However, through data, we can determine whether the A-shares or Hong Kong stocks have been siphoning off from the cryptocurrency market and whether this will affect the prices and liquidity in the crypto space.

The topic of A-shares siphoning off funds has been discussed since before October 1st, coinciding with a seven-day holiday, and October 8th should be the best point for speculation. Therefore, if there are funds ready to move from the crypto market into A-shares or Hong Kong stocks, this is the best time.

To start with the conclusion, there are indeed signs that funds from the crypto market are exiting. While we cannot say that all exiting funds have gone to A-shares and Hong Kong stocks, considering the recent surge in trading volume of Chinese concept stocks in the U.S. market, it can be confirmed that some funds have entered markets related to A-shares. However, the scale of these funds currently appears to be small, and their impact on the crypto market is still very low.

At least up to now, there is no clear data proving that funds moving into A-shares will affect the cryptocurrency industry, nor is there clear data indicating that A-shares' siphoning off from the crypto market is destructive. Furthermore, there has been no observed trend of large-scale funds transferring from the crypto market to A-shares or related markets.

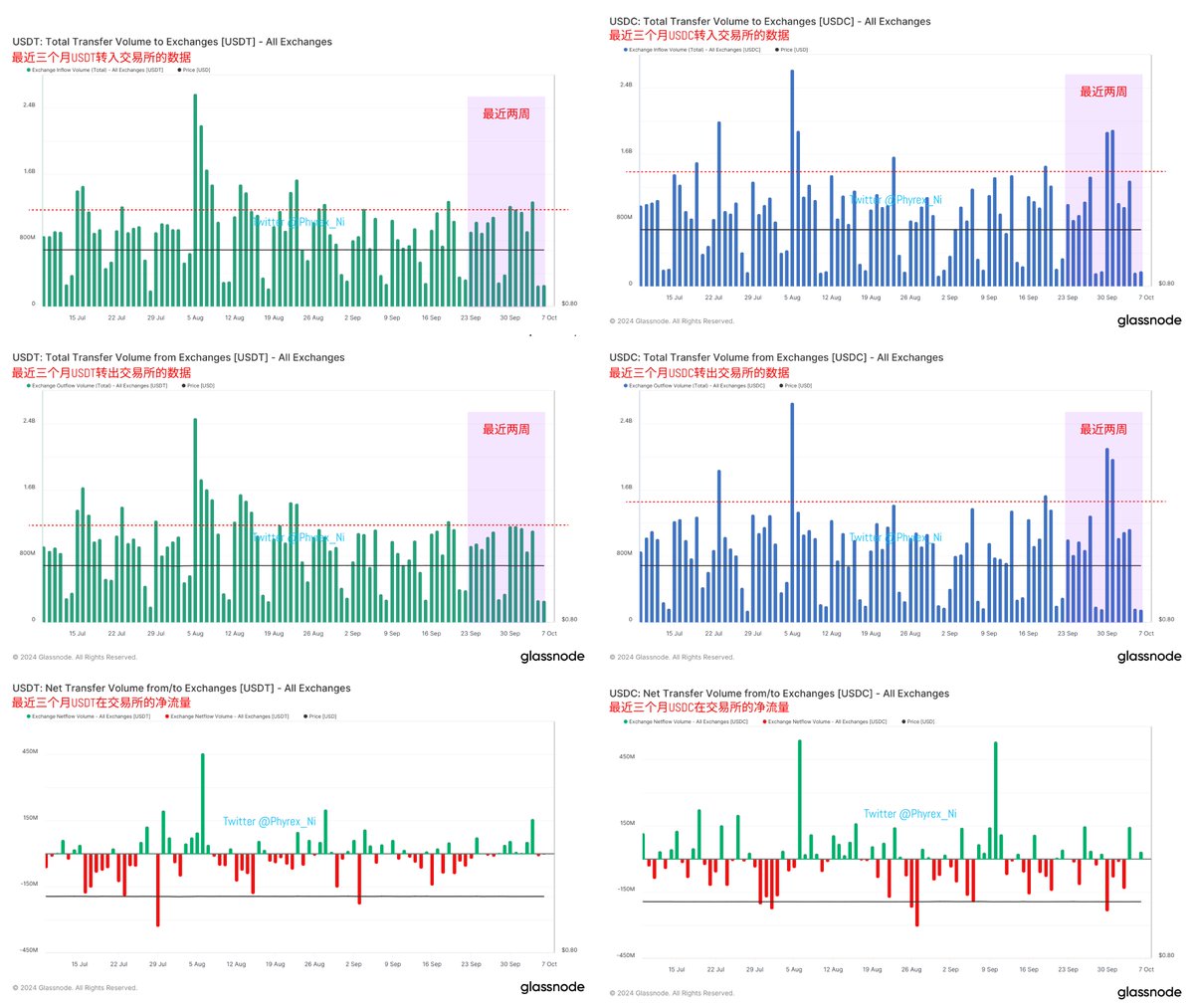

Returning to the data aspect, when discussing funds in the crypto market, the focus is on USDT and USDC. The former is more concentrated in Asia and Europe, while the latter is more favored by U.S. investors. We will assess the two main stablecoins based on their market capitalization, daily net flow in exchanges, stock levels in exchanges, and trading volume with #BTC.

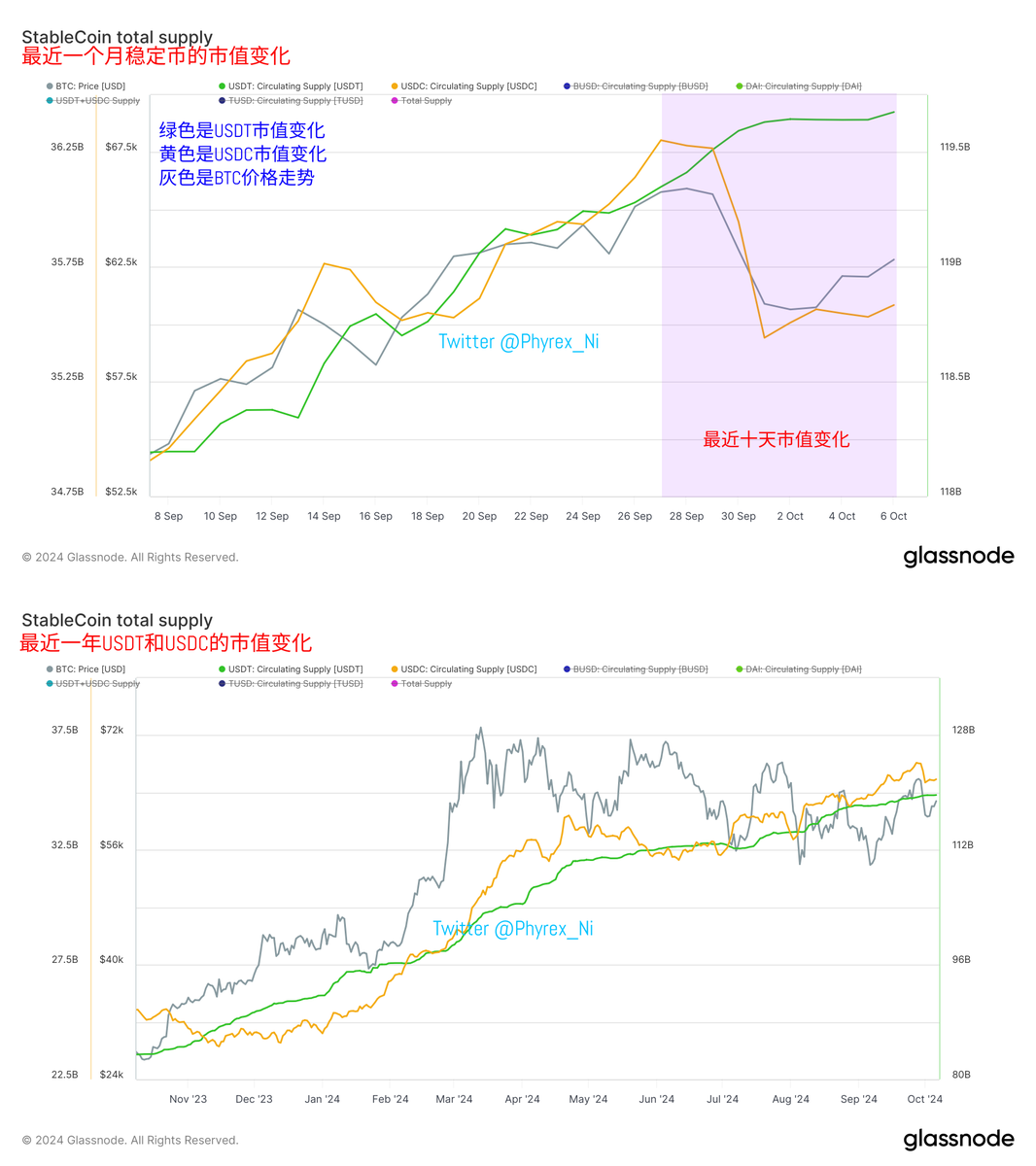

First, regarding the market capitalization of the two main stablecoins, we can refer to Figure 1, which shows the changes in the market capitalization of USDT and USDC alongside the price trend of BTC.

From the figure, it can be seen that there has been no significant change in the market capitalization of USDT over the past month. We know that USDT is predominantly used by investors in Asia and Europe, so if Asian investors want to deploy funds into A-shares, it should be more reflected in the market capitalization of USDT. In reality, we have not seen a significant decline in USDT's market capitalization. Of course, in the past week, USDT's market capitalization has not shown significant growth, which can be seen as a turnover of some funds.

However, the amount of this turnover should not be large. Based on previous weekly growth data, the decrease in USDT's market capitalization over the past week is approximately $40 million. Even if this amount is indeed drawn from the crypto market to A-shares, the impact would not be substantial.

Next, looking at USDC's market capitalization, there has been a noticeable decrease over the past ten days, dropping approximately $85 million from its peak to its lowest point, with a recent recovery of about $13 million over the last four days. The overall decrease is around $72 million. If we calculate the weekly capital increase for USDC, it appears that USDC has reduced its holdings by about $100 million over the past ten days.

This amount may not have directly gone to A-shares or Hong Kong stocks, but it is possible that some of it has been reinvested into U.S. stocks tracking A-share indices, ETFs, or other stocks. This possibility does exist, but similar to USDT, even if this $100 million has transferred from the crypto market to A-shares, it is still not a large amount. Moreover, considering the recent escalation of war trends, it is very likely that funds are exiting USDC in search of stability, so the actual amount that could go to A-shares may be even less.

Therefore, even with the highest estimates, the amount of funds transferred from the crypto market to A-shares over the past ten days is likely between $150 million and $200 million, and its impact on cryptocurrency prices is negligible. The reason for this expectation can be seen in Figure 2.

Figure 2 clearly describes the data of USDT and USDC entering exchanges over the past two weeks. The most intuitive observation is that the amount of funds entering and exiting exchanges for both USDT and USDC has not fallen below or significantly exceeded previous ranges. This indicates that even if there are funds exiting the crypto market and moving to A-shares, the overall amount of funds entering exchanges remains insufficient to impact the normal inflow of funds.

In simpler terms, even if there is so-called siphoning off from the crypto market to A-shares, the impact on #BTC and #ETH and other cryptocurrencies is very minimal.

Returning to Figure 1, there is a very important additional data point: it can be clearly seen that the price fluctuations of BTC are correlated with the changes in USDC's market capitalization, and the correlation is very high. It can be said that the changes in USDC's market capitalization and BTC's price are mutually positively attractive. When USDC's market capitalization is increasing, BTC's price tends to rise, while when BTC's price falls, USDC's market capitalization decreases correspondingly.

Of course, this data is not a 100% judgment method, but we must remember that we have been emphasizing that USDC is more used by U.S. investors, and currently, the main investors in BTC and ETH are also Americans. Therefore, USDC serves as a barometer reflecting the sentiment of U.S. investors.

Next, let’s look at Figure 3.

Figure 3 shows that the stock levels of USDT and USDC in exchanges have not undergone any essential changes. This aligns with the data I shared three weeks ago in the tweet titled "Using Stablecoin Data to Determine Current Investor Trends: Are They Buying or Selling?" Therefore, I can also conclude that even the USDT and USDC present in exchanges show no significant signs of transferring to A-shares. Even if there are some, they are insufficient to impact the purchasing power of the crypto market itself.

Finally, we need to examine the changes in trading volume among the two major BTC exchanges, #Binance and #Coinbase. Let’s look at Figure 4.

In Figure 4, the upper part shows the trading volume of BTCUSDT on Binance, while the lower part shows the trading volume of BTCUSD (USDC). It can be seen that Binance's trading volume did not show significant differences compared to previous periods before last Thursday. There was a slight decline on Thursday and Friday, but it was not severe. In contrast, Coinbase's data appears much more normal; although there was a slight decline on Friday, the percentage of decline was lower. Combined with the BTC turnover rate data released last Friday night, it is evident that the overall turnover has decreased.

Considering the macro sentiment at that time, part of the reason could be that the favorable non-farm payroll data led some investors to remain cautious and not actively participate in the turnover. In fact, the spot ETF data for BTC and ETH is similar. Therefore, from the comparison of trading volumes, even if some USDT and USDC have transferred from the crypto market to A-shares, the volume of these transfers is insufficient to impact the liquidity of the crypto market itself.

In conclusion, there are indeed some funds, especially USDC, that have more clearly exited the crypto market, possibly moving into markets related to A-shares. The total amount transferred should be less than $200 million, and these funds have not significantly impacted the prices of BTC and ETH, nor have they affected the overall liquidity of the crypto market.

At least up to now, there is no clear data proving that funds moving into A-shares will affect the cryptocurrency industry, nor is there clear data indicating that A-shares' siphoning off from the crypto market is destructive. Furthermore, there has been no observed trend of large-scale funds transferring from the crypto market to A-shares or related markets.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。