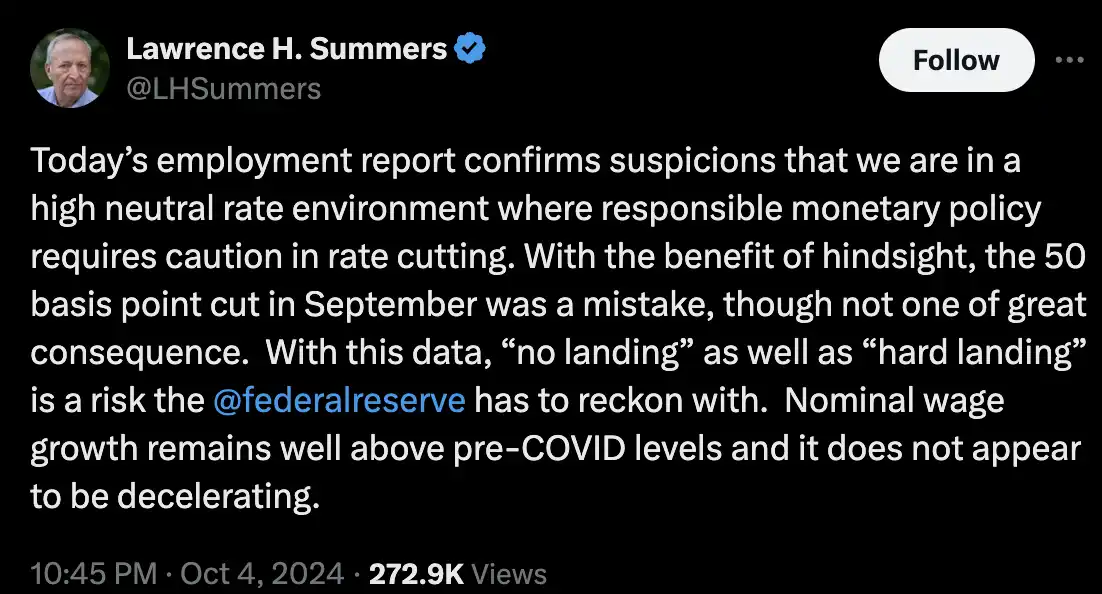

The U.S. economic data released in early October indicates a strong resilience in the U.S. economy, with a declining unemployment rate and non-farm payrolls exceeding expectations, along with upward revisions to the data for July and August. The U.S. job market was not performing poorly at that time, and the 50 basis point rate cut in September, based on weak employment data to guard against recession risks, seems to have been a mistake. Former U.S. Treasury Secretary Summers expressed a similar view. How will the Federal Reserve proceed with rate cuts in the future?

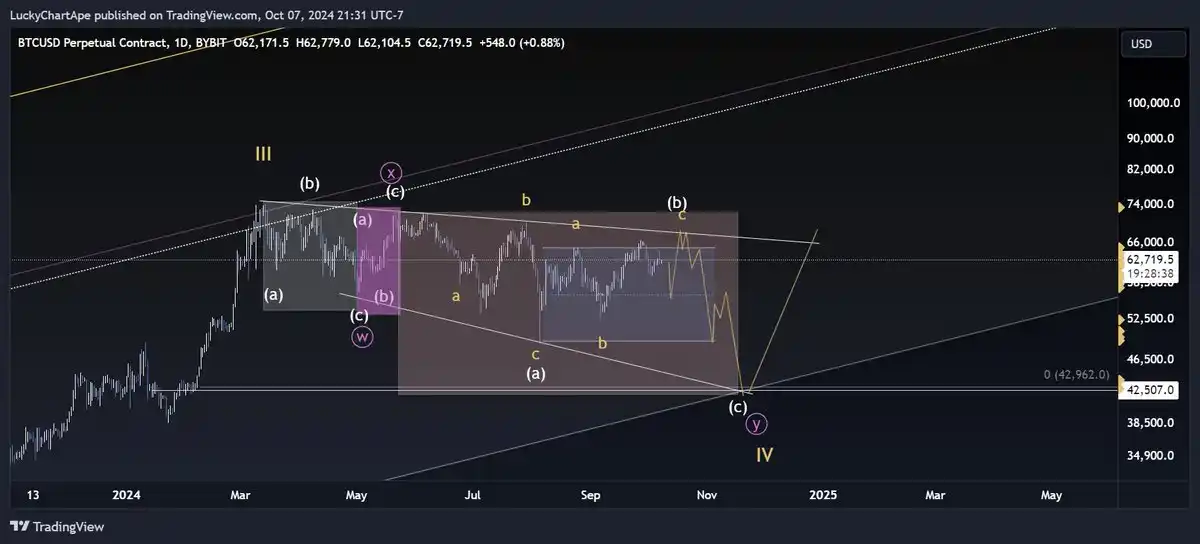

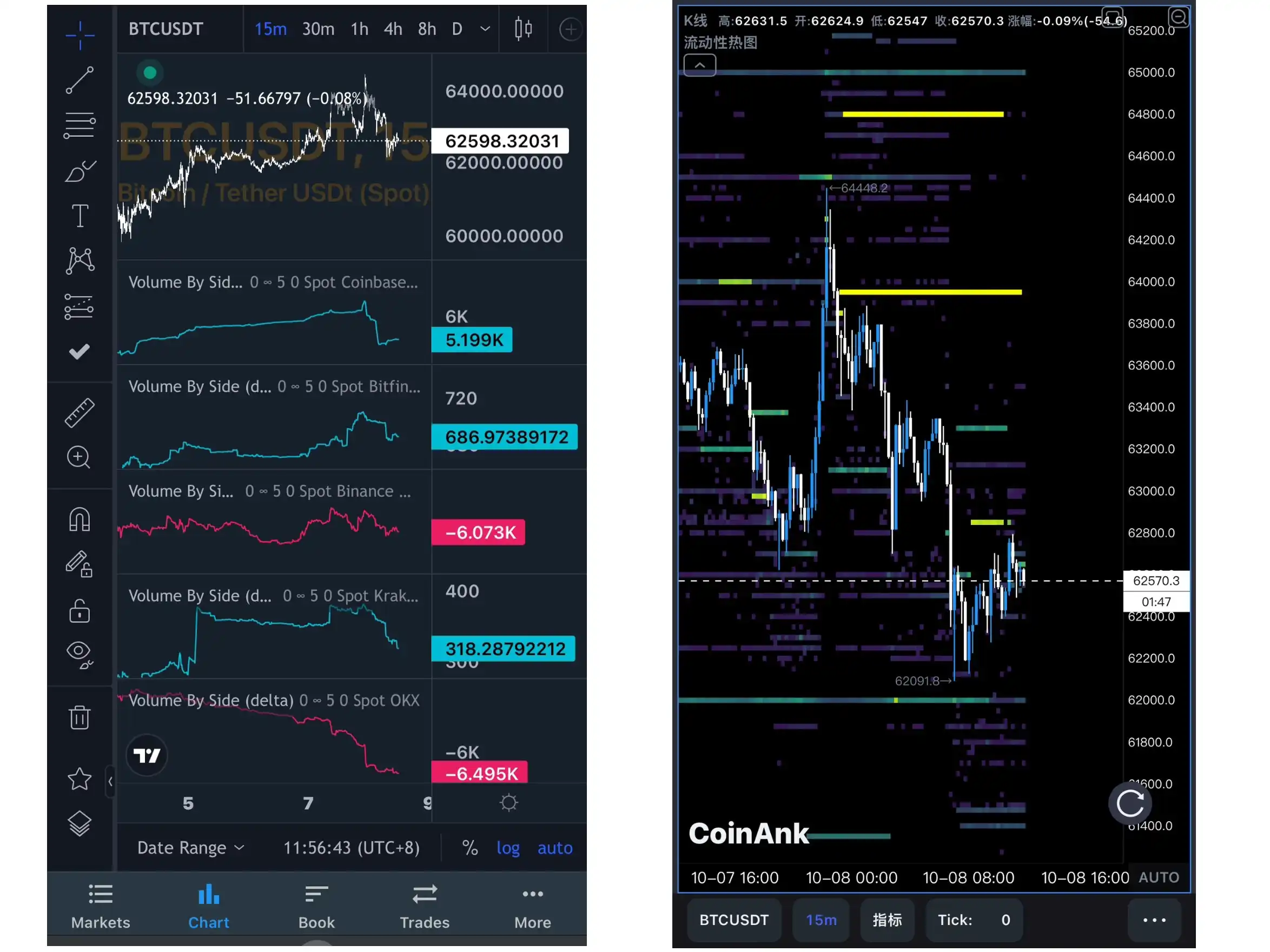

BTC has tested the $60,000 level multiple times and gradually decreased in volume, quickly rebounding to the $64,000 level. The moving averages on the four-hour chart are gradually converging. Will there be a significant market movement ahead? From February to mid-October, BTC has been undergoing wide fluctuations for a total of 8 months. Is this a high-low pattern, existing as a continuation of the upward trend, or is it a high-level peak that needs to seek more adjustments downward? Traders in the market have their own opinions.

Technical & Data Analysis

@luckychartape believes BTC is still in a bull market cycle. After the fourth wave finds support at $42,000, the fifth wave will begin, with a final target reaching the $260,000 price range.

@TraderChenge believes that if the market falls below $59,800, it may complete a potential bat pattern and continue a downward trend. However, until the market breaks below $59,800, I will not be bearish. My strategy before breaking below $59,800 will definitely be to buy low. Short-term market conditions are volatile and require continuous attention to this potential bat pattern.

@CycleStudies believes that after Bitcoin's price reached the overbought zone, it has retraced by 3.6%, about $2,319. Currently, it appears to be a mild retracement, and the bullish structure remains intact.

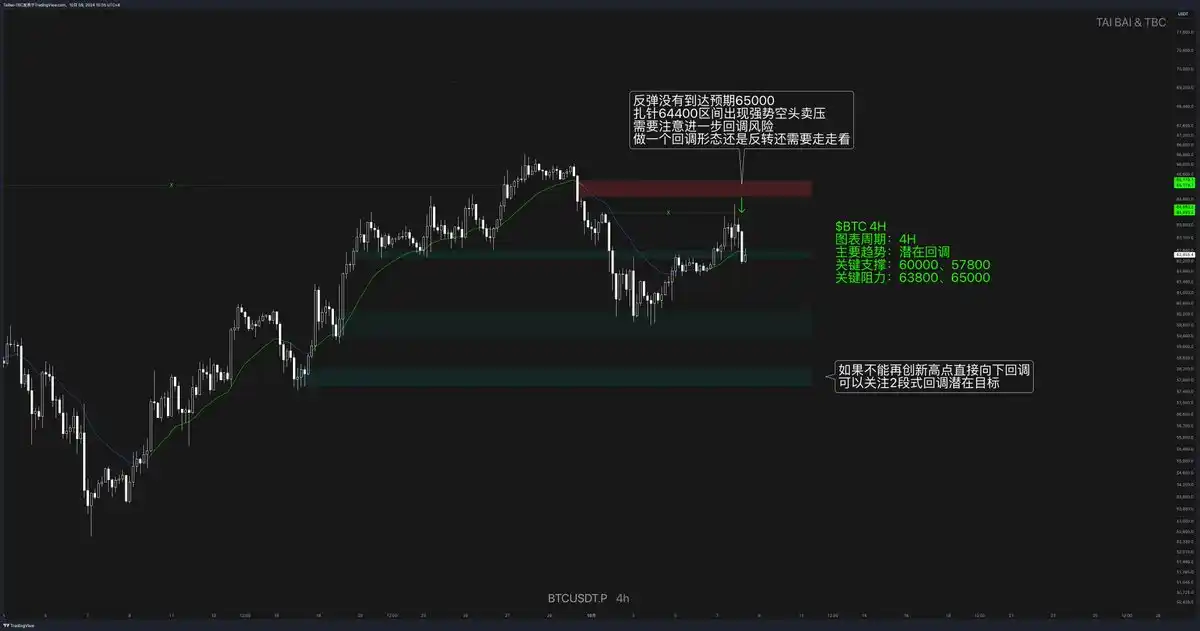

@CryptosLaowai believes that on a smaller scale, it is currently in a narrow fluctuation period between $61,000 and $64,000, and there may be a false breakdown at around $61,500, followed by a strong rebound after a large number of buy orders. It is unlikely to break through $66,000 to form a higher high; there should still be higher points than the previous small high of $64,400.

On a larger scale, it is believed that there will be a significant retracement to around $40,000, forming a pattern similar to a head and shoulders bottom. The real bull market will begin in 2025, and the current pattern will resemble that of late 2019 to early 2020.

@0xtaibai believes that the current main trend is a potential retracement. The rebound has not reached the expected $65,000, and strong bearish selling pressure appeared in the $64,400 range. Whether this is a retracement pattern or a reversal needs to be observed further. Attention should be paid to the risk of further retracement, with key support levels at $60,000 and $57,800, and key resistance levels at $63,800 and $65,000.

@Xbt886 views the market from the order book perspective, noting that most market participants and whales are selling their holdings, indicating a bearish outlook.

Macroeconomic Analysis

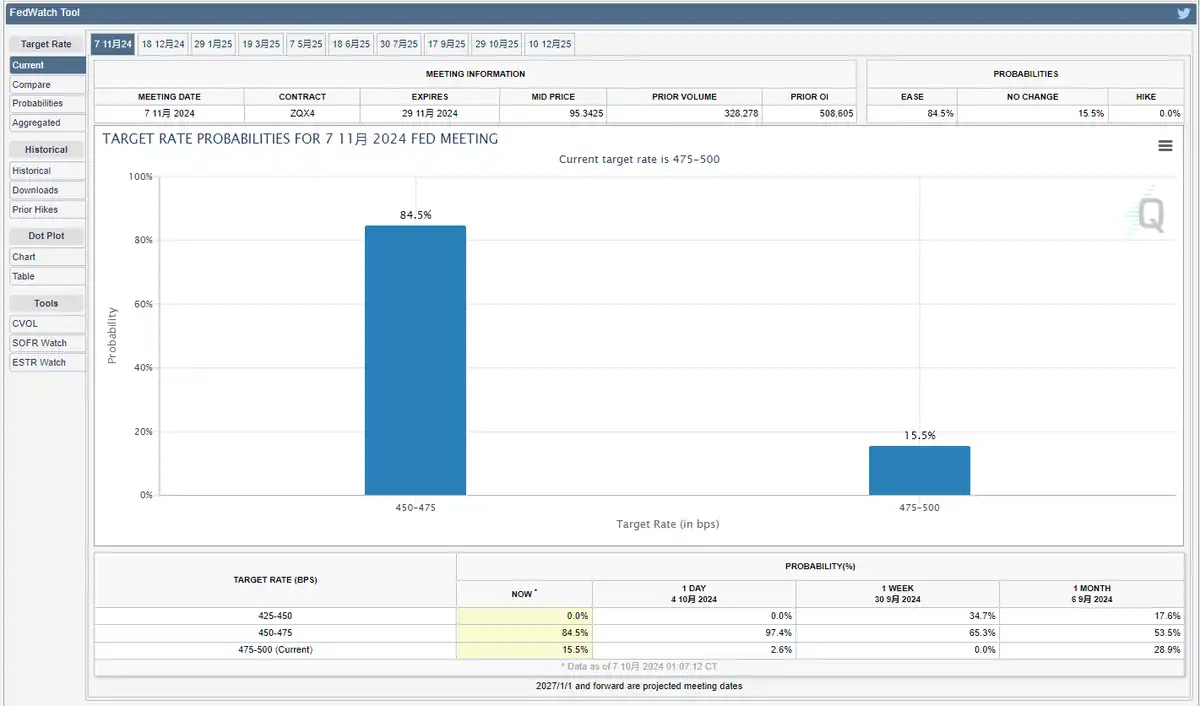

@CryptoPainter_X believes that as U.S. Treasury yields soar to 4%, it may be due to the competition for global capital liquidity in the A-share market. Market expectations for further aggressive rate cuts are beginning to waver. On the other hand, traders in the interest rate swap market are starting to bet on the possibility of no rate cut on November 7, with the probability gradually rising from 3% last week to 10% (currently reaching 15.5%).

Combined with recent financial maneuvers between China and the U.S., it is evident that both sides are becoming aggressive in competing for global asset liquidity. If the next inflation data report shows a rebound, it will force the market to further price in the possibility of pausing rate cuts in November.

From the perspective of the China-U.S. financial war, China is using the execution power of pandemic lockdowns to drive the stock market as a liquidity pool. Even if the Federal Reserve cuts rates by 50 basis points, it still does not match the scale of China's liquidity. Visually, the Fed's 50 basis point rate cut trial seems to have been a misstep, and it may continue to maintain a high-interest environment.

Next, attention should be focused on inflation data. If inflation data rises rapidly, there is indeed a possibility of no rate cut in November, making it difficult for BTC, as the tail end of the Fed's liquidity pool, to continue in a bull market.

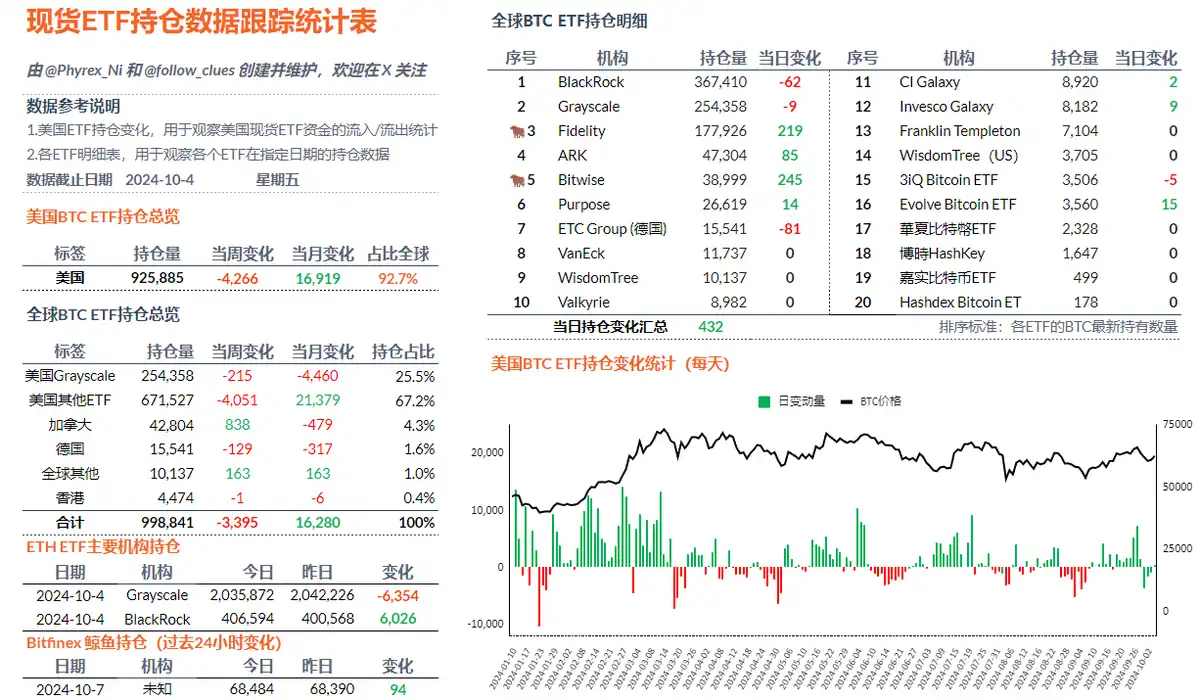

@Phyrex_Ni views the situation from the perspective of BTC ETFs, noting that in the past week, there was a net outflow of 3,394 BTC, ending three consecutive weeks of net inflows. Among these, 4,265 BTC flowed out from twelve ETF institutions in the U.S., with the only four-digit inflow last week coming from BlackRock's 2,100 BTC, indicating a significant decline in purchasing power. Currently, there is no large-scale selling, so BTC's price is more closely linked to macro sentiment. Unless there is a very clear negative factor, the pressure on the price is not significant.

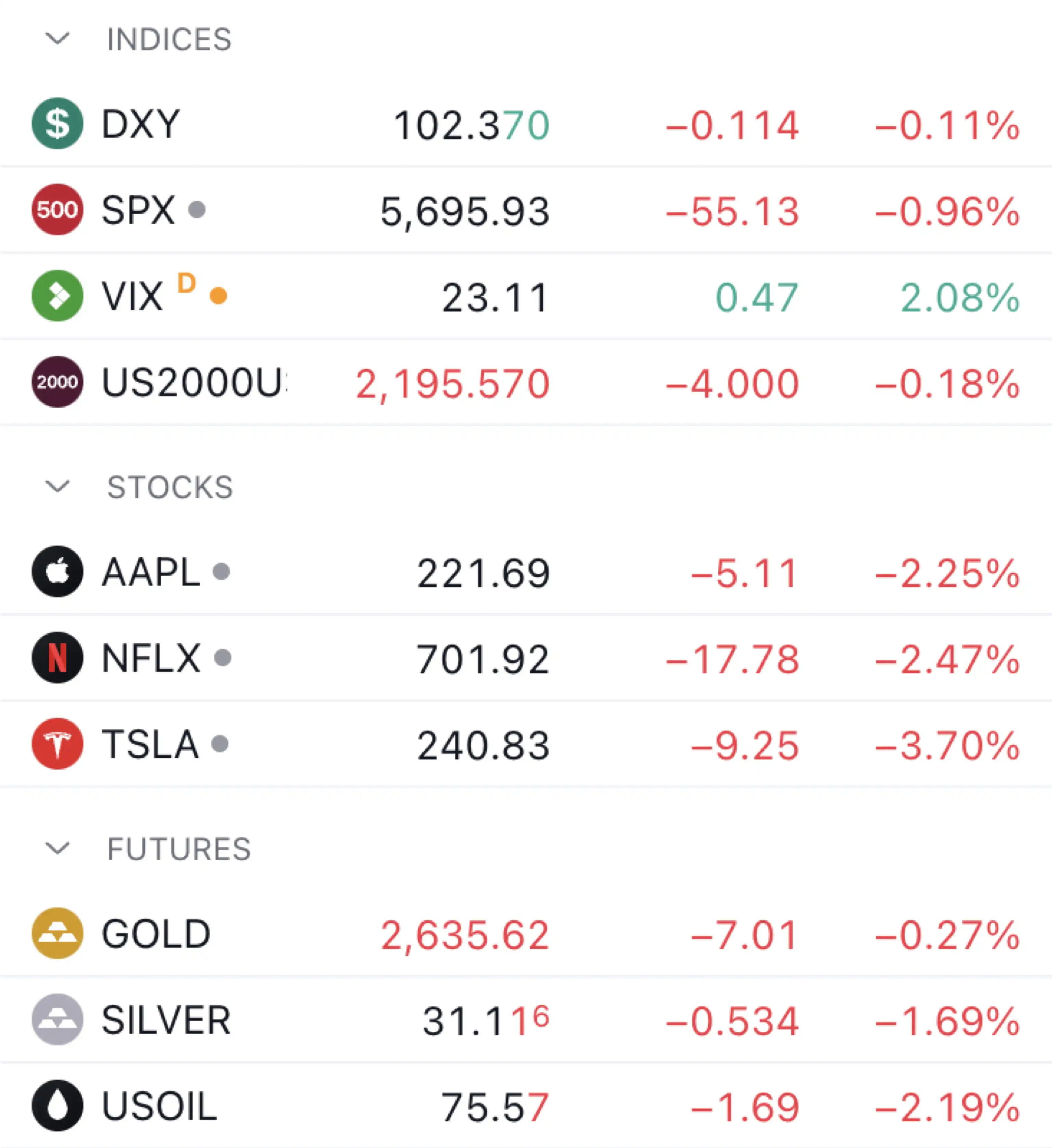

@MaoShu_CN believes that the excessively strong employment data on October 4th is somewhat overwhelming. Under the influence of such data, a strong U.S. economy is constructed, but the steepness of the U.S. Treasury yield curve reinforces the health and stability of the economy, which is not very friendly to the stock market in the short term. The U.S. stock market is currently not performing well, with slight declines. The U.S. dollar index has once again broken through 102, currently hovering around 102.4, continuing to strengthen, which is also a result of last week's data stimulus.

The 10-year U.S. Treasury yield has once again surpassed 4%, and the steep yield curve is a killer for the U.S. economy. Gold experienced a high rebound last week but has since retraced, currently maintaining high volatility. It is in a retracement phase, quoted at $2,635. After several days of consolidation, gold is likely to rise again this week, and geopolitical factors may also stimulate an increase in gold prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。