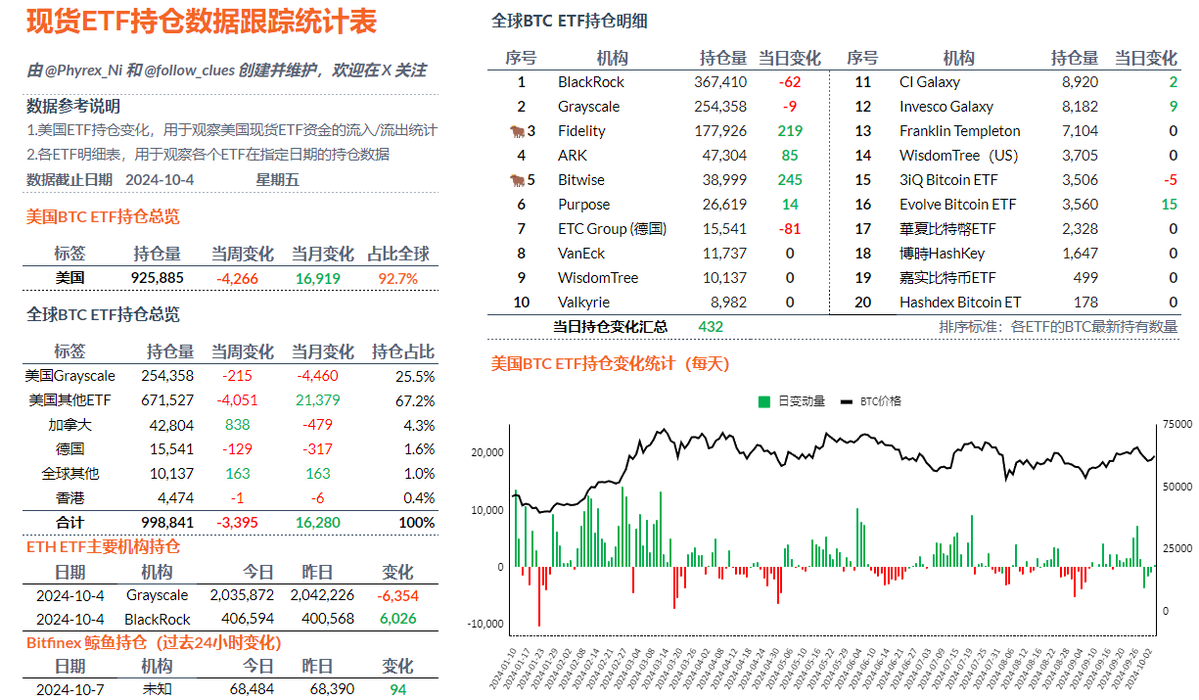

Yesterday we looked at the data for ETH, as ETH has less data. Today, the data for BTC has all been updated, and we can see that the BTC data is not bad either. The main reason is that BTC has not been subjected to the same heavy selling by institutions as ETH. From the data, Grayscale's GBTC is no longer the main force behind the selling; in the past week, the total BTC sold by GBTC was only 215 coins, even less than Fidelity, ARK, and Bitwise. Grayscale's selling of BTC has basically stopped.

In the past week, there was a net outflow of 3,394 BTC, ending three consecutive weeks of net accumulation. Among this, 4,265 BTC flowed out from twelve ETF institutions in the United States. The only four-digit net accumulation last week was BlackRock's 2,100 BTC, indicating a significant decline in purchasing power.

Currently, BlackRock holds a total of 367,410 BTC, ranking first in the holdings leaderboard, followed by Grayscale with 254,358 BTC, and Fidelity with 177,926 BTC. The others account for less than 5%.

At present, due to the lack of large-scale selling, the price of BTC is more closely linked to macro sentiment. Unless there is a very obvious negative factor, the pressure on the price is not significant.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。