Master Discusses Hot Topics:

Just a couple of days ago over the weekend, many friends asked Master a representative question. That is, whether the recent funds in the cryptocurrency market have all flowed into the A-shares, leading to the recent lack of significant volatility and liquidity in Bitcoin.

Master will first discuss the conclusion here: currently, although there has been some capital inflow into the cryptocurrency market, there are no clear signs indicating that large-scale funds will shift to the A-share market.

Major cryptocurrencies like Bitcoin and Ethereum continue to attract substantial funds, and the unique appeal of the cryptocurrency market remains, especially for high-risk, high-return speculative capital. In the short term, funds in the cryptocurrency market are more inclined to stay within the crypto market rather than flow into A-shares on a large scale.

Firstly, the cryptocurrency market is relatively small, so speculative funds can be quickly attracted through price increases, especially against the backdrop of major global economies implementing loose monetary policies and traditional markets (like US stocks and A-shares) competing for funds.

Due to exchange rate friction and capital conversion costs, some funds prefer to remain in the higher-risk but potentially higher-return cryptocurrency market.

Additionally, the Federal Reserve's actions to weaken interest rate cut expectations may also be aimed at preventing the stock market from overheating, while raising cryptocurrency prices at this time can attract more aggressive speculative funds, avoiding being overlooked in global capital flows. The above is merely Master’s personal opinion, and it can be considered as a reference.

Master Looks at Trends:

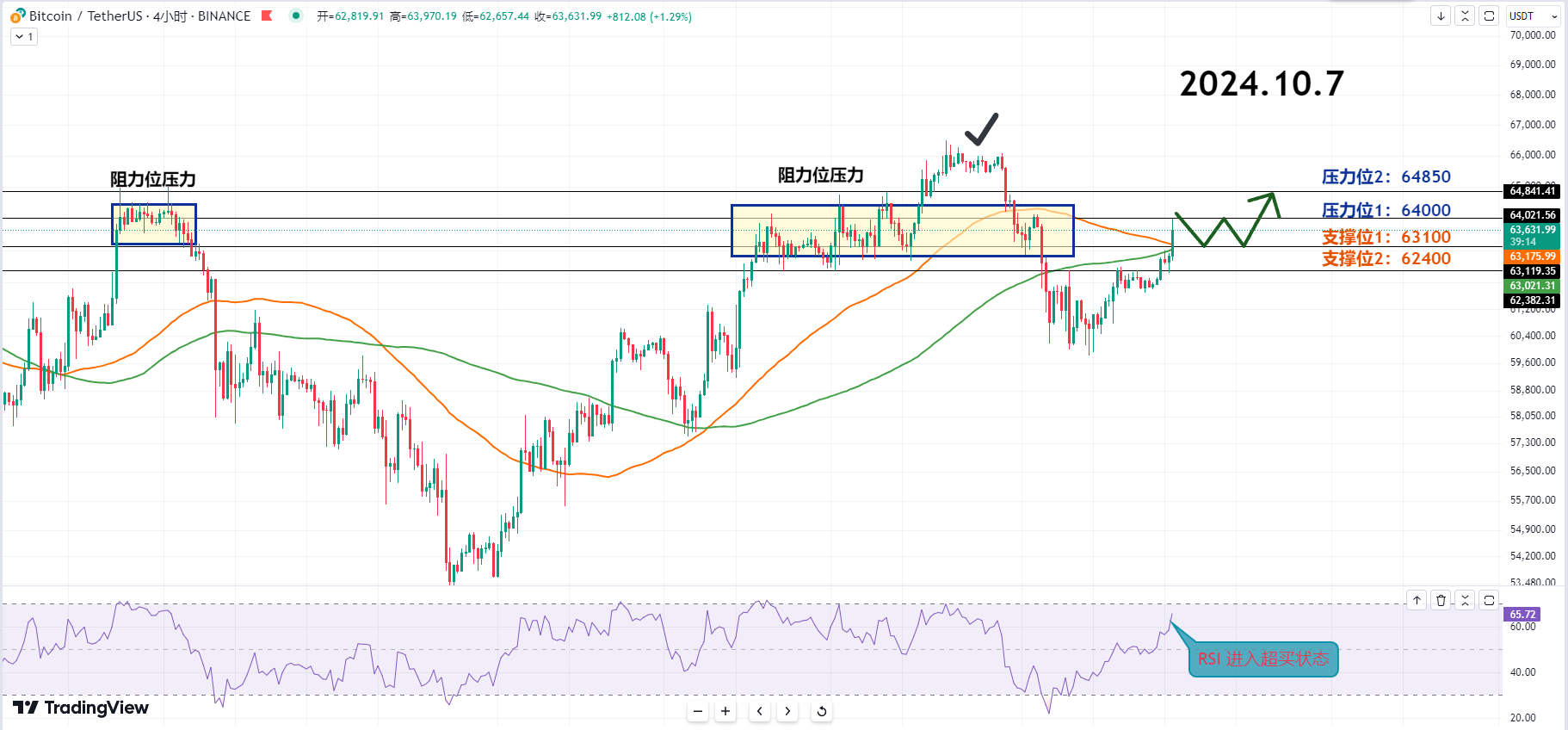

In the morning, Bitcoin rose about 3%, breaking through 63K and approaching 64K.

Due to the increase in new jobs in the US, although the possibility of interest rate hikes has almost disappeared, market expectations that the US economy will not fall into recession and will achieve a soft landing have surged, driving this increase.

At this point, setting 64K as a resistance level, combined with the RSI overbought zone and the formation of a large bullish candle, it is expected that the price will rebound again after a pullback, continuing the upward trend.

Resistance Level Reference:

First Resistance Level: 64000

Second Resistance Level: 64850

If 64K is accompanied by a volume breakout, further increases can be expected. Buying at lower levels during pullbacks is advisable, anticipating a breakthrough of the resistance level.

At the psychological resistance level of 64K, the likelihood of a pullback in the short term is relatively high. Although there is also the possibility of an unexpected surge breaking through, it is more likely that the price will test 64K again after a pullback.

Support Level Reference:

First Support Level: 63100

Second Support Level: 62400

If the price drops to the first support level, it is also a suitable pullback, as well as a short-term entry opportunity.

The first support level is located in the area where the 60-day and 120-day moving averages intersect, thus it is set as a strong support level. If a pullback occurs, it will instead provide an entry opportunity.

Today's Trading Suggestions:

Today's trading maintains a bullish outlook, following the trends of the 60-day and 120-day moving averages.

This is the low-level consolidation area after breaking through the key resistance level, and it is expected to form a range consolidation in the previous trading dense area of 63.1~64K, using this as a reference for trading.

10.7 Master’s Short-term Orders:

Long Entry Reference: Buy in batches in the range of 62100-62400, with a stop loss of 500 points, target 63100-64000

Short Entry Reference: Sell in batches in the range of 64800-65100, with a stop loss of 500 points, target 64000-63100

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot contract trading techniques, operational skills, and knowledge about candlesticks, you can add Master Chen for learning and communication, hoping to help you find what you want in the cryptocurrency market. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% following the trend; daily updates of macro analysis articles across the network, mainstream coins and altcoins technical indicator analysis, and spot medium to long-term price prediction videos.

Warm Reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。