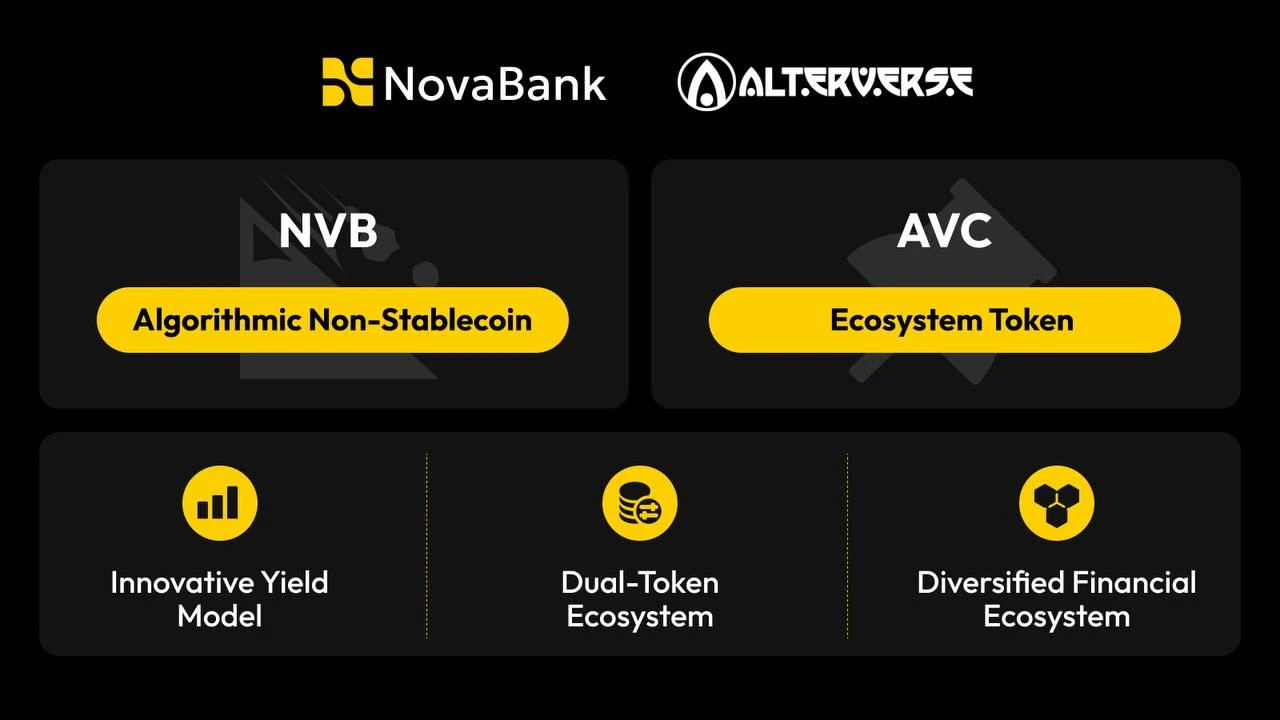

With the rapid development of decentralized finance (DeFi), more and more innovative projects are driving continuous transformation in this field. NovaBank has emerged in this context, based on the successful model of the algorithmic stablecoin OHM from Olympus DAO, and has iteratively innovated on this foundation. NovaBank has built a brand new on-chain banking protocol through its dual-token ecosystem and diversified Web3 ecosystem integration, as well as a fission incentive mechanism, aiming to provide users with more free and transparent decentralized financial services.

1. Introduction to NovaBank

NovaBank is an on-chain banking protocol based on the DeFi 3.0 architecture, with its core being the algorithmic stablecoin NVB. NovaBank draws on the underlying economic model of Olympus DAO—OHM, which is a proven and successful business model that ensures the long-term stability of the protocol. Through the automatic execution of smart contracts, NovaBank achieves fully on-chain transparent operations for token issuance, market regulation, and profit distribution.

NovaBank not only inherits the robust mechanisms of OHM but also significantly enhances community fission speed through its profit model, dual-token ecosystem gameplay (NVB + AVC), and diversified integration in the Web3 field, achieving ecological integration of private and public domains, and making the overall protocol operation more stable.

2. NVB—Algorithmic Stablecoin

NVB is the core token of NovaBank, adjusting its supply and price through an algorithmic mechanism to ensure market stability. The issuance of NVB is based on market supply and demand, minted with a risk-free value (RFV) of 1 USDT as support, ensuring that the token can maintain stability and possess long-term growth potential without external support.

Drawing on the OHM model of Olympus DAO, NovaBank further enhances the utility and growth potential of the token through its profit model and contribution value system. Compared to traditional stablecoin models, NVB's algorithmic model allows for more flexible market regulation, effectively preventing excessive manipulation in centralized financial systems.

3. Six Core Contracts of NovaBank

Treasury Contract: The treasury contract is responsible for managing NovaBank's asset reserves, ensuring the safety and stability of protocol assets. Through continuous asset accumulation, the treasury provides minting support for NVB, ensuring the long-term sustainable development of the protocol.

Sales Contract: The sales contract regulates the issuance of tokens through a market supply and demand balance mechanism, ensuring that the price and liquidity of NVB remain at healthy levels.

Bond Contract: The bond contract provides users with the opportunity to purchase NVB at a discount, allowing users to inject more liquidity and RFV into the protocol by holding bonds, ensuring stable fund flow while enjoying low-cost token acquisition opportunities.

Staking Contract: The staking contract allows users to earn stable compound returns by staking NVB. Users' staking rewards are automatically compounded, increasing the stability of asset appreciation and helping the platform maintain market liquidity.

Yield Vesting Contract: This contract ensures that users' earnings are gradually released according to a predetermined cycle, avoiding short-term fluctuations affecting long-term returns, providing users with higher fund security and return stability. Additionally, users can accelerate yield release by burning the ecological token AVC, gaining greater flexibility.

Contribution Value Algorithm Contract: NovaBank rewards users for their contributions through a contribution value algorithm; the greater the contribution, the more rewards. This mechanism encourages users to actively participate in platform development and enhances the overall activity of the protocol.

4. Innovative Highlights of NovaBank

Dual-Token Ecosystem Gameplay: In addition to NVB as the core token, NovaBank has also introduced the ecological token AVC (Alterverse led by Binance). AVC not only powers the economic cycle of NovaBank but also accelerates community fission and user participation. Users can participate in NVB single-token staking to obtain extremely high APY returns, introduce AVC burning to accelerate yield release, while part of the ecological burning returns is periodically repurchased and burned by DAO voting, truly achieving bidirectional empowerment of private and public domains, greatly enhancing user participation and community stickiness.

Decentralized Governance: NovaBank relies entirely on community governance, allowing users to participate in protocol decision-making and voting by holding NVB. This decentralized management model ensures the transparency and fairness of the protocol, avoiding manipulation of the financial system by centralized institutions.

Diversified Web3 Ecosystem Integration: NovaBank is not just a DeFi protocol; it is also committed to integrating diverse application scenarios in the Web3 field, such as NFTs, DAO governance, GameFi, payments, and RWA, enhancing user activity and community interaction on the platform. As the treasury appreciation plan develops, it will also provide various financial services in the future, such as lending, wealth management, and profit distribution, offering users more choices for asset management and appreciation.

Continuously Innovative Profit Model: NovaBank's profit model gradually releases users' staking rewards through vesting periods, and users can accelerate yield release by burning AVC. This flexible and controllable profit model allows users to enjoy more autonomy while obtaining long-term stable returns.

Community Fission and Combination of Private and Public Domains: Through the ecological dual-token model, NovaBank successfully combines private community and public ecology. Users can not only earn returns through staking but also gain more token rewards by participating in fission incentive policies, thereby promoting community expansion and ecological self-appreciation.

5. Economic Model of NovaBank

The underlying economic logic of NovaBank draws on the OHM model of Olympus DAO, with its token NVB adjusting supply through an algorithmic mechanism and supported by a risk-free value (RFV) of 1 USDT. This mechanism ensures the long-term stable growth of the token and provides high market adaptability.

Additionally, NovaBank's economic flywheel model includes both static and dynamic returns. Users can earn static compound returns by staking NVB while obtaining dynamic returns through the contribution value reward system and bond incentives. A 0.4% block reward every 8 hours (initial balance point) ensures the long-term interests of staking users.

6. How NovaBank Solves Traditional Financial Problems

Breaking Down Centralized Barriers: NovaBank's decentralized protocol allows users to no longer rely on centralized financial institutions, enabling them to directly control their assets and returns, eliminating dependence on traditional banks and financial intermediaries.

Transparency and Auditability: All operations of NovaBank are completed on-chain through smart contracts, publicly and transparently, allowing users to query and audit the protocol's operations at any time, ensuring the safety of funds.

Lowering Financial Participation Barriers: Through algorithmic mechanisms, NovaBank can dynamically adjust market liquidity, allowing users to easily participate in the DeFi ecosystem without the need for extensive financial knowledge and complex operations.

7. Future Outlook of NovaBank

Based on the underlying algorithmic mechanism of Olympus DAO, NovaBank combines innovative diversified ecological economic models to successfully create a decentralized on-chain banking protocol. NVB serves as the core token, while AVC acts as the driving force of the NovaBank 1.0 ecosystem, providing users with long-term stable returns and diverse participation methods.

NovaBank is not only an innovative decentralized on-chain banking protocol but also a complete crypto financial ecosystem. Through algorithmic adjustment, decentralized governance, and diversified ecological models, NovaBank achieves efficient integration of the community and users, greatly promoting the development of decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。