Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

On October 7, local time in the United States, Judge John Dorsey of the Delaware Bankruptcy Court officially decided to approve FTX's bankruptcy plan during a hearing, marking a significant progress in the compensation process for FTX. Moving forward, FTX will use up to $16.5 billion in assets recovered since its bankruptcy filing to compensate its creditors.

Given the considerable confusion and even rumors surrounding the compensation process for FTX in the current market, many readers are still unaware of the full scope of the event and are unable to proactively assess its potential impact on the market. To eliminate these doubts, Odaily Planet Daily will clarify this information in a Q&A format, combining official materials and public statements from professionals.

Q1: What exactly is FTX's bankruptcy plan?

The so-called bankruptcy plan is a reorganization plan formally proposed by the FTX liquidation team led by John J. Ray III on May 7 of this year. The plan entered the voting phase after being approved by Judge Dorsey on June 25, and was officially approved by Judge Dorsey last night.

From the user's perspective, the most important aspect of this bankruptcy plan is that FTX will first use its recovered assets to compensate its customers, and then pay any potential competing claims raised by government regulatory agencies.

Q2: What does the approval of the plan mean?

With the formal approval of the plan, FTX will compensate 98% of its users within 60 days after the bankruptcy plan takes effect.

Q3: When will the bankruptcy plan take effect?

It should be clarified that the approval of the bankruptcy plan does not equate to the plan taking effect; the specific effective date has yet to be determined.

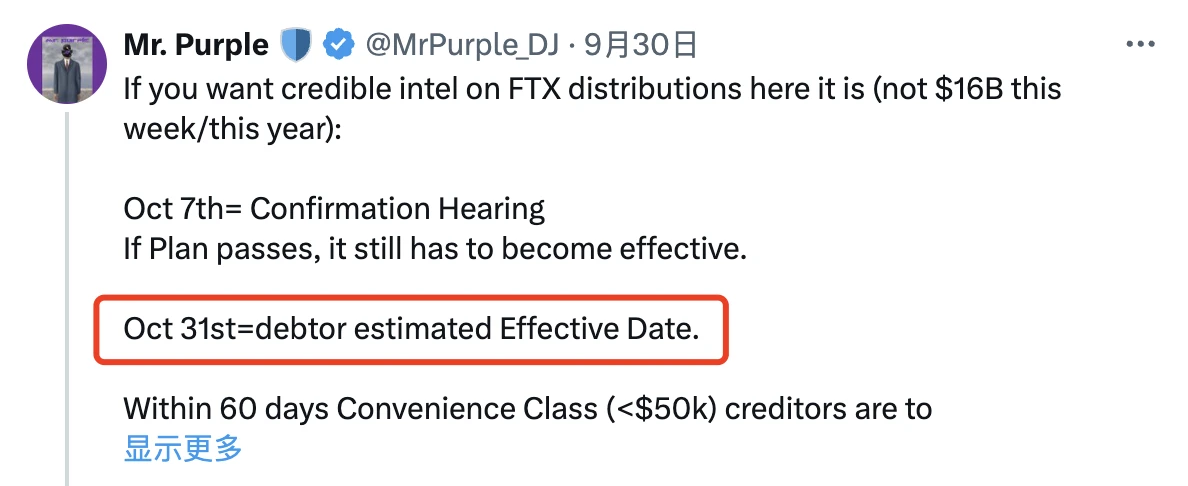

However, according to several FTX creditors, the expected effective date is October 31, which means that 98% of FTX users will begin receiving compensation from FTX before the end of the year.

Q4: Which users will receive compensation first?

According to FTX's bankruptcy plan, the 98% figure is actually a derived user ratio, covering customers who held $50,000 or less in the exchange at the time of FTX's bankruptcy.

Q5: What is the total amount of funds available for compensation?

FTX previously estimated in its bankruptcy plan that the total value of assets recovered and convertible to cash for distribution since filing for bankruptcy will be between $14.5 billion and $16.3 billion.

Q6: Will FTX compensate in full at once?

According to research by Galaxy's head of research, Alex Thorn, FTX is expected to compensate approximately $1.1 billion to 98% of users (those with claims under $50,000) within the year, with the remaining funds expected to be paid between the first and second quarters of 2025.

Q7: What are the compensation standards?

According to the bankruptcy plan, FTX will compensate 98% of creditors in cash based on the dollar value of their claims at the time of bankruptcy in November 2022, with an expected compensation rate of 118%; the remaining creditors will also receive a 100% compensation rate, plus time value compensation amounting to billions of dollars.

Q8: What is the attitude of the creditor group towards the compensation plan?

The hearing last night revealed that about 94.48% of creditors voted in favor of the bankruptcy plan, with the total claim value of these creditors amounting to approximately $6.83 billion.

However, some creditors, including the representative of FTX's largest creditor group, Sunil Kavuri, explicitly opposed it, arguing that FTX should compensate in "physical form" directly in cryptocurrency rather than based on the dollar value from 2022 — the price of Bitcoin has risen from $16,000 in November 2022 to $63,000, and compensating based on dollar value means a significant depreciation in terms of cryptocurrency value, making the so-called "118% compensation rate" negligible compared to the rise in coin prices.

David Adler, a lawyer representing some creditors, also mentioned another issue in court, that if creditors receive compensation in cash rather than in physical form, they may face substantial tax liabilities.

Q9: Why not use physical form for compensation (directly returning coins)?

In response to some creditors' demands for "physical form" compensation, FTX's stance is that it is "impossible."

FTX's liquidation team stated that many users believe FTX always held their cryptocurrencies in their accounts, but the reality is that when the team took over FTX, they discovered a significant asset shortfall on the exchange's books — only 0.1% of BTC and 1.2% of ETH remained on the books.

FTX financial advisor Steve Coverick testified that if physical compensation were to be made, FTX would need to purchase cryptocurrency assets on the open market, which would incur "outrageous" costs.

Judge Dorsey also opposed physical form compensation during the hearing.

Q10: Will the compensation funds flow back into the market?

For the vast majority of ordinary investors, this may be the most concerning question: whether the up to $16.5 billion in funds can flow back into the market, injecting more liquidity and potentially driving up prices.

However, considering that FTX-related claims have been circulating in the market for a long time, many original creditors, due to the need for early liquidation, have sold their claims to institutions specializing in bankruptcy claims; this portion of funds is expected to be difficult to flow back.

There is no specific figure for the proportion of sold claims, but well-known creditor Mr. Purple estimates that this proportion could reach around half.

Su Zhu, who previously helped boost the last bull market alongside SBF in a "sacrificial form," stated that even if these funds cannot fully return to the crypto market, it is still a significant amount that may help drive market trends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。