Master Discusses Hot Topics:

Trump and Musk are joining forces to rally support for the 2024 U.S. presidential election. On October 5, Trump returned to Butler County, Pennsylvania, where he had previously faced a potential attack, to give a speech. Musk expressed his support on-site, praising Trump's resilience and mocking the current president, Biden.

Musk urged the public to vote actively and changed his Twitter profile picture to include elements of the U.S. election. According to Polymarket's predictions, Trump's chances of winning have risen to 51%, surpassing Harris's 48%. This move could bring positive news to the crypto market, with hopes for a price increase by the end of the year.

However, Bitcoin has failed to continue its upward trend from yesterday and is currently stagnant. The rise in U.S. Treasury yields has triggered risk-averse sentiment, impacting Bitcoin.

There remains uncertainty in the crypto asset market, and the market direction is expected to be influenced by various factors. It is recommended to pay attention to the release of the U.S. September CPI and geopolitical risks.

The current Fear and Greed Index remains neutral, with market participants inclined to buy during price declines.

Master Looks at Trends:

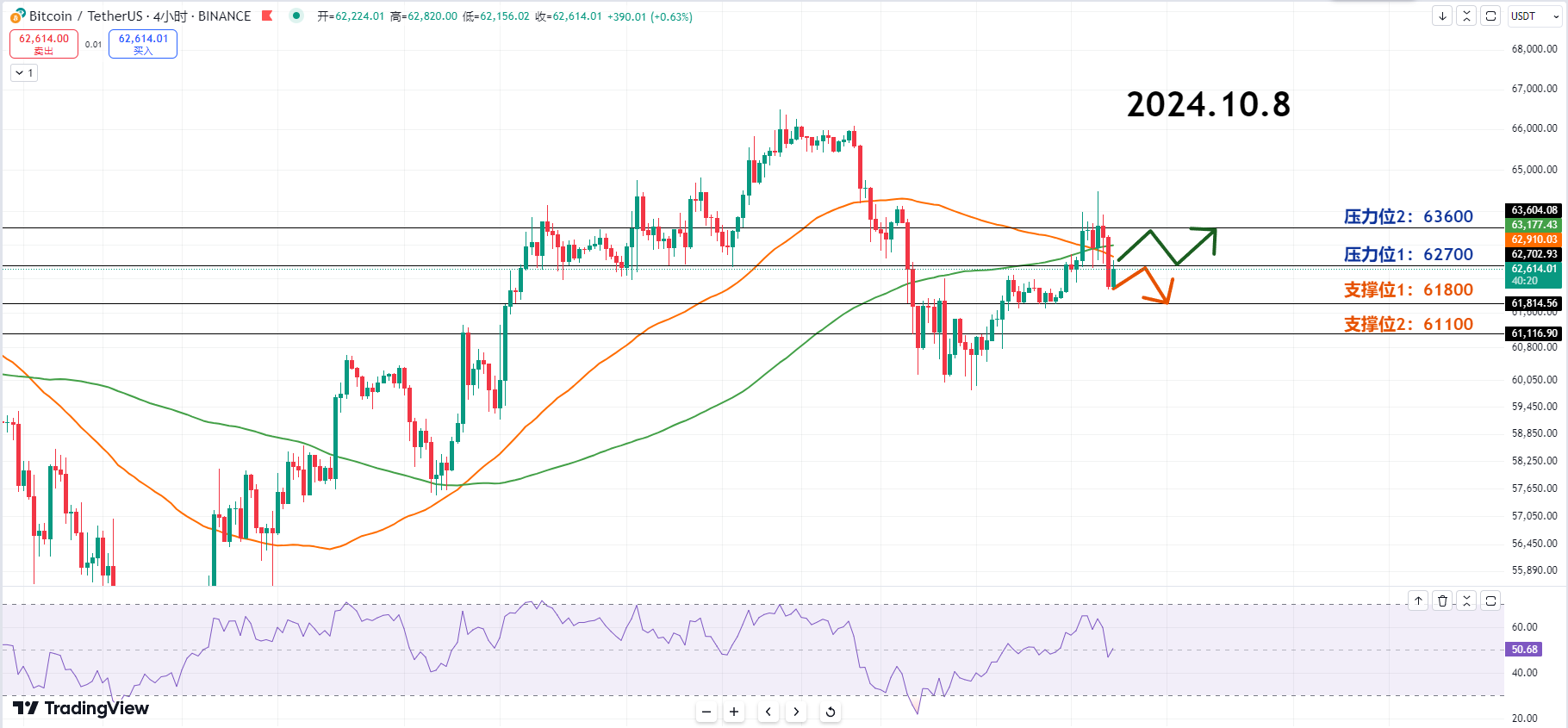

Resistance Level Reference:

First Resistance Level: 62700

Second Resistance Level: 63600

The current price must first break through the first resistance level to maintain a bullish trend, while 63K has become a new resistance. The second resistance is a short-term high point range and is an important resistance that must be broken to achieve an upward movement.

Due to the uncertainty of breaking through the first resistance level in the short term, it is recommended to pay attention to the red arrow trend after the breakout. If there is no trading volume during the rebound, it may lead to a short-term adjustment trend towards the blue arrow.

Support Level Reference:

First Support Level: 61800

Second Support Level: 61100

If it falls below 62K and reaches the first support level, the Master does not recommend entering at the low point immediately but rather waiting for an entry opportunity around 61K.

If the psychological support level of 62K is lost, disappointment selling may occur, creating opportunities for lower prices. It is advised to act cautiously.

Today's Trading Suggestions:

In today's trading, as Bitcoin has retraced the gains from the previous day, further declines can be anticipated, and opportunities to enter long positions should be sought.

The Master personally believes that if Bitcoin declines, it will be a good time for short-term entry. It is recommended to adopt a staggered buying approach, increasing positions in certain decline ranges to lower holding costs.

10.8 Master Short-term Pending Orders:

Long Entry Reference: Buy in batches in the 60800-61100 range, with a stop loss of 500 points, target 61800-62700

Short Entry Reference: Sell in batches in the 63600-63900 range, with a stop loss of 500 points, target 62700-61800

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot contract trading techniques, operational skills, and knowledge about candlesticks, you can add Master Chen for learning and communication. I hope it helps you find what you want in the crypto space. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% following the trend; daily updates on macro analysis articles, mainstream coins, and altcoin technical indicator analysis, as well as spot medium to long-term price prediction videos.

Warm Reminder: This article is only written by Master Chen on the official account (as shown above). Any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。