Original | Odaily Planet Daily (@OdailyChina)

On October 5, the market reported that the Web2 social media platform X has paid the fine imposed by the Brazilian Supreme Court and will subsequently apply to restore its services in the country, marking a relatively satisfactory conclusion to the previous conflicts between traditional social media and national regulatory forces.

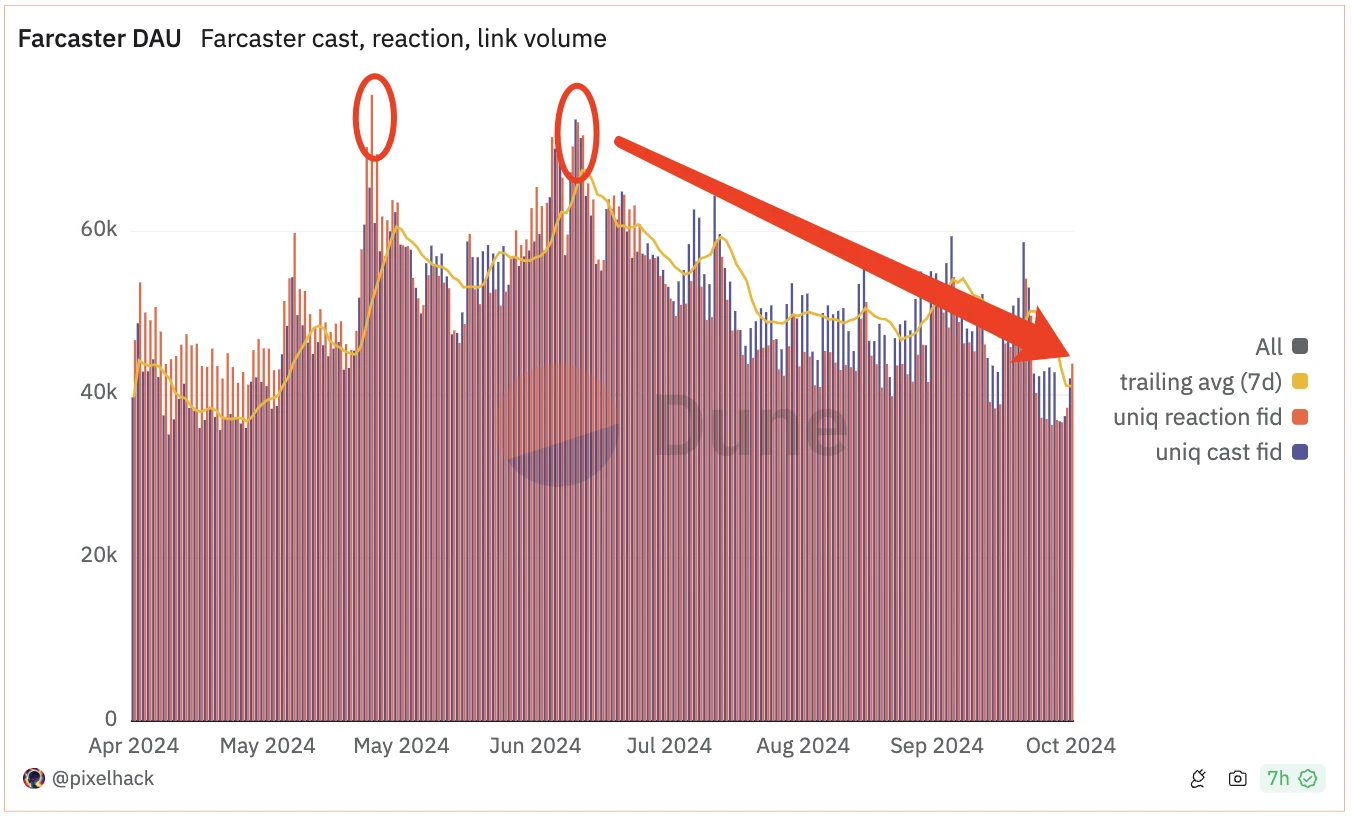

On the other hand, as a synonym for Web3 social media, the SocialFi sector is once again facing a distressing "industry test." The unicorn in the sector, Farcaster, is experiencing sluggish growth, with a user increase of only about 30,000 since mid-August, and protocol revenue has gradually slowed since July, currently totaling around $2.33 million. The once "hot favorite," friend.tech, after aggressively harvesting protocol revenue of $81.953 million (with the team receiving about $45 million in fees), has chosen to almost "soft rug" by relinquishing control of the smart contract.

Despite star investors like a16z and Paradigm continuing to heavily bet on the SocialFi sector, the current state of the industry is still disheartening: Is crypto social still a promising sector? What does the future hold for SocialFi? Has the SocialFi narrative already failed? What problems exist in social projects within the cryptocurrency industry, and are they even a false proposition?

Odaily Planet Daily will explore these issues in a phased manner in this series of articles, with this article primarily focusing on the existing problems in the SocialFi sector.

SocialFi Problem One: "Head-On Collision" with Traditional Social Giants, Attacking Their Strengths with Weaknesses

The Metcalfe's Law states that the utility of a network is proportional to the square of the number of its users.

Traditional internet social media platforms, including Facebook, Instagram, Snapchat, WeChat, and TikTok, have become the "traffic origin," "attention gateway," and "social network carriers" of the entire internet ecosystem based on their accumulated user base. The vast array of traditional social products is the very battleground where many social applications in the cryptocurrency field, namely SocialFi products, choose to "attack their strengths with their weaknesses" on the "path of bones."

Historically, even kings competing for dominance understood the strategy of "building high walls, accumulating grain, and delaying the claim to kingship." Today's commercial products, upon encountering towering "south walls," do not choose to go around but instead crash headlong into them—creating products that are indistinguishable from traditional social media platforms, often operating under the following banners:

"Everyone is our target user";

"Our goal is to disrupt the X (Twitter) platform";

"We want to change the status quo of the social sector and truly return social data and power to the users."

It must be said that the "arrogance" of entrepreneurs in the cryptocurrency industry is evident here—they do not consider the real needs of users, do not care about the costs of users migrating platforms, do not concern themselves with whether users care about so-called "decentralized power," and do not think about the social network maps of users and where their social networks come from and go; instead, they fall unilaterally into the trap of "self-pleasure" and "self-delusion."

Know yourself and know your enemy, and you will never be defeated; if you do not know your enemy and do not know yourself, you will be defeated in every battle.

Farcaster Daily Active User Data

SocialFi Problem Two: No Substitute Value, Failing to Find Its "Trojan Horse"

In the 12th century BC, the ancient Greek city-states waged a protracted war against Troy. Ultimately, the allied forces of the city-states used a wooden horse, concealing many soldiers, to infiltrate the city of Troy, which mistakenly believed the enemy had retreated, leading to their victory in the war. The "Trojan Horse" thereafter became a symbol of subterfuge and deceit.

Currently, the competitors facing SocialFi products are akin to the hard-to-conquer city of Troy. On one hand, they need to find their value that can replace or surpass traditional social media platforms; on the other hand, they need to discover the secret to "infiltrating the enemy camp" and "breaking through its fortress from within."

Some people pin their hopes on the Fi attribute in SocialFi, where using certain crypto social products can yield economic rewards, such as token airdrops; others view it as part of traditional social media platforms (e.g., paid stickers, Sofamon in the Base ecosystem, for more details, refer to my previous article “Analyzing Sofamon: The Next friend.tech or the Web3 Version of CM Show?”).

Currently, the path chosen by the former will ultimately narrow down in the spiral of token airdrops or token price declines, amounting to a "chronic suicide after a data bubble"; the latter remains in a niche demand sector, unable to attract attention and liquidity on a larger scale, requiring time for validation.

At present, a true "Trojan Horse" needs an application at the level of "AI Personalized Companion" to "initiate the next offensive."

SocialFi Problem Three: Fi for the Sake of Fi, Making Social a Joke

Murphy's Law states that if something bad can happen, it will happen; similarly, the more people desire something, the less likely they are to obtain it.

For many SocialFi products and users, when social interactions are pursued solely for Fi, social becomes a joke.

From a psychological perspective, the essence of social interaction is to seek like-minded individuals, not merely for monetary or material incentives. If a person is willing to engage in social behavior solely to obtain Fi incentives, their "social purpose" naturally becomes impure, making it difficult to sustain long-term interactions purely for "social" reasons.

When the motivation to meet others and explore better interactive relationships is distorted into "for monetary returns," SocialFi becomes a different kind of "funding scheme," and the term Social naturally becomes a joke.

If it cannot provide users with a strong "social drive," SocialFi products are destined to be mere financial games disguised as "social shells."

SocialFi Problem Four: Inability to Establish a Value Closed Loop, Becoming a "Capital Toy"

All value systems originate from a logically coherent and tightly integrated value closed loop, which is precisely what current SocialFi products lack or even miss entirely.

Currently, the value of SocialFi product applications often comes from venture capital investments, failing to build a relatively clear value closed loop system. More directly, current SocialFi products resemble "ranking apps," where all funds, liquidity, and attention flow in to obtain more economic returns, without establishing deeper connections and links with others' ideas, resources, funds, capital, and attention, thus failing to stimulate more value exchanges.

As a result, social value becomes a one-way consumable, with no new generation, and users of SocialFi products are not joining an "infinite game without boundaries that continuously expands," but rather a "zero-sum game" where newcomers pay for the benefits of early adopters.

SocialFi products naturally become toys for capital to collect high management fees and seek investment returns—essentially, they are not much different from a PPT filled with various fraudulent information and empty promises.

Since there is no real data or actual value output, it would be more straightforward to operate a 24/7 casino or "data scheme."

SocialFi Problem Five: Impure and Wavering "Business Models"

Most SocialFi products on the market still rely on one of the most stable revenue streams in the cryptocurrency industry—charging transaction fees.

However, the steps and processes for collecting fees in SocialFi products differ significantly from the "transaction processes" in GameFi, NFT, and other sectors driven purely by speculative trading, and they are also distinct from the "staking for yield" in DeFi and Restaking, which seeks to reduce token supply and increase prices. Instead, they require leveraging "social content," "social relationships," and "social influence" as intermediaries to facilitate the establishment of a broader social network.

In the current environment of tightened industry liquidity and a decreasing number of active participants, this has undoubtedly become a significant hurdle for many SocialFi projects.

They must either be niche enough to "self-generate" and take the "rural encircling the city" approach to accumulate small gains; or be broad enough to attract more people with "what you see is what you get," taking the "stranger vs. dating choice" route to serve some real needs.

Otherwise, SocialFi products are likely to remain stagnant, unable to advance to the next wave of cryptocurrency surges.

Summary: Is Social Still About Commission? That's the Question.

Many SocialFi products today crudely abstract "social graphs" and "social products" into "products that share commissions through social recommendations," which is undoubtedly the most accurate portrayal of the current industry's "dataism."

However, this is clearly not a normal "social phenomenon." Just like the phenomenon-level e-commerce platform Pinduoduo, which has rapidly grown its e-commerce user network through social relationships, it primarily serves as a bilateral trading platform for buyers and sellers, which is its fundamental base.

A true social platform should serve to help people establish social relationships more quickly, better, more directly, and more harmoniously with others, rather than viewing people as "data mines" to be exploited for economic value and then discarded without further concern.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。