In summary: What is the real Meme here? Token distribution.

Author: 0xLouisT

Compiled by: Deep Tide TechFlow

Three days ago, 3AC launched a Meme fund called $3AC. Users of @bubblemaps quickly discovered that 80% of the supply is concentrated in a single cluster.

However, curiosity drove me to dig deeper—what exactly are Su and Kyle up to? Are these former billionaires really going to make a comeback?

Presale

On-chain traces show that the team raised 750 ETH (approximately $2 million) from about 25 investors in a private presale. The participating wallets are closely associated with the bobocoineth team, Milady team, izebeleth, maybectrlfreak, PandoraERC404, and OXFUNHQ team, which is not surprising.

Issuance

The issuance of the 3AC token is quite attractive. The 3AC team roughly split the proceeds from the private sale in half. They allocated 317 ETH ($850,000) for liquidity on Uniswap V2, locking it for a year. The remaining 336 ETH ($880,000) is distributed across eight wallets, which belong to the team that purchased $3AC ahead of its listing. Currently, the returns from these wallets range from 10x to 30x their cost basis.

Another early buyer, possibly tipped off by an insider, used @BananaGunBot (great product!) to scoop up $3AC worth $320,000, which peaked at $1.23 million. He cashed out at the high but changed his mind and repurchased the same amount a few minutes later. Now, the value of these $3AC has dropped by over 50%.

Token Economics

If you think the "low circulation, high FDV" model is bad, just wait to see 3AC's "low circulation, high concentration" model.

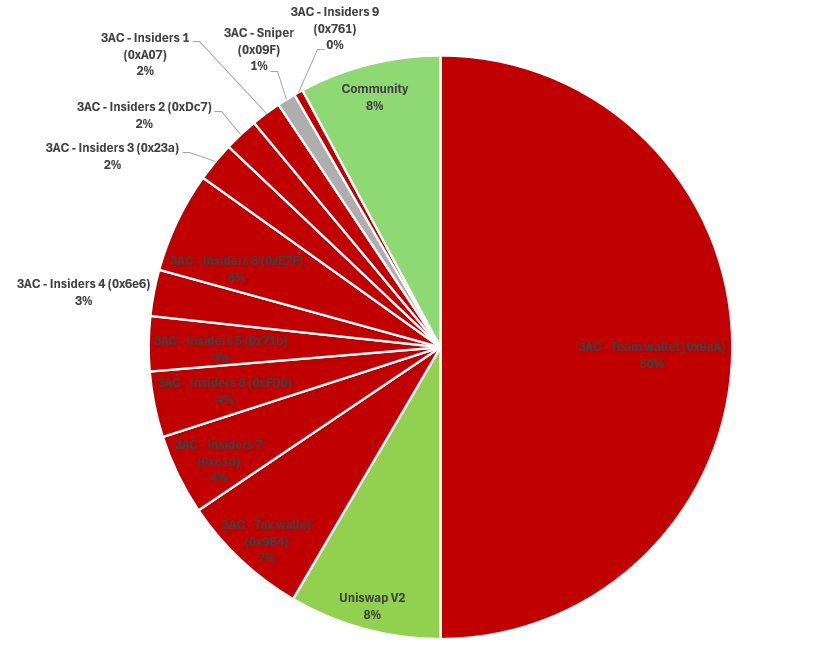

In addition to the substantial portion of supply early purchased by those eight team wallets, 3AC allocated 50% of the supply to itself at the token genesis (0x9aA17AF45fE866f88A9a82Eb55fA250c2fF43597).

The token also charges a 1% tax on every buy and sell, with the tax flowing into a tax wallet (0x9B427aC936B8B25266Cd9DA54C667A8ba2353C5B), which has accumulated over 7% of the total supply.

Most (but not all) of these wallets were merged a few hours ago into a primary team and insider wallet (0x60244d0DD5FDebE73E2E25577d78Ad1Ad07f2430).

In summary, we have this striking chart, with tokens held by insiders marked in red, while community and liquidity are marked in green:

8% Community

8% Liquidity

84% Team and Insiders

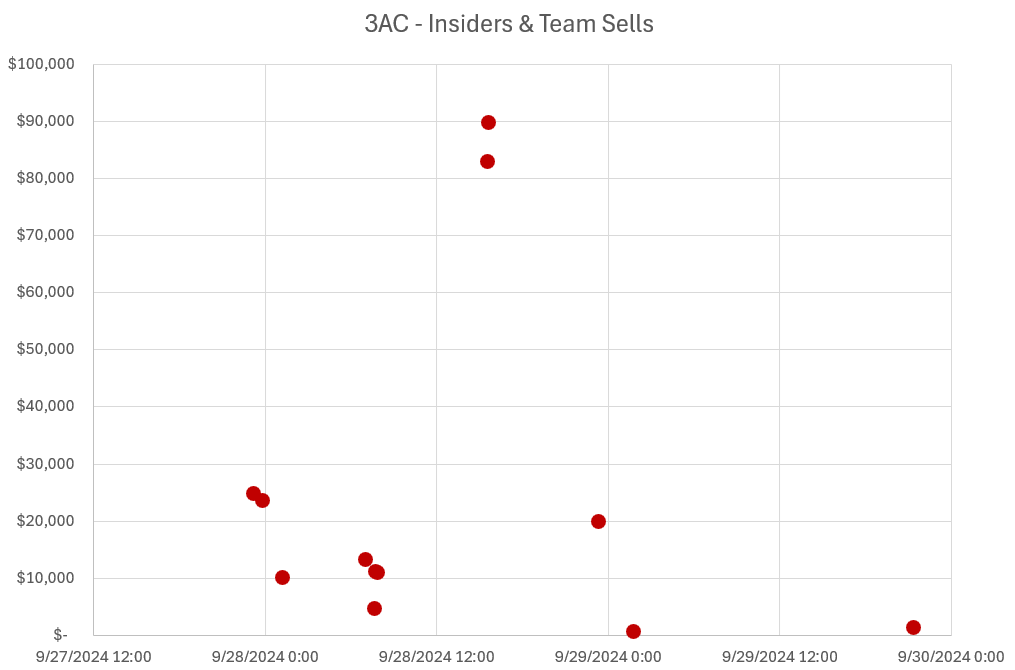

Presale participants have begun receiving distributions of 3AC tokens, with amounts per wallet ranging from $25K to $100K. It is worth mentioning that less than 25% of presale participants have sold their first distribution of 3AC. However, several presale participants have already cashed out multiple five-figure sums.

At this point, it should be clear that purchasing this token means placing trust in a small group that controls over 84% of the supply. Some might even call it a concentrated token. The choice is yours: decide whether you want to participate in this game.

In summary: What is the real Meme here? Token distribution. Are these former billionaires really going to make a comeback?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。