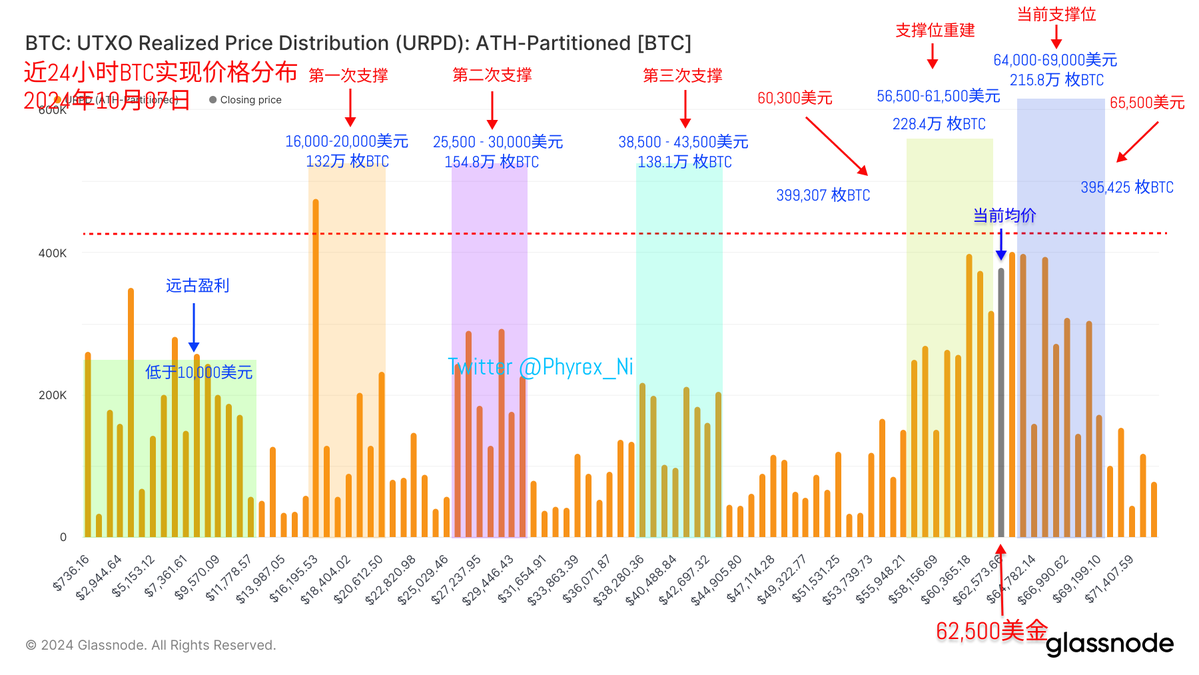

There’s not much homework to write about on Sunday; it’s essentially the lowest point of liquidity. The actual turnover is slightly more than expected, but not by much. Most #BTC holders have no intention of trading over the weekend. Among the limited data, short-term profit investors have the most turnover, while loss-making investors are almost completely inactive.

I’m quite looking forward to Monday. On one hand, I’m eager to see how the A-shares react after the National Day holiday. From the data of the Hong Kong stock market, A-shares should perform well, but whether this can last for a few days is uncertain. Additionally, when the U.S. stock market opens on Monday, we’ll know if the positive sentiment from last Friday’s non-farm payroll data will continue into the new week.

After all, wars do not pause for the weekend. There’s still information about the war this weekend, and I wonder if it will affect the risk markets. Next Thursday and Friday, there will be several data releases. Pay a little attention to Thursday’s CPI and the Federal Reserve’s meeting minutes, although they are not very important anymore. Also, it’s good to be aware of Friday’s PPI, but there’s not much else.

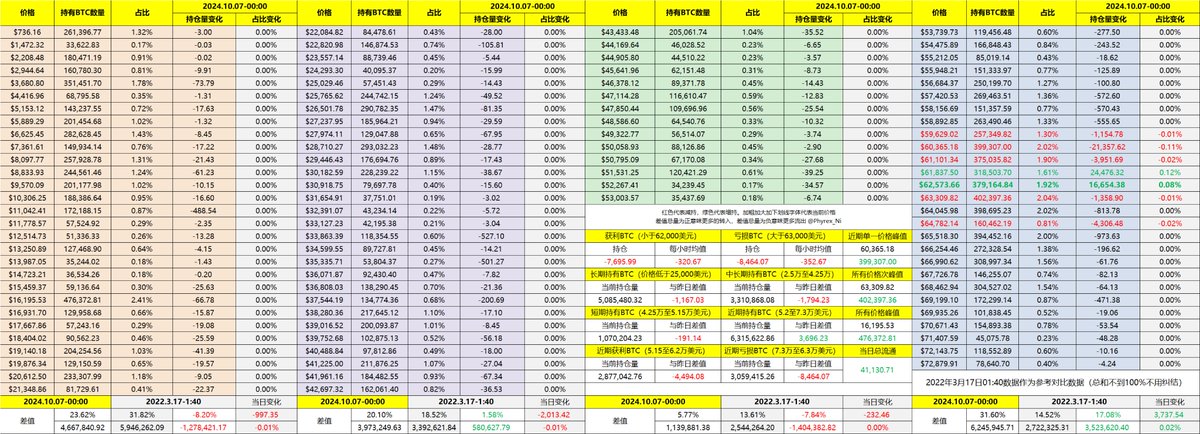

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。