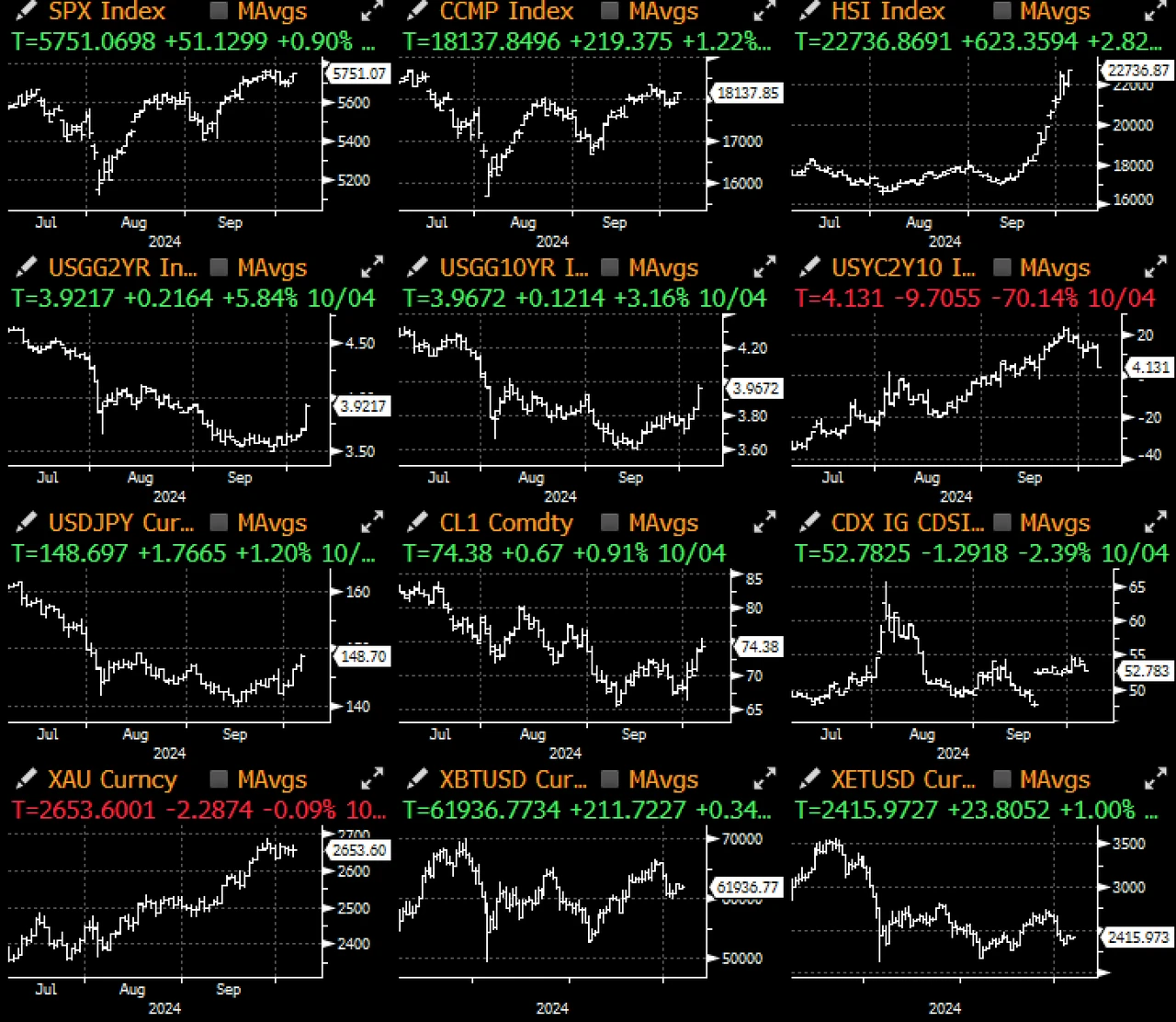

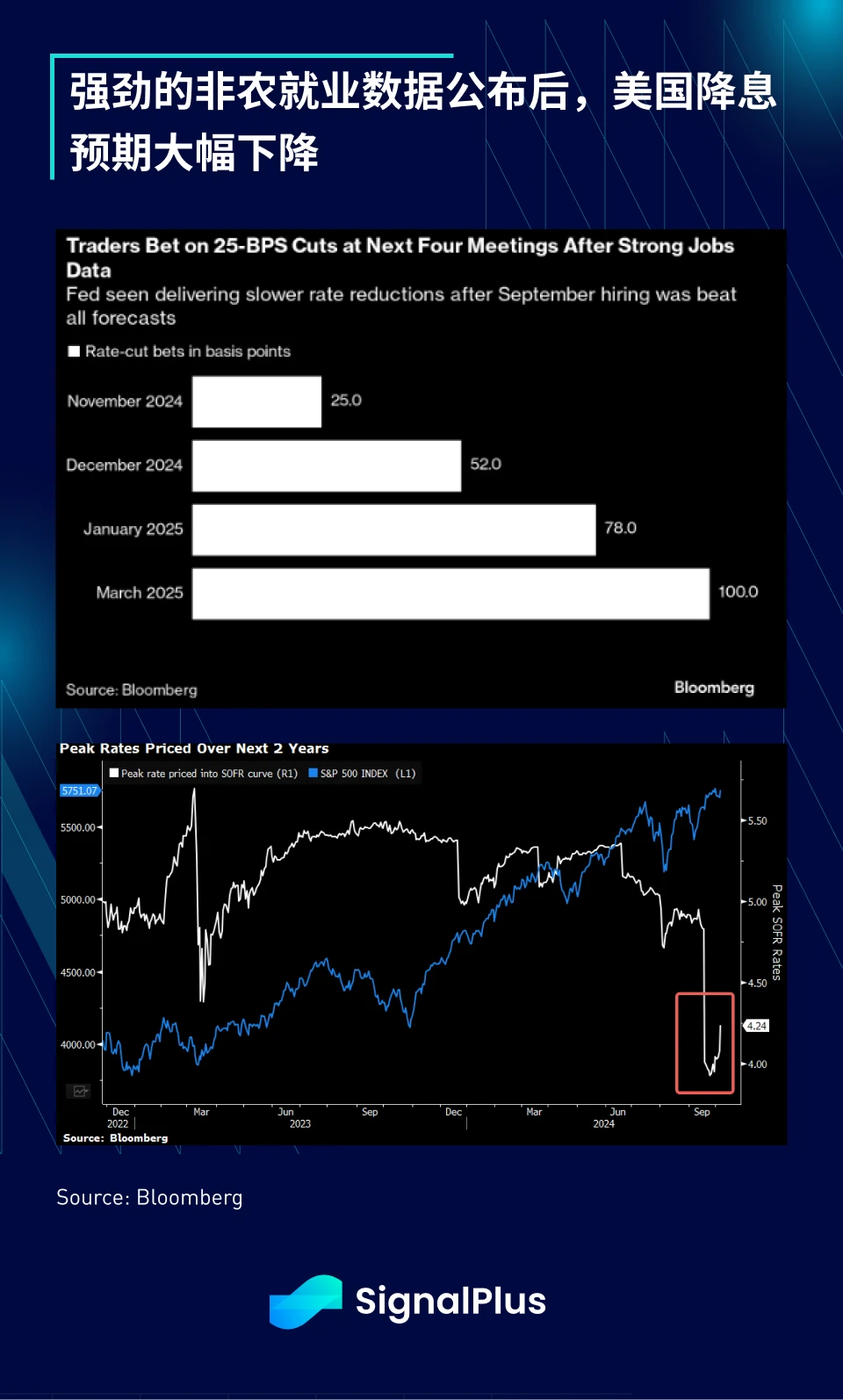

U.S. non-farm payroll data significantly exceeded expectations, with an increase of 254,000 jobs (expected 150,000), the unemployment rate falling to 4.05%, and average hourly wages remaining strong, raising questions in the market about whether the Federal Reserve's decision to cut rates by 50 basis points last month was wise.

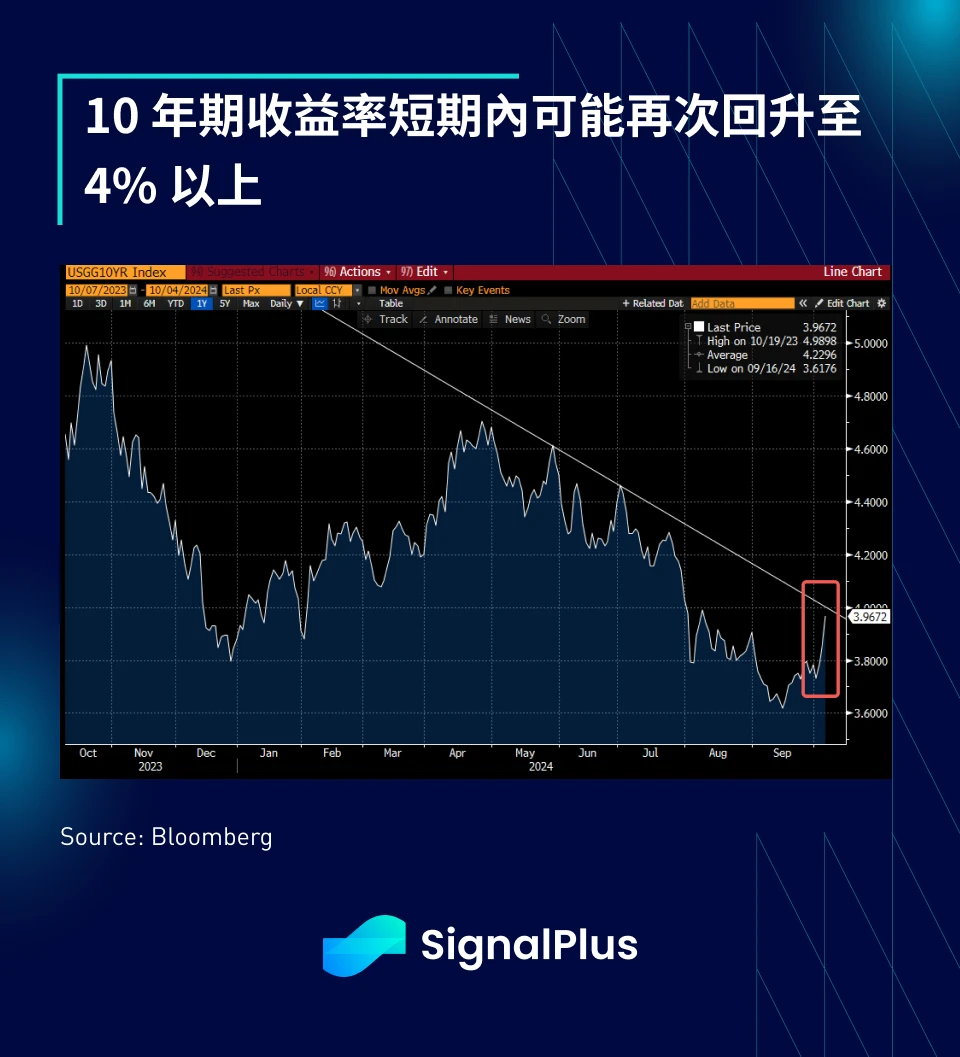

The reaction in the fixed income market was very intense, with the yield curve sharply flattening, short-term yields rising by 20 basis points, and the 10-year yield breaking through the resistance level of 3.93%, likely to surpass 4%. Meanwhile, the terminal rate surged by 25 basis points to nearly 4.25%, cooling market expectations for rate cuts to only 25 basis points over the next four FOMC meetings.

Despite the turmoil in the fixed income market, the U.S. dollar strengthened against all major currencies, particularly the Japanese yen, which saw a strong rebound after Japan's new Prime Minister Shigeru Ishiba stated that he would maintain an accommodative monetary policy and introduce new stimulus measures.

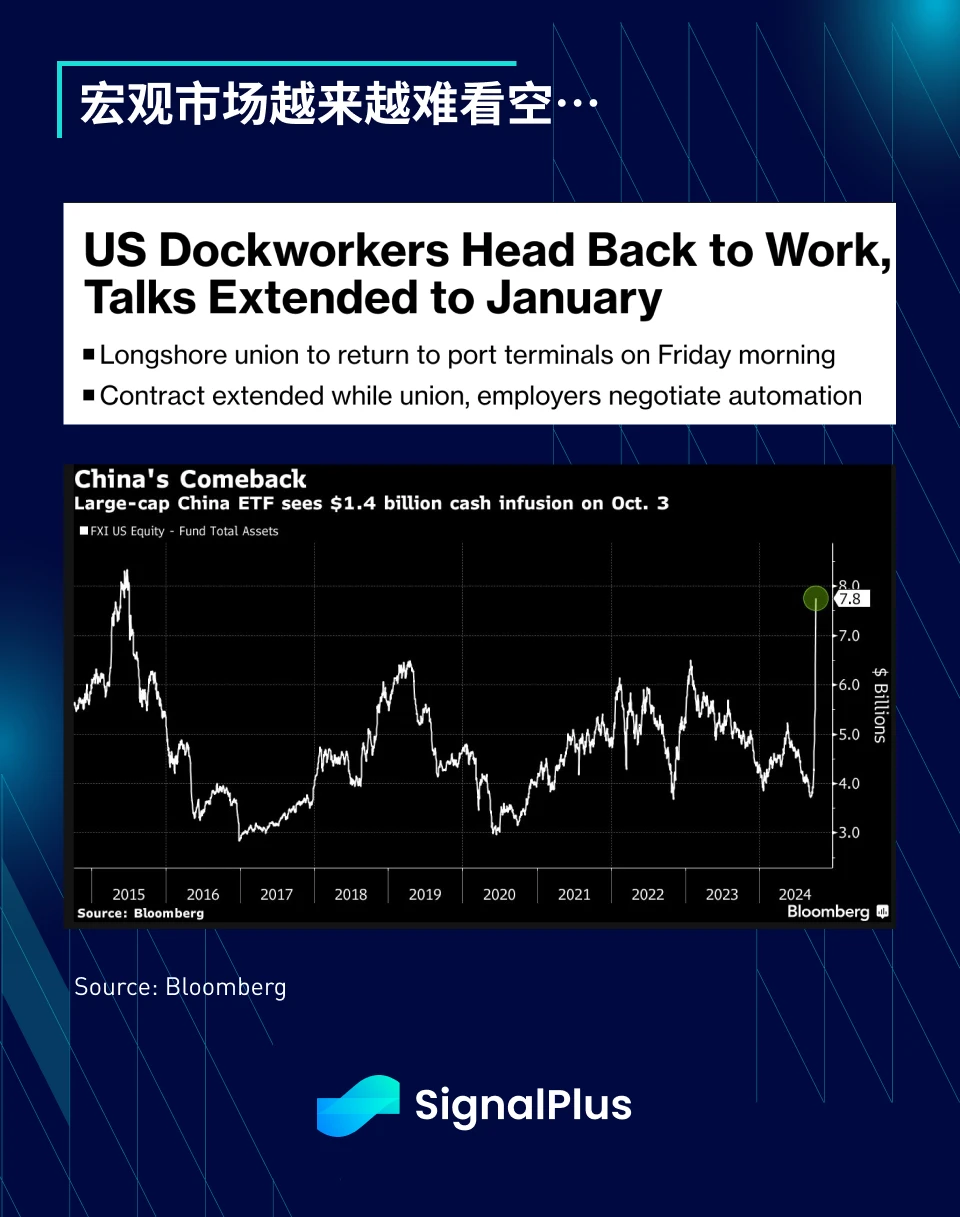

As expected, global stock markets had another strong week, with most indices rising, particularly in technology stocks. Strong economic data, friendly central bank policies, and even the timely end of the U.S. dockworkers' strike provided investors with ample reasons to maintain a risk-on attitude. Additionally, a record $1.4 billion flowed into Chinese assets through the FXI ETF, intensifying the fervor in the world's second-largest economy and further driving up risk assets.

Looking back at history, Chairman Powell's 50 basis point rate cut appears more dovish, especially since both inflation and unemployment rates remain close to extreme levels. On a normalized basis, the PCE remains around the top 15th percentile, while the unemployment rate is near a ten-year low. Furthermore, similar to 2020, as the stock market trends upward, global central banks are beginning to cut rates, leading to a rebound in inflation expectations over the past few weeks.

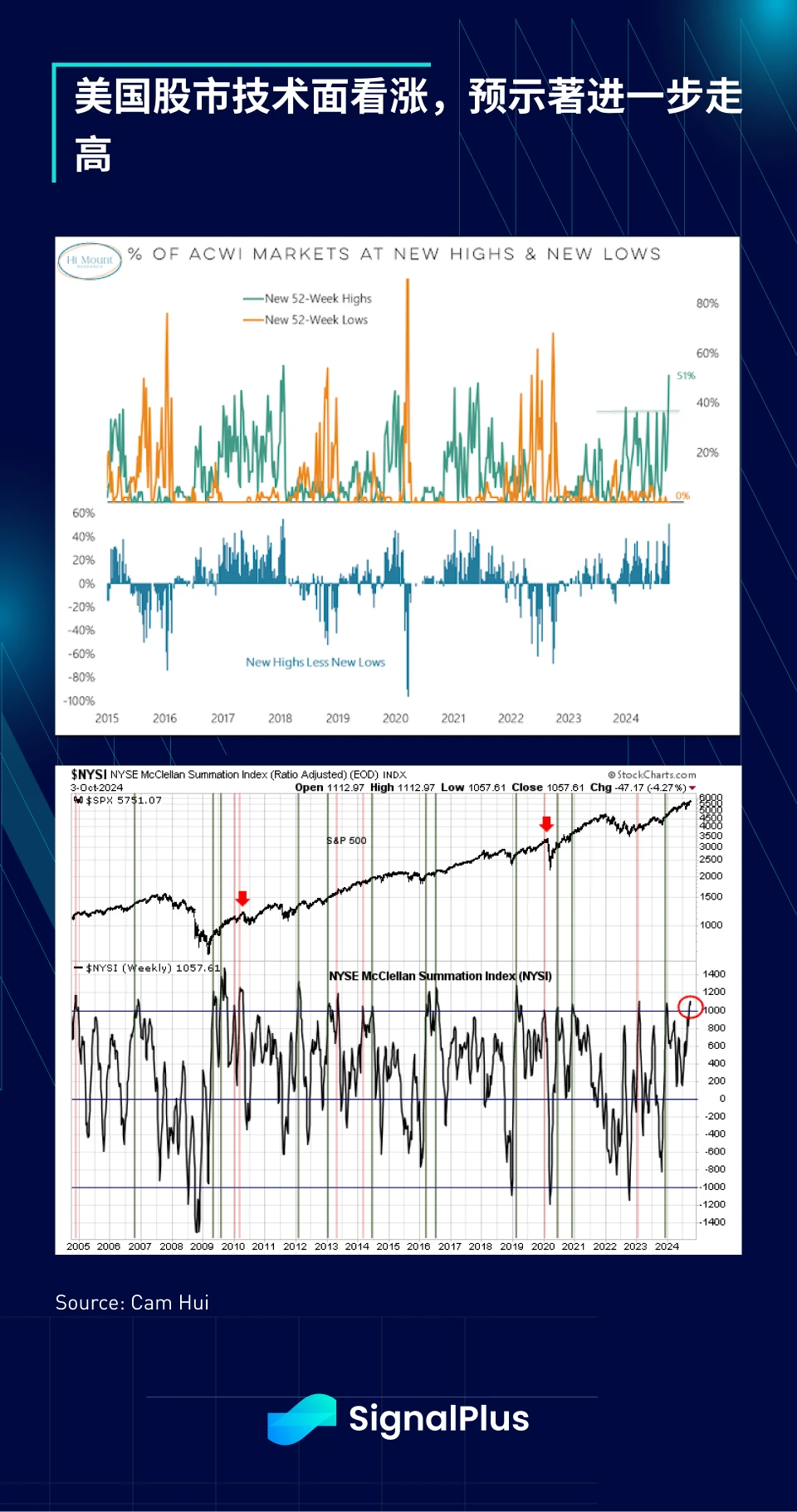

From a technical perspective, the charts of the U.S. stock market look very positive, with various indices hitting 52-week highs at a rare pace, and other momentum indicators also showing a trend of breaking higher. Undoubtedly, current valuations are very high, with the SPX forward P/E ratio at an extremely elevated level, but price movements do not necessarily have to be influenced by valuations.

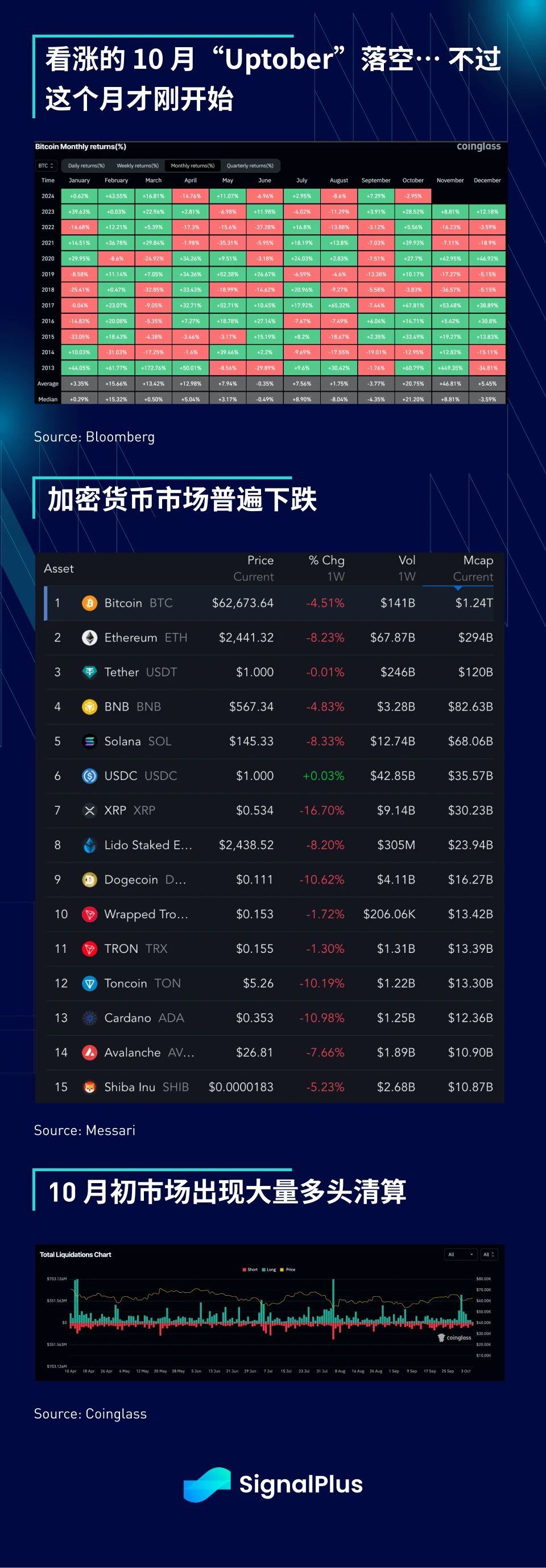

While the macro market celebrates new highs and a soft landing scenario, cryptocurrencies have performed poorly, experiencing the worst October start since 2019, with BTC dropping to $60,000 at the beginning of the month, and other altcoins not faring much better (with weekly declines of up to 10%). Some local FOMO sentiment seems to be overshadowed by the strong rally in A-shares, as nearly $500 million in cryptocurrency long futures were liquidated in the first few days of October, according to Coinglass data.

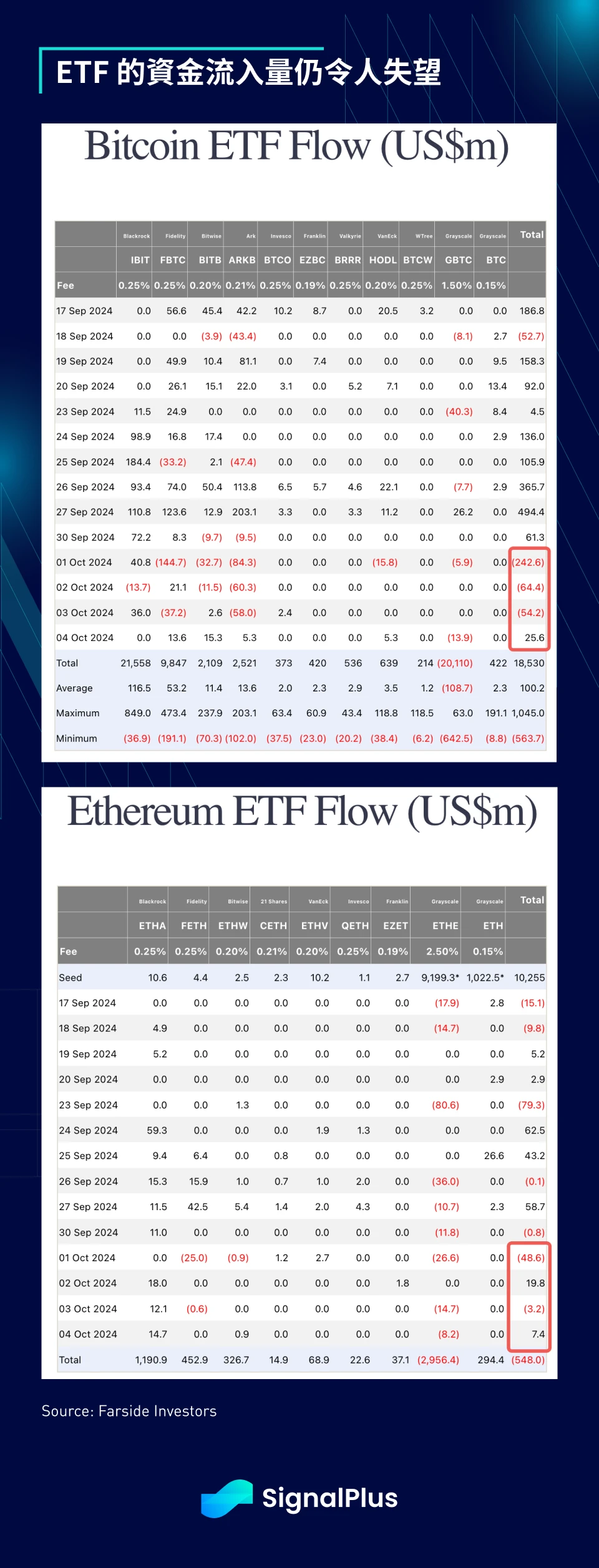

ETF inflows saw a slight rebound last Friday, but the overall trend remains concerning. Additionally, cryptocurrencies have failed to act as a "risk hedge" asset amid the recent tensions in the Middle East, a phenomenon that cannot be ignored. Until the situation changes, the performance of cryptocurrencies will resemble that of a high beta asset.

Nevertheless, we expect that accommodative monetary policy, strong risk appetite, and the rising probability of a Trump victory (due to Kamala's poor handling of hurricane relief efforts) will provide strong support for cryptocurrency prices in the fourth quarter. Although the process may be bumpy, we are still encouraged by the recent price movements, with each subsequent low after a drop being higher. BTC still has a chance to set new highs before the end of the year, after all, we have just entered October.

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。