The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and refuse any market smoke bombs.

Unexpectedly, a short-term correction in Ethereum has caused so many contract users to be liquidated. I didn't expect everyone's gambling nature to be so strong. Leverage is something that needs to be carefully considered for investment, and everyone must not be anxious. Many users who have invested in Lao A also hope that Lao Cui can talk about how long this bull market can last. So today’s analysis will start with Lao A, and I will briefly touch on the cryptocurrency circle. Everyone should be clear that all financial markets have competitive relationships, with gains and losses balancing each other, which is understandable. The current trend in the cryptocurrency market is also inseparable from the boost of Lao A's growth. The continuous growth of Lao A will inevitably lead to a short-term correction in the cryptocurrency market. If the capital does not come in, a slow oscillating upward process will continue in the short term. For Lao A, there are definitely many positive news, the biggest positive being the influx of 28 trillion yuan into the stock market. If 28 trillion yuan flows in completely, it can at least support until the end of this year. This is something everyone needs to pay attention to daily regarding the inflow of capital.

Especially with foreign capital entering the market, investment banks like Goldman Sachs, UBS, and Morgan Stanley are all optimistic about Chinese assets, and large amounts of capital are flowing into the stock market. So in the short term, don’t think there will be a significant drop. To understand how long the entire bull market will last, we need to start from its underlying logic. It can be said that this round of bull market is entirely a policy-driven bull market. Its core purpose is to help state-owned enterprises and local governments solve the massive debt problem. The simplest method is to issue more stocks to stimulate the stock market and then cash out to pay off debts. Lao Cui personally predicts the following three development trends: The first stage is a surge in the stock market, with continuous rises attracting retail investors, while foreign capital will be more cautious, with daily trading volume maintaining around 1-3 trillion yuan, and a weekly increase of about 400-600 points; once retail investors start entering, we will enter our second stage, which we are currently in, with retail investors rushing in and foreign capital slowly entering. The national team operates state-owned enterprises and local listed companies, starting to issue more stocks to cash out and resolve the debt crisis. It is essential to check the news in a timely manner; once the cash-out mode starts, one must exit promptly.

The trading volume in the second stage will completely maintain around 1 trillion yuan daily, with a weekly increase of 100-300 points; then comes the third stage, where institutions start to exit, and the state-owned capital's stock increase to resolve the debt issue comes to an end, leading the stock market to enter a downward trend, with retail investors gradually getting stuck. The most important judgment here is to keep a close eye on Goldman Sachs and foreign capital's statements; their predictions are much more accurate than those domestically. It is said in the circle that Goldman Sachs has never made a wrong prediction regarding the decline of the Chinese stock market, but has never accurately predicted a bull market. If Goldman Sachs advises everyone to exit, one must leave decisively. For domestic news, just pay attention to the local government's statutory debt balance of 41 trillion yuan (excluding urban investment), and if we assume a one-to-one ratio, the urban investment debt is around 40 trillion yuan, making the total local government debt about 80 trillion yuan (some other data suggest it is between 150-200 trillion yuan, which Lao Cui cannot verify). We will calculate based on local debt of 80 trillion yuan; currently, the total market value of the stock market must be raised to about 1.2 times the domestic GDP.

This means it needs to rise from the current 90 trillion yuan to around 150 trillion yuan to have operational space for resolving debts. However, based on historical operations, generally, once it rises to around 100-120 trillion yuan, it will start to decline. Overall, it will grow by about 10-20% before starting to expand shares to resolve debts. Converted to this range, it means Lao A's current 3300 points will rise to around 3500-3600 points, and everyone should prepare to exit. Even if it can be pushed to 4000 points, do not continue to hold. Currently, investments in the stock market can only be used to hedge against the 28 trillion yuan increase, which is to hedge against currency devaluation. As long as one can outperform the speed of currency devaluation, this round will be profitable; those who move slowly will definitely get stuck. When it reaches around 3500-3600, everyone can still exit gracefully. For individual stocks, there will not be a general rise; this is indeed the most ideal exit time for everyone. Coupled with the recent instability in the Middle East and the data released by the U.S., which often exceeds expectations and leads to growth (although Lao Cui does not believe it), but it is indeed said every day, there will definitely be some growth. The growth of the dollar and U.S. stocks shows a strong posture of returning to the top of the world.

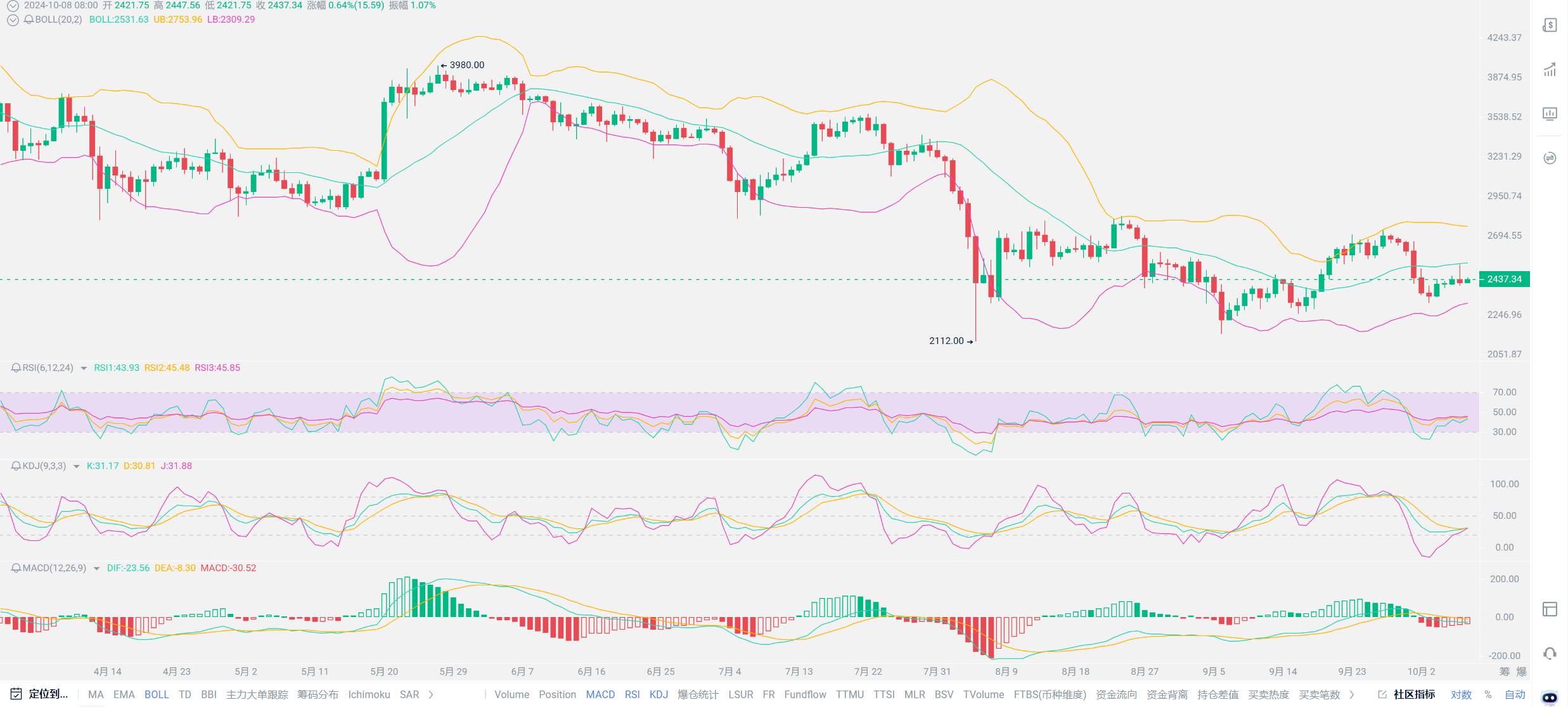

Recently, the U.S. has been speculating that a rate cut in November may lower expectations or even not happen. Everyone knows that U.S. data is often inflated, and they often use this to intimidate the market, which still has a certain impact. Even Buffett has reduced his holdings in U.S. bank stocks by hundreds of millions of dollars, but it is hard to say. The U.S. rate cut has indeed led global capital flows and should be acknowledged. In contrast to our cryptocurrency circle, Lao A is currently in the second stage, which is the strong phase, and excess funds will not flow too much into the cryptocurrency market. Therefore, the biggest possibility for the cryptocurrency market right now is to maintain a stable horizontal mechanism with slow growth. As long as there is no significant crash, there will not be a large increase in the short term. However, once Lao A starts to decline, it will mark the rise of the cryptocurrency market, and only then will Lao A's third stage lead to sustained growth in the cryptocurrency market.

Lao Cui summarizes: Rate cuts will definitely prioritize the flow of funds, and large amounts of capital will certainly move towards more stable directions. Moreover, rate cuts have already led to a wave of growth in the cryptocurrency market, which can be said to be beneficial for cryptocurrency users. The next step is to wait for funds to flow back into the cryptocurrency market. As long as other markets cannot maintain this retaliatory growth, the cryptocurrency market will return to the bull market stage. Currently, users in the cryptocurrency market must lower their posture and wait for the bull market. At this time, as long as there is no war impact, everyone can confidently buy the dip. For current contract users, if there is a deep correction, just enter long positions directly, and profits should be targeted around 50 points in Ethereum. Long positions are the way to profit; after a breakout, do not chase the rise. Low-position small positions are the mainstream strategy. This year, Ethereum rising above 3000 is not a big problem, and even higher is also an opportunity that can be reached. Just calm down and wait; spot users need to be more patient. Lao A's ability will gradually decline, making it difficult to survive this year.

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or positions, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。