This article introduces 50 cryptocurrency research tools covering areas such as fundamentals, news, and financing, aimed at helping users enhance their market insights and data analysis capabilities.

Author: Stacy Muur

Translation: Baihua Blockchain

My toolbox includes dozens of tools that help me distill market insights, analyze protocols, and validate market data assumptions. You may be familiar with some of them, such as DefiLlama, TokenTerminal, or Dune. However, there are many tools specifically tailored for certain tasks.

In this article, I want to introduce you to 50 outstanding research tools.

I have categorized the tools based on their missions and highlighted the best use cases for each tool. Some versatile protocols may appear multiple times, so keep scrolling down to find the mission you are currently interested in.

Let’s discover some new tools together to enhance your research capabilities!

1. Fundamentals

Fundamental research is the process of analyzing a project to understand its core value, appeal, and potential. It focuses on key aspects such as product attractiveness, token economics, financing, and community.

The goal is to determine whether a project has long-term growth potential by observing these factors, rather than just following market trends.

Product Metrics

Here is a list of tools I primarily use to research product metrics, which include TVL (Total Value Locked), active users, token holders, cross-chain net inflows, trading volume, revenue dynamics, and financial data, as well as tools for assessing the competitive landscape.

TokenTerminal currently tracks data from over 400 mature protocols, providing one of the most comprehensive analytical metrics. It also offers powerful tools for identifying data trends in Web3 and changes in fundamentals and market attention, whether general or segmented by specific parameters or categories.

DefiLlama follows closely, covering over 3,000 protocols. If I can't find a protocol on TokenTerminal, I turn to DeFiLlama, which provides important data on TVL, trading volume, and token metrics. It also facilitates comparisons of competing protocols and reveals power distribution within specific categories or blockchain ecosystems.

Next is Dune, which provides comprehensive dashboards for most Web3 protocols, outlining their fundamental information.

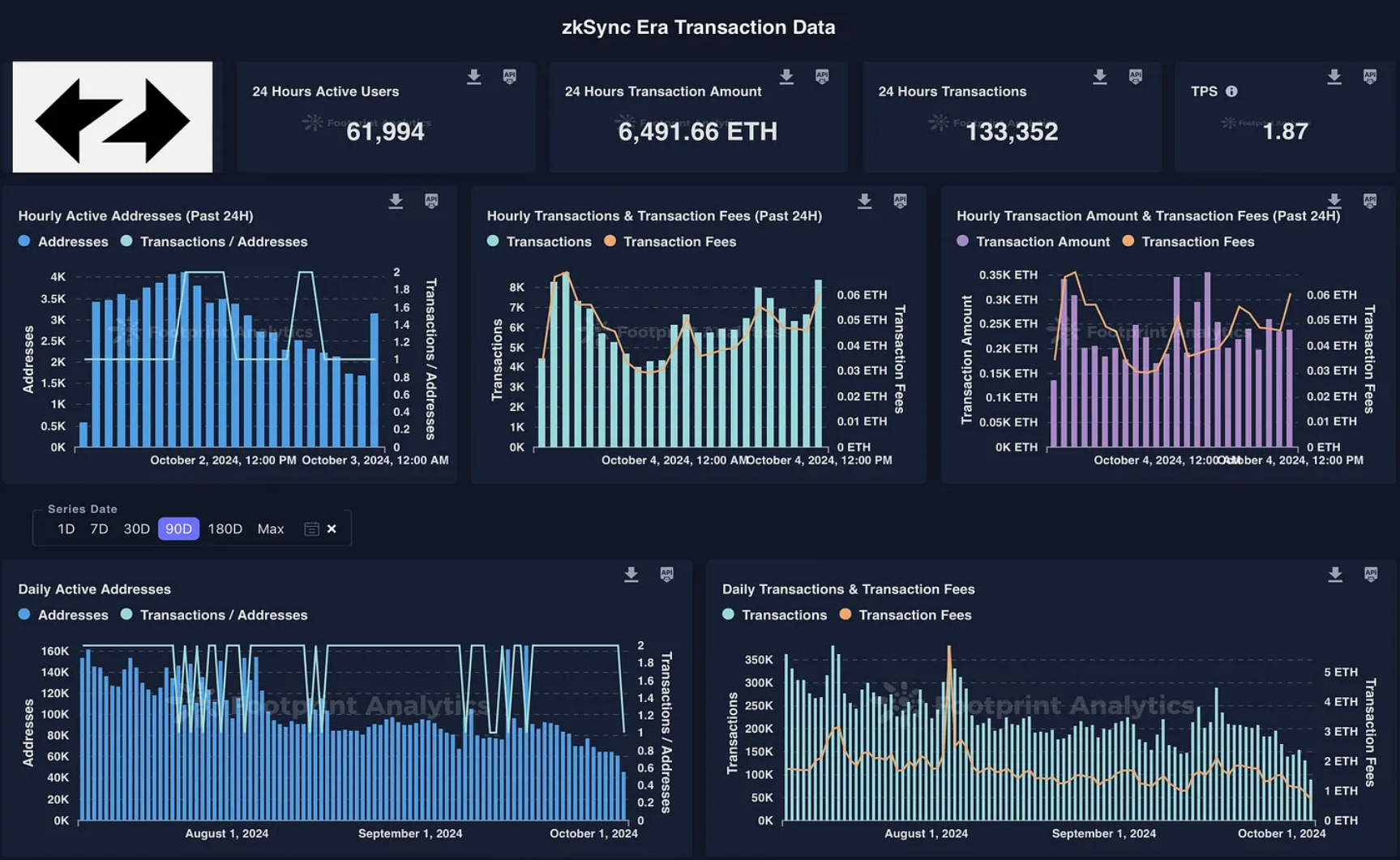

Tip: If you can't find specific data on Dune, check Footprint Analytics. Their designs are very similar, and Footprint may have unique data that Dune does not.

ZKsync Era dashboard on Footprint Analytics

When researching Ethereum Layer 2, L2Beat may be the best tool, providing comprehensive data on the status of Ethereum rollups. For Bitcoin Layer 2, Bitcoin Layers is the closest tool to L2Beat.

Nansen is another powerful on-chain analysis tool covering over 35 networks and nearly 400 protocols. It allows users to track various aspects of networks, tokens, and NFTs, even monitoring the activities of investors and traders. The main drawback is that most data requires a subscription to access.

Artemis is a blockchain data science platform that monitors key metrics for various projects, including financial, economic, and social indicators. It also provides statistics for specific Web3 domains and has a dedicated section for tracking developer activity.

2. Publishing and News

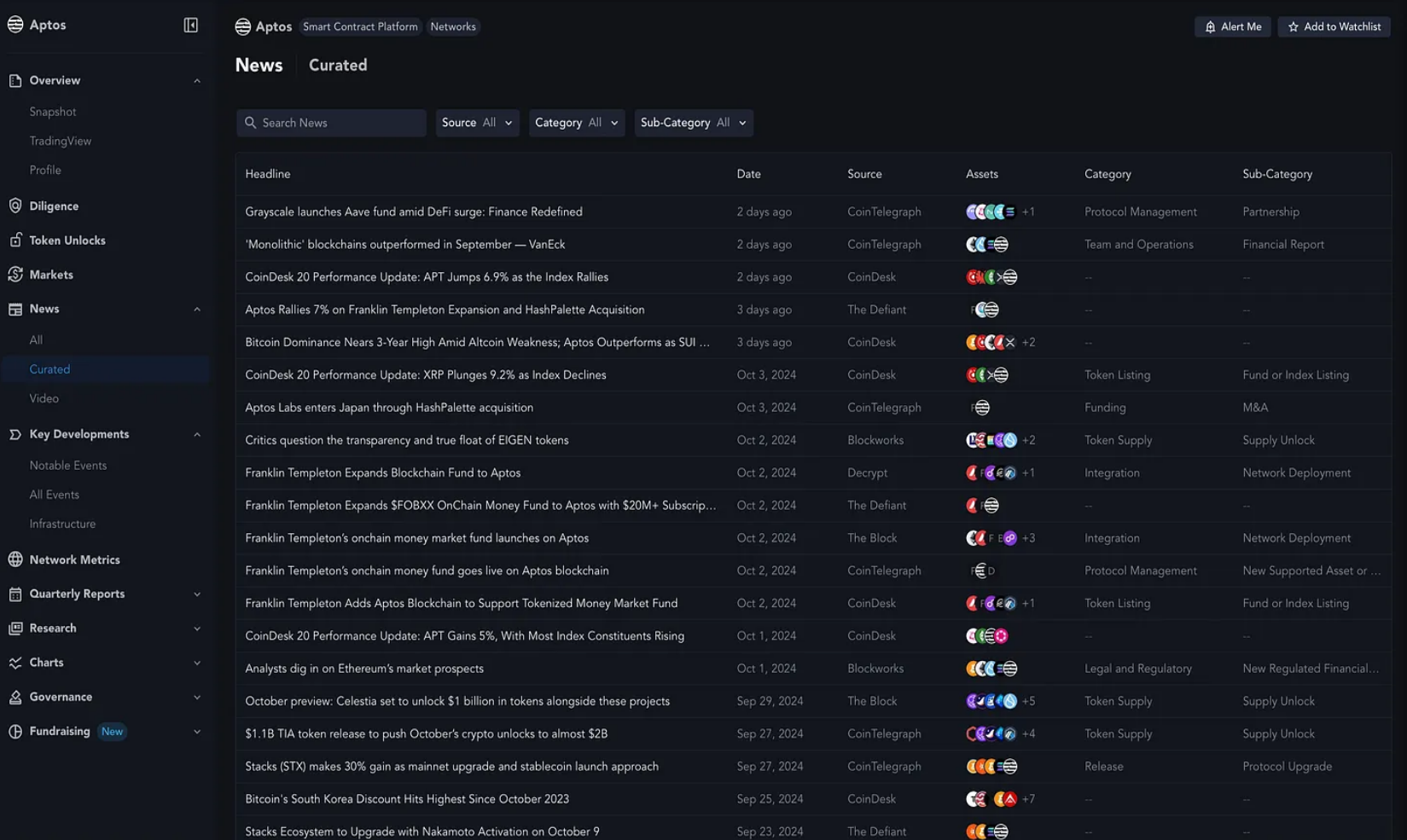

Messari is a very unique tool that I frequently use. In addition to providing basic fundamental data, its unique advantage lies in aggregating the latest dynamics, news, and providing specialized research reports. This is one of the few paid research tools I use.

Aptos: Latest news dashboard on Messari.

CryptoPanic is a news aggregation and portfolio tracking platform designed to serve traders and cryptocurrency enthusiasts. It highlights the impact of various events on the market and prices. The site allows users to track crypto-related news as well as broader market news to assess the potential impact of these events on asset prices and investor sentiment.

CoinMarketCal is an economic calendar for crypto assets that enables users to track key market events. Stay updated on new coin listings, the start of trading on new platforms, NFT collection releases, and major events and conferences.

Coindar is another calendar tool for tracking projects, assets, and events in the Web3 space. Similar to CoinMarketCal, it also allows users to view the dates of various macro events related to projects or tokens.

Web3alerts is a portal designed to receive data and notifications about significant Web3 events. The platform allows users to track the launch of new projects and related events. Investors and venture capitalists can subscribe to receive direct notifications in a timely manner.

3. Financing

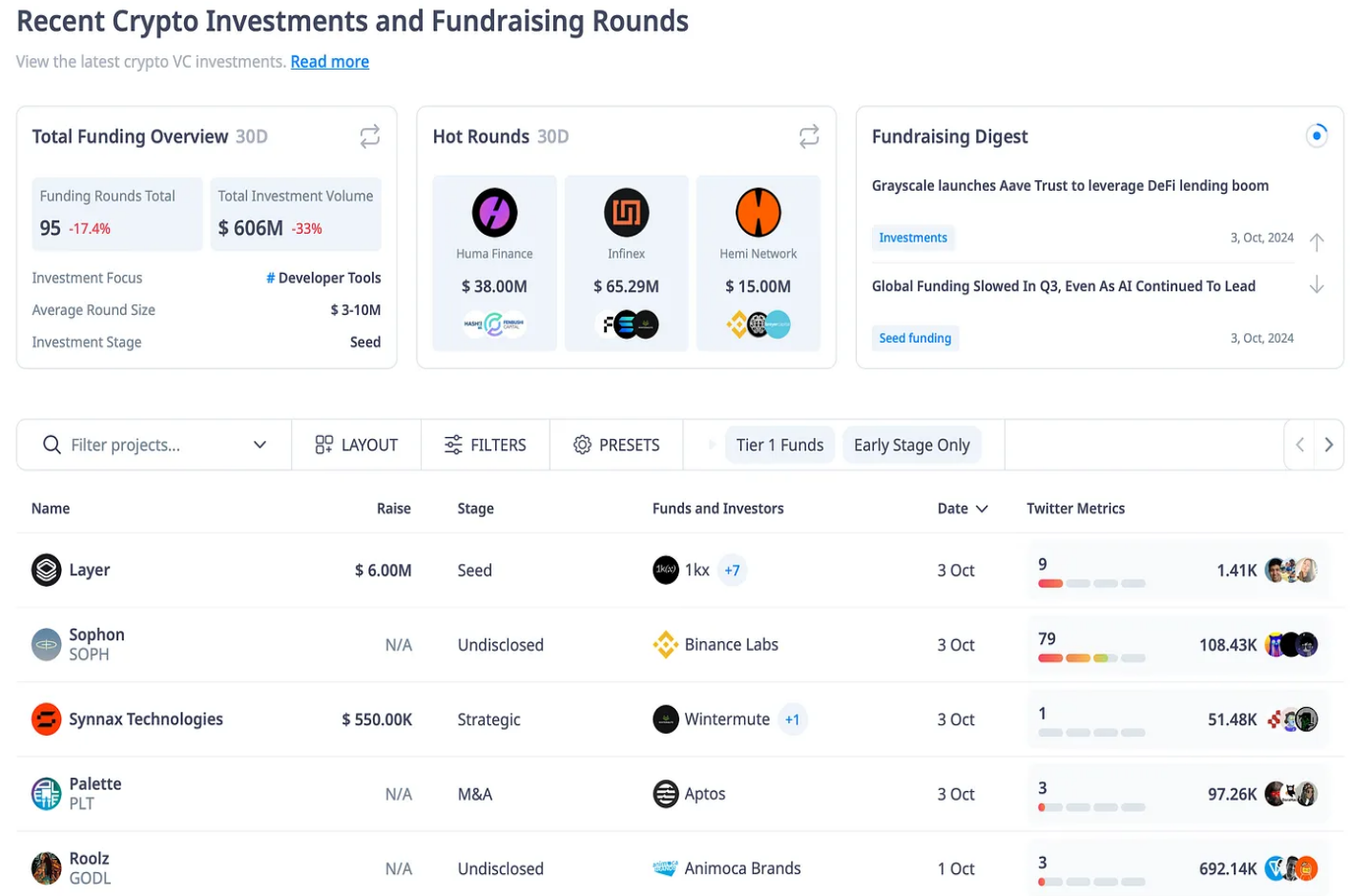

Many platforms provide financing data, with DefiLlama being one of the most popular. Here are some other platforms I frequently use to discover financing data.

CryptoRank is an analytical platform designed to track various data, including metrics for tokens, funds, and projects. It enables users to monitor financing rounds for various projects, focus on top IDOs and ICOs, and discover current crypto airdrops. Additionally, the platform provides lists of ongoing and potential airdrops, complete with tasks and detailed guides, as well as data on token unlocks.

CypherHunter is a comprehensive database similar to LinkedIn, specifically designed for the crypto world. It aggregates data on blockchain projects, individuals involved in the crypto space, and recent financing rounds.

Crunchbase is a website that tracks detailed project information, including financing rounds, key investors, and total funds raised. It also provides insights into employees, events, and potential contacts (for connecting with founders).

Crypto Fundraising is a valuable resource that tracks the latest financing rounds, events, and news. It provides information on projects that have not yet been covered by other analytical platforms. The site also offers a simple and convenient list of funds, investors, and their contact information.

4. Token Economics

Token Unlocks is a service for tracking token unlocks and token economic data. The platform allows users to filter projects and tokens for easier analysis of their potential. It also monitors token economic data and upcoming supply unlocks.

CoinBrain is an analytical platform that provides on-chain and off-chain data. It offers filtering features to help users search for newly created tokens. The platform also includes a hot list of new coins and upcoming token unlocks, as well as search functionality across various categories.

5. Project Discovery

Many of the tools mentioned earlier are very useful for protocol discovery and narrative filtering. However, there are also some unique multifunctional dashboards that can help assess the current market conditions and uncover new investment ideas.

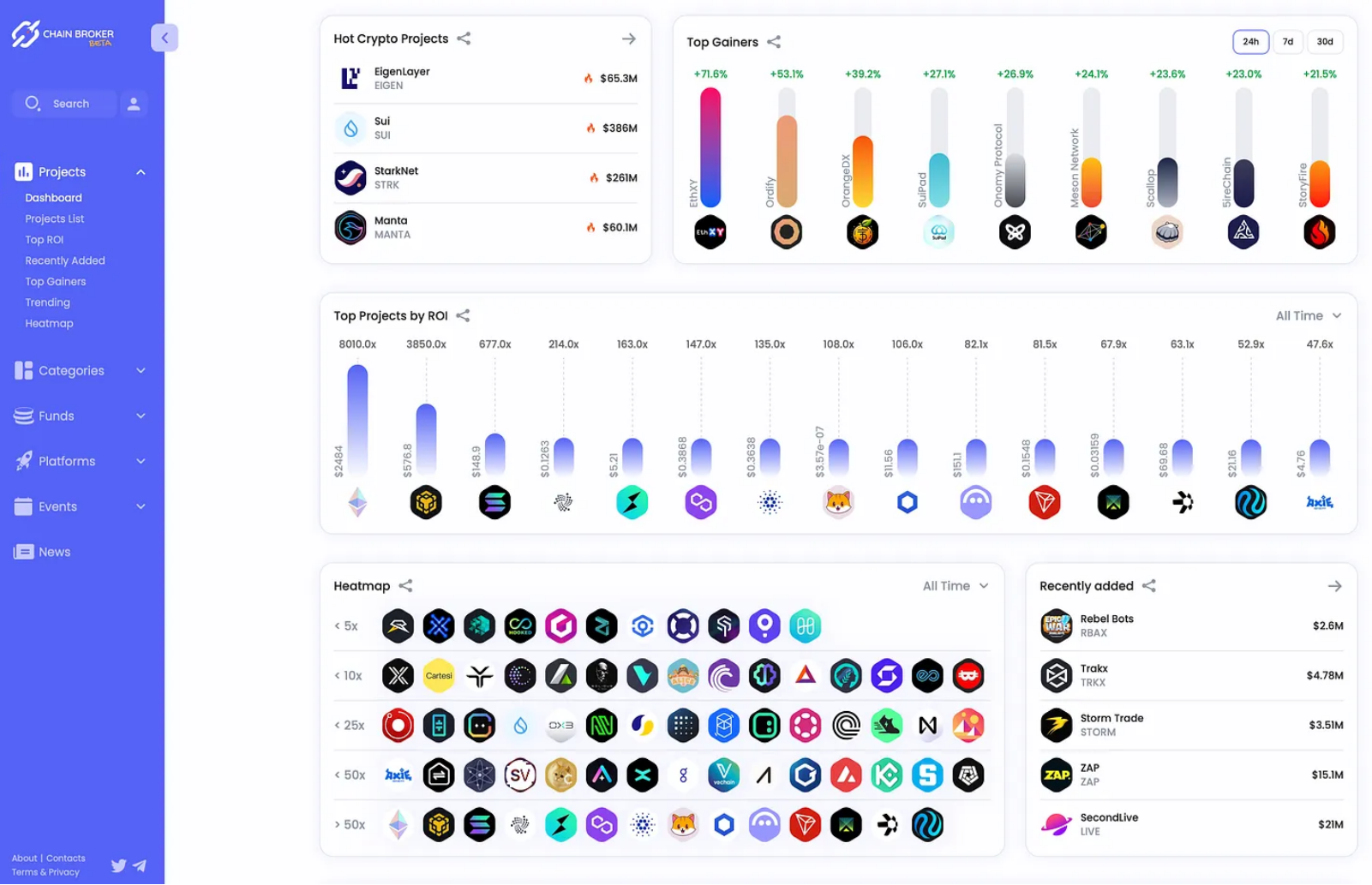

ChainBroker is a service designed to track various financial metrics of networks and tokens. It allows users to analyze market conditions, investor activity, and platform engagement. The site also provides heat maps in certain categories, offering a visual assessment of the potential of networks and assets over a period or specific timeframe.

Protocol dashboard on ChainBroker

DYOR is another great platform for tracking the pulse of DeFi, providing a range of leaderboard dashboards segmented by specific on-chain metrics.

Moni Discover is a unique tool that leverages social attention trends to help you identify new early opportunities, covering everything from meme coins to infrastructure projects.

6. Trading

This category can be divided into three directions: social and copy trading, meme coin trading, and market analysis.

1) Social Trading

AlphaScan monitors sentiment for specific tokens and tracks mentions of coins and tokens on X, showing their frequency on specific dates. It also reveals potential profits that KOLs (Key Opinion Leaders) could earn by following their recommendations. This information helps assess the trading potential of certain bloggers and communities and gauge the hype around certain assets.

Cielo is a platform designed to monitor top traders' trades and gain market insights. It provides necessary notifications and insights, allowing users to track other traders' wallets and apply these strategies for copy trading.

Scopescan, previously known as Watchers, is the first product to utilize the 0xScope knowledge graph. This on-chain data analysis platform can create real-time entity profiles with significant connections. It provides comprehensive data on wallet activities, listing projects and coins ranked by activity and TVL (Total Value Locked), as well as insights into fund flows and smart money signals.

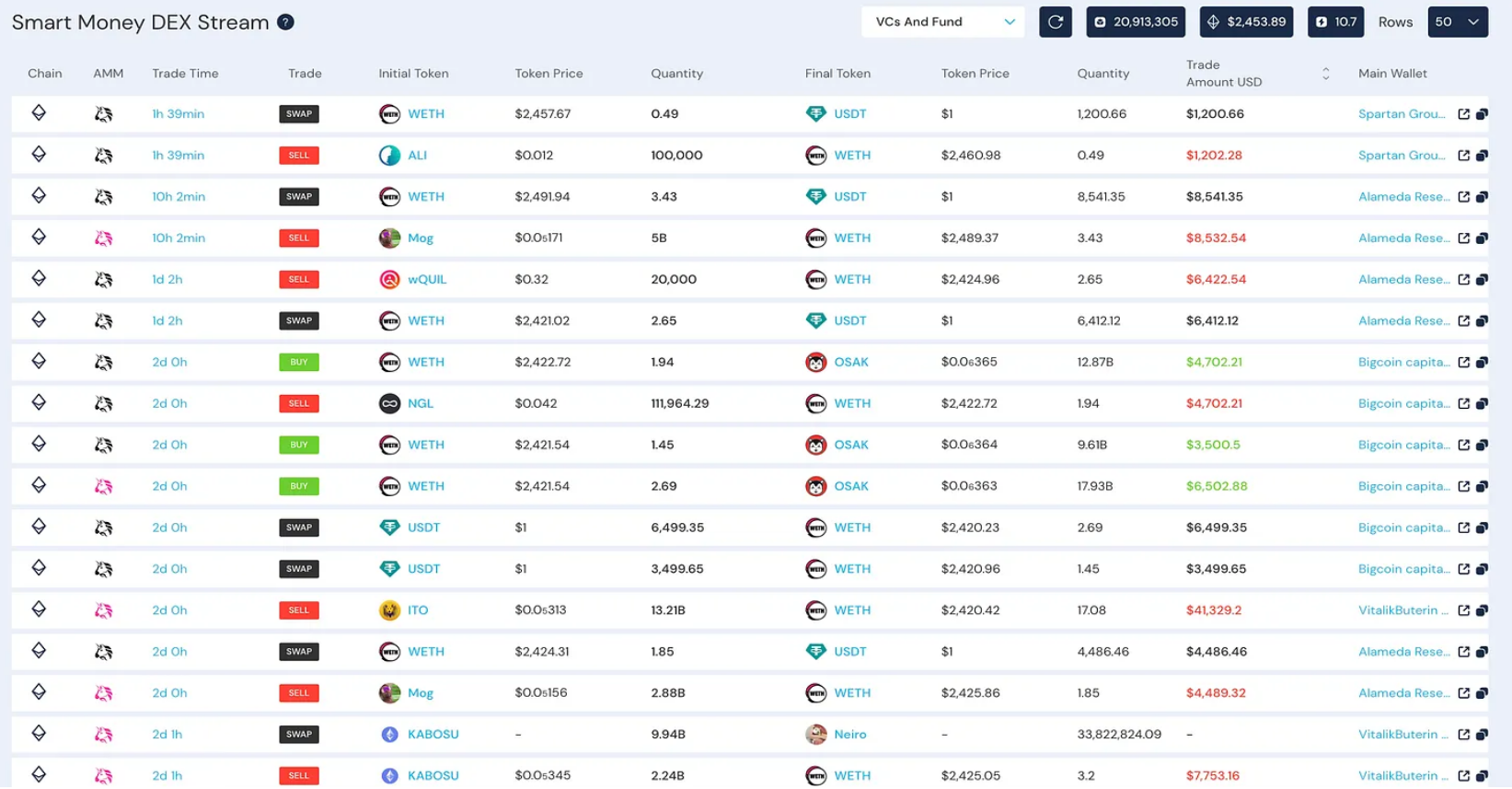

Alphanomics is a multifunctional service that helps you discover real-time decentralized exchange (DEX) on-chain trades, keeping you updated on current trends. It helps users gain real-time insights to uncover new asymmetric opportunities, track the strategies of the smartest traders and wallets, and see how they manage their portfolios.

Smart money DEX flow data on Alphanomics

2) MemeCoin Trading

When looking for MemeCoins and other newly created trading pairs, the two most popular platforms are DexScreener and DEXTools. These platforms can help you find the best prices, liquidity, and activity for specific trading pairs, as well as track wallet activity.

To track potential malicious features of smart contracts, I recommend using Honeypot (supporting Ethereum, BNB Chain, and Base), De.Fi, and SolidityScan.

3) Market Analysis

TradingView is the leading platform used by traders worldwide, known for its charts displaying trading pair data for thousands of assets across multiple trading platforms. You can customize charts in various formats, add personal notes, and seamlessly compare assets.

CoinGecko and CoinMarketCap are among the most commonly used platforms for tracking market data. Additionally, both platforms offer valuable research centers.

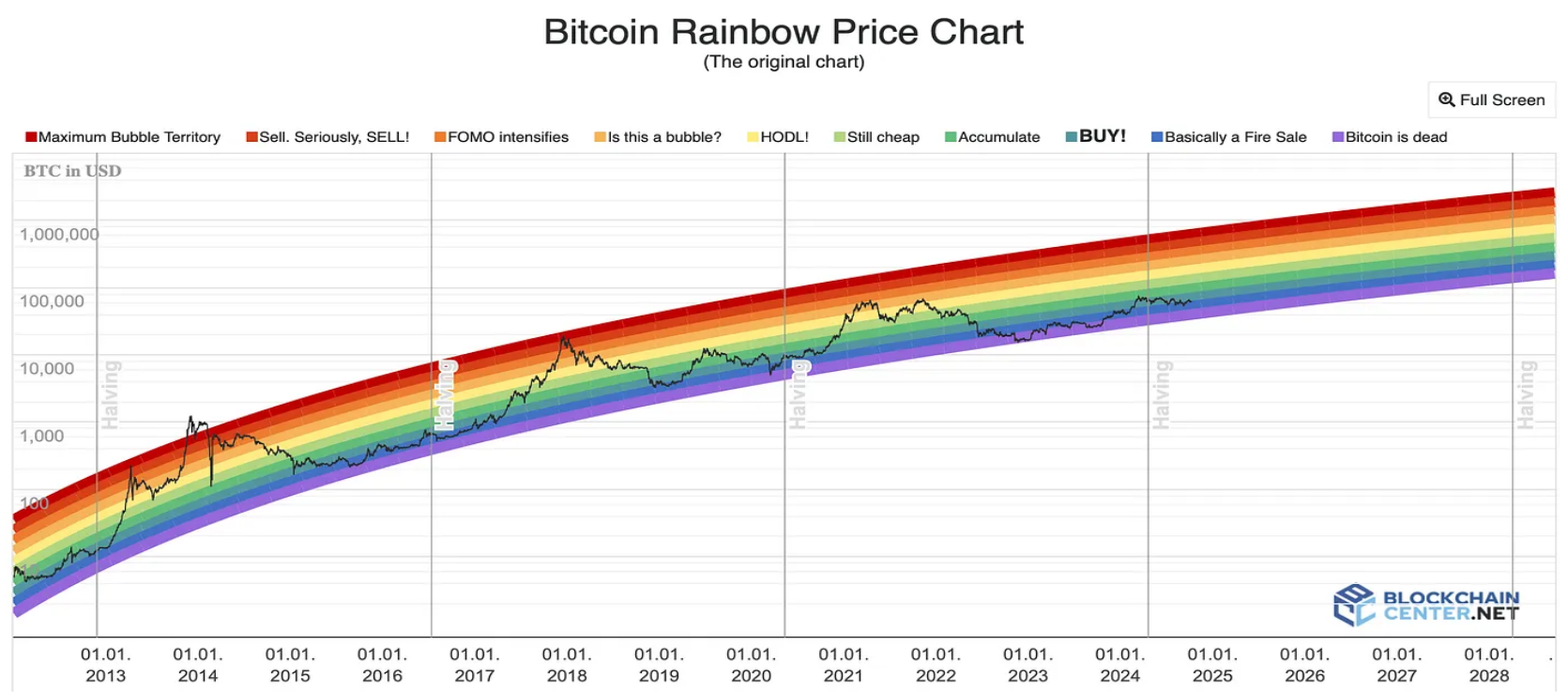

BlockchainCenter is a platform that provides various visual charts and metrics to help track and compare network data. It enables users to assess market conditions, asset status, and the dominance of specific coins. The platform's standout feature is its visual charts, which even novice traders can easily grasp to understand current market trends.

Bitcoin rainbow price chart on BlockchainCenter

Glassnode allows traders and investors to predict key trends and turning points affecting digital assets. The platform focuses on advanced blockchain and market data, providing unique insights into capital flows, asset fundamentals, and Web3 blue-chip market sentiment. It offers various economic, financial, and network metrics, as well as research and reports on the state of the industry.

Coinglass is a comprehensive platform for tracking the financial status of various markets. It monitors the crypto market and other assets, including liquidations, long and short positions, and options trading. Coinglass is particularly suitable for professional traders.

CryptoBubbles offers a unique service that presents a market map in the form of bubbles. Here, you can visually track changes in market trading volume, identify which cryptocurrencies are rising or falling in price, see who holds specific proportions of assets, and observe their dynamics.

CryptoQuant is a powerful community-driven market data research platform that provides rich insights and research from the CryptoQuant team and users.

MarketCapOf allows you to estimate the price of a cryptocurrency if it shares the market capitalization of another cryptocurrency. For example, if Ethereum's market cap were the same as Bitcoin's, its price would be approximately $10,000.

7. Passive Income

Discovering and managing the best passive investment pools can be challenging. Here are some tools that can help you find and manage these investments.

Revert is a comprehensive explorer and user interface for Uniswap V2, V3, and Sushiswap AMM liquidity providers. It helps investors track investment efficiency and analyze data.

Other platforms specifically designed to find good passive income opportunities include De.Fi and DefiLlama.

8. Airdrops

Although the hype around airdrops is not as high as it was a year ago, they still serve as a source of passive income for many users. I previously mentioned the CryptoRank toolkit for discovering airdrops. Here are some platforms you can use as an airdrop hunter.

1) Airdrop Hunters

DropsTab is a multifunctional tool for tracking portfolios, analyzing markets, and discovering new airdrops. Its extensive features allow it to replace multiple analytical tools simultaneously.

Bankless provides a service for tracking airdrops and promising projects. It helps users select projects to participate in and allows them to check for any unclaimed airdrops associated with their wallet addresses.

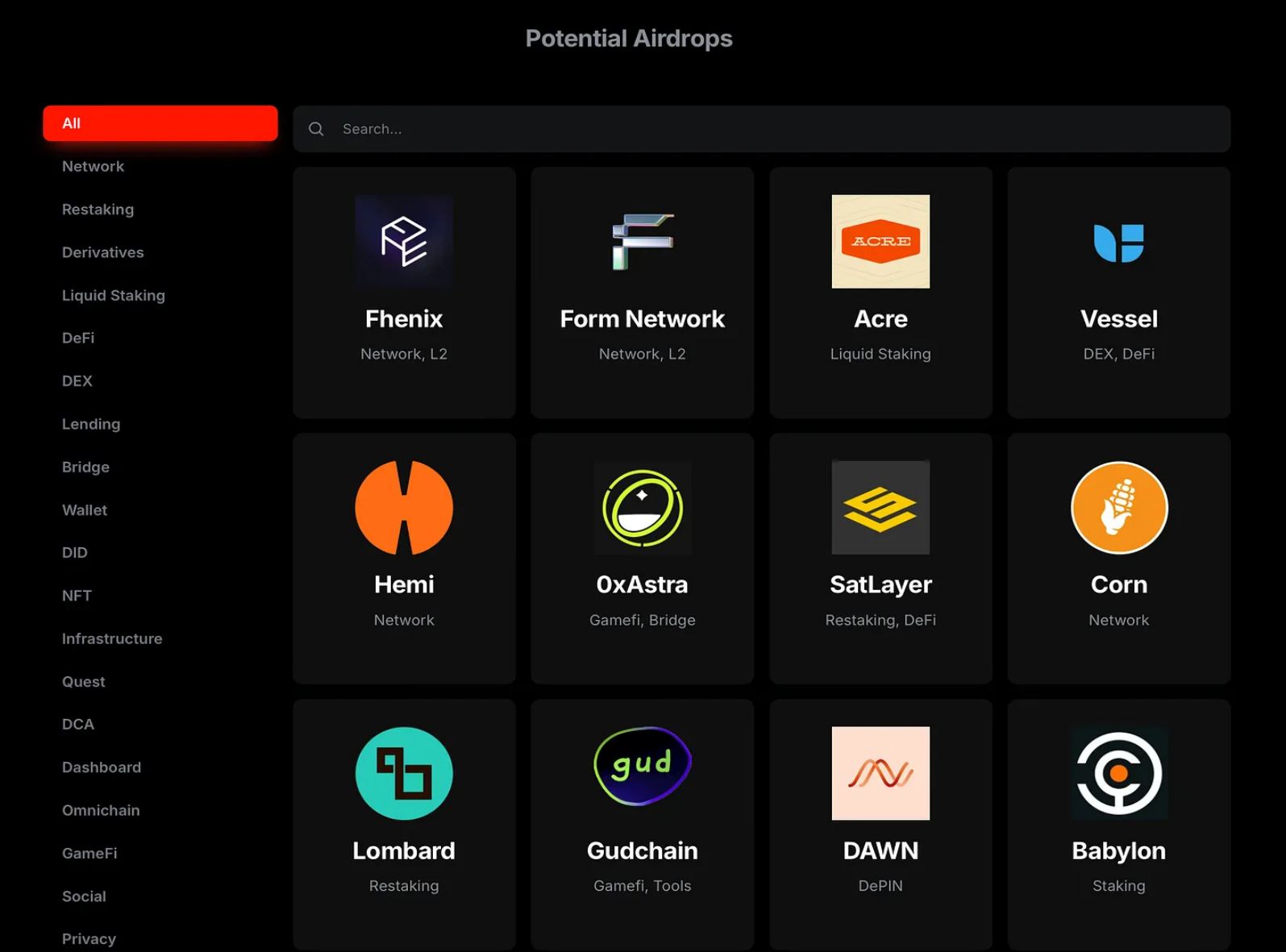

Alpha Drops is a convenient platform for tracking airdrops across various Web3 domains. It offers user-friendly filters that allow you to select projects by domain. Each project page provides detailed information about available tasks, funding metrics, and project stages, whether in testnet or mainnet phases.

Potential airdrop tags on Alpha Drops

AirdropsAlert is a website that aggregates current and upcoming token airdrops, providing detailed descriptions of the steps required to participate. You can sort airdrops based on various criteria, including whether KYC is required.

2) Tasks: Portfolio Tracking

Tracking a diversified portfolio across numerous chains, assets, and pools can be challenging. The following tools will be very helpful for your daily investment management.

DeBank is a platform for tracking portfolios and checking wallets. It allows you to monitor all assets in your wallet, track transaction history, view historical net worth changes, and more.

CoinStats is a portfolio tracking and analysis platform where users can monitor the status of assets across the entire market and view financial data from wallets. It conveniently provides access to transaction histories across various networks, including identifying fraudulent transactions targeting your address.

Arkham offers powerful tools to link cryptocurrency activities with real-world individuals and institutions. The platform can track the operations of organizations, including large institutions and government entities.

3) Research

As a research enthusiast, I maintain an extensive watchlist of companies that consistently publish valuable market research, focusing on macro trends, narratives, or specific protocols. In addition to Messari, CryptoQuant, and Glassnode, here are some of my favorite research sources.

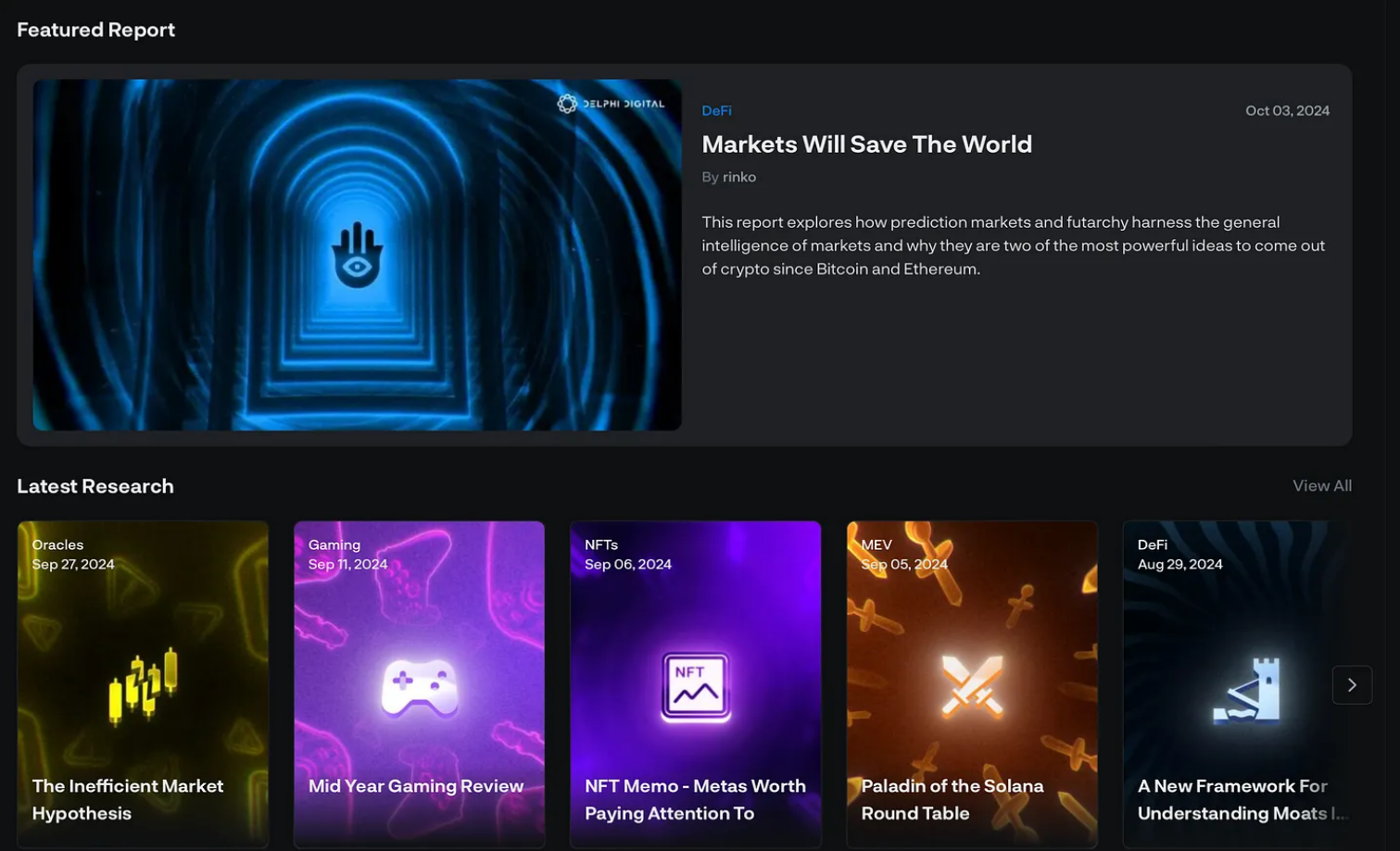

Delphi Digital is a research-driven company with a global team dedicated to accelerating and enhancing the development of cryptocurrencies. It consists of three independent entities—research, labs, and venture capital—sharing a common brand and mission.

Delphi's featured report

Chainalysis is a leading blockchain analysis company that provides compliance and investigation tools for banks, crypto companies, and government agencies. It offers a suite of tools for transaction tracking, risk analysis, and data visualization.

Article link: https://www.hellobtc.com/kp/du/10/5458.html

Source: https://stacymuur.substack.com/p/godmode-research-50-tools-for-dyor?utmsource=%2Finbox&utmmedium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。