In the past few days, there have been no comments on the articles, which I find quite strange. When the market is on the rise, everyone is silent; as soon as the momentum breaks, the comment section explodes. Could it be that those following the Hunter are all haters? As soon as a trade goes wrong, they strike hard. Can we get some encouragement, please?

Last night, someone messaged the Hunter privately, saying that the articles I've been writing recently are only suitable for experienced traders, and beginners would be completely confused. This is because when I review the market in my articles, readers need to convert the text into auxiliary lines and then annotate them on the market charts to understand. It's hard to grasp the ideas I want to express with just plain text. After thinking about it, I realized that it is indeed unfriendly to beginners. Today, with plenty of time on the weekend, I will try to change this by interpreting the text alongside the market charts, making it easier for everyone to understand. If you still don't get it, please leave a message in the background or message me privately, and I will explain it again.

First, let’s talk about the non-farm payrolls issue. I didn’t mention a word about the non-farm payrolls in yesterday's article. Friends familiar with the Hunter know that I usually provide interpretations of data trends in advance. The reason I didn’t do so this time is that it’s useless. Since the second half of the year, the non-farm data has been arbitrarily modified to align with the Federal Reserve's policy announcements. To put it simply, it’s ridiculously fake. Analyzing such absurdly fake data will only lead to more absurd conclusions.

I still stand by my statement: the butt determines the brain. In any situation, don’t just look at what they say; look at what they do. When analyzing an event, you cannot just look at the event itself; you must consider the causes and consequences. The causes can help analyze the process, while the consequences can help analyze the motives. History has proven that many things cannot be decided by an individual; it’s not the person pushing the event, but the event pushing the person. Instead of focusing on the so-called published results of the non-farm payrolls, it’s better to find out the reasons behind such actions.

Taking the Federal Reserve's first rate cut of 50 basis points in September as a turning point, before the rate cut, the U.S. and China were in a financial confrontation—high blood pressure battling low blood sugar. The symptoms of high blood pressure can be fatal if not controlled, and only by taking antihypertensive medication can it be alleviated. The symptoms of low blood sugar can lead to weakness and fainting if not supplemented, but just eating something can restore it. Therefore, you will find that although China appears weak in this round of competition, it is not fatal, while the U.S. will die if it continues to hold out without taking antihypertensive medication.

Thus, the Federal Reserve's announcement of a rate cut is not accidental but inevitable. The world has also seen through America's weakness (there are many arguments in the previous text; if interested, you can check the Hunter's recent articles). At this time, the Federal Reserve also announced two rate cuts within the year, totaling a 100 basis point cut. Once the news broke, the dollar plummeted. Although the interest rate is still at 4.75%, if the dollar depreciates too quickly, leading to a currency collapse, no matter how high the interest rate, capital will not be attracted. It will definitely accelerate its escape, and where can it run? Only to China.

Now, the situation is clear: the financial confrontation between the U.S. and China has ended, and both sides have entered the next round, starting to compete for capital. The U.S. needs to find ways to retain capital, while China needs to find ways to attract capital. After the Federal Reserve's rate cut, China took the initiative with a series of policy announcements, almost writing the words "pick up money" on the faces of capital. The U.S. has no choice but to passively respond.

To retain capital, the dollar exchange rate must be maintained. The rate cut has already begun, so what should I do next? I need to make the economic data look good; I need to find excuses for not cutting rates later. Therefore, on Friday, the non-farm payrolls data was surprisingly good, reasonable or not? This is the butt determining the brain; even if it’s ridiculously fake, it has to be published this way. Otherwise, how will the Federal Reserve find reasons not to cut rates later?

From this point onward, the expectation is that the dollar will rise, and when the dollar rises, Bitcoin will fall. These two are negatively correlated (Bitcoin is priced in dollars).

So from a macroeconomic perspective, cyclical declines still exist.

Having discussed the macroeconomics, let’s return to the Bitcoin market, following the usual practice of reviewing the market.

On Thursday night, it broke below the 60,000 mark, quickly rebounded for repair, and then after multiple oscillations at low levels, it began to rise.

From this, we can conclude: the speculative long positions at 60,000 were intimidated by the break, and after a false alarm, the market experienced multiple downward tests, forcing small profits to be taken. At the same time, breaking below 60,000 led to short positions entering the market, which were trapped after repeated low-level tests.

On Friday, with the non-farm payrolls, the market rose slowly throughout the day, with 61,500 being effectively resisted multiple times. Up until the non-farm data was released, the market was still hovering around 61,500, unable to form a one-sided rise.

From this, we can conclude: low-level long positions were forced to take profits, and the entire day saw a slow rise without a drop, making it impossible to find an entry point for long positions near the 60,000 support level. At the same time, the resistance at 61,500 meant that even if one chased long, there was no room for profit, so the market had no existing long positions, only low-level short positions trapped.

As the afternoon approached the release of the non-farm data, the resistance at 61,500 gave confidence to the low-level short positions, waiting for the evening non-farm data to relieve them. If 61,500 had directly broken through and accelerated, the shorts would have inevitably surrendered and stopped out. However, the actual situation was that even if 61,500 broke through, it did not trigger an accelerated rise but instead fluctuated back and forth, repeatedly falling, leaving the trapped shorts in a dilemma.

In the evening, the non-farm data was released, which was very favorable for the dollar and unfavorable for the cryptocurrency market. The dollar index surged, Bitcoin briefly spiked to 62,000 before quickly falling, hitting a low of 60,800.

From the perspective of long positions: the data was very unfavorable, and going long still belongs to counter-trend trading. The only option is to enter near the 60,000 mark, so it must drop to at least 60,500 to go long.

From the perspective of short positions: the data was very unfavorable, with the market peaking at 62,000, testing and confirming that the 62,300 pressure remains effective. With structural pressure + unfavorable data + the actual market starting to decline, the short-term has already reached 60,800, and the shorts have stabilized.

The actual market: on Friday night, the lowest was 60,800, and long positions could not enter, while low-level short positions were still unable to be relieved.

Thus, we can confirm that there are only short positions in the market, no long positions.

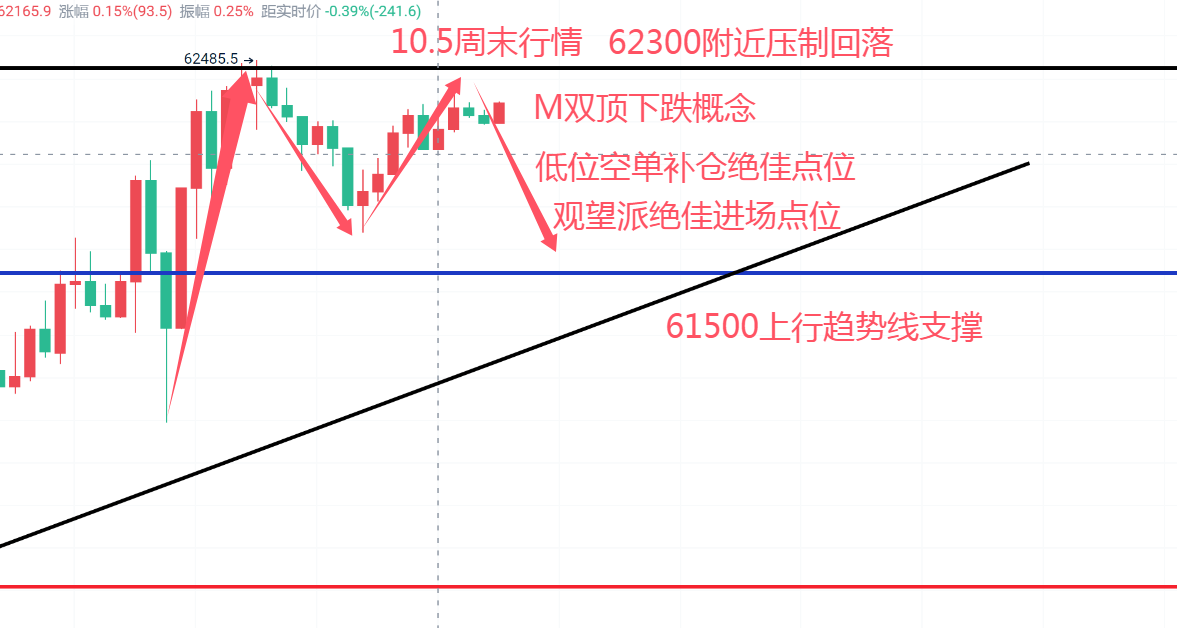

Now it’s Saturday, and the market has tested the resistance at 62,400 multiple times, showing a slight downward pressure with a minimum price of 61,700, indicating that the 62,300 top-bottom conversion pressure remains effective.

From the perspective of bulls: the current price is at the ceiling, and with a short-term pullback, there is no profit space for going long, and the distance to the bottom support is too far. Plus, it’s the weekend, making it impossible to enter the market.

From the perspective of bears: low-level short positions have already been trapped by 2,000 points, and hoping for a short-term pullback to exit is unrealistic. Now that the market has reached 62,300, which is an ideal short pressure point, if not now, then when? Moreover, the market has also pulled back from the 62,300 resistance, and there’s the concept of an M double top decline, so it’s time to add to the short positions.

From the perspective of short-term observers: the current position is at the ceiling, with short-term downward pressure and the concept of an M double top. Going long has neither profit nor suitable stop-loss points, while going short has an ideal position and suitable stop-loss. 62,300 is also a point to short, with conservative stop-loss at 62,500-62,800.

Now the Hunter has seen through the thoughts of all parties in the market. As the main force, what will they do? Will there be a final acceleration upward at the 62,300 position?

If 62,300 accelerates and breaks upward, the shorts will lose all confidence and will have to stop out. The trend shorts will also be forced to exit, and the low-level shorts will be directly blown up. The most exaggerated thing is that through the Hunter's interpretation, there are currently no large retail long positions in this market, which means the main force can explode the shorts without any damage and eat the profits.

Weekend market layout—

Go long near 61,500 (200 points up or down), stop-loss at 61,000, take profit at a minimum of 63,000, with an upper limit below 64,000.

Go short near 63,800 (200 points up or down), stop-loss at 64,200, take profit at 50% between 62,300-62,500. If it breaks below 62,300, you can continue to hold, looking down to 58,000.

For friends who were notified on Friday about locking in the trend shorts above 64,000 at 60,000, do not make any changes; lock in profits and wait for the market to develop further. I will notify in the real trading group.

Reason: Combining the previous macroeconomic analysis, we can see that the current and upcoming trends have not changed the bearish mindset. From a technical perspective, if the market reaches 63,000-64,000, it will either force out all shorts before declining or completely reverse the trend upward. The Hunter cannot give a definite answer here; we can only wait for the market to unfold on Monday. If next week the market maintains above 62,300, the upward trend will be confirmed; conversely, if it drops from 64,000-63,000 and breaks below 62,300, a new round of shorts will continue.

Long-term trend positions are only announced in the internal core group. If interested, message me. The complete planning and argumentation have been finished. The last time we argued from May, the trend started in June at 69,000, and we chased the top down to 53,000-50,000, with nearly 20,000 points of space. This was publicly available for free across the internet, including real-time updates during live broadcasts. However, people do not cherish free things, and very few can persist. This time, only cooperation can allow you to join. The community team will control the rhythm throughout, and the Hunter's grasp of the trend needs no explanation; history has proven it countless times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。