Native USDC is about to launch on Sui, and NAVI may rise again.

Author: TechFlow

To be fair, we are experiencing a cycle that is not particularly positive. Whether it's the lack of mutual support or the MEME resistance movement, there is always a hint of self-mockery from the community behind the seemingly lively scenes. However, with the interest rate cuts taking effect, the market has finally reunited with the long-lost optimistic sentiment.

At the beginning of the highly anticipated fourth quarter, Sui has captured the community's attention with its leading growth.

According to data from DeFi Llama, Sui's TVL has surpassed $1 billion, with an increase of over 250% in the past two months, and the token price has broken through $1.72, with a 30-day increase of over 109%.

Beyond the data, Sui has also officially announced important ecological developments such as the Grayscale SUI Trust Fund and the upcoming launch of native USDC, which not only raises expectations for the future direction of the Sui ecosystem but also ignites the community's enthusiasm for laying out the Sui ecosystem:

After all, the Solana ecosystem produced applications with significant wealth effects, such as Raydium, during the last bull market. In the face of the thriving Sui ecosystem, who can seize the opportunity to reignite the enthusiasm for Sui and the entire crypto industry? With TVL surpassing $400 million, firmly establishing Sui's leading position in DeFi, the lending protocol NAVI has become the top choice for many seeking to unlock the wealth code of Sui.

This article attempts to provide more readers with reference choices on how to better participate in the Sui ecosystem through project ecological positioning, on-chain data comparisons, and recent positive developments.

Sui TVL Surpasses $1 Billion, NAVI's Contribution is Indispensable

In the past few months, if you have paid even a little attention to the market, you cannot have missed Sui's impressive on-chain performance.

According to data from DeFi Llama, on August 5, 2024, Sui's TVL was still hovering around $500 million, but now Sui's TVL has surged to $1.3 billion, ranking among the top ten public chains (currently ranked eighth), with an increase of over 250% in just two months.

In fact, since the beginning of 2024, Sui has shown a continuous and vigorous growth momentum, with TVL skyrocketing from nearly zero to a peak of $1.3 billion. This kind of explosive growth is unique in the development of public chains during this cycle.

We know that the prosperous development of on-chain data mainly relies on the activity of the ecosystem, and DeFi is the main contributor to ecosystem activity. Therefore, when analyzing the driving forces behind Sui's ecological growth, DeFi is undoubtedly a key area worth in-depth study.

In the DeFi field, DEX, lending, and stablecoins have long been regarded as the three driving forces for development, playing an indispensable role in promoting the healthy development of the ecosystem. Especially in lending, as an important application scenario of decentralized finance, decentralized lending's TVL has long surpassed DEX, becoming the largest track for capital accommodation in the DeFi field.

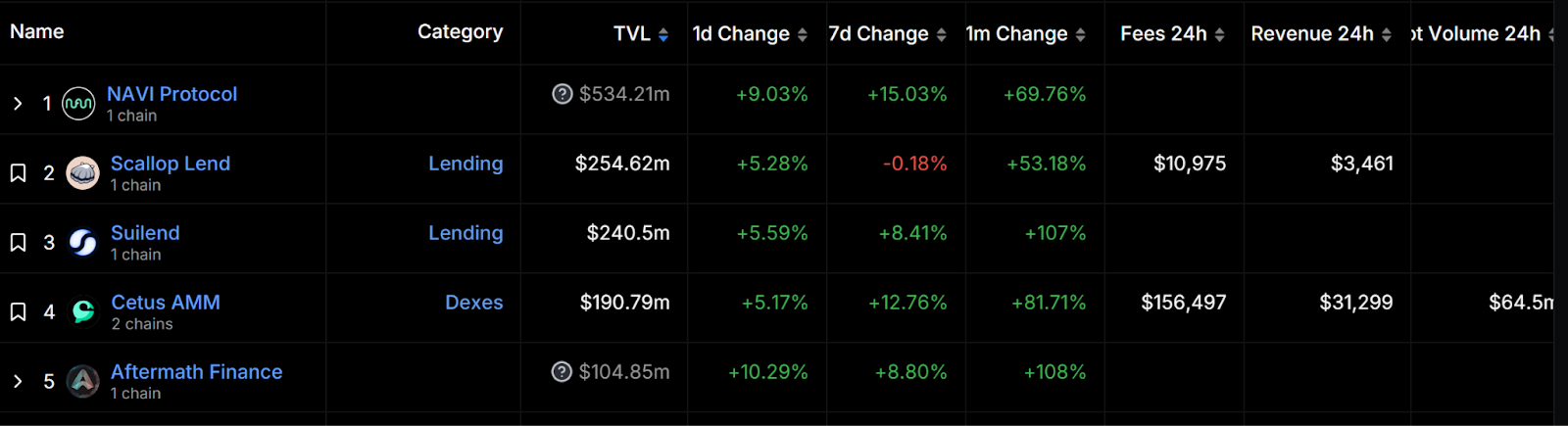

From DeFi Llama data, we can also see that among the top five projects in the Sui ecosystem by TVL, all are DeFi projects.

From the perspective of TVL data, NAVI Protocol ranks first in the Sui ecosystem with an absolute advantage of over $530 million in TVL; Scallop Lend ranks second with a TVL of around $250 million; Suilend ranks third with a TVL of over $240 million, with a small gap between the second and third places.

It is worth noting that NAVI alone contributes nearly 40% of the entire Sui ecosystem's TVL, and its TVL is more than twice that of the second place. This not only demonstrates NAVI's competitive advantage in the Sui ecosystem but also places NAVI in a strong leading position.

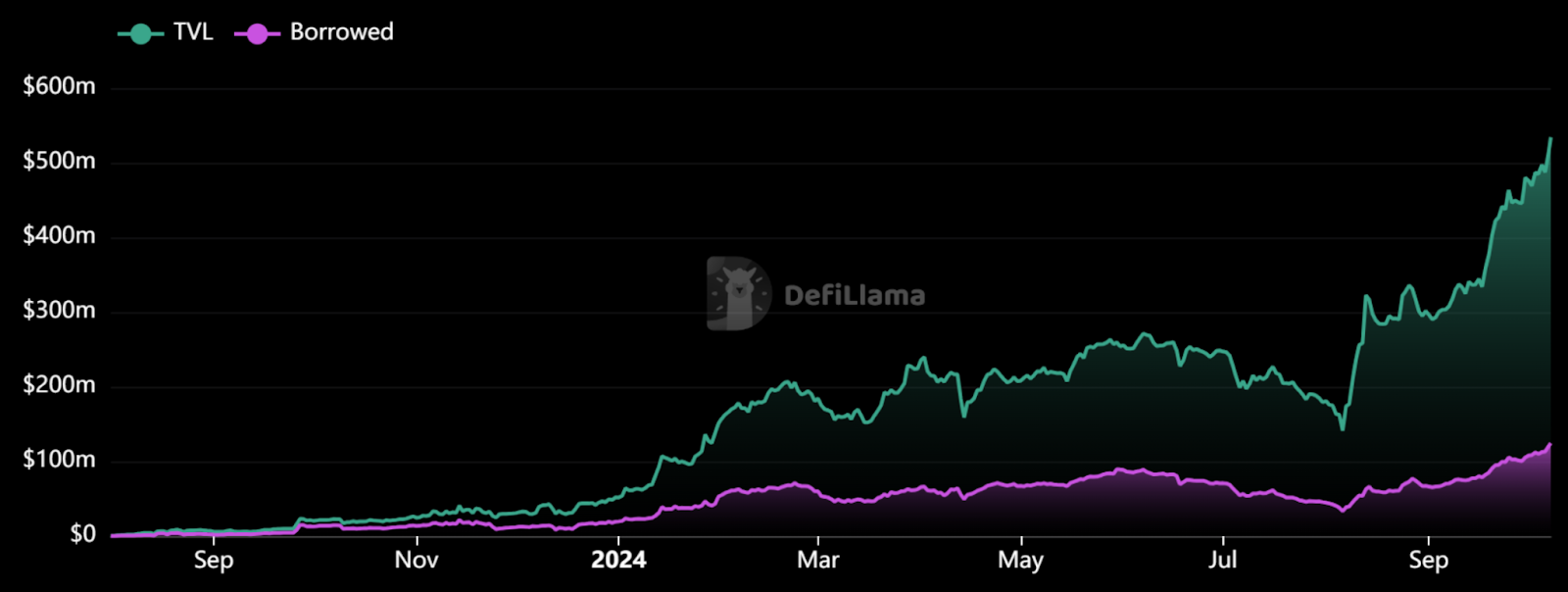

Of course, while TVL is an intuitive data point, it is also a general figure. For lending projects, a more meaningful comparison lies in the borrowing volume, which is the total amount of assets borrowed by users through the protocol. This data can better measure the usage and liquidity of the lending protocol.

From the perspective of borrowing volume data, NAVI's borrowing volume has surpassed $120 million; Scallop's borrowing volume has exceeded $88 million; Suilend's borrowing volume has surpassed $57 million. Compared to other lending protocols, NAVI still excels in real lending business performance.

Moreover, according to data from NAVI's official website, NAVI has over 850,000 active users, which further reflects the demand and trust users have in the NAVI lending platform.

Throughout history, the importance of an outstanding lending protocol in a public chain ecosystem is self-evident. It not only plays a crucial role as a source of capital and traffic but also serves as a key source of underlying liquidity for the entire ecosystem, bringing higher capital efficiency and better liquidity to the ecosystem.

Through DeFi Llama data, we can also find that the top three TVL projects in the Sui ecosystem are all lending projects, which makes it easy to see the fierce competition in the lending track of the Sui ecosystem.

With its strong leadership position demonstrated in TVL, borrowing volume, active users, and other aspects, NAVI continues to stand out in fierce competition, not only as the strongest driving force behind the rapid growth of the Sui ecosystem in the eyes of many but also as an opportunity that most users cannot afford to miss in hunting for wealth opportunities in the Sui ecosystem.

Looking beyond the phenomenon to the essence, let us now delve into the specific technological innovations and fundamentals of the project to explore the factors behind NAVI's success, and by outlining the upcoming milestones of NAVI and the Sui ecosystem, we will investigate the project's future growth potential.

Lending + LST Dual-Drive: Becoming a One-Stop Liquidity Hub for Sui and MOVE Ecosystems

Specifically, NAVI's business can be divided into two main parts:

NAVI Lending: This is NAVI's most basic business, allowing users to participate in the Sui ecosystem as liquidity providers or borrowers;

Volo LST: NAVI has made a deep layout in LST by acquiring the leading liquidity staking protocol Volo in the Sui ecosystem, supporting users to earn more rewards by staking SUI tokens to obtain liquid staking tokens vSUI.

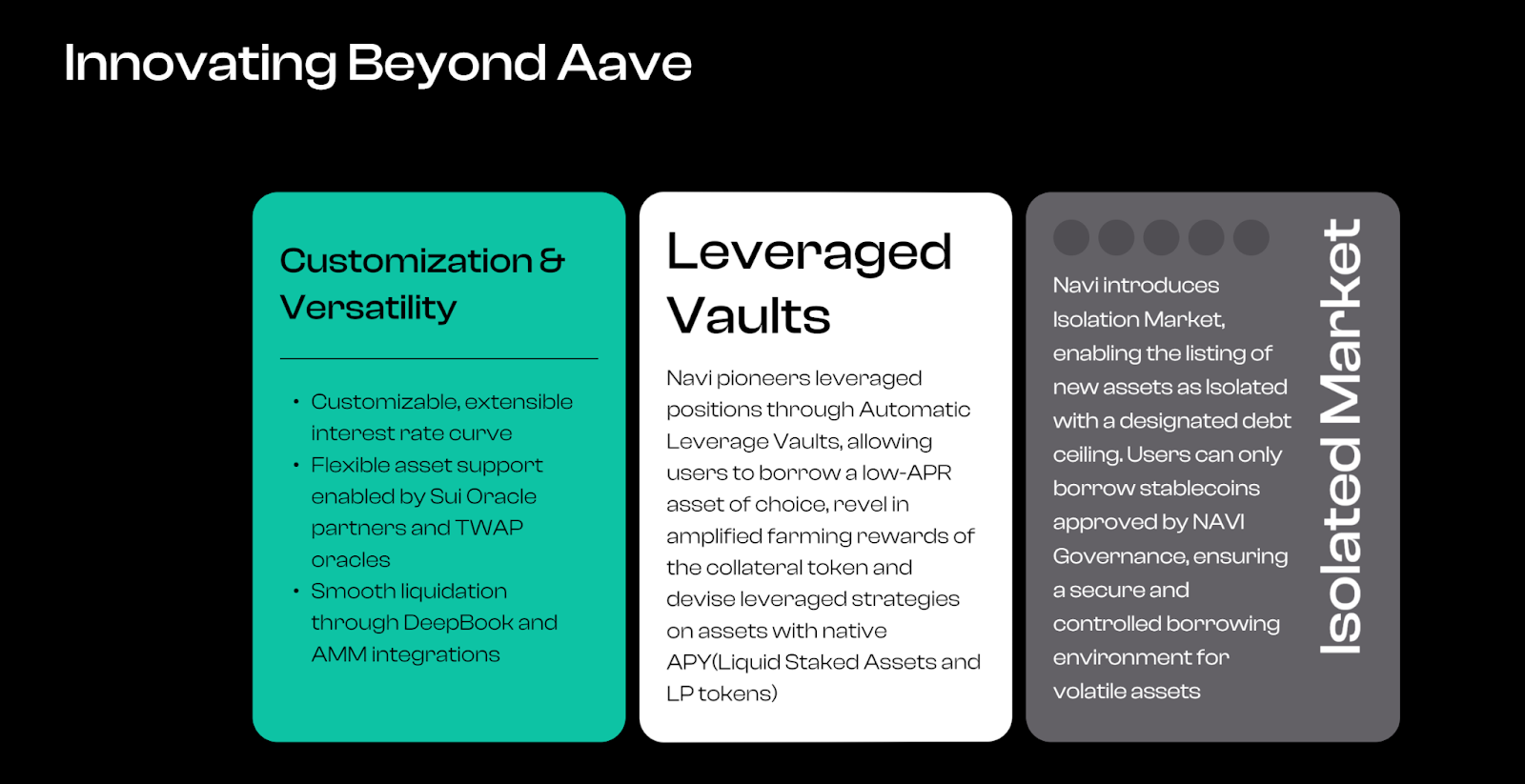

In terms of lending, through innovations such as "leverage vaults" and "isolation mode," NAVI has long been known for its higher capital efficiency, stronger security, and better user experience.

The "leverage vault" includes multiple functions: the automated leverage feature meets users' needs for repeatedly borrowing assets to further enhance capital utilization, with simple and intuitive operations; low annual interest rate asset lending, high mining returns, and leverage strategies for native APY assets (liquid staking assets and LP tokens) further release capital efficiency and enhance user returns.

The "isolation mode" ensures transaction security: this feature requires new assets to be collateralized only after being approved by NAVI governance, further ensuring that users can participate in new trading opportunities with minimal risk.

In addition, in terms of UI presentation, product functions, and other details, NAVI also has several deeply resonant designs: the introduction of the health factor (Hf) concept clearly and intuitively shows users their lending risks; the 24-hour notification feature helps users grasp market fluctuations in real-time and make timely decisions; the transaction history feature allows users to easily check all interactions with the NAVI protocol with just a few clicks… With multiple iterations of the product, NAVI has received unanimous praise from the community for its product experience, which has allowed NAVI to grow into a leading lending project in the Sui ecosystem in a short time since its inception in 2023.

In terms of LST, acquiring Volo and deeply integrating its business is a differentiated ace that NAVI cleverly plays compared to other lending protocols.

We know that liquidity is the lifeblood of DeFi development, and LST was born to release liquidity. Since Ethereum transitioned from PoW to PoS, bringing the staking narrative, the popularity of LSTFi has surged, being seen as the next trillion-dollar track.

According to Defillama data, Volo's current TVL has reached $83.7 million, with the number of new stakers in September reaching a peak of 891 in a single day. Whether in terms of TVL or the number of stakers, Volo ranks first among SUI ecosystem LST protocols.

By acquiring Volo, NAVI further integrates the upstream and downstream of liquidity from a business perspective, aiming to provide users with deeper liquidity, flexible composability, and richer yield compositions, allowing NAVI users and stakeholders to enter a larger market and enjoy various cross-vertical industry synergies.

From a market positioning perspective, integrating Volo helps NAVI quickly capture over 30% of the Sui LST market, not only further expanding NAVI's service coverage but also driving NAVI to build a central market for efficient capital circulation with its dual-drive strategy, making a significant step towards becoming a "one-stop liquidity hub" for Sui and the entire Move ecosystem.

Beyond the specific business logic, several functional iterations and upgrades of NAVI in the third quarter of 2024 have further improved its functionality and optimized the product experience, also driving significant growth in its on-chain data.

In September of this year, NAVI launched a leverage strategy that helps users more easily use leverage strategies through one-click operations based on Sui PTB, allowing for a simpler way to participate and achieve more considerable returns.

Just recently in August, NAVI announced the launch of the DApp "NAVI Pro," supported by Mysticeti and Sui's new consensus algorithm. This product includes a rich UI interface, advanced DeFi strategies, better liquidity management, community building tools, and developer onboarding guides, aimed at further lowering the participation threshold for DeFi in the Sui ecosystem and providing users with a richer and more advanced selection of DeFi strategies.

Since the launch of these two features, NAVI has shown significant growth in terms of new on-chain users, active on-chain transactions, and TVL, and has received widespread acclaim from the broader DeFi community.

Beyond product advantages, NAVI has also garnered favor in the capital markets:

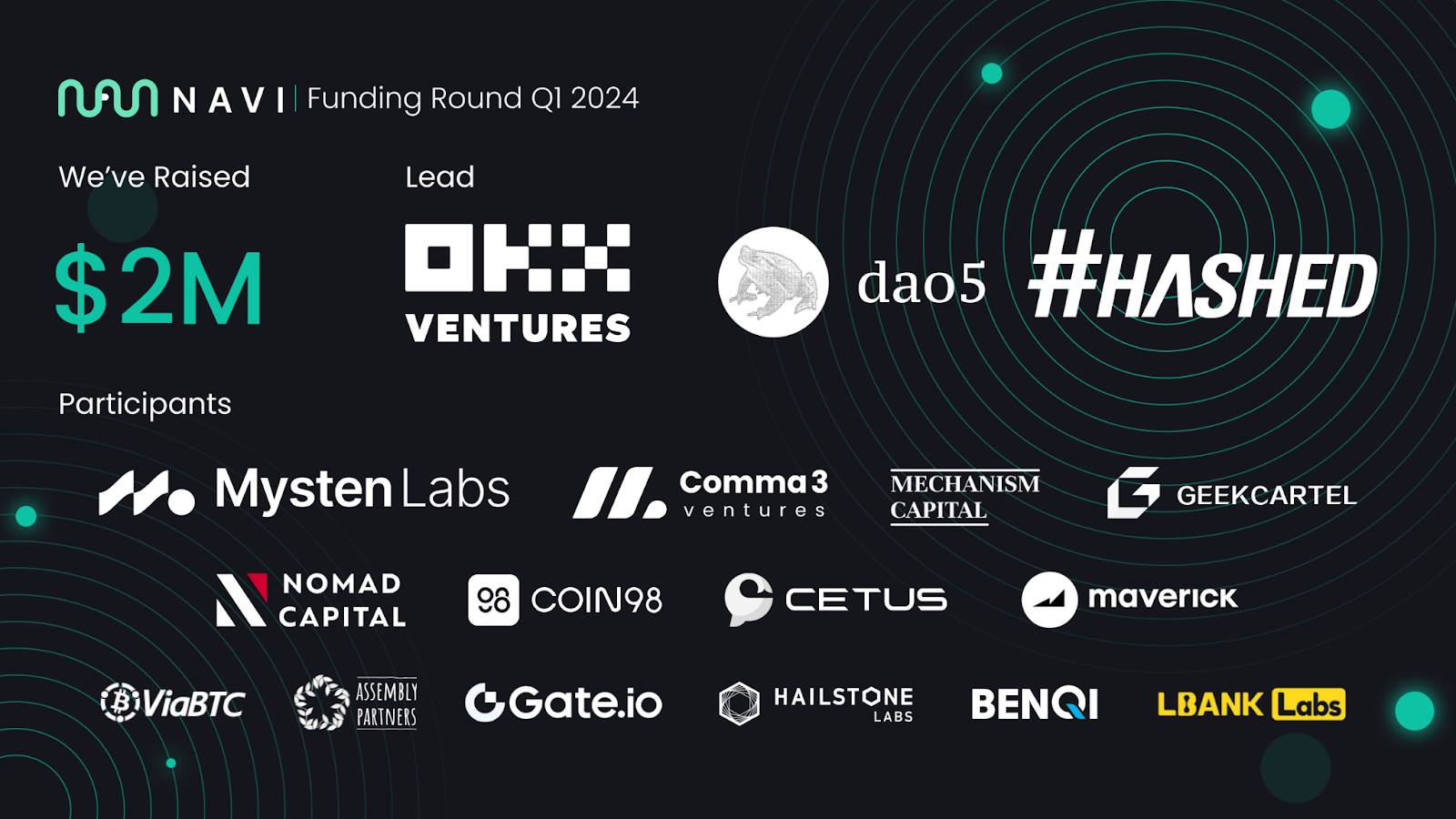

Earlier this year, NAVI announced the completion of a $2 million financing round to expand its innovative integrated lending, borrowing, and LSDeFi platform.

This round of financing was co-led by OKX Ventures, dao5, and Hashed, with other participating investment institutions including Mysten Labs, Comma3 Ventures, Mechanism Capital, Coin98 Ventures, Gate.io, and LBank Labs.

The backing of well-known VCs not only represents the recognition of NAVI's narrative logic and future development by capital but also lays a more solid foundation for NAVI's continued positive development with stronger financial and resource support.

It is worth noting that within NAVI's financing lineup, the community has been highly engaged in discussions about the participation of Mysten Labs and OKX Ventures:

On one hand, as the developer behind Sui, Mysten Labs' choice to invest in NAVI can essentially be seen as an endorsement of NAVI's project prospects in the Sui ecosystem. This support will also provide NAVI with more technical backing beyond funding, enabling it to present better products and integrate more deeply with the Sui ecosystem.

On the other hand, we see that the NAVI token NAVX has already been listed on many second-tier exchanges and announced its launch on Bybit Launchpool and spot trading platform on October 7. Additionally, this launch event has set up a reward pool of 2.5 million NAVX for SUI token holders, allowing users to participate in earning rewards by staking NAVX, SUI, and USDC.

The community is eagerly awaiting whether NAVX will target major exchanges next, and with the investment from OKX Ventures, there is heightened anticipation for NAVX's listing on OKX and access to OKX's rich ecosystem resources.

In fact, although both Sui and NAVI have maintained a rapid growth momentum for a long time, in the highly anticipated fourth quarter of 2024, the Sui ecosystem and NAVI will welcome multiple milestone achievements. Beyond expectations, based on current community and social media feedback, both the Sui ecosystem and NAVI are still generally viewed positively, continuing to maintain rapid growth in the next phase.

Native USDC is about to launch on Sui, and NAVI may rise again

As we enter the fourth quarter, the most unmissable milestone for NAVI is the upcoming launch of native USDC on Sui, which is one of the key reasons the community firmly believes NAVI will continue its growth momentum.

At the recently concluded Sui Builder House event in September, Sui announced to the global community the upcoming launch of Circle's native USDC. At the same time, the Cross-Chain Transfer Protocol (CCTP) will also be launched on Sui. As a permissionless on-chain utility, CCTP can prove the secure transfer of USDC between blockchains, providing a safer and more capital-efficient trading method.

Through this collaboration, Sui becomes the first Move public chain to support native USDC. As the largest compliant dollar-backed stablecoin in the crypto industry, the integration of USDC into the Sui network will immediately enhance Sui's utility and interoperability for users and developers, significantly improving the user experience of dApps in DeFi, gaming, DePin, cross-border payments, and commerce.

As the largest DeFi protocol in the Sui ecosystem, NAVI will undoubtedly gain tremendous empowerment from USDC. The most direct benefit will be that after the launch of native USDC on Sui, major exchanges will also support the deposit and withdrawal of native USDC on Sui, providing ample liquidity for Sui. NAVI, which aims to become the liquidity hub of the Sui ecosystem and has already firmly occupied an absolute market share in the Sui ecosystem, will be the first choice for users looking to increase leverage. It will not only capture on-chain liquidity first but also subsequently, NAVI's native token NAVX will introduce a series of empowerments to capture revenue after absorbing massive liquidity.

Beyond USDC, according to the roadmap on the official website, NAVI will also complete the integration of Volo in the fourth quarter of 2024, which undoubtedly injects stronger confidence into NAVI's continued growth.

Given the recent significant growth momentum of the Sui ecosystem, many people view Sui as the next Solana and believe that Sui will replicate Solana's development path, expecting leading projects within the Sui ecosystem to generate traffic, momentum, and wealth effects.

After acquiring the LST protocol Volo, NAVI has successfully completed a narrative upgrade, evolving from a pure lending protocol to a "one-stop liquidity protocol for the Sui ecosystem" that combines lending and LSTFi. This combination inevitably evokes comparisons to Solana's Kamino + Jito.

Kamino is a lending, liquidity, and leverage protocol built on Solana, while Jito is the first liquid staking protocol on Solana that combines MEV earnings with staking rewards. Both have performed exceptionally well in the resurgence of Solana that began at the end of 2023 and are major contributors to Solana's TVL. Currently, Jito ranks first in Solana's TVL with $1.9 billion, while Kamino ranks second with $1.6 billion.

For the Sui ecosystem, the ecological positioning of NAVI + Volo is akin to Solana's Kamino + Jito. The synergistic advantages brought by this configuration have already been tested in the Solana ecosystem, and the success of both Kamino and Jito has led the community to expect significant growth potential for NAVI and Volo in the future.

It is worth mentioning that according to information revealed in the Volo white paper, Volo will issue a governance token for the project in the future, which is currently in the blind mining phase. Long-term holders of Sui can deposit into Volo to gain potential airdrop opportunities, which undoubtedly adds higher attractiveness for users to participate in NAVI and Volo.

Of course, in the face of NAVX (NAVI's native token), which has achieved a 211.5% increase in the past 30 days, many still have doubts: Is now a good time to enter?

Perhaps on-chain data can largely answer these concerns.

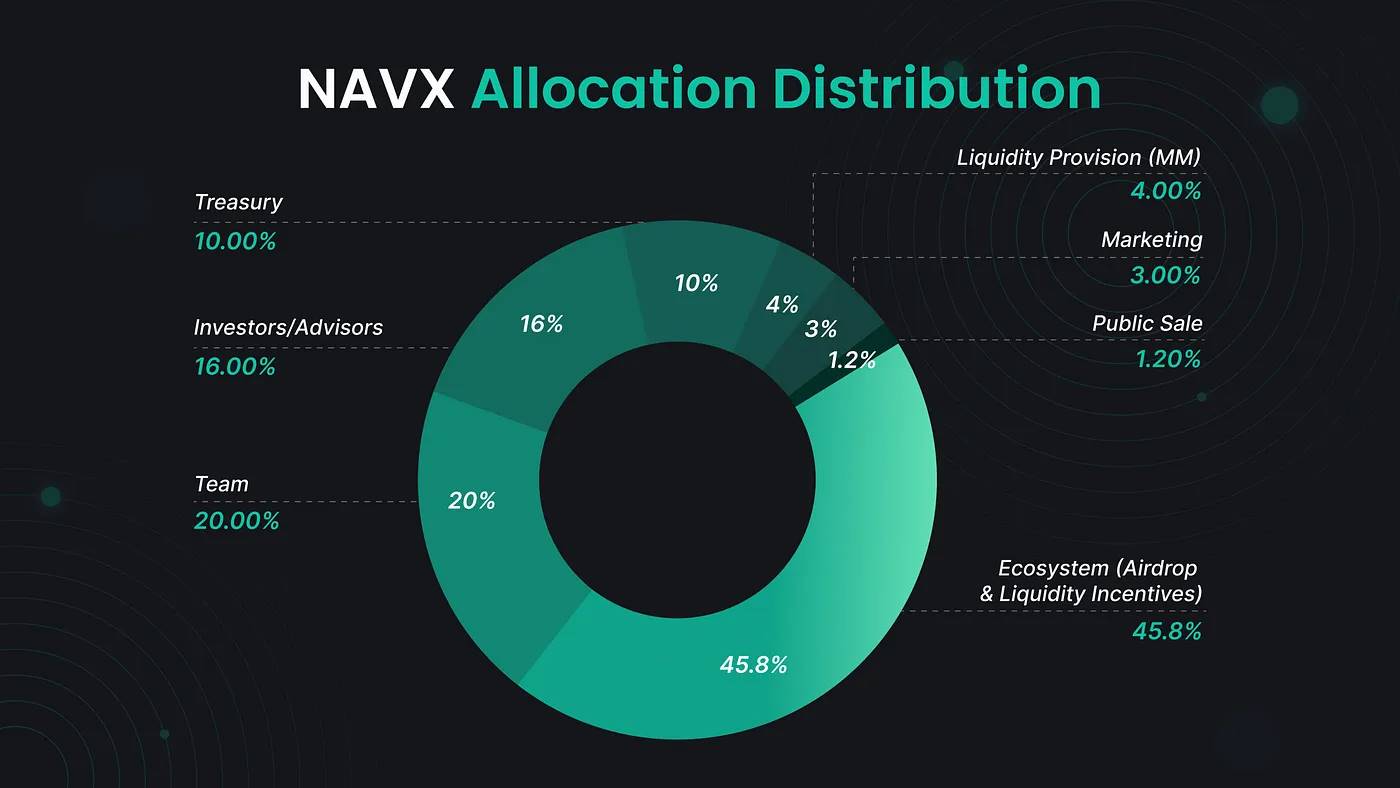

We know that as NAVI's native token, NAVX has a total supply of 1 billion tokens, with applications in governance, incentives, and protocol fee sharing. Its specific distribution is as follows:

According to Coingecko data, although NAVX has achieved a 211.5% increase in the past 30 days, when we shift our perspective:

Taking the DEX project Cetus, which ranks first in TVL within the Sui ecosystem, as an example, we can see that NAVI's TVL is around $530 million, while Cetus's TVL is around $190 million, showing a nearly 3-fold difference;

From a market capitalization perspective, NAVX's market cap is around $42 million, while Cetus's market cap is $55 million.

The gap and mismatch between these figures lead many to have very optimistic expectations for NAVI's future growth, further propelling NAVI to become the top choice for those positioning themselves in the Sui ecosystem.

Conclusion

On October 7, the day this article was written, the price of Sui tokens achieved a 20% single-day increase, currently quoted at $2.1. The ongoing growth momentum of Sui is evident, which raises the community's expectations for the performance of leading projects in the Sui ecosystem. On the same day, NAVI's native token NAVX also achieved a 14.3% increase. As the absolute leading project in the Sui ecosystem, the wealth effect brought by NAVI has already begun to manifest.

Through clever product design, the narrative upgrade from acquiring Volo, and strong ecological dominance, we can also see NAVI's development landscape and ambition: NAVI does not want to be a follower of Sui's growth but aims to become an important driving force in maintaining Sui's rapid growth through innovative product design, continuously growing on-chain data, and impressive market performance.

With the launch of native USDC on Sui, the completion of Volo's integration, and the realization of more milestones, NAVI's vision of becoming a one-stop liquidity protocol for Sui and the entire Move ecosystem has a stronger foundation for realization.

In the face of such a thriving Sui and NAVI, are you still struggling with the current cycle being too mediocre and boring?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。