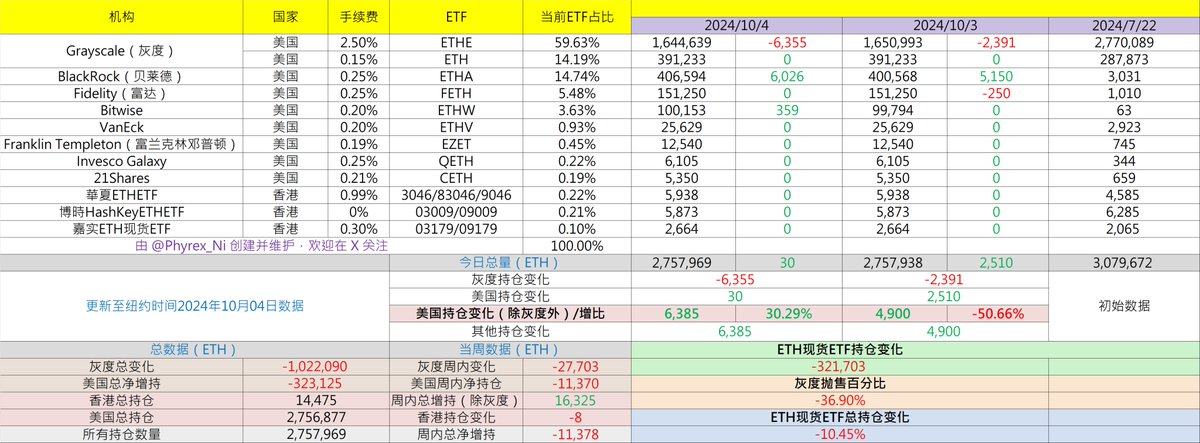

Although it is quite reluctant, it is indeed true that last Friday's ETH spot ETF saw a net inflow of 30 ETH. The main reason for this was that ETHE sold 6,355 ETH, which is the second highest amount sold during the week. In total, ETHE sold 28,551 ETH over the past week, leaving a remaining balance of 1,644,639 ETH. Grayscale's total sales have exceeded 1 million ETH.

BlackRock was the champion of accumulation last week, increasing its holdings by 6,026 ETH on Friday, bringing the total accumulation for the week to 22,992 ETH, which is lower than the increase of 36,054 ETH in the tenth week.

Last Friday, Bitwise also increased its holdings by 359 ETH. Apart from that, the other six ETF institutions in the U.S. had zero activity, indicating that last week was essentially ETHE selling, BlackRock buying, and other institutions mostly watching from the sidelines. Since the escalation of the war situation last week, investor sentiment has been continuously declining, and purchasing power has returned to levels seen before the tenth week.

The only positive data is that there is almost no selling pressure outside of ETHE. Although investor buying sentiment is very low, they are still unwilling to sell, so the selling pressure on ETH is not very significant.

Data for the eleventh week will be sent separately later.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。