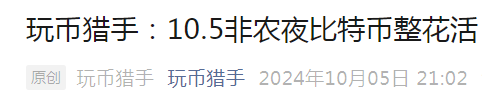

The weekend hunter's article has detailed this market enough, right? They’ve stripped everything bare for you to see, letting you operate in the 200-point area around 61500. The market hit a low of 61700, directly taking you up, with a minimum profit target of 63000 and a maximum limit below 64000, with today’s high at 63900.

Every time the hunter reviews, it’s really not about wanting to boast about how great I am; I just want to tell you that through reviewing, you can reasonably and objectively view market trends to get a reliable answer. You see, every time I write an article, it’s not just about giving you points; it’s a complete review of the week’s market, clarifying everyone’s movements, and the conclusion drawn is that profit is just the added value brought by the correct answer.

Although we trade for profit, during the opening phase, don’t preset how much you want to earn. Profit is the conclusion that comes to you. Collect information, make arguments, refine trading logic, form a closed loop, then execute, and the final result is profit!

Today, the hunter teaches everyone to use Texas Hold'em to make the dull market more interesting.

If we compare the cryptocurrency market to a poker table, you and I are players at this table. There’s a saying: if you can’t find your fish after half an hour at the table, you are the biggest fish on the table. You must be clear that in this zero-sum game market, every profit you make represents someone else losing money to pay you, so finding your own fish is key.

In relation to the market, your only goal is to harvest other retail investors. On the table, there are institutional players, novice investors, seasoned veterans, and technical analysts.

Now let’s start analyzing their hands (operational ideas) combined with the community cards (the market that has already appeared) to verify the subsequent market.

Currently, the market has broken through 62300 with a one-sided surge. The weekend hunter analyzed the low position of 60000 for short positions and 62300 for adding to short positions in the article. Either they have already been liquidated or stopped out (with the breakthrough of 62300, the bears have no conceptual space), so it is known that the current market’s short positions have almost been cleared, and only the previously trapped long positions above 64000 remain, with the vast majority of long positions trapped after chasing long at 65000. Those who do not know the reasons behind the high long positions should refer to the hunter's article from early October.

In the morning, after breaking through 62300, a pullback confirmed support, initiating a second rise to 63900, with multiple spikes around 63000.

From the perspective of the bears: after breaking through 62300, there is no concept of shorting; one can only wait to short around 64000.

From the perspective of the bulls: breaking through 62300 with a one-sided surge, the morning pullback to confirm support initiated a second rise, making this an excellent entry point for long positions. Currently, there is a short-term pullback to the previous spike point at 63000.

Bears can short around 64000.

Bulls can enter long positions steadily between 62300-62500, or aggressively at 63000.

OK, everyone’s hands have been revealed. Now, based on the community cards, let’s predict the subsequent market by verifying the turn card.

If the subsequent market can continue to push up to 64000, it will further eat into the retail investors' short positions.

If the subsequent market maintains a sideways adjustment around 63000, then this position will tempt the first batch of long positions to enter, and then gradually trap the long positions that entered at 62300.

Based on the speculation of enticing longs at 63000, the subsequent market will repeatedly oscillate at this position, allowing long positions to enter but not giving exit opportunities. Calculating the sideways movement between 63000-63300, short-term long positions want to take profit, and the minimum profit must be 500 points. Thus, the premise for the long trap speculation is that tonight’s market will not exceed 63800.

Because once it exceeds 63800, the shorts will be tempted to enter, and the longs will take profit and leave, which will trap the shorts.

Now that the argument is complete, let’s start today’s operations:

Short at 63500-63300, stop loss at 63800, target 62300 to reduce positions, and if it breaks below 62300, look directly at below 58000.

The weekend long position at 61700 has already taken profit above 63000.

Friends who have already entered short at 63800, continue to hold.

The reason for looking at 58000 will be announced in tomorrow's article; it’s too much to explain all at once, and you can’t digest it.

Long-term trend positions are only announced in the internal core group. If you are interested, message me. The complete planning and argumentation have been finished. The last time we started the argument from May, the trend that started in June at 69000 was chased all the way down to 53000-50000, with nearly a 20000-point space. This was publicly shared for free across the internet, including real-time updates during live broadcasts, but people don’t cherish free things, and very few can persist. This time, only cooperation can allow you to join. The community team controls the rhythm throughout, and the hunter’s grasp of the trend needs no explanation; history has proven it countless times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。