Key Indicators: (Hong Kong Time September 30, 4 PM -> Hong Kong Time October 7, 4 PM):

BTC/USD price remained flat ($63,500 -> $63,500), ETH/USD fell 4.6% ($2,600 -> $2,480)

BTC/USD December (year-end) ATM volatility decreased by 0.7v (56.8 -> 56.1), December 25 risk reversal volatility decreased by 0.4v (2.7 -> 2.3)

Spot Technical Indicators Overview

In the long term, the top flag resistance is too strong to break through — this remains our fundamental judgment on market trends before next month's U.S. elections.

BTC faced resistance in the $65-66k range, and the escalation of geopolitical tensions led to a brief drop below the previous $60-61k support range, but strong support around $60k stabilized the price.

We believe that short-term support at $60.5-60k should hold temporarily, while upward movement may be limited around $65k. Overall, the market may enter a consolidation phase, waiting for the election results as a new catalyst to clarify direction.

Major Market Events

The market enthusiasm brought by China's stimulus policies has waned, shifting focus to the escalating geopolitical situation in the Middle East. After Iran's missile attack on Israel (which seems to have caused more damage than Israel acknowledges), Israel vowed to retaliate, although the specific form of retaliation is currently unclear. The U.S. appears to be trying to persuade Israel to de-escalate the situation to prevent further escalation. The tense geopolitical situation has put pressure on cryptocurrency prices, with BTC/USD briefly dropping below $60k and ETH/USD falling below $2400 — recently, cryptocurrency prices have been highly correlated with U.S. stock market trends (showing no safe-haven characteristics).

U.S. employment data significantly exceeded expectations, with the unemployment rate falling to 4.05%, and new jobs exceeding expectations by 100,000! This boosted U.S. stock prices and the dollar against fiat currencies last Friday, but cryptocurrencies instead performed well due to stock market-related factors, surpassing the influence of the dollar and U.S. interest rates. This indicates that the market's stock market Beta effect is more pronounced, overshadowing the impact of the dollar and U.S. interest rates.

U.S. employment data far exceeded expectations, with the unemployment rate falling to 4.05%, and new job numbers exceeding expectations by 100,000! This boosted U.S. stock prices last Friday, while the dollar strengthened against fiat currencies. Cryptocurrencies also rebounded after this data release, but their gains were mainly influenced by the stock market's beta rather than the beta of the dollar and U.S. interest rates.

In the vice-presidential candidate debate, Vance performed excellently, bringing the election polls back to a 50/50 situation. Given that Vance has brought more mid-term credibility to the Trump camp and supports cryptocurrencies, this increases the likelihood of favorable election outcomes (previously, Trump was trailing Harris in polls, and the market had relatively conservative expectations).

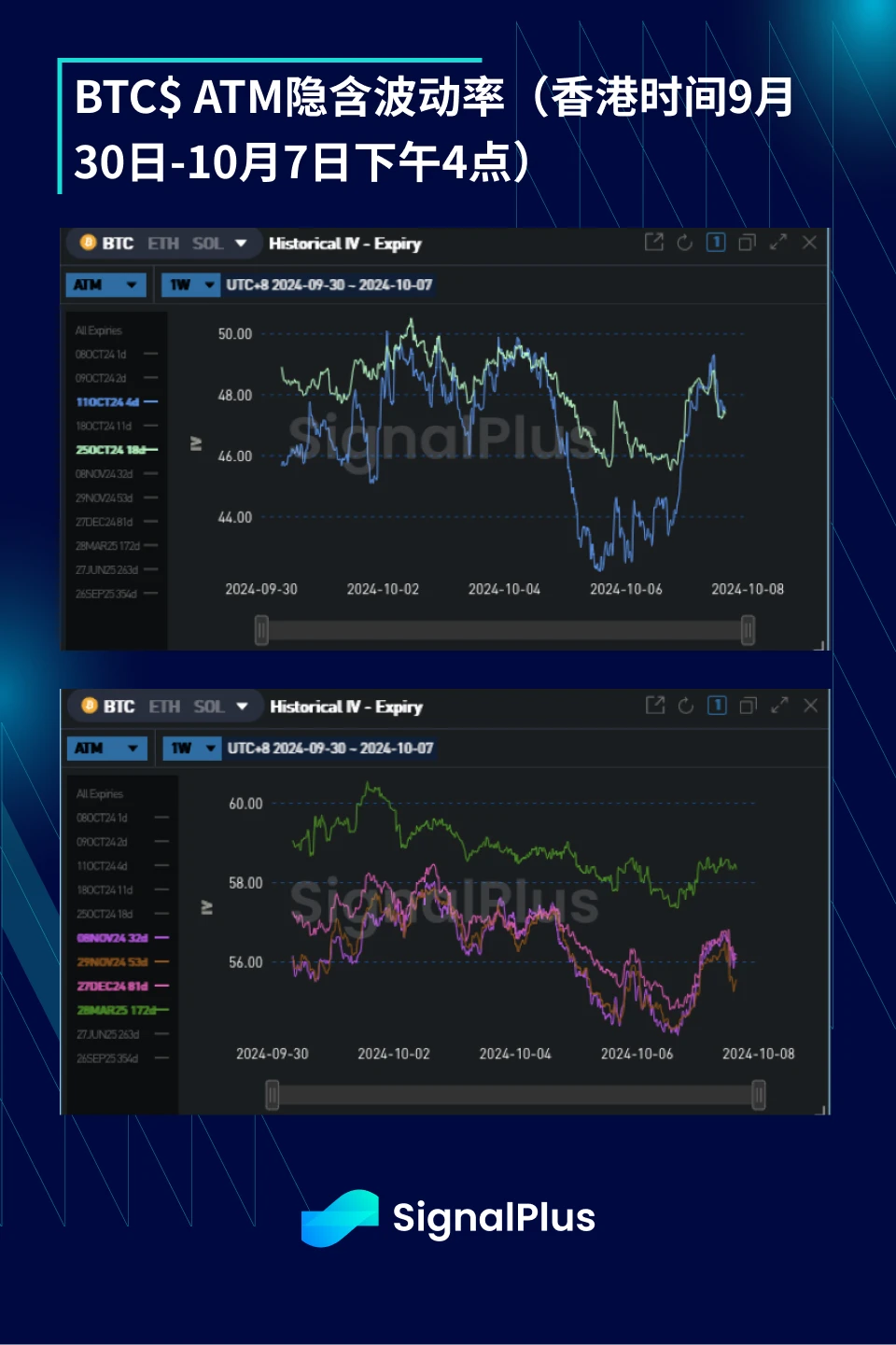

ATM Implied Volatility:

Affected by geopolitical tensions, BTC/USD spot was liquidated, with prices briefly dropping below $60k, and actual volatility rebounded from very low levels. Nevertheless, high-frequency and fixed-term actual volatility remains at levels of 40-45 (up from 35 last week), while daily volatility is around 45-49.

As spot prices stabilized around $60k and rebounded due to last Friday's U.S. stock market recovery, implied volatility significantly dropped over the weekend, reaching a new low for the recent cycle. Due to low actual volatility and insufficient demand, the market appears very cautious about holding positions. Actual volatility over the weekend was extremely low (25), but slightly rebounded on Monday morning after the easing of the Middle East situation pushed BTC/USD spot prices up by 2.5%.

Unless the Middle East situation escalates again or CPI data shows significant anomalies, we continue to expect Gamma performance to remain subdued this week (the front end of implied volatility will be under pressure).

Before the weekend, the market removed risk premiums from the implied volatility curve, leading to a further reduction in the pricing of election volatility. Given that there are only four weeks left until the election and the election odds are 50/50, market attention will soon shift to this election as the next new catalyst. As election day approaches, event pricing is expected to rise accordingly.

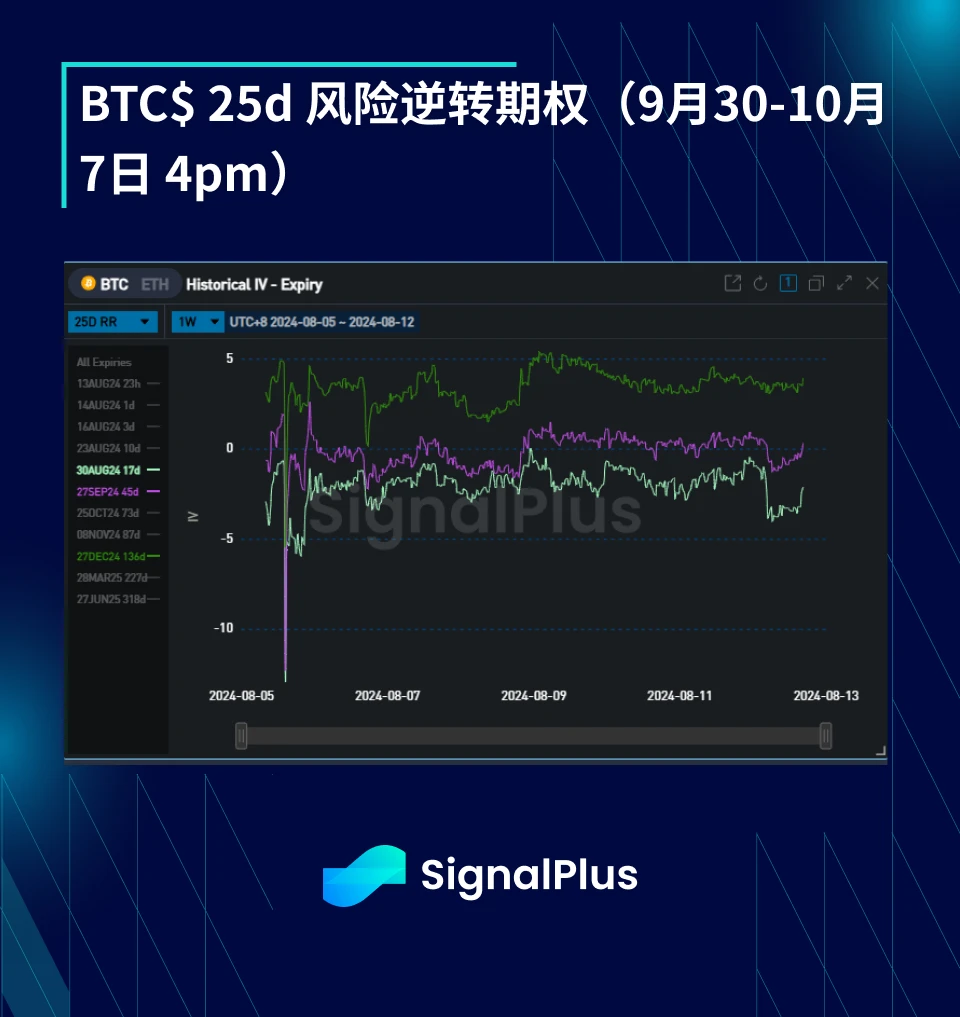

Skew/Convexity:

This week, skew prices have retreated, with a large supply of December call options appearing in the market (proportion of call spreads). Additionally, from the perspective of actual volatility, geopolitical news has exacerbated the downward movement of spot prices, leading to relatively strong demand for short-term contracts (especially those expiring in October and November 8).

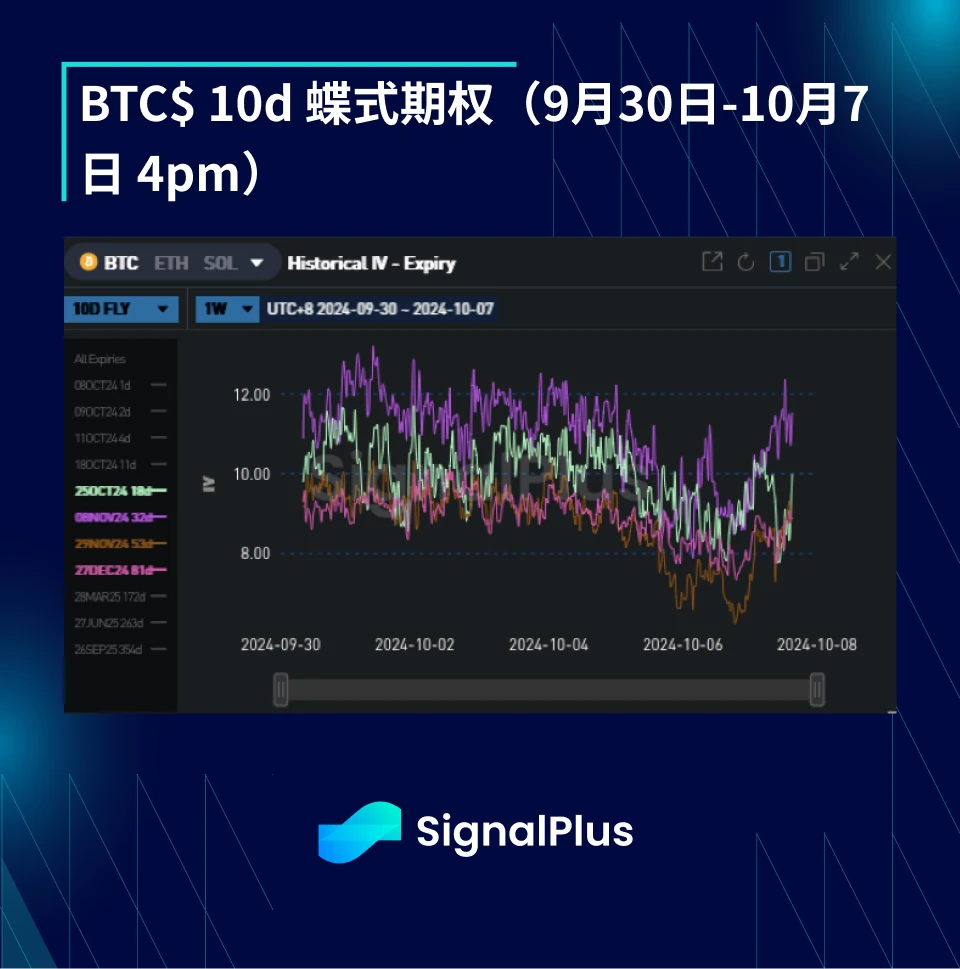

Convexity remained flat this week, although there was some supply of call spreads, but this was offset by direct demand for wing options (strike prices outside the 55/70k range).

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。