At the PayFi summit during the 2049 Singapore conference, multiple projects showcased the potential of blockchain in the payment sector, covering time efficiency, compliance knowledge, and emerging market opportunities.

Author: @Andrea__Chang

Translation: Plain Language Blockchain

During the 2049 Singapore conference, I attended a very popular side event (with over a thousand applicants) — the PayFi summit hosted by @humafinance, @solana, and @StellarOrg. Overall, these projects mainly focused on:

• The time value saved by PayFi

• Compliance knowledge

• Opportunities in emerging markets (such as global transfers and remittances)

• Stablecoin collaborations (especially the progress of @circle's USDC and PYUSD).

Here is a brief introduction to these 12 PayFi-related projects.

After the opening keynote on the PayFi vision by @calilyliu, Chair of the Solana Foundation, the host @PayFiKing introduced Huma Finance's PayFi architecture and highlighted 12 key projects.

To be honest, considering the tight schedule that week (with @OakGroveVC also hosting some panel discussions and events), I had to leave early and couldn't listen to all the keynotes.

However, I am very interested in the progress of these projects, and I believe many who are focused on PayFi would want to know as well.

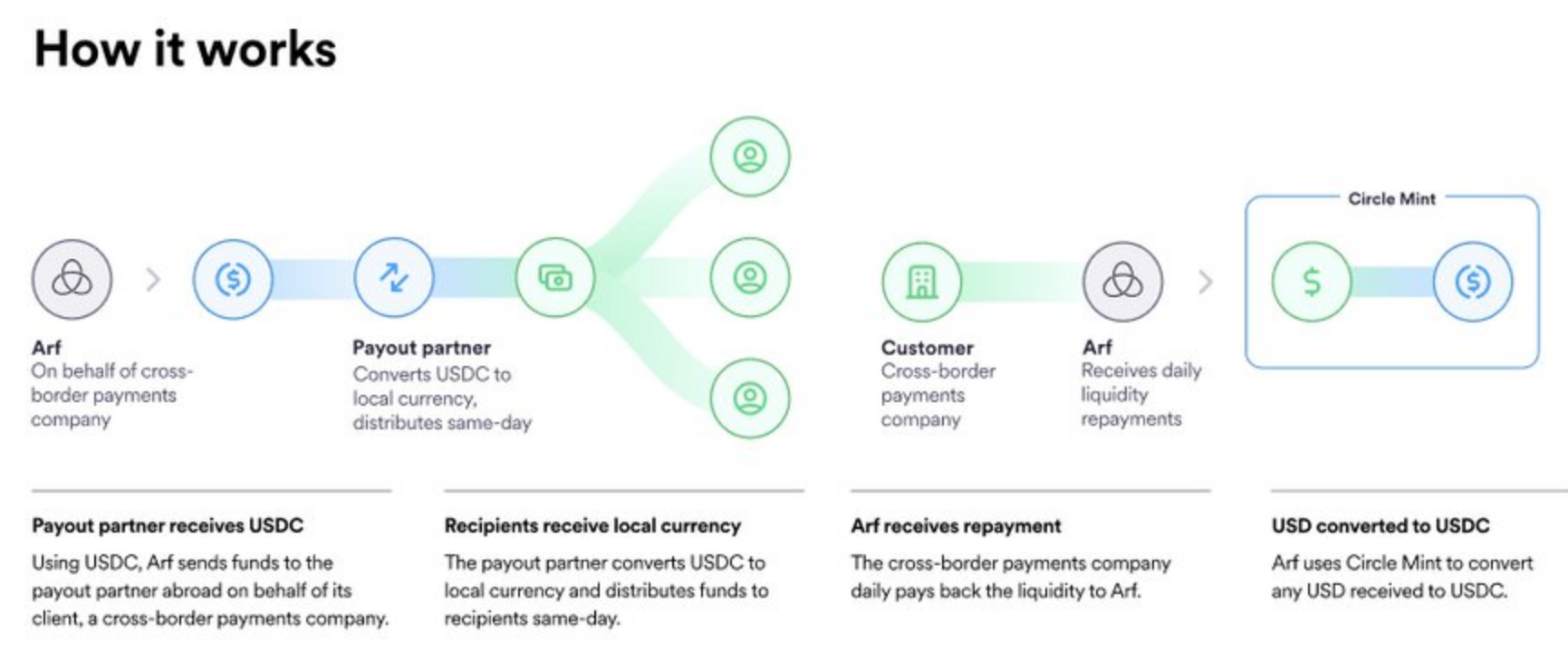

1. @arf_one

@arf_one has developed a blockchain-driven liquidity platform that uses the USDC stablecoin to accelerate cross-border payments and reduce costs.

“Through Arf credit lines, licensed financial institutions can access unsecured short-term operational funding for 1 to 5 days, enabling same-day settlement with partners by eliminating pre-funding and counterparty risk.”

2. @BackedFi

@BackedFi is a Swiss-regulated tokenization platform/service provider. It offers tokenization services and has issued tokenized real assets, including exchange-traded funds (ETFs) and tokenized stocks (such as Coinbase (COIN) and Tesla (TSLA)).

Additionally, it supports other major EVM chains, such as Gnosis Chain, Polygon, Avalanche, Arbitrum, Base, and BNB Chain.

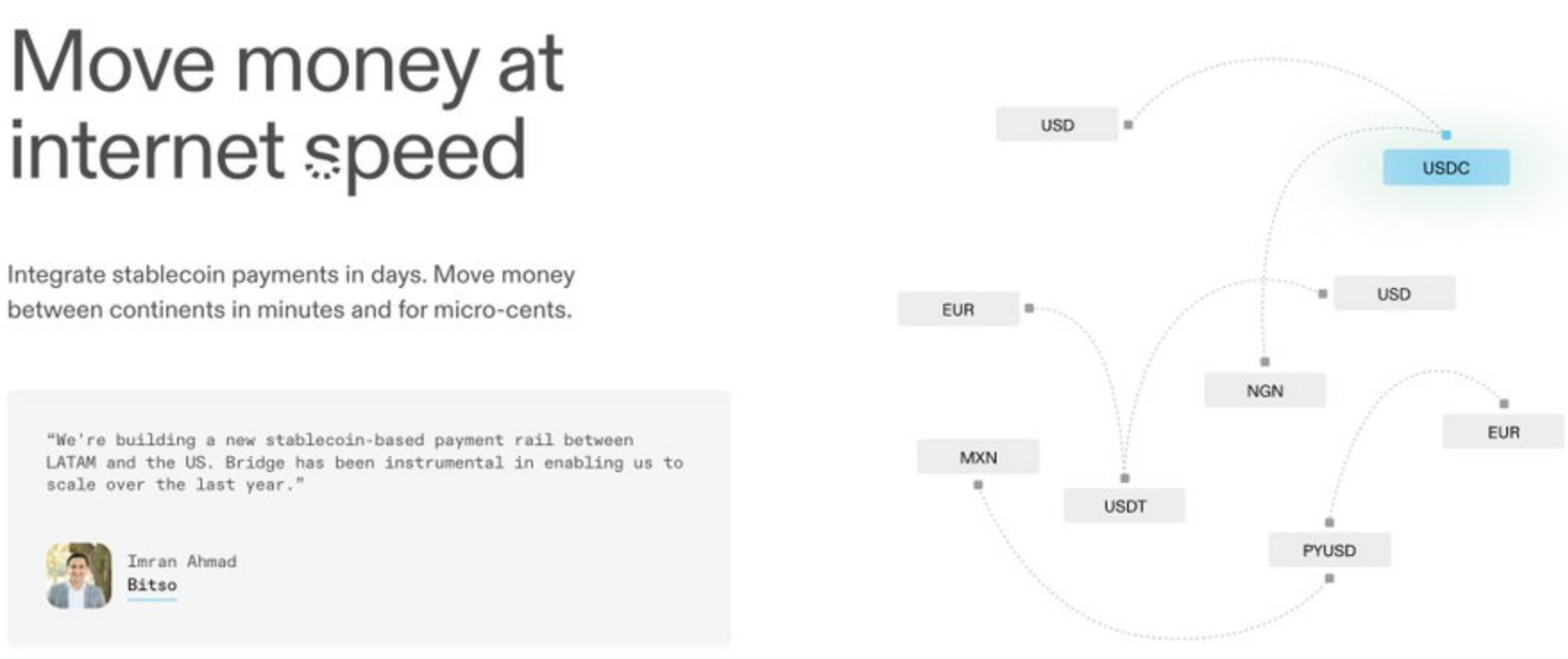

3. Bridge (@StableCoin)

Bridge (@StableCoin) is a payment platform focused on stablecoins, recently raising $40 million from @sequoia and Ribbit Ventures.

“We are building stablecoin orchestration and issuance services. Orchestration provides a simple API for easy conversion between any two dollar formats.”

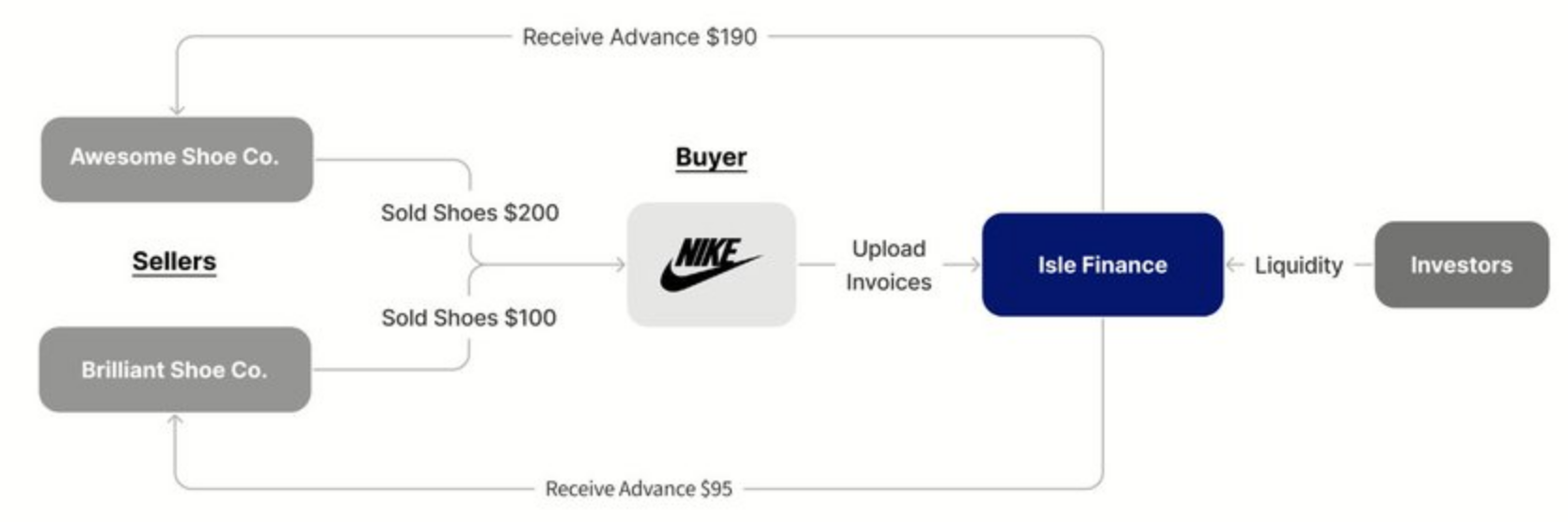

4. @BSOSTech / @isle_finance

@BSOSTech / @isle_finance (the Web3 branch of BSOS) is a decentralized protocol for supply chain finance. It allows those seeking DeFi yields to access real returns generated from supplier receivables and provides suppliers with more timely crypto funding.

“Isle Finance is an innovative financing solution designed to meet the needs of suppliers for large buyers, allowing suppliers to obtain crypto financing through buyer-approved invoices on the blockchain.”

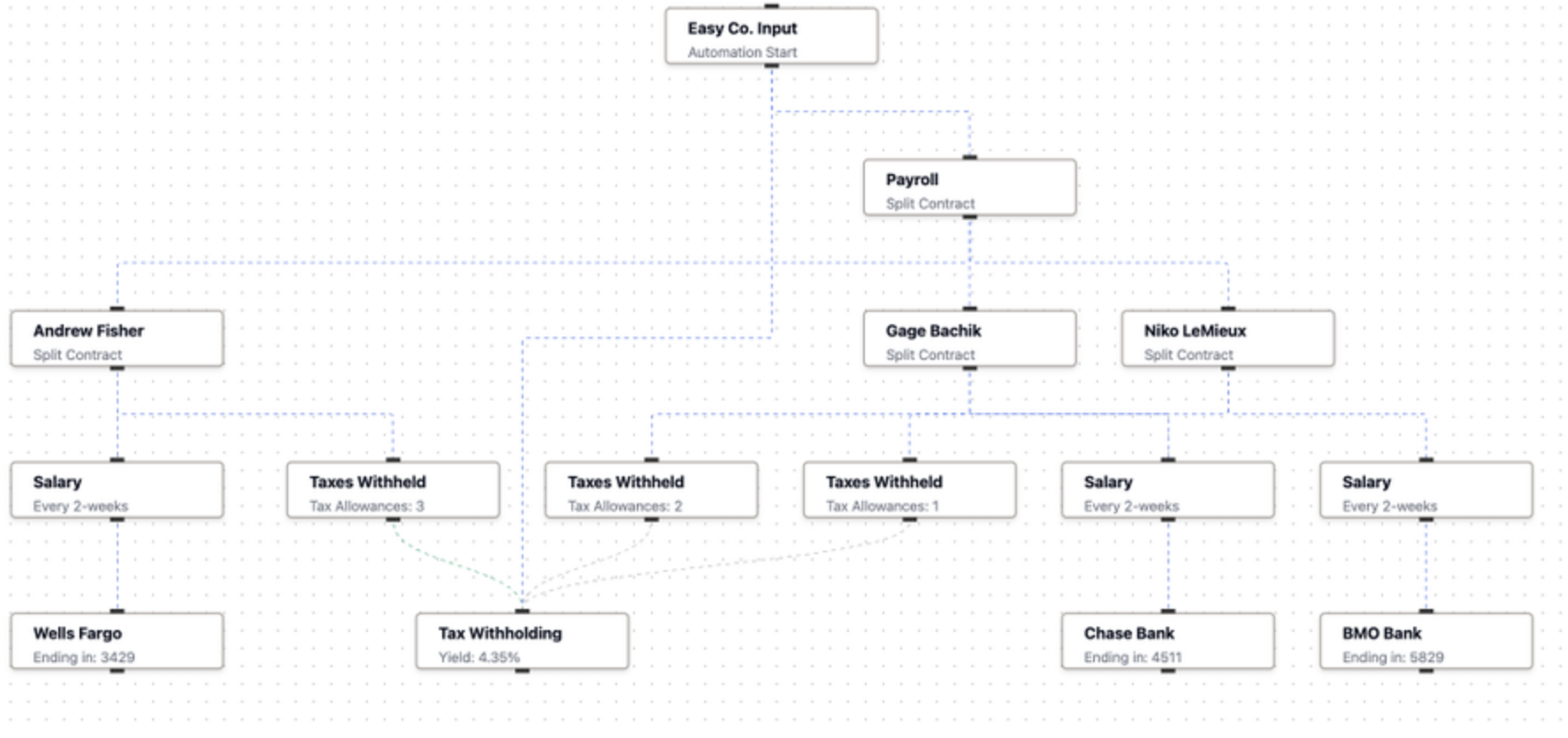

5. @itseasyco

@itseasyco's Easy Labs is dedicated to programmable payment processing solutions, allowing users to build automated financial logic through their SDK and no-code platform.

6. @helio_pay

@helio_pay's Helio Pay supports crypto payments across various sectors, including e-commerce stores, presales, and NFT markets. Recently, Helio launched a Solana Pay plugin on Shopify. Other key products include payment links (crypto checkout pages), subscription modules, and embeddable payment modules.

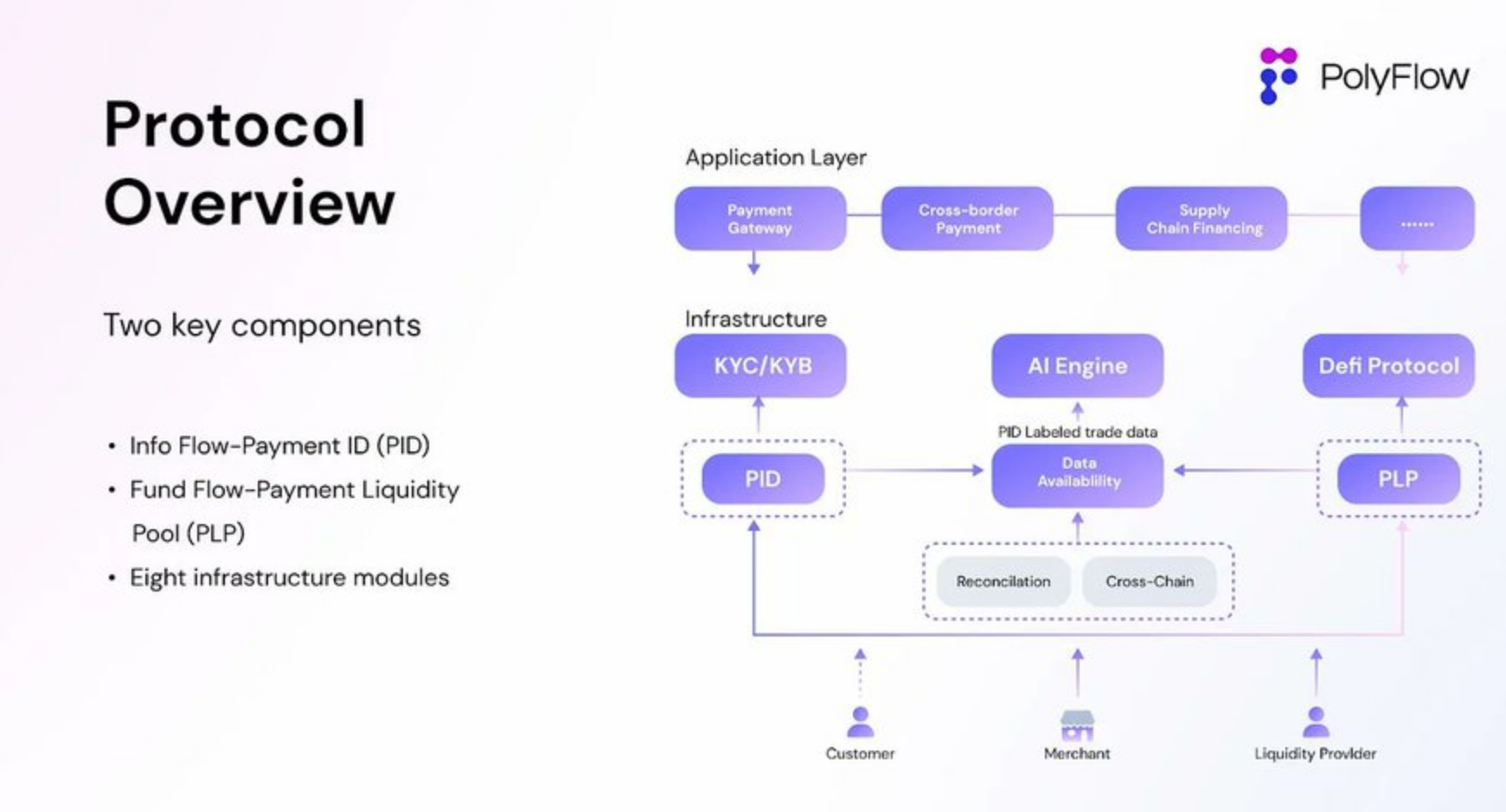

7. @Polyflow_PayFi

@Polyflow_PayFi is a PayFi protocol that provides payment IDs and payment liquidity, acting as a self-custodial enterprise wallet capable of generating yields and compatible with DeFi.

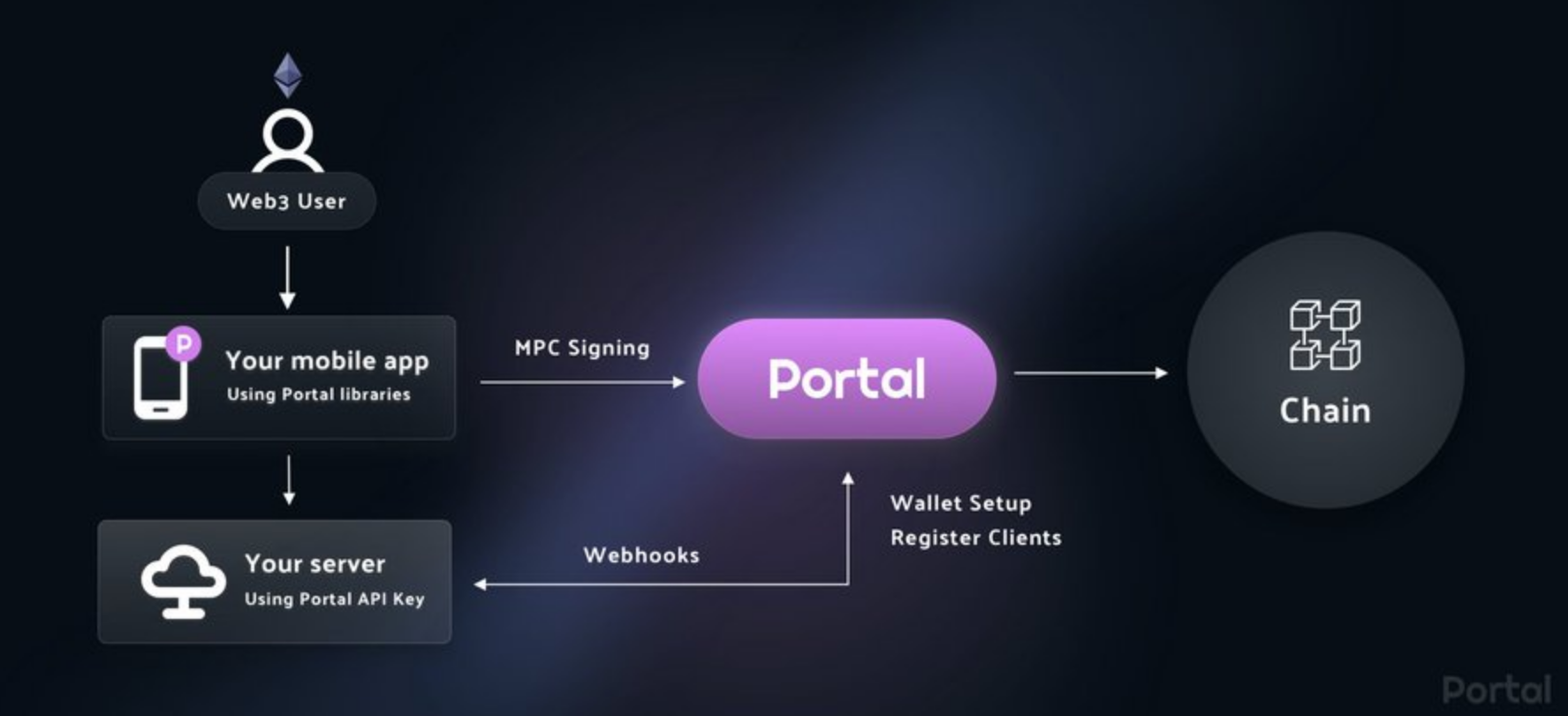

8. @portal_hq

@portal_hq creates embedded crypto wallets for mobile devices and Web3, featuring MPC API and account abstraction capabilities. It offers white-label wallet solutions for banks, trading platforms, emerging banks, and financial service issuers, serving as infrastructure for stablecoin accounts and global remittances. The platform supports multiple blockchains, including Solana.

9. @PayWithRipe

@PayWithRipe, based on @solana, focuses on providing crypto payments for merchants in Southeast Asia. It allows crypto wallets like Bitget Wallet or Phantom to scan existing merchants' QR codes, such as Vietnam's Momo, Singapore's PayNow/SGQR, or the Philippines' GCash/QRPh.

“These wallets then send stablecoins to the wallet address controlled by Ripe. The company handles fiat currency exchange and foreign exchange in the background, delivering local fiat currency to merchants in real-time.”

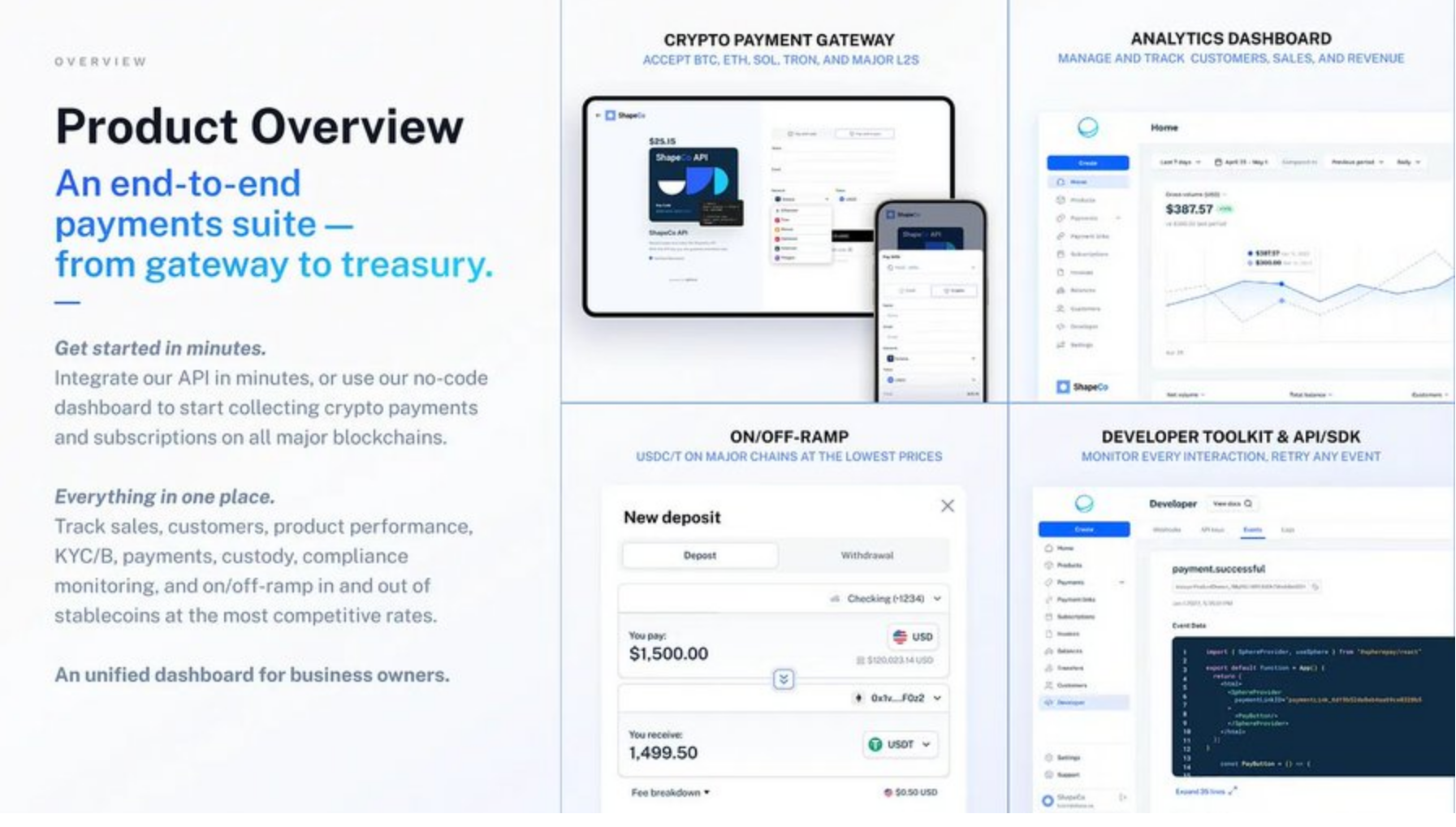

10. @sphere_labs

@sphere_labs provides payment gateway infrastructure for retail and merchants, as well as on/off-ramp services for cryptocurrencies. Sphere API offers subscription, payment links (including checkout pages), and invoicing modules. The main supported chains include @base, @solana, Polygon, and Avalanche.

The primary use cases for businesses include compliant cross-border payments, achieving near-instant settlement. They recently partnered with @helium_mobile as a DePIN client.

11. @tlay_io

@tlay_io is the only DePIN project on the list. @humafinance highlighted the case of using Huma Finance's instant borrowing solution among DePIN clients, where smart contracts automate underwriting decisions using data.

“The core value proposition of PayFi lies in its ability to provide credit when needed by leveraging future on-chain cash flows. DePIN projects have a significant advantage because their cash flows are essentially on-chain, and the generated data can be accessed in real-time.”

12. @zothdotio

@zothdotio offers a market for real assets (fixed income). Its flagship products include Zoth Tokenized Liquid Notes (ZTLN) and Zoth Secured Trade Financing (ZSTF). According to their website, the platform has generated $106 million in assets, with a reinvestment rate of up to 91%.

ZTLN provides an investment-grade fixed income portfolio priced in USD, including U.S. Treasury bonds and high-quality corporate bonds.

ZSTF focuses on secured short-term receivables from top factoring companies in emerging markets.

Article link: https://www.hellobtc.com/kp/du/10/5452.html

Source: https://x.com/Andrea__Chang/status/1841502402048098597

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。