Author:

Freya & Knight & Ausdin from ZJUBCA

Elaine & Youyu from Satoshi Lab

Abstract

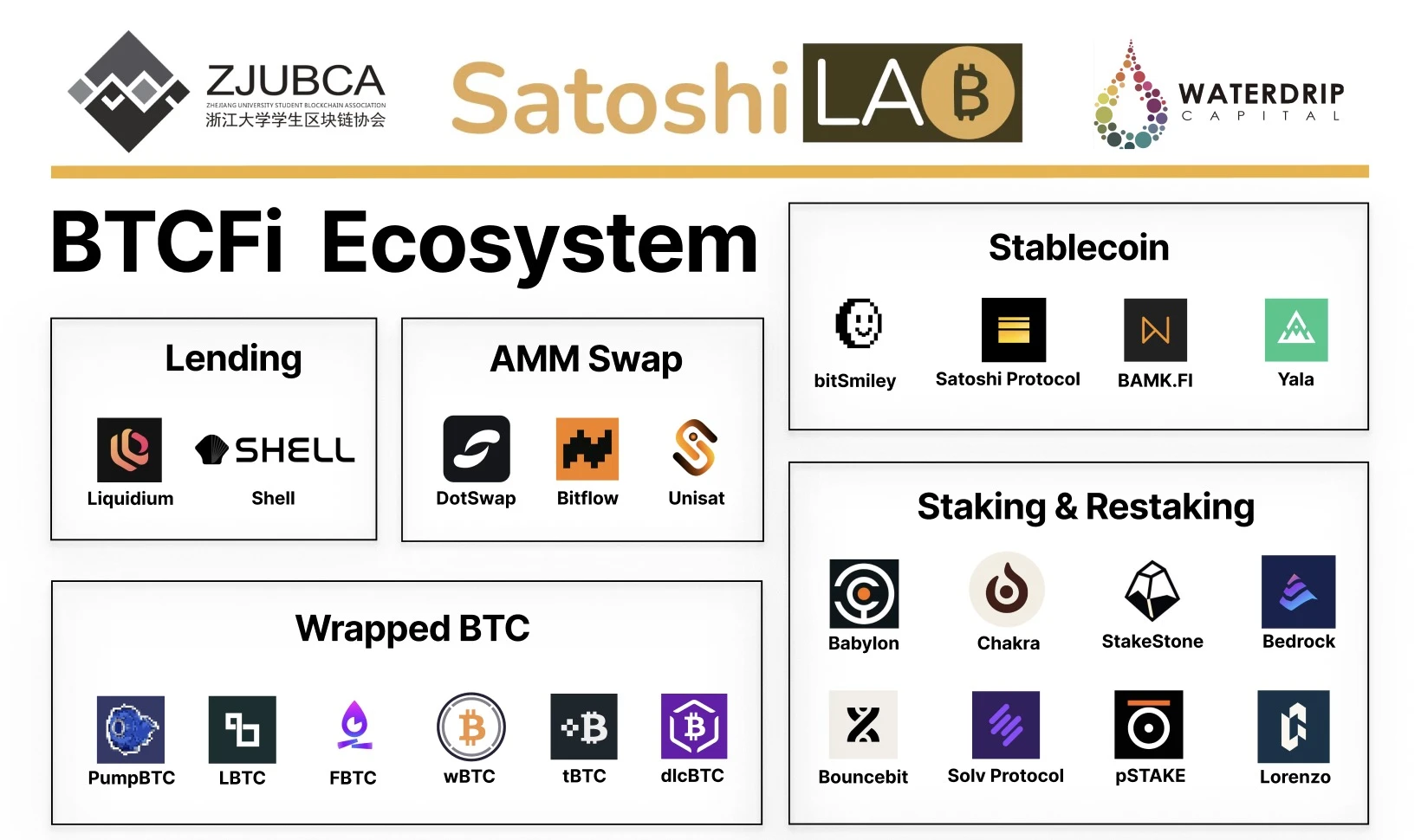

As Bitcoin (BTC) solidifies its position in the financial market, the BTCFi (Bitcoin Finance) sector is rapidly becoming the forefront of cryptocurrency innovation. BTCFi encompasses a range of Bitcoin-based financial services, including lending, staking, trading, and derivatives. This research report deeply analyzes several key tracks of BTCFi, exploring stablecoins, lending services, staking services, restaking services, and the combination of centralized and decentralized finance (CeDeFi).

The report first introduces the scale and growth potential of the BTCFi market, emphasizing how the participation of institutional investors brings stability and maturity to the market. It then discusses the mechanisms of stablecoins in detail, including the different types of centralized and decentralized stablecoins and their roles in the BTCFi ecosystem. In the lending sector, it analyzes how users can obtain liquidity through Bitcoin lending while assessing the major lending platforms and products.

In terms of staking services, the report highlights key projects like Babylon, which provide staking services for other PoS chains by leveraging Bitcoin's security, while creating income opportunities for Bitcoin holders. Restaking services further unlock the liquidity of staked assets, providing users with additional sources of income.

Additionally, the report explores the CeDeFi model, which combines the security of centralized finance with the flexibility of decentralized finance, offering users a more convenient financial service experience.

Finally, the report reveals the unique advantages and potential risks of BTCFi compared to other cryptocurrency finance sectors by comparing the security, yield, and ecological richness of different asset classes. As the BTCFi sector continues to develop, it is expected to welcome more innovations and capital inflows, further solidifying Bitcoin's leadership position in the financial domain.

Keywords: BTCFi, stablecoins, lending, staking, restaking, CeDeFi, Bitcoin finance

Overview of BTCFi Tracks

• Squirrels collect acorns before hibernation and store them in a hidden and safe place; pirates bury their plundered treasures in soil known only to themselves; in today's society, people deposit cash in fixed-term accounts, seeking not only an annualized return of less than 3% but also a sense of security. Now imagine you have a sum of cash, you are optimistic about the cryptocurrency market but do not want to take too much risk, and you want to obtain assets with a relatively high ROI, so you choose BTC, known as "digital gold." You want to hold BTC long-term rather than making unnecessary trades that could lead to losses due to price fluctuations. At this point, you need something that can utilize your BTC, unlocking its liquidity and functionality, similar to DeFi on Ethereum. It not only allows you to hold your assets long-term but also brings additional returns, enabling secondary and even tertiary utilization of the liquidity of your assets, with numerous strategies and projects worth deep exploration.

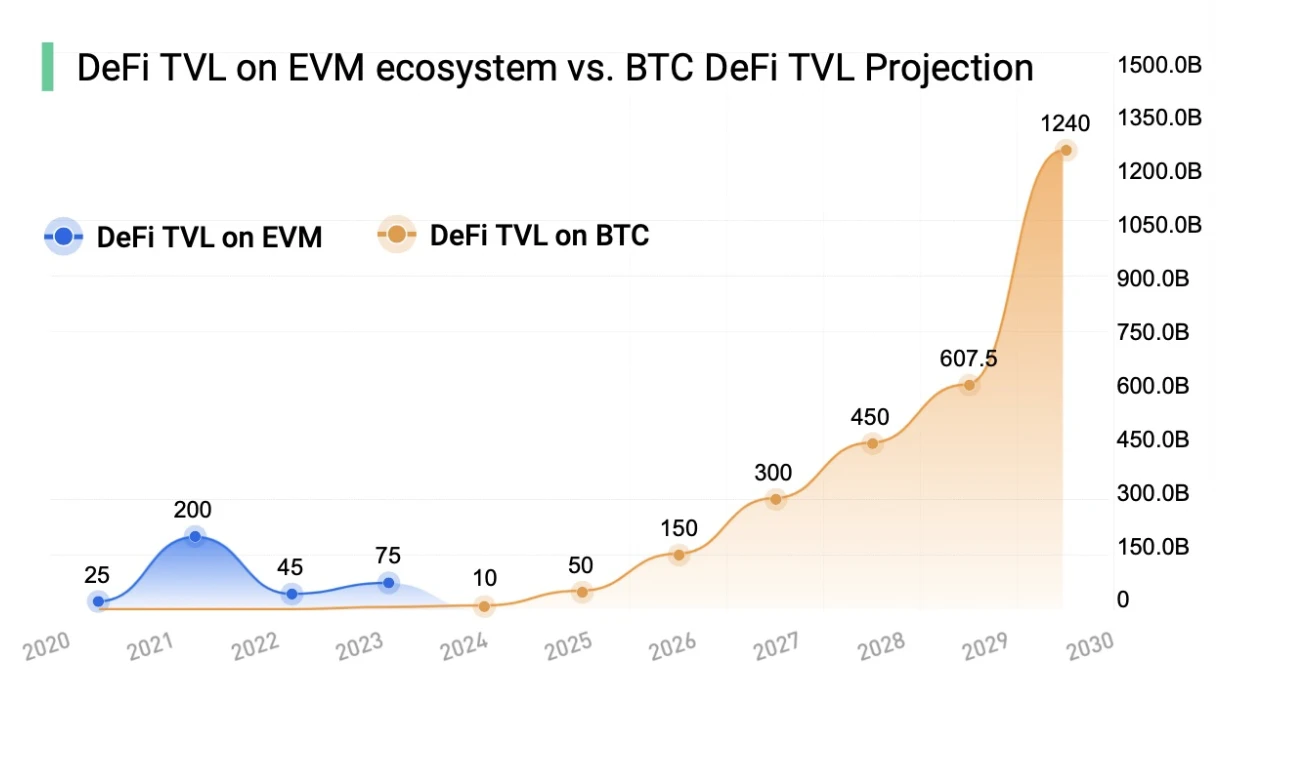

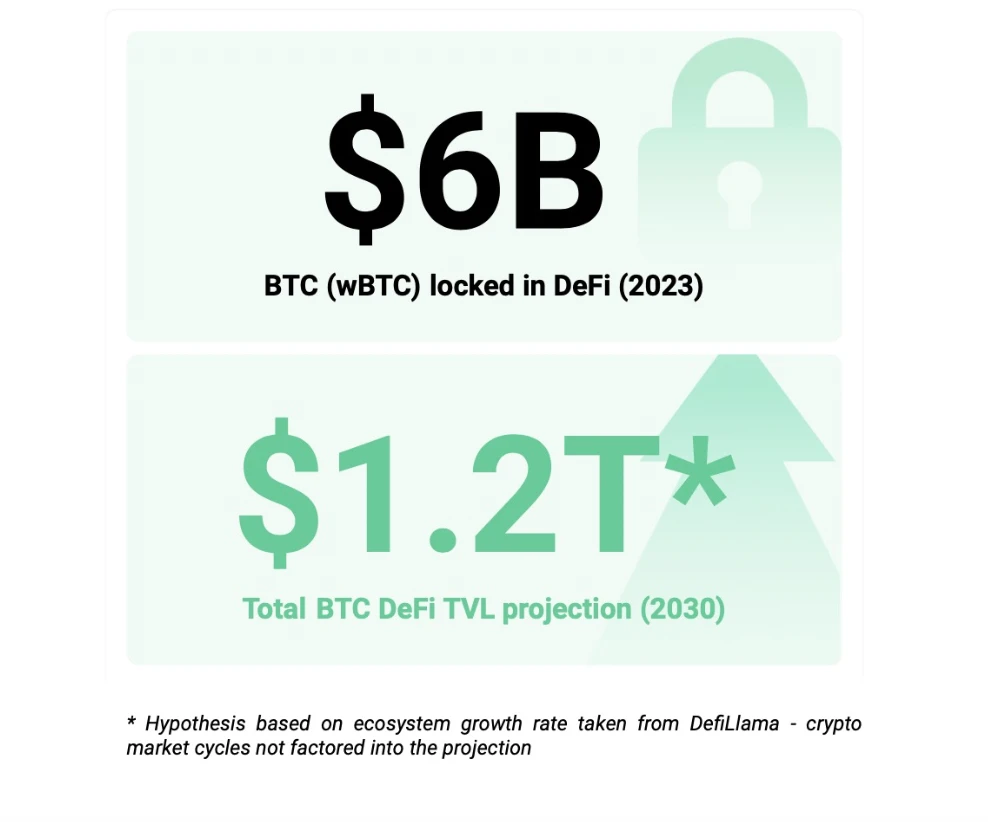

• BTCFi (Bitcoin Finance) acts like a mobile Bitcoin bank, encompassing a series of financial activities centered around Bitcoin, including Bitcoin lending, staking, trading, futures, and derivatives. According to data from CryptoCompare and CoinGecko, the BTCFi market reached approximately $10 billion in 2023. According to Defilama's projections, the BTCFi market is expected to reach $1.2 trillion by 2030, which includes the total value locked (TVL) of Bitcoin in the decentralized finance (DeFi) ecosystem, as well as the market size of Bitcoin-related financial products and services. Over the past decade, the BTCFi market has shown significant growth potential, attracting more institutional participation, such as Grayscale, BlackRock, and JPMorgan entering the Bitcoin and BTCFi markets. The participation of institutional investors not only brings substantial capital inflows, increasing market liquidity and stability but also enhances the maturity and standardization of the market, bringing higher recognition and trust to the BTCFi market.

• This article will delve into several popular areas in the current cryptocurrency financial market, including Bitcoin lending (BTC Lending), stablecoins (Stablecoin), staking services (Staking Service), restaking services (Restaking Service), and the combination of centralized and decentralized finance (CeDeFi). Through detailed introductions and analyses of these areas, we will understand their operational mechanisms, market development, major platforms and products, risk management measures, and future development trends.

Part Two: Segmentation of BTCFi Tracks

1. Stablecoin Track

Introduction

• Stablecoins are cryptocurrencies designed to maintain a stable value. They are typically pegged to fiat currencies or other valuable assets to reduce price volatility. Stablecoins achieve price stability through reserve assets or algorithmic adjustments to supply, widely used in trading, payments, and cross-border transfers, allowing users to enjoy the advantages of blockchain technology while avoiding the severe fluctuations of traditional cryptocurrencies.

• In economics, there is an impossible trinity: a sovereign country cannot simultaneously achieve a fixed exchange rate, free capital movement, and an independent monetary policy. Similarly, in the context of crypto stablecoins, there is also an impossible trinity: price stability, decentralization, and capital efficiency cannot be achieved simultaneously.

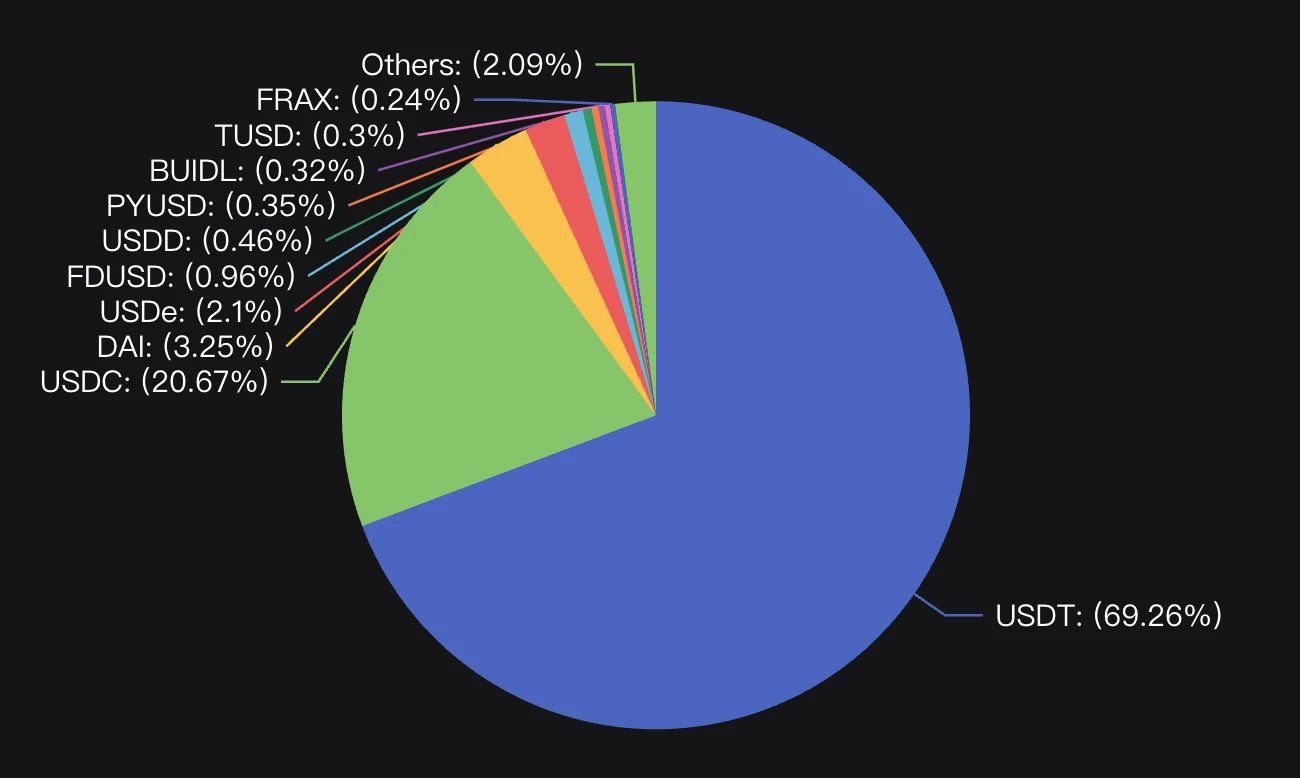

• Classifying stablecoins by their degree of centralization and collateral type are two relatively intuitive dimensions. Among the current mainstream stablecoins, they can be categorized by degree of centralization into centralized stablecoins (represented by USDT, USDC, FDUSD) and decentralized stablecoins (represented by DAI, FRAX, USDe). By collateral type, they can be divided into fiat/physical collateral, crypto asset collateral, and under-collateralized.

• According to DefiLlama data from July 14, the total market capitalization of stablecoins is reported at $162.372 billion. In terms of market capitalization, USDT and USDC dominate, with USDT leading significantly, accounting for 69.23% of the total stablecoin market. DAI, USDe, and FDUSD follow closely, ranking 3rd to 5th in market capitalization. All other stablecoins currently account for less than 0.5% of the total market capitalization.

• Centralized stablecoins are generally fiat/physical collateralized, essentially being real-world assets (RWA) like USDT and USDC, which are pegged 1:1 to the US dollar, while PAXG and XAUT are pegged to the price of gold. Decentralized stablecoins are typically crypto asset collateralized or uncollateralized (or under-collateralized), with DAI and USDe being crypto asset collateralized, which can further be subdivided into fully collateralized or over-collateralized. Uncollateralized (or under-collateralized) stablecoins are generally referred to as algorithmic stablecoins, represented by FRAX and the former UST. Compared to centralized stablecoins, decentralized stablecoins have a lower market capitalization, are slightly more complex in design, and have given rise to several star projects. In the BTC ecosystem, the decentralized stablecoin projects worth noting are therefore those that are decentralized stablecoins, so the mechanisms of decentralized stablecoins will be introduced below.

The top ten stablecoins by market capitalization as of July 14, 2024, source: Coingecko

The market share of the top ten stablecoins as of July 14, 2024, source: DefiLlama

Decentralized Stablecoin Mechanism

• Next, we will introduce the CDP mechanism (over-collateralization) represented by DAI and the contract hedging mechanism (equal collateralization) represented by Ethena. Additionally, there are algorithmic stablecoin mechanisms, which will not be detailed here.

• CDP (Collateralized Debt Position) represents a mechanism in decentralized finance systems for generating stablecoins through the collateralization of crypto assets, first pioneered by MakerDAO and now applied in many DeFi, NFTFi, and other categories of projects.

○ DAI is a decentralized, over-collateralized stablecoin created by MakerDAO, designed to maintain a 1:1 peg with the US dollar. The operation of DAI relies on smart contracts and a decentralized autonomous organization (DAO) to maintain its stability. Its core mechanisms include over-collateralization, collateralized debt positions (CDP), liquidation mechanisms, and the role of the governance token MKR.

○ CDP is a key mechanism in the MakerDAO system used to manage and control the process of generating DAI. In MakerDAO, CDPs are now referred to as Vaults, but their core functions and mechanisms remain the same. The following is a detailed operation process of CDP/Vault:

i. Generating DAI: Users deposit their crypto assets (such as ETH) into MakerDAO's smart contract, creating a new CDP/Vault, and subsequently generate DAI based on the collateralized assets. The generated DAI represents a portion of the user's borrowed debt, with the collateral serving as security for the debt.

ii. Over-Collateralization: To prevent liquidation, users must maintain their CDP/Vault's collateralization ratio above the system's minimum collateralization ratio (e.g., 150%). This means that if a user borrows 100 DAI, they must lock up collateral worth at least 150 DAI.

iii. Repayment/Liquidation: Users need to repay the generated DAI along with a certain stability fee (priced in MKR) to redeem their collateral. If users fail to maintain sufficient collateralization, their collateral will be liquidated.

• Delta represents the percentage change in the price of a derivative relative to the price of the underlying asset. For example, if the Delta of an option is 0.5, when the price of the underlying asset increases by $1, the option price is expected to increase by $0.5. A Delta-neutral position is an investment strategy that offsets price movement risk by holding a certain amount of the underlying asset and derivatives. The goal is to make the overall Delta value of the portfolio zero, thereby maintaining the value of the position when the price of the underlying asset fluctuates. For example, for a certain amount of spot ETH, one would buy an equivalent short perpetual contract for ETH.

Ethena tokenizes the "Delta-neutral" arbitrage trading of ETH by issuing a stablecoin, USDe, that represents the value of Delta-neutral positions. Therefore, their stablecoin USDe has the following two sources of income:

○ Staking income

○ Basis spread and funding rates

○ Ethena achieves equal collateralization and additional income through hedging.

Project 1: Bitsmiley Protocol

Project Overview

• The first native stablecoin project in the BTC ecosystem.

• On December 14, 2023, OKX Ventures announced a strategic investment in the stablecoin protocol bitSmiley on the BTC ecosystem, which allows users to mint the stablecoin bitUSD by over-collateralizing native BTC on the BTC network. At the same time, bitSmiley also includes lending and derivatives protocols, aiming to provide a new financial ecosystem for Bitcoin. Previously, bitSmiley was selected as a quality project in the BTC hackathon co-hosted by ABCDE and OKX Ventures in November 2023.

• On January 28, 2024, it was announced that the first round of token financing was completed, led by OKX Ventures and ABCDE, with participation from CMS Holdings, Satoshi Lab, Foresight Ventures, LK Venture, Silvermine Capital, and individuals from Delphi Digital and Particle Network. On February 2, LK Venture, a subsidiary of the Hong Kong-listed company Blueport Interactive, announced on platform X that it had participated in the first round of financing for bitSmiley through the Bitcoin network ecological investment management fund BTC NEXT. On March 4, KuCoin Ventures tweeted to announce a strategic investment in the Bitcoin DeFi ecosystem project bitSmiley.

Operational Mechanism

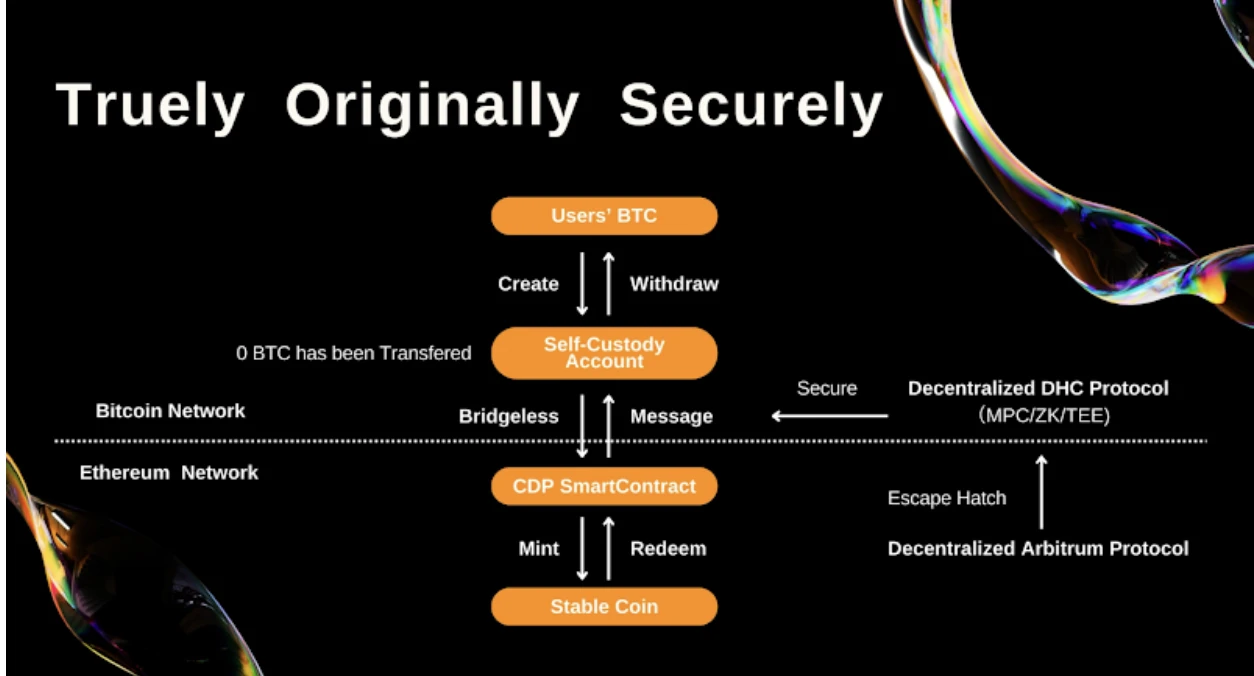

• bitSmiley is a Bitcoin native stablecoin project based on the Fintegra framework. It consists of a decentralized over-collateralized stablecoin, bitUSD, and a native trustless lending protocol (bitLending). bitUSD is based on bitRC-20, a modified version of BRC-20, and is compatible with BRC-20. bitUSD has added Mint and Burn operations to meet the needs for stablecoin minting and destruction.

• In January, bitSmiley launched a new DeFi inscription protocol called bitRC-20. The first asset of this protocol, OG PASS NFT, is also known as bitDisc. bitDisc is divided into two levels: Gold Card and Black Card, with Gold Cards allocated to Bitcoin OGs and industry leaders, totaling fewer than 40 holders. Starting from February 4, Black Cards will be made available to the public through whitelist activities and public minting activities in the form of BRC-20 inscriptions, which caused temporary congestion on the chain. Subsequently, the project team stated that they would compensate for unsuccessful inscriptions.

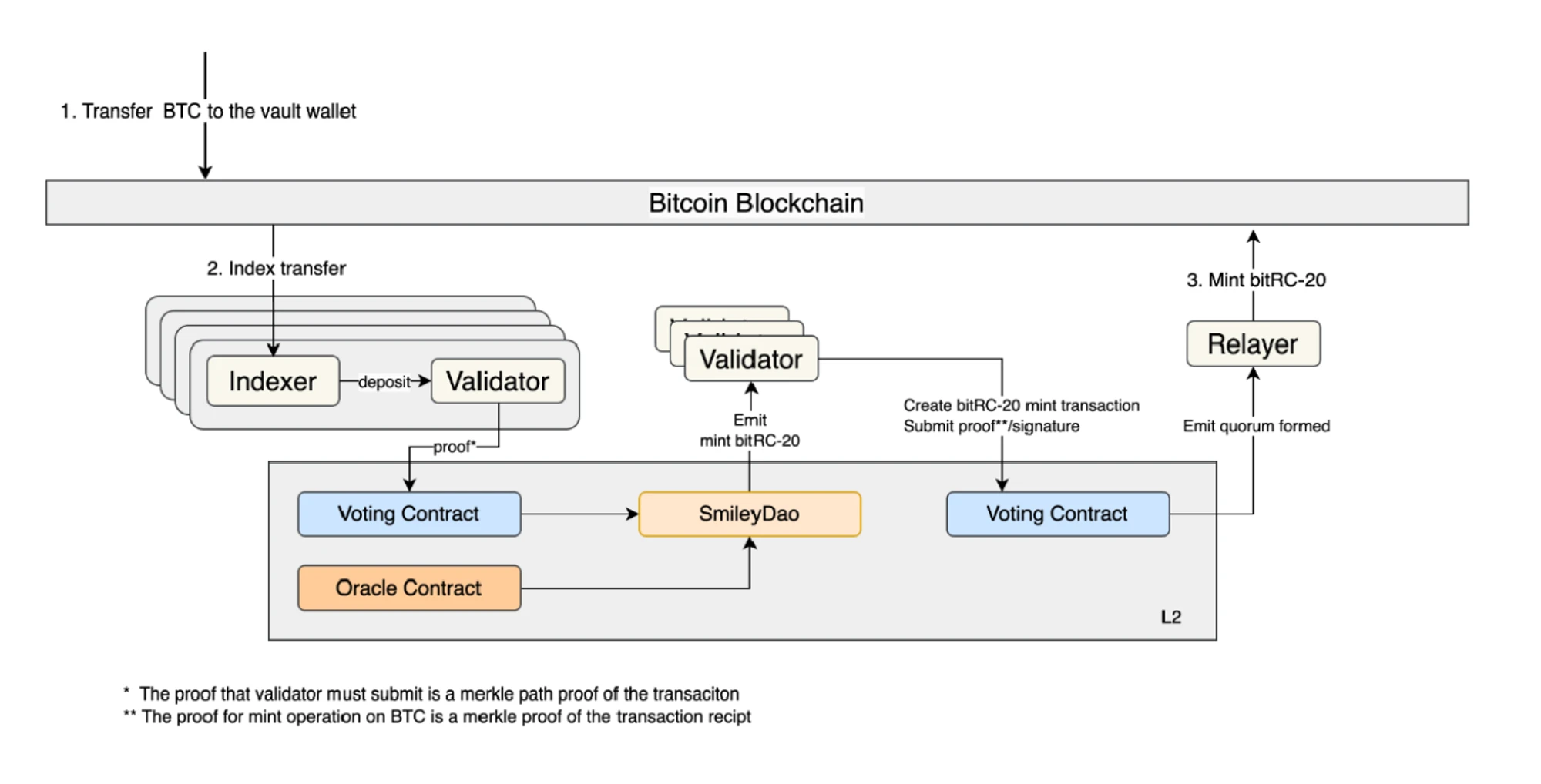

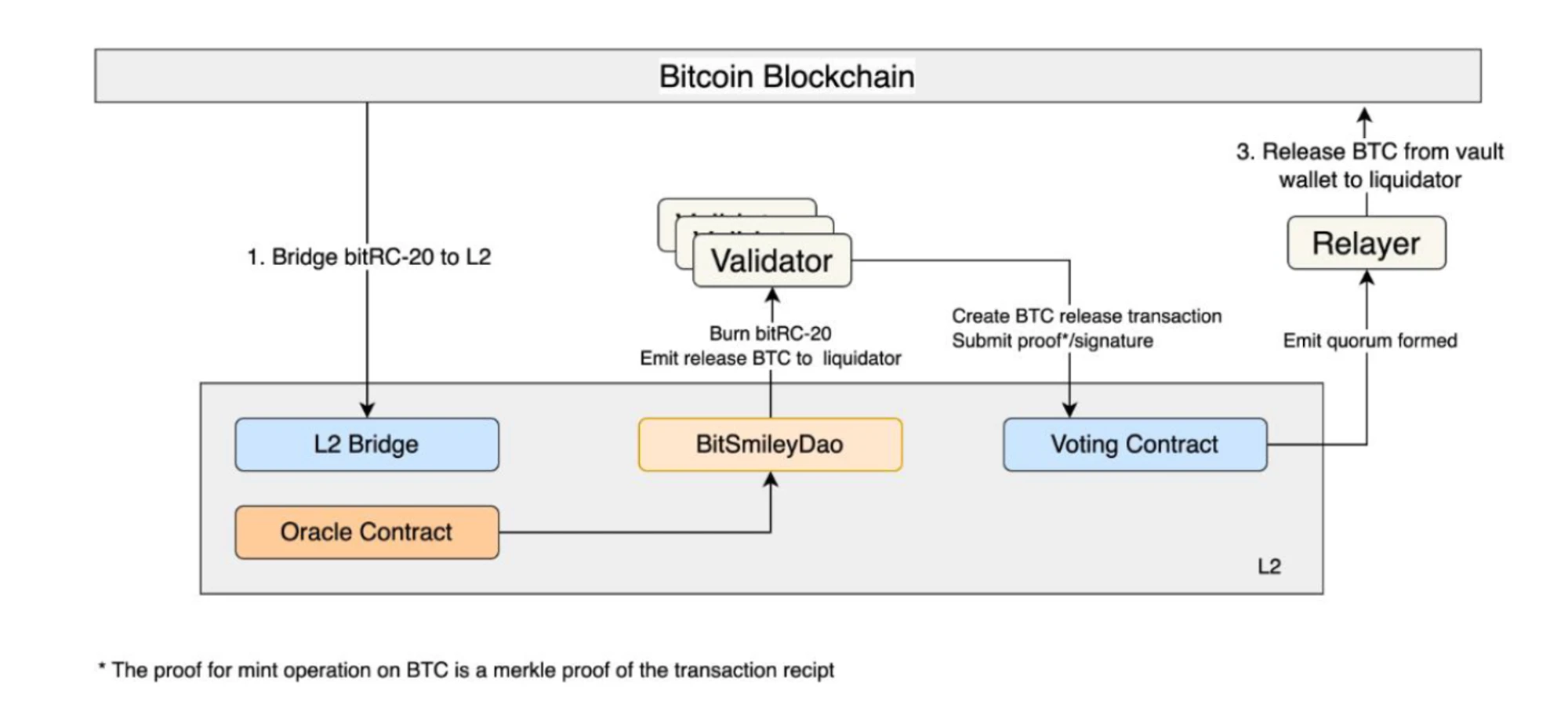

• $bitUSD Stablecoin Operational Mechanism

The operational mechanism of $bitUSD is similar to that of $DAI, where users first over-collateralize, and then the bitSmileyDAO on L2 issues a Mint bitRC-20 message to the BTC mainnet after receiving oracle information and reaching consensus.

Source: https://github.com/bitSmiley-protocol/whitepaper/blob/main/BitSmileyWhitePaper.pdf

• The logic of liquidation and redemption is also similar to that of MakerDAO, with liquidation conducted in a Dutch auction format.

Source: https://github.com/bitSmiley-protocol/whitepaper/blob/main/BitSmileyWhitePaper.pdf

Project Progress & Participation Opportunities

• bitSmiley launched Alphanet on BitLayer on May 1, 2024. The maximum loan-to-value (LTV) ratio is set at 50%, with a relatively low LTV ratio established to prevent user liquidation. As the adoption rate of bitUSD increases, the project team will gradually raise the LTV.

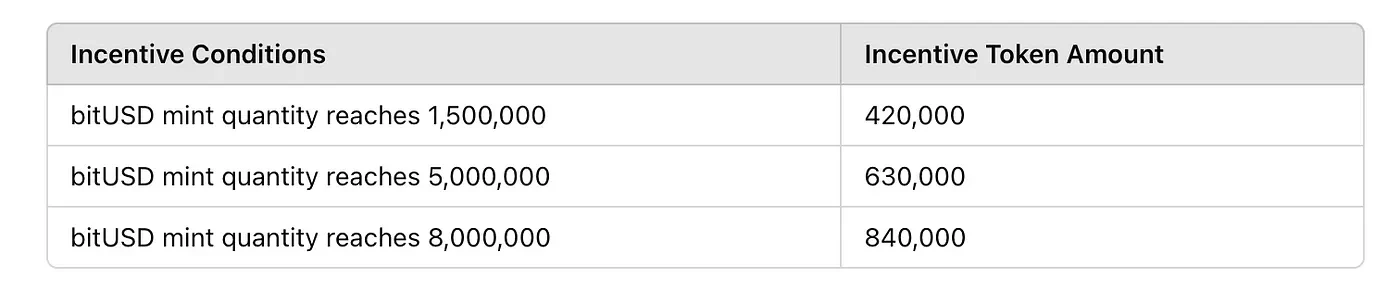

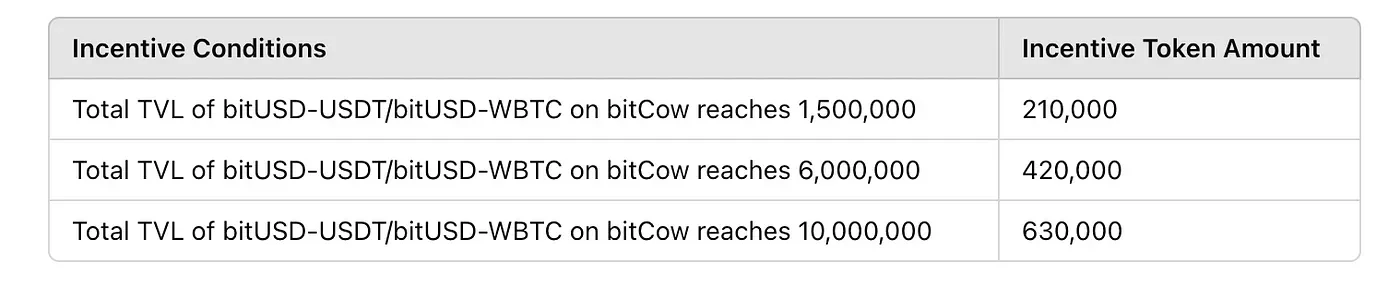

• bitSmiley and the Merlin community will launch an exclusive liquidity incentive grant starting from May 15, 2024, to increase the liquidity of bitUSD. The detailed rules are as follows:

○ bitSmiley will provide up to 3,150,000 $BIT tokens as rewards to members of the Merlin community. Rewards will be unlocked based on user behavior within the Merlin community. The first season runs from May 15, 2024, to August 15, 2024.

○ Reward methods: Incentives will be provided for achieving minting targets for bitUSD and for increasing liquidity in the bitUSD pool on bitCow, with details illustrated in the following image. The liquidity incentive funds will be distributed based on the bitPoints earned by users on the Merlin chain; the more points a user earns, the more token incentives they will receive.

Source: https://medium.com/@bitsmiley/exclusive-liquidity-incentive-grant-details-bitsmiley-x-bitcow-alpha-net-on-merlin-chain-3f88c4ddb32d

Project 2: Bamk.fi (NUSD)

Project Overview

• The Bamk.fi protocol is the issuer of NUSD (Nakamoto Dollar), which is a synthetic dollar on Bitcoin L1. NUSD circulates on the BRC20-5byte and Runes protocols (currently equivalent).

Operational Mechanism

• The project design has two phases. In Phase 1, NUSD is supported at a 1:1 ratio with USDe, and holding NUSD allows users to accumulate BAMK in each block [accumulating more BAMK the earlier they hold NUSD]. In Phase 2, NUSD will be fully supported by delta-neutral Bitcoin positions and will earn native yield, referred to as "Bitcoin bonds," while enabling minting and redemption based on BTC. However, the current minting method provided on the official website is a 1:1 minting with USDT.

• The project token BAMK is in rune form, with the rune code BAMK•OF•NAKAMOTO•DOLLAR, minted on April 21, 2024, with a maximum supply of 21,000,000,000 (21 billion). Of this, 6.25% of the supply has been provided as rewards to all NUSD holders. Users can start accumulating BAMK tokens simply by purchasing NUSD and holding it in their wallets. Each block between 844,492 and 886,454—totaling 41,972 blocks—will accumulate 31,250 BAMK, distributed proportionally based on the user's NUSD holdings divided by the total NUSD TVL at that block height.

Project 3: Yala Labs

Project Overview

• Yala enables its stablecoin $YU to flow freely and securely across various ecosystems through its self-built modular infrastructure, releasing BTC liquidity and bringing significant capital vitality to the entire crypto ecosystem.

• Core products include:

○ Over-collateralized stablecoin $YU: This stablecoin is generated through over-collateralization of Bitcoin, and the infrastructure is not only based on Bitcoin's native protocol but can also be deployed freely and securely in EVM and other ecosystems.

○ Metamint: A core component of $YU that allows users to conveniently mint $YU using native Bitcoin across various ecosystems, injecting Bitcoin's liquidity into these ecosystems.

○ Insurance Derivatives: Providing comprehensive insurance solutions within the DeFi ecosystem, creating arbitrage opportunities for users.

Operational Mechanism

• To facilitate users' use of $YU across various ecosystems, the Metamint solution has been launched. Whether using native Bitcoin or wrapped BTC on EVM as collateral, users can easily mint $YU on any target chain. To lower the entry barrier, users do not need to manually wrap Bitcoin; they simply need to collateralize BTC, and the system will automatically generate the required wrapped BTC for the target chain in the background, thus minting $YU on the target chain.

• Through this seamless asset conversion solution, users can participate in various DeFi protocols across ecosystems, including cross-chain yield farming, staking, and other DeFi activities, opening up new income opportunities. This multi-chain solution significantly enhances users' potential to achieve greater returns. Unlike traditional stablecoin companies that centralize profits, Yala returns system-generated fees to core $YU holders, ensuring that users directly benefit from the growth of the ecosystem.

• Features and Advantages

○ Using Bitcoin as the primary collateral while enjoying the security and resilience of the Bitcoin network.

○ Users can participate in various DeFi activities and earn returns through $YU.

○ Yala follows a user-centered decentralized governance structure, with revenues returned to core users.

Project Progress & Participation Opportunities:

Through collaborations with outstanding projects, Yala provides users with various income opportunities while ensuring security. For example, through collaboration with Babylon, Yala users can over-collateralize BTC on the platform and mint the stablecoin $YU, then further stake these collateral assets on the Babylon platform to achieve multiple returns. Since the Babylon staking protocol does not require third-party custody, this integration enhances returns while ensuring the absolute security of user assets.

Yala's roadmap focuses on building a robust liquidity layer that connects Bitcoin to outstanding Layer 1 and Layer 2 ecosystems in the market. To ensure security and optimal user experience, Yala will gradually launch its mainnet and testnet in phases:

• Testnet V0: $YU stablecoin issuance, Pro mode, oracles, and oracles;

• Testnet V1: Lightweight mode of $YU stablecoin with meta-yield;

• V1 Release: Insurance module and security upgrades.

• V2 Launch: Governance framework initiation.

As the launch of the testnet approaches, Yala has already secured support from top-tier funds, with specific institutions and valuation details to be announced in upcoming financing news.

Project 4: Satoshi Protocol

Project Overview

• The first CDP stablecoin protocol in the BTC ecosystem, based on the BEVM ecosystem.

• Satoshi Protocol announced the completion of its seed round financing on March 26, 2024, led by Web3Port Foundation and Waterdrip Capital, with participation from BEVM Foundation, Cogitent Venture, Statoshi Lab, and other institutions. On July 9, 2024, it announced the completion of $2 million in financing.

Operational Mechanism

• By offering low interest rates, Bitcoin holders can release liquidity from their assets; at the same time, the Satoshi protocol is a multi-chain protocol, and its stablecoin SAT has a highly compatible multi-token standard mechanism. Satoshi Protocol currently has two tokens: the USD-pegged stablecoin SAT and the utility token OSHI that incentivizes and rewards ecosystem participants. Users can mint the USD stablecoin $SAT by depositing BTC and other BTC-based yield-bearing assets at a minimum collateralization rate of 110%, participating in trading, liquidity pools, lending, and other scenarios to earn returns.

• In the Satoshi protocol, users must maintain at least a 110% collateralization rate when opening a position to avoid liquidation. For example, when borrowing 100 SAT, users need to lock up BTC worth more than 110 SAT as collateral. If the price of BTC falls, causing the collateral value to drop below the 110% collateralization rate, the protocol will initiate the liquidation mechanism.

• The stability pool is the core mechanism of the Satoshi protocol, designed to repay the debts of liquidated positions by providing liquidity, ensuring the stability of the system. When under-collateralized positions (collateralization rate below 110%) are liquidated, the SP uses SAT to repay debts and acquires the liquidated BTC collateral. Users participating in the stability pool can purchase these BTC collaterals at a discount, and the protocol uses the SAT obtained from these liquidations to repay debts.

Project Progress & Participation Opportunities

• The latest announcement states that Satoshi Protocol is developing a rune-based stablecoin on the Bitcoin mainnet and is collaborating with projects like Omini Network to connect the Bitcoin and Ethereum ecosystems to achieve the vision of a "full-chain stablecoin."

• Currently, an airdrop points activity for $OSHI is underway, where users can earn points by voting for the project in the BVB program, depositing collateral to borrow $SAT, providing liquidity, and recommending four methods, with $OSHI distributed later based on points earned.

Project 5: BTU

Project Overview

• BTU is the first decentralized stablecoin project in the Bitcoin ecosystem, using a collateralized debt position (CDP) model that allows users to issue stablecoins based on BTC assets. BTU addresses the liquidity issues faced by Bitcoin holders in the existing decentralized finance (DeFi) ecosystem through seamless decentralized design, providing a safer and trustless stablecoin solution.

Operational Mechanism

Bitcoin-backed stablecoin: BTU is a decentralized stablecoin fully collateralized by Bitcoin. Users can directly mint stablecoins by locking BTC in the BTU protocol without transferring assets off-chain or relinquishing control over their BTC. This design ensures decentralization and avoids the risks associated with traditional centralized exchanges or custodians.

No cross-chain bridges required: Unlike other solutions that rely on cross-chain bridges, BTU completes all operations within the Bitcoin network, eliminating the need for users to transfer BTC across chains. This design removes potential third-party risks that may arise during cross-chain processes, further enhancing the security and control of users' assets.

Proof of assets without transactions: BTU introduces a mechanism that allows users to prove their BTC holdings without transferring their Bitcoin. This trustless, seamless design provides users with additional flexibility, enabling them to maintain full control over their BTC assets while participating in the DeFi ecosystem.

Decentralized CDP model: BTU adopts a decentralized collateralized debt position (CDP) model, allowing users to fully control when to issue or redeem BTU stablecoins. The protocol design ensures that users' BTC can only be used with their consent, maintaining a high degree of decentralization and control.

Enhanced liquidity and leverage: BTU is the first protocol to map BTC on the Bitcoin network and increase its liquidity and leverage. Through this mechanism, BTC holders can bring their assets into the DeFi ecosystem without sacrificing decentralization, enjoying greater flexibility and investment opportunities.

• BTU provides Bitcoin holders with a trustless, decentralized way to participate in the DeFi ecosystem by unlocking Bitcoin's liquidity. Traditionally, Bitcoin holders have found it challenging to engage in DeFi and on-chain financial activities without relying on centralized exchanges or custodians. The emergence of BTU brings new opportunities for Bitcoin holders, allowing them to safely issue stablecoins, increase liquidity, and maintain control over their BTC.

• This innovative decentralized stablecoin solution not only offers more financial choices for BTC holders but also brings new growth potential to the DeFi ecosystem. By promoting the release of Bitcoin's liquidity, BTU has the potential to drive the emergence of a new generation of DeFi applications and protocols, further expanding the user base and use cases of the DeFi market.

• The infrastructure design of BTU emphasizes decentralization and security. Since it operates entirely within the Bitcoin network, BTU does not require cross-chain bridges or third-party custodians, significantly reducing issues related to centralized risks. BTU's decentralized model ensures seamless integration with the existing Bitcoin ecosystem without introducing additional technical or security risks.

Project Progress & Participation Opportunities

• The project has currently received investment support from Waterdrip Capital, Founder Fund, and Radiance Ventures.

2. Lending Track

Introduction

• Bitcoin lending (BTC Lending) is a financial service that allows users to obtain loans by using Bitcoin as collateral or earn interest by lending Bitcoin. Borrowers deposit Bitcoin into lending platforms, which provide loans based on the value of Bitcoin, with borrowers paying interest and lenders earning returns. This model provides liquidity for Bitcoin holders while offering investors new income channels.

• The collateralized loans in BTC Lending are similar to traditional mortgages. If a borrower defaults, the platform can auction the collateralized Bitcoin to recover the loan. BTC Lending platforms typically implement the following risk management measures:

1. Control of collateralization ratio and loan-to-value (LTV): Platforms set an LTV. For example, if the value of Bitcoin is $10,000, the loan should not exceed $5,000 (LTV of 50%). This provides a buffer against Bitcoin price fluctuations.

2. Additional collateral and margin calls: When the price of Bitcoin falls, borrowers must provide additional collateral to lower the LTV. If they fail to do so, the platform may force liquidation.

3. Forced liquidation mechanism: When borrowers fail to provide additional collateral, the platform will sell part or all of the collateralized Bitcoin to repay the loan.

4. Risk management and insurance: Some platforms establish insurance funds or collaborate with insurance companies to provide additional protection.

• From 2013 to 2017, Bitcoin gradually gained acceptance as a new asset class, with early lending platforms like Bitbond and BTCJam emerging, primarily using a P2P model for lending. Between 2018 and 2019, the cryptocurrency market experienced rapid growth, leading to the emergence of more platforms like BlockFi, Celsius Network, and Nexo, with the DeFi concept driving the rise of decentralized lending platforms.

• Since 2020, the COVID-19 pandemic has caused turmoil in global financial markets, leading to increased attention on cryptocurrencies as safe-haven assets, resulting in a surge in demand for BTC Lending and rapid expansion of lending scales. Major platforms continue to innovate, launching various financial products and services such as flash loans, liquidity mining, and cryptocurrency reward credit cards, attracting more users.

• The BTC Lending sector has become an important component of the cryptocurrency market, covering major cryptocurrencies like Bitcoin and Ethereum, with lending products including collateralized loans, deposit accounts, and unsecured loans. Platforms profit through interest rate spreads and fees. Popular platforms like Aave offer flash loans and liquidity mining rewards, MakerDAO provides the DAI Savings Rate (DSR), and Yala offers DeFi yields based on stablecoins. Next, we will introduce popular products in the BTC Lending sector.

Project 1: Liquidium

Project Overview

• Liquidium is a P2P lending protocol running on Bitcoin, allowing users to use native Ordinals and Runes assets as collateral to lend and borrow native Bitcoin.

• On December 11, 2023, Liquidium completed a $1.25 million Pre-Seed round of financing, with participation from Bitcoin Frontier Fund, Side Door Ventures, Actai Ventures, Sora Ventures, Spicy Capital, UTXO Management, and others.

• On July 18, 2024, it completed a $2.75 million seed round of financing. This round was led by Wise 3 Ventures, with participation from Portal Ventures, Asymmetric Capital, AGE Fund, Newman Capital, and others.

Operational Mechanism

• The platform completes Bitcoin lending in a secure and non-custodial manner using partially signed Bitcoin transactions (PSBT) and discrete log contracts (DLC) on Bitcoin L1. Currently, it supports lending of Ordinals and Runes assets (BRC-20 is in testing).

• Tokenomics: The LIQUIDIUM•TOKEN in rune form was launched on July 22, 2024, with a total supply of 100M. The genesis airdrop has been completed. As of September 3, the market price of LIQUIDIUM•TOKEN is approximately $0.168, with a market cap of $2M.

• According to Geniidata's data, as of September 3, the total trading volume of the protocol reached approximately 2400 BTC, with most being Ordinals and a small portion being Runes assets. The protocol's trading volume peaked in April-May, averaging about 15-20 BTC of Ordinal assets traded daily. With the launch of Runes, DAU and trading volume saw a new peak before gradually declining. In August and September, trading volume dropped to an average of 5-10 BTC per day.

Project 2: Shell Finance

Project Overview

• A stablecoin protocol based on BTC L1, supporting the use of BTC, Ordinals NFTs, Runes, BRC-20, and ARC-20 assets as collateral to obtain $bitUSD.

Operational Mechanism

• Similar to Liquidium, it implements native Bitcoin lending based on PSBT and DLC technology. PSBT allows for secure and collaborative transaction signing, while DLC enables conditional and trustless contract execution based on verified external data.

• Unlike Liquidium's P2P model, Shell Finance adopts a Peer-to-Pool approach to maximize utilization.

• The testnet has not yet been launched.

3. Staking Track

Introduction

• Staking is typically recognized for its secure and stable yield characteristics. When "staking" tokens, users usually receive some form of access, privileges, or reward tokens over time in exchange for locking their coins, which they can withdraw at any time. Staking occurs at the network level and is entirely used to secure the network. Ethereum's proof-of-stake (PoS) mechanism is the most typical example of staking, with over 565,000 validators holding the standard 32 ETH, which is worth over $32 billion today. Staked assets are often linked to DeFi liquidity, yield rewards, and governance rights. Tokens are locked in a blockchain network or protocol to earn returns, and these tokens are used to provide critical services to users.

• The current concept of staking bringing shared security provides a new dimension for the modular track, utilizing the potential of "digital gold and silver." Narratively, it releases trillions of dollars in liquidity and is a key core for future scalability. Recent examples include Bitcoin staking protocol Babylon and Ethereum's restaking protocol EigenLayer, which raised $70 million and $100 million, respectively, indicating strong recognition from top VCs for this sector.

• At this stage, this sector is mainly divided into two factions: 1. Layer 1 with sufficient security serving as a functional layer for Rollups; 2. Creating an existence with security close to Bitcoin/Ethereum but with better performance, such as Celestia, which aims to create a secure, decentralized, and high-performance DA layer in a short time through a pure DA functional architecture and low gas costs. The disadvantage of this solution is that it requires time to complete its decentralization and lacks orthodoxy. Newly emerged projects like Babylon and Eigenlayer are more neutral compared to the first two, inheriting orthodoxy and security while providing more application value to main chain assets—creating shared security services by leveraging the asset value of Bitcoin or Ethereum through PoS.

Project 1: Babylon

Project Overview

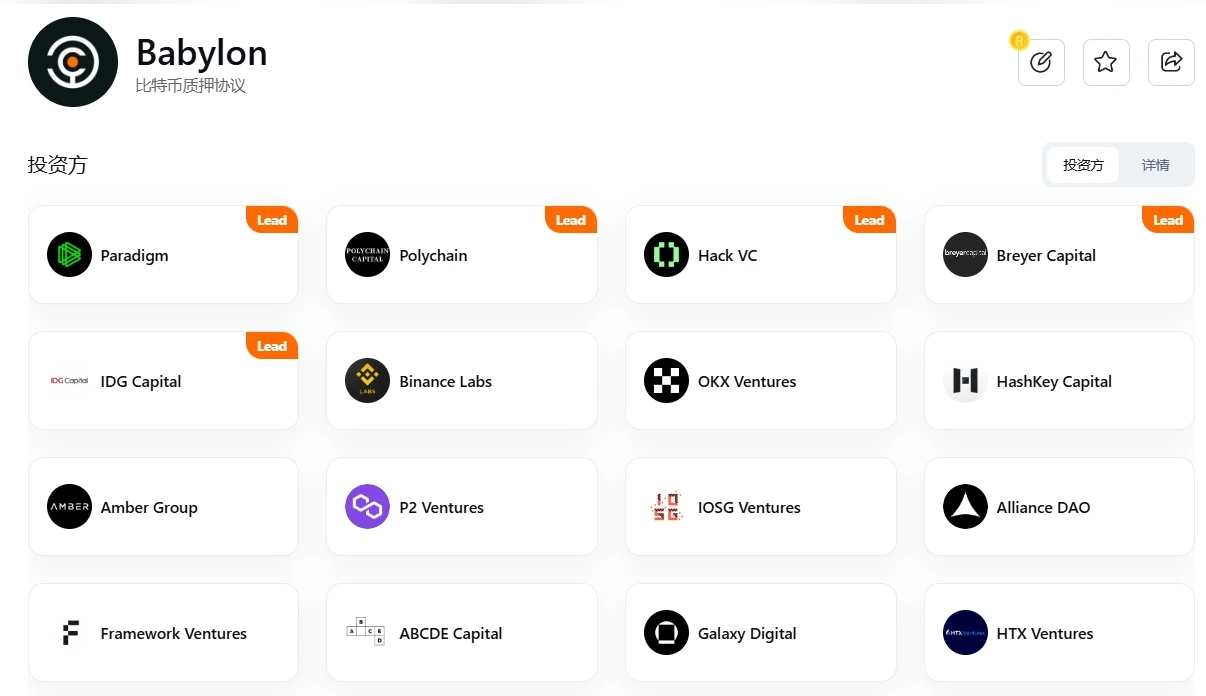

• Babylon is a layer 1 blockchain founded by Stanford University Professor David Tse. The mission of the project is to bring Bitcoin's unparalleled security to all PoS blockchains without any additional energy costs. The team consists of researchers from Stanford University, experienced developers, and seasoned business advisors.

• Babylon is a Bitcoin staking protocol, with its core component being a PoS public chain compatible with Cosmos IBC, allowing Bitcoin locked on the Bitcoin mainnet to provide security for other PoS consumer chains while earning staking rewards on the Babylon mainnet or PoS consumer chains. Babylon enables Bitcoin to leverage its unique security and decentralization characteristics to provide economic security for other PoS chains, facilitating the rapid launch of other projects.

Image source: https://www.rootdata.com/zh/Projects/detail/Babylon?k=MjgwNQ%3D%3D

• The Babylon team consists of 32 technical personnel and advisors, showcasing strong technical capabilities. The team's advisors include Sunny Aggarwal, co-founder of Osmosis Lab, and Sreeram Kannan, founder of Eigenlayer, serving as strategic advisors. As of June 1, 2024, Babylon has disclosed multiple rounds of financing, totaling over $96.8 million. The following table shows that compared to other Bitcoin Layer 2 projects, Babylon's financing amount is relatively high, with numerous institutions involved.

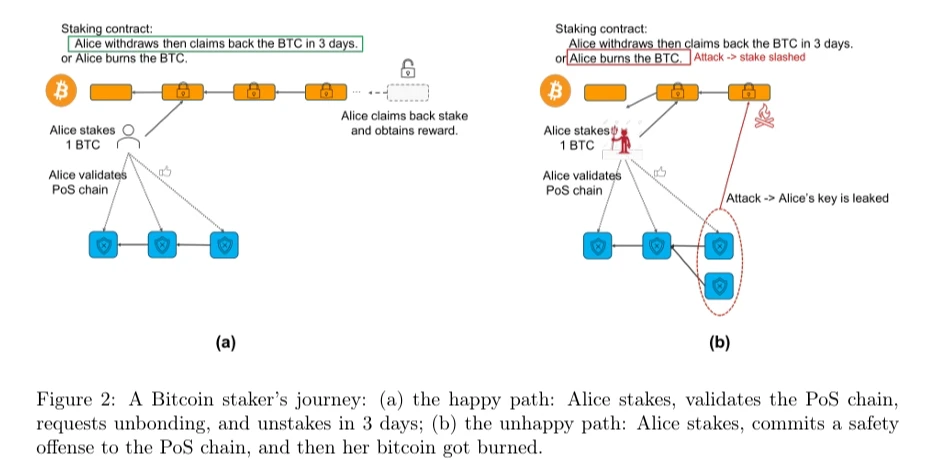

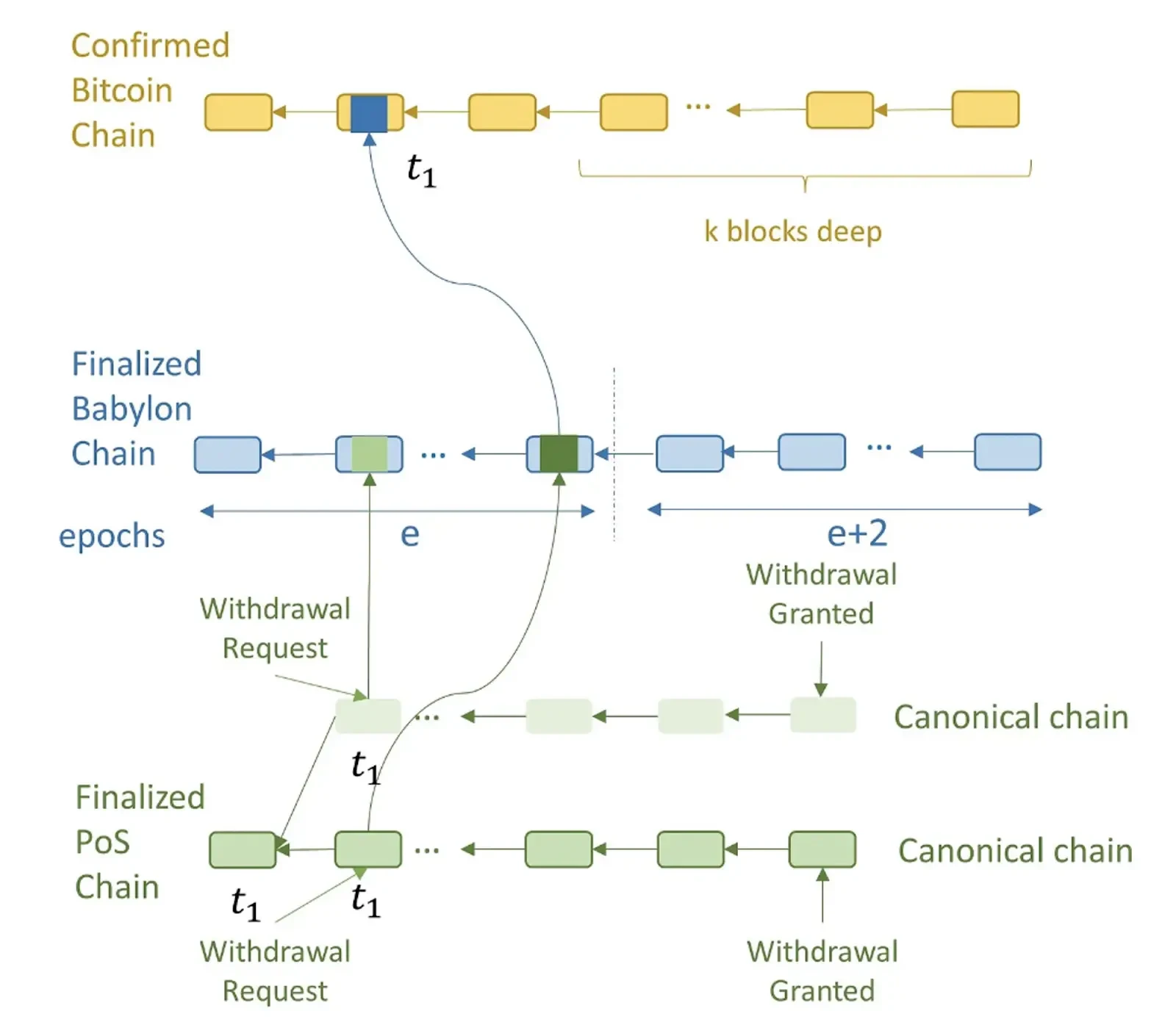

Operational Mechanism

• In terms of operational mechanism, Babylon is consistent with Ethereum's restaking protocol EigenLayer. "Bitcoin + Babylon" can be seen as "Ethereum + EigenLayer," but since Bitcoin does not support smart contracts, Babylon needs to take an additional step compared to EigenLayer, which is the most challenging step from 0-1: making non-stakable Bitcoin stakable first, and then proceeding to restake Bitcoin.

• Babylon utilizes UTXO to implement staking contracts, referred to as remote staking. This means that the security of BTC is transmitted to the PoS chain through an intermediate layer, while cleverly combining existing opcodes in its approach. The specific steps to implement the contract can be broken down into the following four steps:

a. Locking funds

Users send funds to an address controlled by multi-signature. Through OPCTV (OPCHECKTEMPLATEVERIFY, which allows the creation of predefined transaction templates to ensure that transactions can only be executed according to specific structures and conditions), the contract can specify that these funds can only be spent when certain conditions are met. Once the funds are locked, a new UTXO is generated, indicating that these funds have been staked;

b. Condition verification

Calling OPCSV (OPCHECKSEQUENCEVERIFY, which allows setting a relative time lock based on the transaction's sequence number, indicating that the UTXO can only be spent after a certain relative time or block number) can achieve a time lock, ensuring that the funds cannot be withdrawn for a certain period. Combining the aforementioned OP_CTV allows for staking, unstaking (under the condition that the staking time is met, the staker can spend the locked UTXO), and slashing (in cases of malicious behavior by the staker, the UTXO will be forcibly spent to a locked address and restricted to an unspendable state, similar to a black hole address);

Image source: https://docs.babylonchain.io/assets/files/btcstakinglitepaper-32bfea0c243773f0bfac63e148387aef.pdf

c. Status Update

Whenever a user stakes or withdraws staked funds, it involves the creation and spending of UTXOs. New transaction outputs generate new UTXOs, while old UTXOs are marked as spent. This way, every transaction and flow of funds is accurately recorded on the blockchain, ensuring transparency and security;

d. Reward Distribution

Based on the amount staked and the staking duration, the contract calculates the rewards due and distributes them by generating new UTXOs. These rewards can be unlocked and spent through script conditions once specific criteria are met.

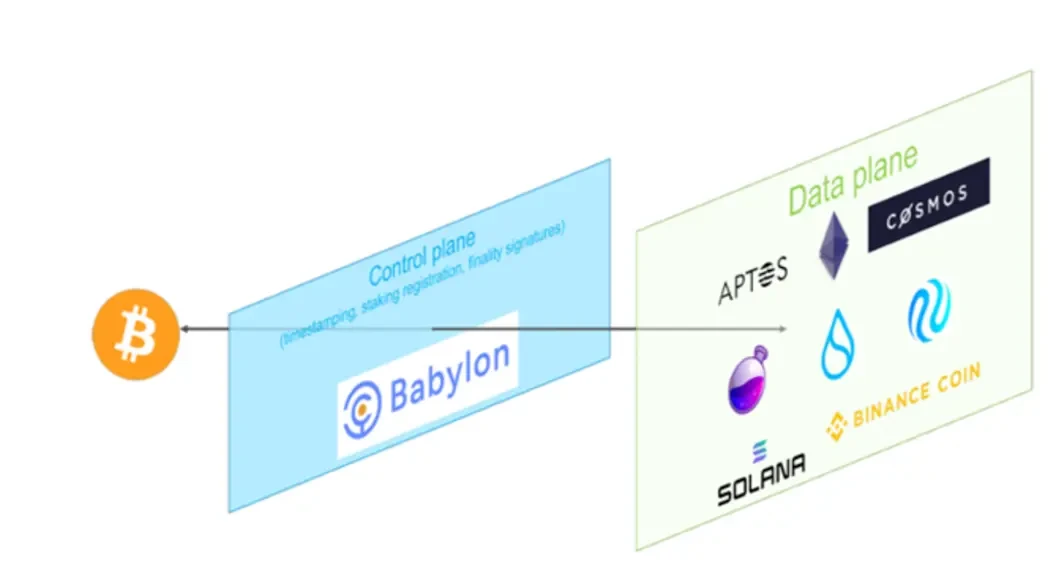

• The overall architecture of Babylon can be divided into three layers: Bitcoin (as a timestamp server), Babylon (a Cosmos Zone), serving as the intermediate layer, and the PoS chain demand layer. Babylon refers to the latter two as the Control Plane (the Babylon itself) and the Data Plane (the data demand plane, i.e., various PoS consumer chains).

• Validators of various PoS chains download Babylon blocks and check whether their PoS checkpoints are included in the Bitcoin-checked Babylon blocks. This allows PoS chains to detect discrepancies, for example, if Babylon validators create an unavailable block checked by Bitcoin and lie about the PoS checkpoints included in the unavailable block.

• Therefore, there are slashing rules, meaning that if a validator does not withdraw their stake upon detecting an attack, they can be slashed for having a double-signing conflict PoS block. Malicious PoS validators may fork the PoS chain while assigning Bitcoin timestamps to blocks on the PoS chain. In the eyes of later PoS clients, this will change the PoS chain from the top chain to the bottom chain. Although this is a successful security attack, it results in the slashing of the malicious PoS validators' stakes, as they have double-signing conflict blocks but have not yet withdrawn their staked rights.

Image source: https://docs.babylonchain.io/assets/files/btcstakinglitepaper-32bfea0c243773f0bfac63e148387aef.pdf

Project Progress & Participation Opportunities

• In February 2023, Babylon achieved BTC timestamping testnet. In July, it implemented BTC staking PoC, and a BTC staking testnet will be launched in Q4.

• In Q2 2024, Babylon will launch its Mainnet, and in Q3–4 2024, it will introduce Data Availability, currently in testnet 4. Users participating in the testnet will receive project points as incentives, which can be exchanged for governance token airdrops on the mainnet.

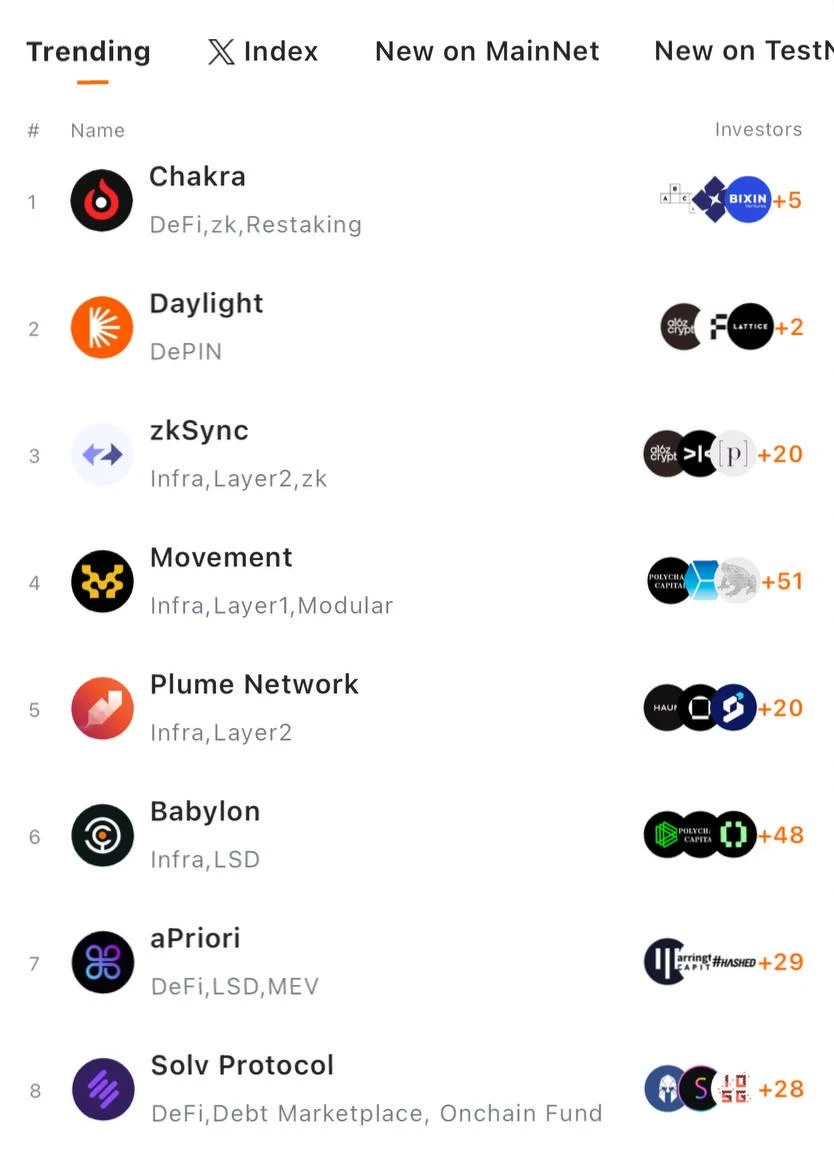

• The mainnet is expected to launch soon. On August 1, 2024, Babylon began collaborating with popular restaking projects such as Chakra, Bedrock, Solv Protocol, and pStake, initiating the pre-staking process. Users can now participate in Babylon's pre-staking through the aforementioned projects and obtain corresponding shares, making it a great time to get involved. After the mainnet launches, users staking on the mainnet will also receive governance tokens, and stakers can earn annualized returns from the staking network at any time.

4. Restaking Track

Introduction

• Building on staking, ETH first introduced the concept of restaking. ReStaking is the use of liquid staked token assets for staking with validators on other networks and blockchains to earn additional returns while still contributing to the security and decentralization of the new network. Through ReStaking, investors can earn double returns from both the original network and the ReStaking network. Although ReStaking allows stakers to achieve greater returns, it also carries risks associated with smart contracts and fraudulent validator staking behaviors.

• In addition to accepting original assets, ReStaking networks also accept other assets, such as LSD tokens, LP tokens, etc., which enhances the security of the network. Furthermore, it releases an infinite source of liquidity in the DeFi market while still generating actual income for the protocol and its users. The income for both ReStaking networks and standard networks comes from security leasing, validators, and fees generated by dApps, protocols, and layers. Staking participants on the network will receive a portion of the network's income and may also earn inflation rewards in the form of the network's native tokens.

• Many BTC holders will stake their BTC in projects like Babylon and Bedrock to achieve considerable annualized returns and governance tokens, with early participants receiving significant returns and long-term benefits. However, their BTC loses other application value due to staking. So, how can new liquidity be released to give their BTC more value? Since it is impossible to release more liquidity from BTC, the focus shifts to LSD to release the liquidity obtained through staking. Users are naturally willing to restake the asset certificates obtained from staking BTC, exchanging them for fivefold returns—annualized returns from staking, governance tokens obtained from staking, annualized returns from restaking, and governance tokens obtained from restaking.

Project 1: Chakra

Project Overview

• Chakra is an innovative modular settlement infrastructure that employs zero-knowledge proof technology to ensure trustless security and efficiency. By integrating decentralized Bitcoin liquidity, Chakra provides a more secure and seamless settlement experience. Users can easily stake Bitcoin with one click, leveraging Chakra's advanced settlement network to participate in more liquidity yield opportunities, including LST/LRT projects within the Babylon ecosystem.

• Chakra is primarily supported by the Starknet ecosystem. In March 2024, it was officially announced that it had secured investments from StarkWare, CoinSummer, and several early investors, including numerous token holders and miners.

Operational Mechanism

• Chakra achieves the free flow of BTC derivative assets between major public chains by providing a highly modular Bitcoin settlement network, injecting liquidity into DeFi protocols and addressing the liquidity and interoperability issues of Bitcoin within the current blockchain ecosystem. At the same time, Chakra helps Layer 2, decentralized exchanges (DEX), and DeFi protocols bypass the complexities of building Bitcoin settlement infrastructure, avoiding resource waste and security risks associated with redundant settlement system construction.

• Chakra enhances economic security by utilizing the finality provided by the Babylon network, preventing settlement errors caused by consensus attacks. Chakra can provide efficient zero-knowledge proof aggregation for Layer 2 state and liquidity settlement, ensuring frictionless circulation of cross-chain Bitcoin assets. The parallel virtual machine (Parallel VM) designed and implemented by the Chakra team achieves over 5000 TPS performance under 4 threads through multithreading optimization, and in a high-configuration environment with 64 threads, TPS can even reach 100,000.

Project Progress

• Chakra launched its Devnet in May, incentivizing developers to co-build the application ecosystem and establishing deep connections with multiple local communities in Starknet. Subsequently, a series of developer education activities and Devnet incentives will be launched with the support of Starknet. In June, during the simultaneous launch of the testnet activities for Chakra and Babylon, Chakra became the top Finality Provider for the entire Babylon network, contributing 41% of the staking users across the network.

• From August 1 to August 7, 2024, Chakra, in collaboration with the Binance Web3 wallet, launched the Babylon pre-staking event. Participants were offered potential returns from Babylon and dual rewards from ChakraPrana, with future opportunities to earn rewards from other ecological tokens within the settlement system. The event has concluded, with a total of 48,767 users participating in staking.

Project 2: Bedrock

Project Overview

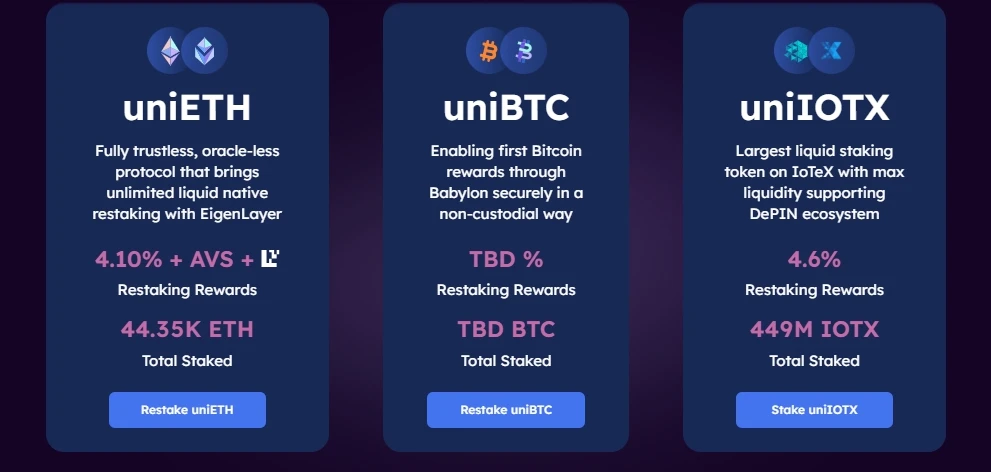

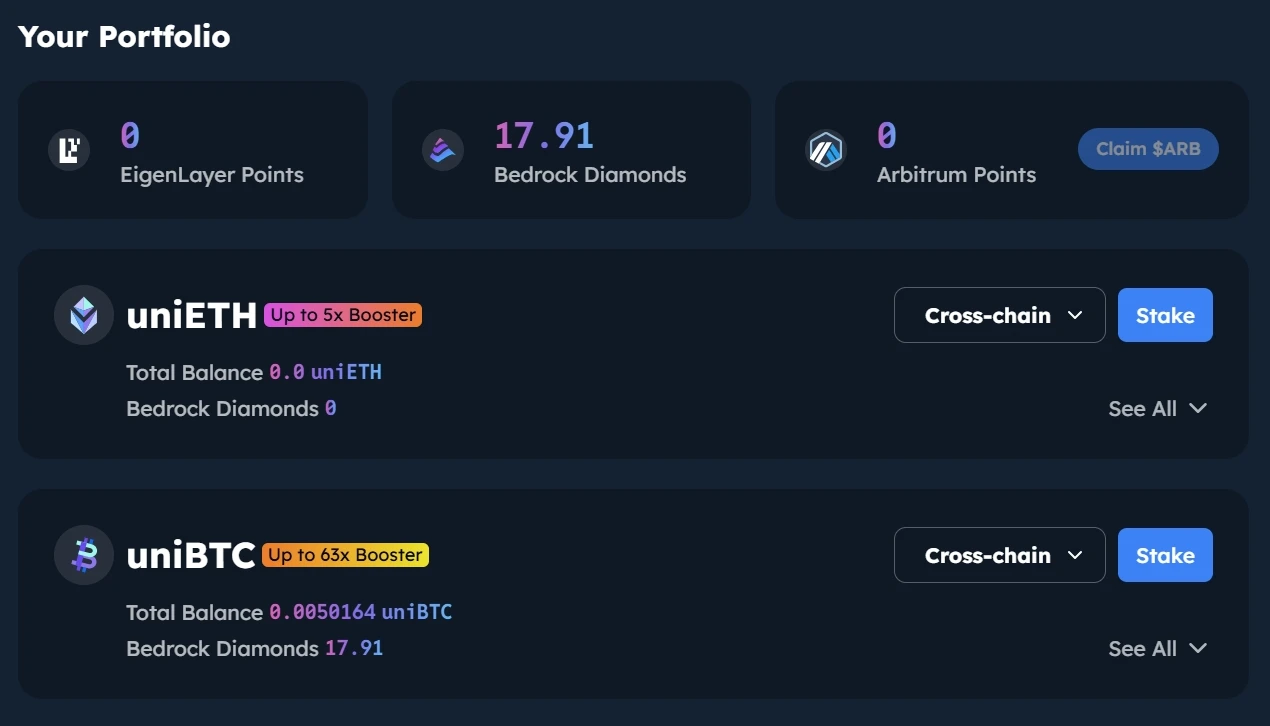

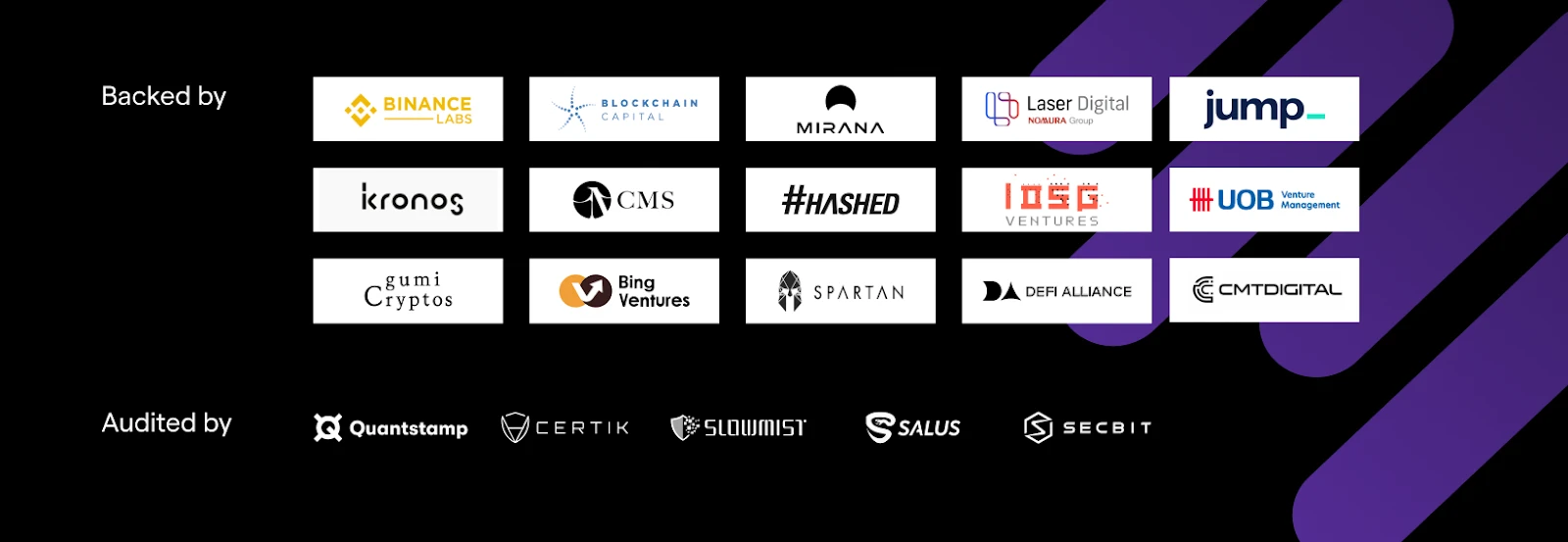

• Bedrock is a multi-asset liquidity restaking protocol supported by a non-custodial solution designed in collaboration with RockX. Bedrock leverages its universal standards to release liquidity and maximize value for PoS tokens (such as ETH and IOTX) as well as existing liquid staked tokens (referred to as uniETH and uniIOTX).

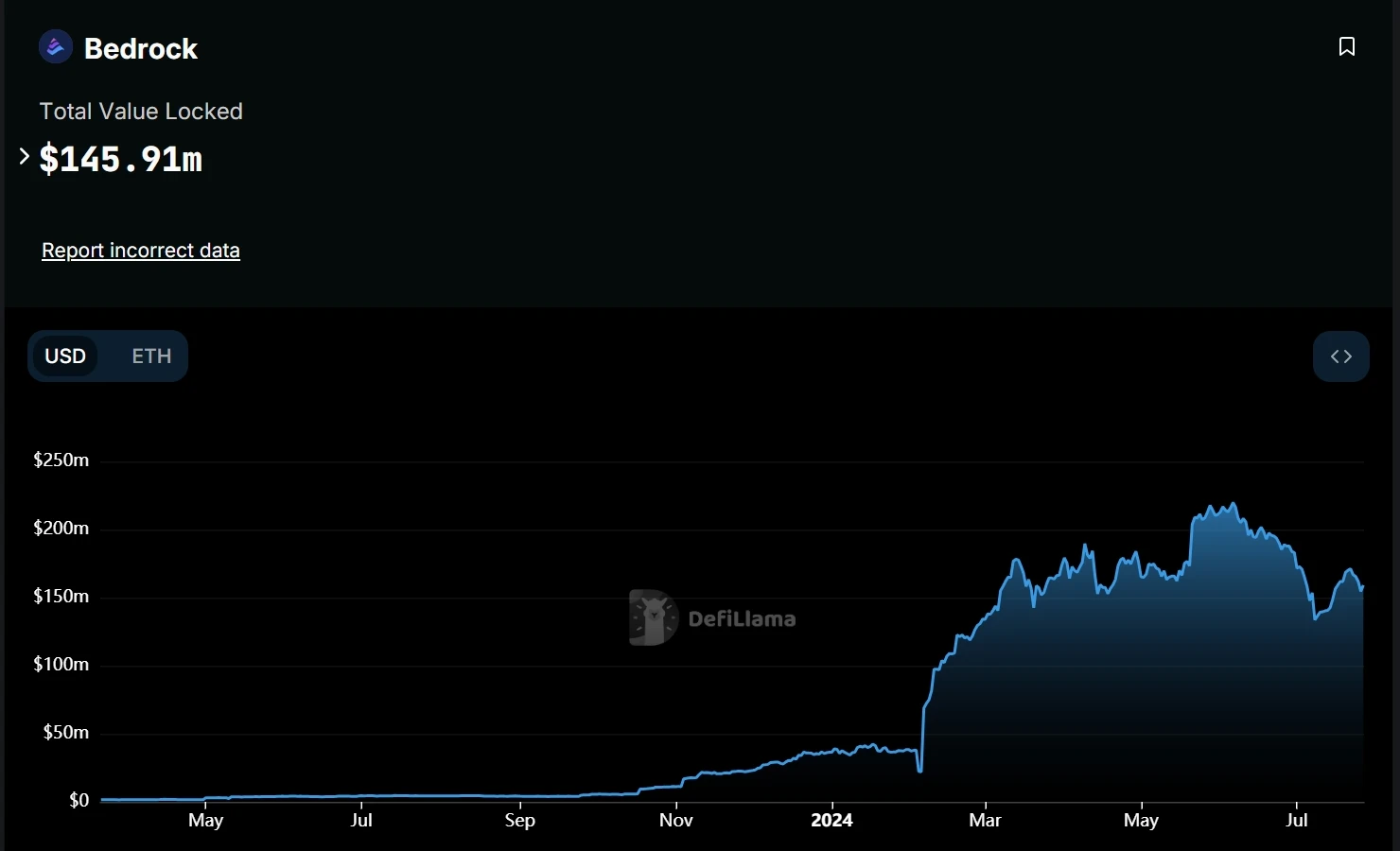

Current TVL:

Image source: https://defillama.com/protocol/bedrock#information

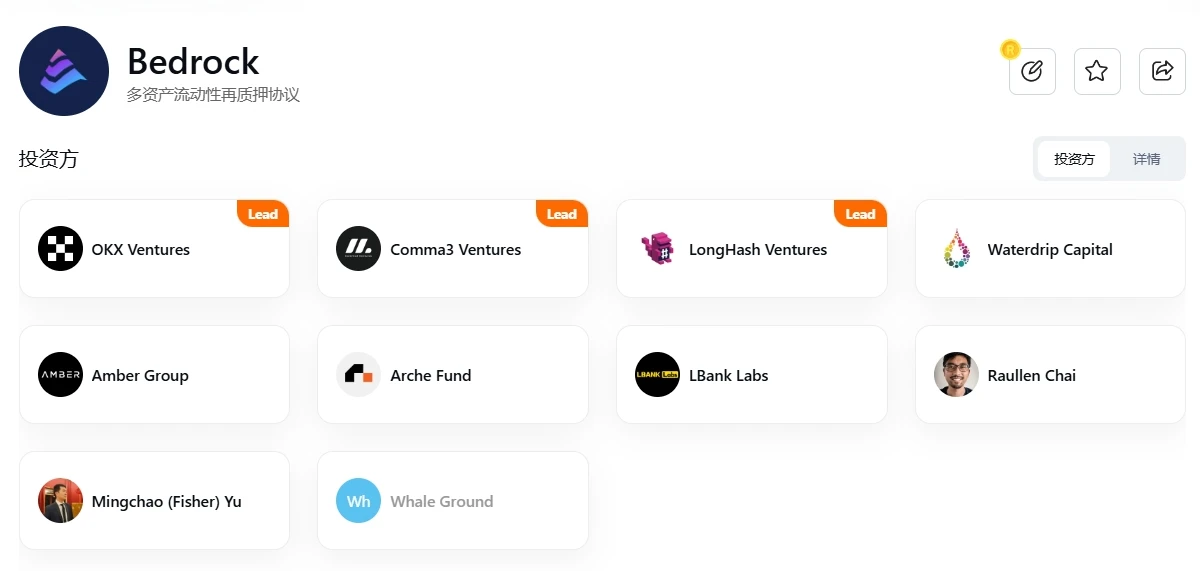

• The TVL once exceeded $200 million and shows signs of rising again. Additionally, the project has engaged in deep collaborations with ecological protocols such as Pendle, Karak, Celer, and zkLink, highlighting its influence in the DeFi ecosystem.

Image source: https://www.rootdata.com/zh/Projects/detail/Bedrock?k=MTI1OTM%3D

• Bedrock has received investments from renowned institutions such as OKX Ventures, Waterdrip Capital, and Amber Group. On May 2, 2024, OKX Ventures announced it would lead the investment in Bedrock. OKX Ventures founder Dora Yue stated, "With the rapid development of DeFi, the total value of on-chain staking has exceeded $93.4 billion, with 48% coming from the liquidity restaking sector. Our investment in Bedrock aims to accelerate liquidity restaking solutions. We hope to provide community users with diversified and secure asset management options. We look forward to the gradual maturation and systematization of DeFi use cases, promoting the sustainable development of the Web3 industry."

Operational Mechanism

• Re-staking is done using uniBTC supported by Babylon. Users can stake wBTC on Babylon via the ETH chain, and after staking their WBTC, they will receive a 1:1 certificate—uniBTC, which can be exchanged for wBTC at any time. Babylon provides core technical support. Users who stake wBTC and hold uniBTC can earn Bedrock and Babylon points. By collaborating with Babylon through uniBTC, Bedrock offers liquidity staking services to support Babylon's PoS chain. The minting of uniBTC ensures the stability and security of the Babylon PoS chain and further expands Bedrock's products to the BTC chain.

Image source: https://www.bedrock.technology/

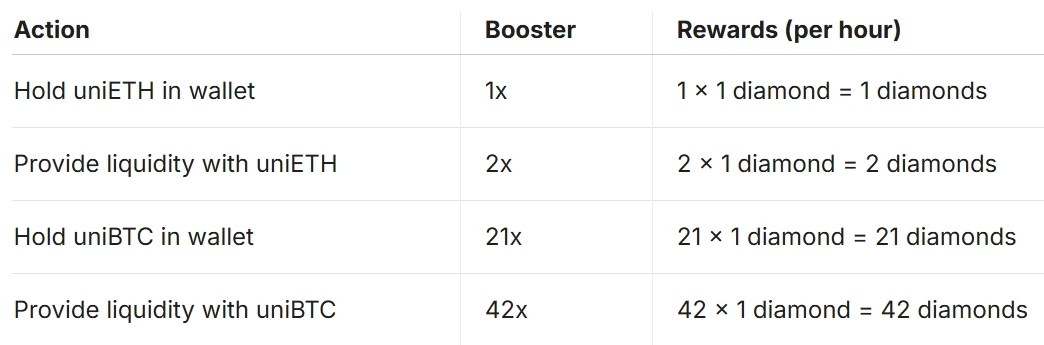

• From August 1 to August 7, 2024, Bedrock launched a staking event in collaboration with Binance. Starting from August 1, users only need to hold uniBTC in their wallets, and they will earn 21 times Bedrock diamond rewards for each token every hour, with Binance Web3 wallet users receiving an additional 3 times boost.

Image source: https://docs.bedrock.technology/bedrock-lrt/bedrock-diamonds

5. Decentralized Custody

• Recently, BitGO, the entity behind wBTC, announced the relinquishment of control over wBTC, sparking discussions in the market about the security of WBTC.

WBTC

• WBTC is the earliest and most widely used form of wrapped Bitcoin, bridging Bitcoin assets to the Ethereum ecosystem and utilizing Ethereum's DeFi scenarios to release Bitcoin's liquidity. However, this ERC-20 token form of wrapped Bitcoin has centralization management issues, leading to user concerns about asset security and transparency. MakerDAO voted to stop new lending against WBTC, destroying over $30 million worth of WBTC within a week. Interest in competing products such as tBTC and Coinbase's new product cbBTC has increased.

tBTC

• When crossing from BTC to ETH, minting tBTC can be considered. Users can exchange WBTC for tBTC and then redeem it back to native BTC for safekeeping or continue using tBTC as DeFi collateral. tBTC has a good DeFi adoption rate and has seen numerous use cases in Curve Finance. In addition to being actively traded in major stable and volatile pools, tBTC can also be minted into crvUSD stablecoin.

FBTC

• FBTC is a new type of synthetic asset that is fully chain-agnostic, pegged 1:1 to BTC, and supports the circulation of BTC across all chains (Ominichain). Initially, FBTC will launch on ETH, Mantle, and BNB chains, with plans to expand to more networks later, allowing users to earn yields in DeFi scenarios using FBTC.

• The key advantages of FBTC include:

FBTC will use multi-party computation custody providers.

The minting, burning, and cross-chain bridging of FBTC are managed by a TSS (Threshold Signature Scheme) network operated by the FBTC security council and security firms.

The proof of reserves for FBTC can be queried in real-time and is monitored and verified by security firms.

Locked FBTC can be directed to schedule underlying BTC as collateral or participate in Babylon staking.

Built by well-known entities in the blockchain ecosystem and Bitcoin financial institutions, it is trusted by numerous miners and builders.

Governance tokens as incentives.

dlcBTC

• dlcBTC is a non-custodial token for Bitcoin on Ethereum, allowing Bitcoin holders to participate in DeFi protocols while retaining full ownership of their assets. It uses Discreet Log Contracts (DLCs) to lock Bitcoin in a multi-signature UTXO, with one key held by the user and another distributed across a decentralized network. The minted dlcBTC tokens can be used as collateral on various DeFi platforms (such as Curve and AAVE).

• Unlike wBTC and other bridged assets (such as tBTC and BTC.B), dlcBTC locks Bitcoin on-chain by eliminating the need for intermediaries or custodians, placing user sovereignty as a core principle. dlcBTC is protected by the full hash power of the Bitcoin network, and users do not need to send their Bitcoin to third-party deposit addresses.

• Compared to wBTC, dlcBTC has the following advantages:

Self-wrapping: dlcBTC is self-wrapped by depositors (dlcBTC merchants), locking BTC in the DLC. Self-wrapping means that the DLC can only pay the original depositor, preventing BTC from being stolen in a hack or seized by government action.

Fully automated: Due to manual steps in the BitGo custody process, minting or burning wBTC can take 3-12 hours. In contrast, dlcBTC is fully automated, completing minting or burning in 3-6 BTC block confirmations.

Flexible fees: Since DLC.Link is not a custodian, dlcBTC incurs lower overhead, providing more competitive minting and burning fees.

6. CeDeFi

Introduction

• CeDeFi is a financial service that combines characteristics of centralized finance (CeFi) and decentralized finance (DeFi). The end of DeFi Summer has prompted reflection on the urgent need for mechanism innovation to eliminate the hassles of manual operations and liquidity mining pool interactions, and to break through the algorithmic limitations of underlying mining pools. With Ethereum's transition to PoS, Lido's success has propelled an active asset management model that generates yields by staking native ETH to obtain stETH, releasing liquidity while earning interest. In this process, users have shifted from interacting with liquidity pools to entrusting their assets to professional asset management institutions (centralized), which is the essence of CeDeFi.

• In the CeDeFi model, users lock Bitcoin in an independent over-the-counter settlement network managed by third-party custodians, which are separate from exchanges. These Bitcoins are mapped to tokens on the exchange at a 1:1 ratio. Users can then utilize these tokens on CeDeFi platforms for various operations, such as engaging in interest rate arbitrage trades between different markets. The actual Bitcoin is securely stored in cold wallets isolated from exchanges. Only necessary fund flows occur between the custody platform and exchange accounts, ensuring the security of user assets.

• As of June 13, 2024, approximately 28% of the total ETH supply is staked (33 million / 120 million), with about 29% of ETH staked through Lido (10 million / 33 million). This means that the liquidity of Bitcoin, valued in the trillions, has not been released, which is why CeDeFi is in high demand.

• The sources of income for CeDeFi typically include fee arbitrage, staking yields, restaking yields, and protocol-specific revenues (such as airdrop expectations). Fee arbitrage refers to utilizing the interest rate differences between the CeFi and DeFi systems to conduct arbitrage trades for profit. CeDeFi arbitrage strategies combine the security of CeFi with the flexibility of DeFi, allowing users to arbitrage through delta-neutral interest rates.

Project 1: Solv Protocol

Project Overview

• The Solv Protocol is a unified Bitcoin liquidity matrix aimed at consolidating the trillion-dollar liquidity of Bitcoin through SolvBTC.

• In 2021, it secured seed round funding, completing four rounds of financing totaling over $11 million (including an undisclosed strategic round from Binance Labs); the project contracts have been audited by several well-known firms.

Operational Mechanism

• SolvBTC is the liquidity layer for Bitcoin, currently launched on Ethereum, BNB Chain, Arbitrum, and Merlin Chain. As of July 16, 2024, the protocol's TVL holds 20,224 BTC, approximately $1.22B.

• By staking SolvBTC, users can earn SolvBTC Ethena (SolvBTC.ENA) or SolvBTC Babylon (SolvBTC.BBN).

○ SolvBTC Ethena uses Bitcoin as collateral to borrow stablecoins, which are then used to mint and stake Ethena's USDe. This process primarily generates returns from two main sources: financing obtained from Ethereum staking and delta-hedged derivative positions. Additionally, users can earn token incentives from both Solv and Ethena.

○ SolvBTC.BBN will initially not generate returns, but it is designed to prepare for the mainnet launch of Babylon, expected at the end of July. The 500 BTC quota for the first and second epochs has already been claimed.

• Solv Protocol collaborates with digital asset custodians such as Copper, Ceffu, Cobo, and Fireblocks. These custodians provide "over-the-counter settlement" solutions, allowing Solv to delegate assets to centralized exchanges or withdraw from them without transferring the actual assets.

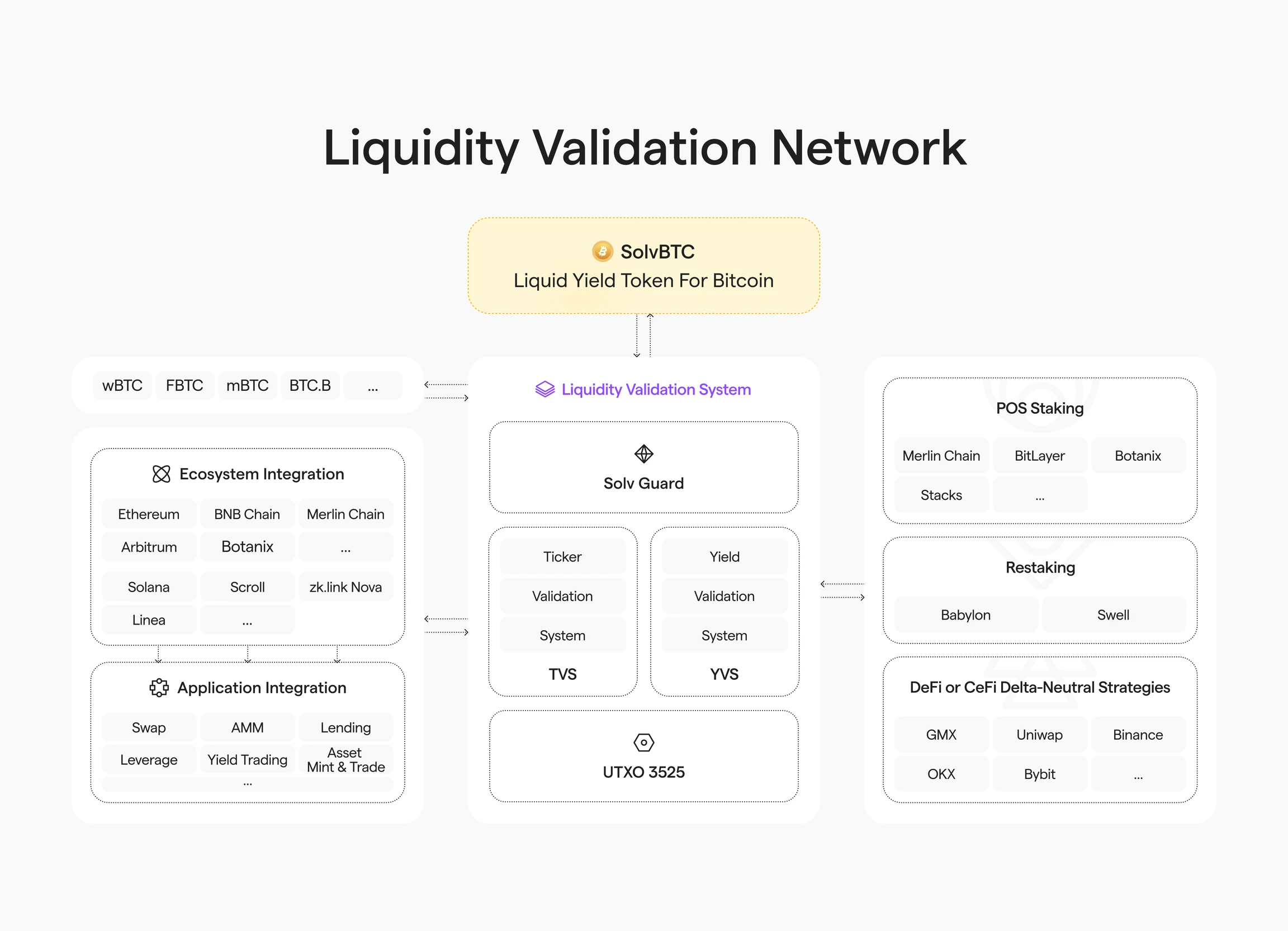

• Technical Framework: The Solv technical architecture revolves around the Liquidity Validation Network (LVN), a framework designed to provide secure liquidity validation for digital assets, primarily focusing on LST. The first asset supported by LVN is SolvBTC. Solv Guard has been launched as the foundational security module of LVN, ensuring the integrity and security of all operations within the network by supervising and managing the permissions of asset managers.

Image source: https://docs.solv.finance/solv-documentation/getting-started-2/liquidity-validation-network

Project Progress & Participation Opportunities

• The Solv points system is operational and will serve as a reference for future airdrops.

○ Total XP = Base XP + Boost XP + Referral XP

○ Base points can be enhanced through staking (Base XP = (XP earned per dollar deposited) x (holding time)). Additionally, users can achieve multipliers for Boost XP by reaching certain thresholds or participating in community activities.

• On July 16, community news announced that the third epoch of SolvBTC.BBN is about to launch.

Project 2: Bouncebit

Project Overview

• BTC Restaking Chain, fully compatible with EVM, featuring CeDeFi product design, utilizing LCT (Liquidity Custody Token) for restaking and on-chain farming.

• On February 29, 2024, BounceBit announced the completion of a $6 million seed round, led by Blockchain Capital and Breyer Capital, with participation from CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, DeFiance Capital, OKX Ventures, and HTX Ventures. On the same day, OKX Ventures and HTX Ventures announced strategic investments in it. On April 11, Binance Labs announced its investment in BounceBit.

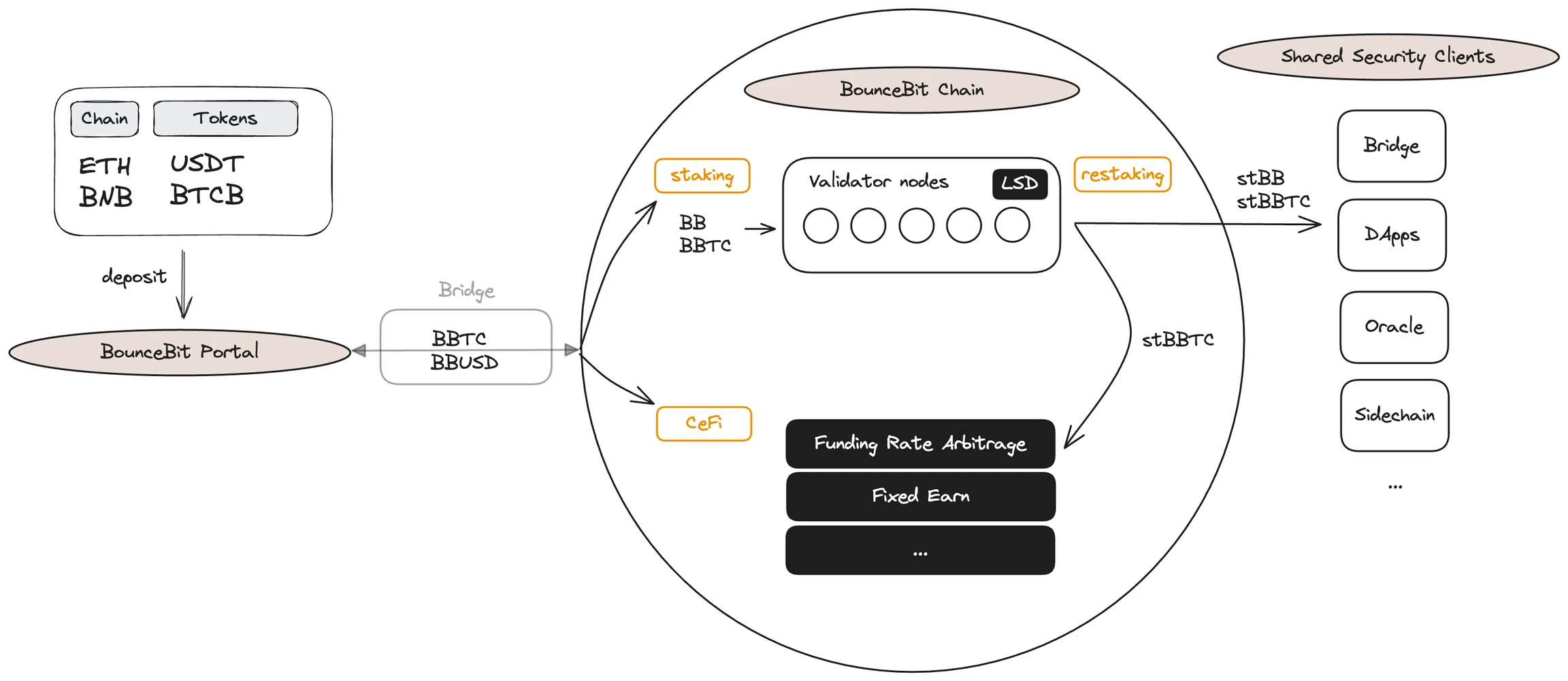

Operational Mechanism

• Bouncebit introduces Mainnet Digital and Ceffu's MirrorX technology to complete regulated custody guarantees, mapping assets to exchanges to achieve yield on BTC in MPC wallets. Meanwhile, the chain employs a BTC + BounceBit hybrid PoS mechanism for validation.

• BounceBit supports seamless conversion of pure BTC into more flexible forms, such as BTCB on the BNB chain and Wrapped Bitcoin (WBTC). Users can choose to deposit their BTC into secure custody services accessible via EVM networks, bridging these assets to the BounceBit platform. This process allows for the accumulation of on-chain yields without directly interacting with the Bitcoin main chain.

• The Bouncebit CeDeFi ecosystem offers users three types of yields: original CeFi yields (arbitrage), node operation rewards for staking BTC on the BounceBit chain, and opportunity yields from participating in on-chain applications and Bounce Launchpad (on-chain ecosystem DeFi yields).

○ User contributions to TVL are securely managed by Mainnet Digital's regulated custody services, ensuring compliance and security. These assets are then mirrored through Ceffu's MirrorX service. Users receive BBTC/BBUSD.

Image source: https://docs.bouncebit.io/cedefi/bouncebit-cefi-+-defi/infrastructure

Project Progress

• The mainnet launched in May, and as of July 16, the market cap of $BB is $201M, with an FDV of $968M and a mainnet TVL of $310M.

Project 3: Lorenzo Protocol

Project Overview

• Lorenzo is a BTC liquidity financial layer based on Babylon.

• On May 21, the Bitcoin liquidity financial layer project Lorenzo announced an ecological strategic partnership with the Bitcoin Layer 2 project Bitlayer, where Lorenzo will launch a Beta version on Bitlayer to accept BTC staking, supporting users to utilize the liquidity staking tokens stBTC generated from staking to earn additional yields on Bitlayer.

Operational Mechanism

• Lorenzo tokenizes staked Bitcoin into Liquidity Principal Tokens (LPT) and Yield Accumulation Tokens (YAT) for each staking transaction. Lorenzo also provides infrastructure for exchanging LPT and YAT and cashing out staking rewards.

• Lorenzo matches users staking BTC with Babylon and converts the BTC staked in Babylon into BTC liquidity staking tokens, releasing liquidity to the downstream DeFi ecosystem. Architecturally, Lorenzo consists of a Cosmos application chain built using Cosmos Ethermint, a relay system synchronizing BTC L1 and the Lorenzo application chain, and a system responsible for issuing and settling BTC liquidity staking tokens.

• As of July 16, 2024, the TVL is $70M.

7. DEX AMM Swap

Introduction

• DEX AMM Swap (Decentralized Exchange Automated Market Maker Swap) is a decentralized trading mechanism running on the blockchain. It utilizes algorithms and liquidity pools to automatically provide liquidity for trading pairs without a centralized order book. Users can directly swap tokens on-chain, enjoying a trading experience with low slippage and low fees. The AMM model significantly enhances the liquidity and usability of DEX, making it a crucial infrastructure in the DeFi ecosystem.

• The development of DEX in the Bitcoin ecosystem has lagged behind other smart contract-supported chains, primarily due to the original design intent and technical limitations of the Bitcoin network.

• Technically, AMM (Automated Market Maker), PSBT (Partially Signed Bitcoin Transaction), and atomic swaps collectively provide the technical foundation for DEX implementation on Bitcoin. AMM manages liquidity pools through algorithms, achieving automatic pricing and trade execution; PSBT allows for stepwise construction of complex transactions and multi-party participation, enhancing transaction flexibility and security; atomic swaps enable trustless exchanges of cross-chain assets, with the core mechanism being Hash Time-Locked Contracts (HTLC).

Project 1: Bitflow

Project Overview

• Bitflow focuses on sustainable BTC yields, utilizing PSBT, atomic swaps, AMM, and Layer-2 solutions like Stacks for trading BTC, stablecoins, and more.

• Bitflow announced the completion of a $1.3 million pre-seed round of financing on January 25, 2024, led by Portal Ventures, with participation from Bitcoin Frontier Fund, Bitcoin Startup Lab, Big Brain Holdings, Newman Capital, Genblock Capital, Tykhe Block Ventures, and others. Co-founder Dylan Floyd is the CEO, previously a software engineer at AT&T, and a graduate of Georgia Tech. Another co-founder, Diego Mey, is the CSO and founding partner of Bussola Marketing Group, having previously worked in business development at Wicked Studios.

Operational Mechanism

• Bitflow is positioned as a DEX (Decentralized Exchange) built on Stacks. According to DefiLlama data, Bitflow's current TVL is $18.27M. The project's feature is to earn native BTC yields without introducing custody risks. Users can provide liquidity in liquidity pools to earn yields, primarily including stablecoins like USDA, STX, stSTX, and BTC (supported after the Nakamoto upgrade on Stacks).

• Another goal of Bitflow is to build BTCFi. With BitFlow's StableSwap, in addition to stablecoins, xBTC and sBTC (both Wrapped BTC on Stacks) and native Bitcoin assets can easily integrate into the BitFlow ecosystem. sBTC is a 1:1 peg to Bitcoin on Stacks, operating under a fully decentralized framework supervised by an open member signer community. xBTC is a wrapped version of Bitcoin issued on Stacks, supported 1:1 by Bitcoin held in reserve, similar to Wrapped Bitcoin on the Ethereum network.

Project Progress & Participation Opportunities

• Bitflow has launched the AMM DEX mainnet, currently supporting multi-hop trading. Meanwhile, Bitflow's RUNES AMM is under construction, and users can sign up for the waiting list on the official website. Regarding tokens, $BFF is about to launch, and updates can be followed.

Project 2: Dotswap

Project Overview

• A native AMM DEX on the BTC mainnet, supporting assets including Runes, BRC20, ARC20, and the latest CAT20. The mainnet launched in September 2023 and has been updated to version V3. As of September 25, 2024, the total trading volume reached 1,770 BTC, with a current TVL close to 60 BTC.

Operational Mechanism

• Upgraded Multisignature: DotSwap's liquidity pools are supported by MMM (Multilayered Multisig Matrix), an upgraded multisignature framework that integrates the advantages of MPC and native Bitcoin multisignature.

• Non-custodial permissionless atomic swaps: Utilizing PSBT technology.

Project Progress

• In Q3 2024, DotSwap launched new tools: Rune Minting Machine and Multi-functional BTC Trading Accelerator. The accelerator (DotSwap Accelerator), originally named BTC-Speed, optimizes BTC transaction times using Child Pays for Parent (CPFP) methods. The Rune minting/etching feature emphasizes zero fees and offers three different minting modes.

Project 3: Unisat AMM Swap

Project Overview

• Unisat is a wallet application focused on Ordinals and brc-20, implementing a trading market for inscriptions (including Ordinals, brc-20, and Runes) based on an order book, which differs from typical AMM-based DEXs.

• Unisat completed a strategic financing round in February 2024 and followed up with a Pre-A round led by Binance in May.

• At the end of May, Unisat began airdropping pizza inscriptions. On September 9, the Fractal mainnet developed by the Unisat team officially launched, solidifying its position as a giant in the inscription field.

Part Three: Comparison of Different Asset Classes

Security Comparison

• The BTC ecosystem places a much higher emphasis on "security" compared to other ecosystems, which is determined by the characteristics of BTC ecosystem participants. From the storage of funds in wallets to the specific steps involved in participating in FI schemes, security guarantees are essential, with effective control over "asset ownership" being a key focus.

• Ethereum is the largest proof-of-stake (PoS) blockchain by total staked value. As of August 2024, ETH holders have staked over $111 billion worth of ETH, accounting for 28% of the total ETH supply. The amount of staked ETH is also referred to as Ethereum's security budget, as stakers face penalties from the network for violating protocol rules. While ETHFi has spawned a massive ETH ecosystem, it has also introduced systemic risks to Ethereum itself (including risks of over-centralization, liquidity crises, etc.). Since the security of PoS is determined by the value of staked coins, any liquidity crisis or validator exit could lead to a death spiral, reducing PoS security. Additionally, in a bear market, falling coin prices may decrease gas fees, leading to ETH inflation and further price declines. Lastly, "51% attacks" are also a security concern for ETH, as validators controlling over 50% of governance can easily manipulate and attack the network.

• The total TVL of the Solana ecosystem reached $4.86B on July 17, 2024. Although this is still less than Ethereum's $59B, it has slightly surpassed BSC, ranking third after Tron. Solana is also a PoS blockchain, with security logic similar to that of Ethereum. Notably, Solana is more susceptible to external factors, making its coin price more volatile compared to Ethereum. For example, in April of this year, Solana experienced network congestion due to memecoin and Ore mining.

• Given that BTC operates on a PoW system, it theoretically does not face such issues. However, if excessive risks from FI protocols accumulate and create systemic risks, it could lead to a significant drop in BTC prices, adversely affecting the overall market trend, which is particularly detrimental for BTCFi, especially in its early development stage, making it vulnerable to "failure" and requiring more time for recognition.

Yield Comparison

• There are many sources of yield, adapting to different product application scenarios. Generally, these include staking yields, DeFi product yields, and yields from the protocol itself.

○ Staking yields, such as those proposed by Babylon, which uses BTC as a guarantee for the security of the PoS chain, generating staking yields.

○ DeFi product yields, such as arbitrage yields involved in Solv products or yields generated from lending protocols.

○ Protocol yields refer to the yields brought by the protocol's coin price or expectations during the token issuance period.

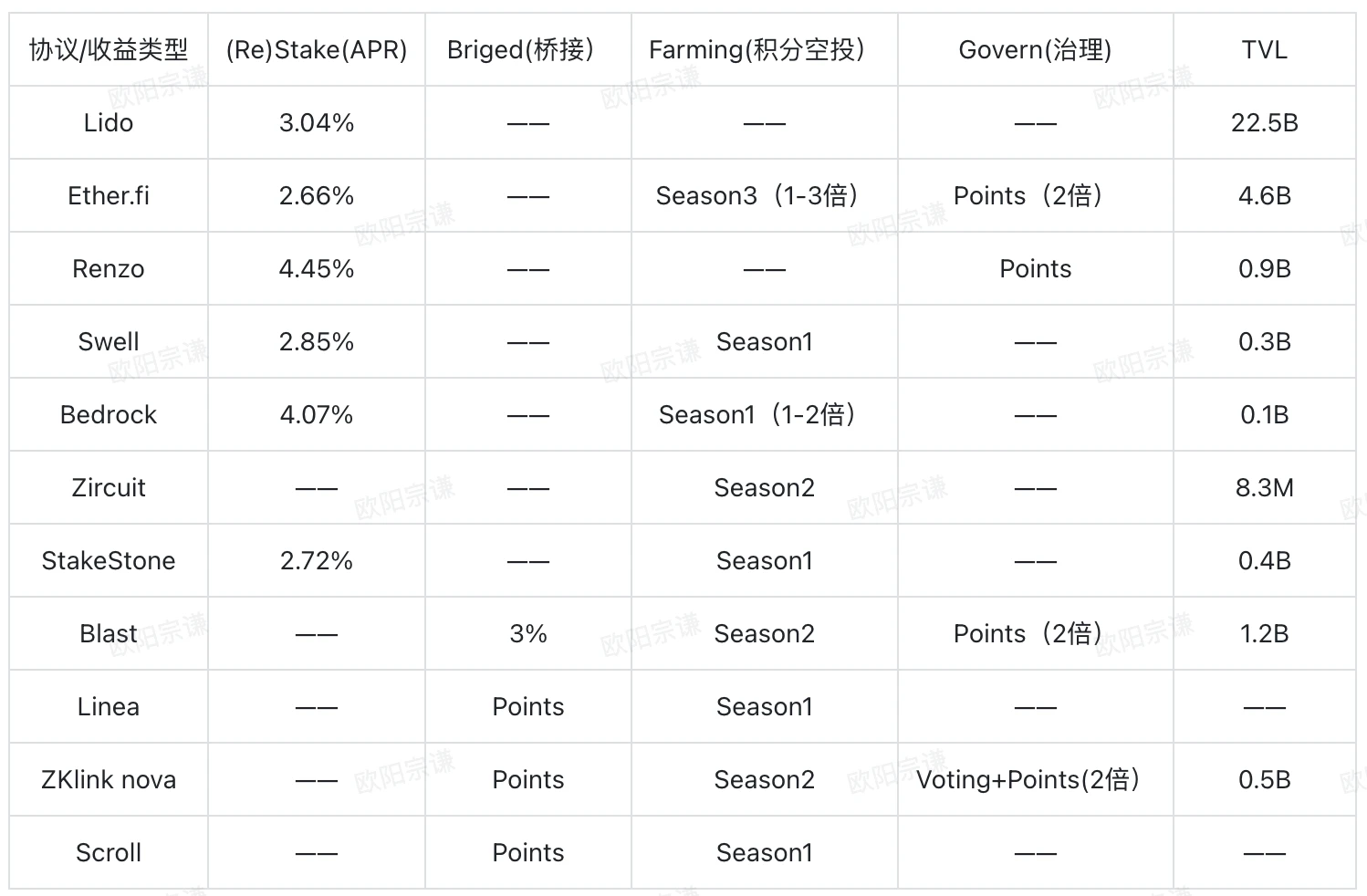

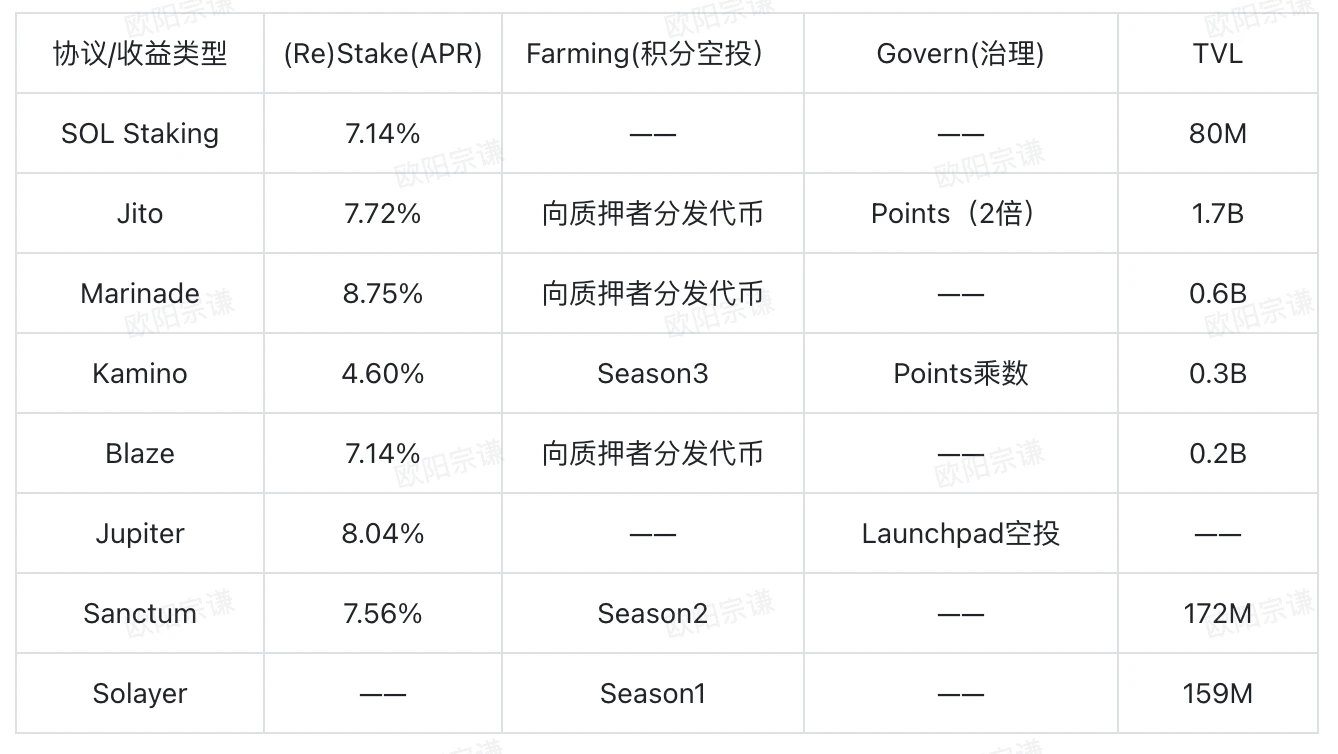

• Below is a comparison of the yields and sources of yields for major projects/protocols in ETHfi, SOLfi, and BTCfi.

○ Current yields and sources of yields for popular protocols in ETHfi:

○ Current yields and sources of yields for popular protocols in SOLfi:

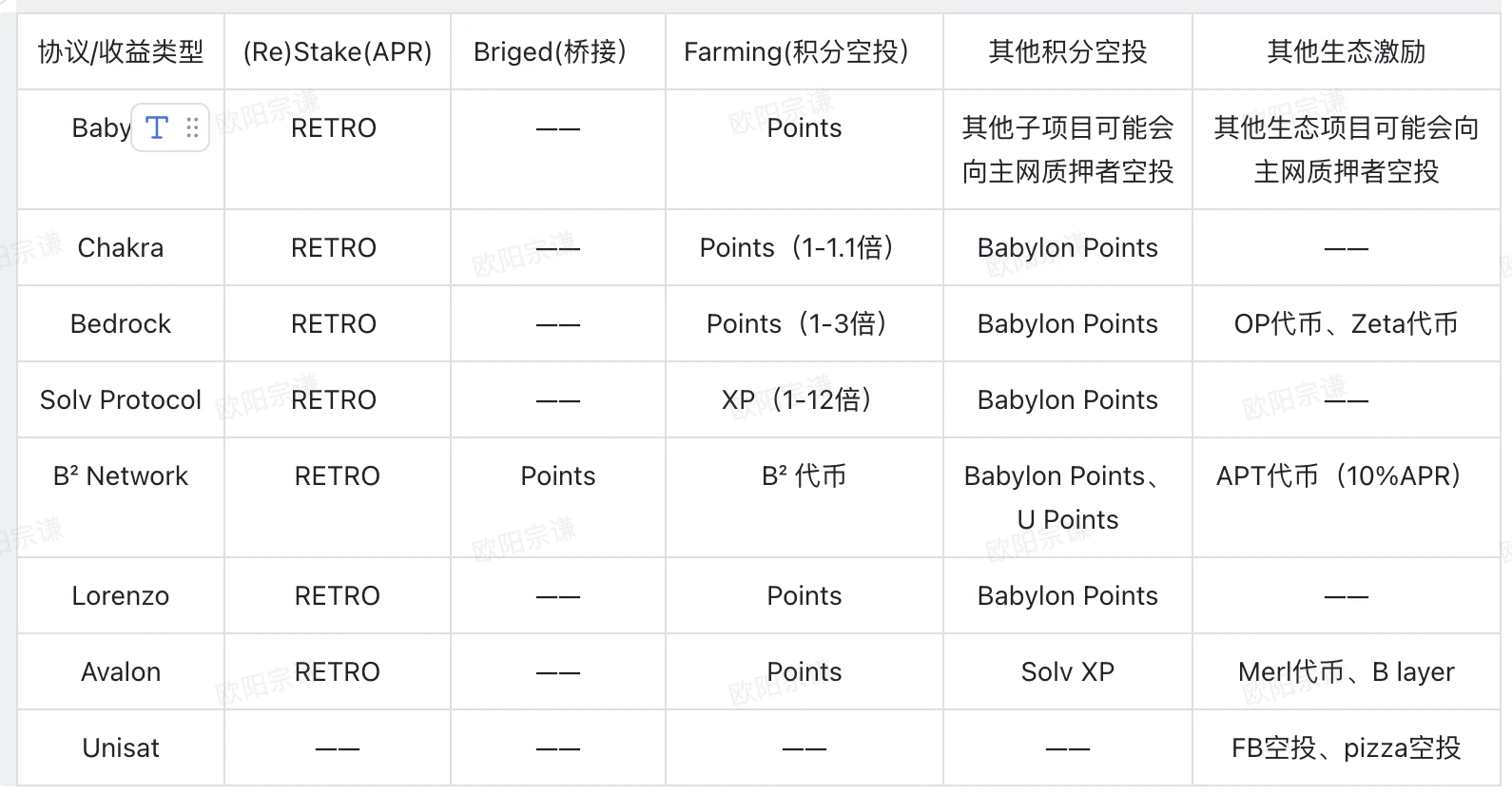

○ Current yields and sources of yields for popular protocols in BTCfi:

Note: The RETRO in the table indicates that the APR for Babylon has not yet been calculated, while the APR for other projects depends on Babylon, so no estimates are made here. Additionally, Binance, OKX, HTX, and others have collaborated with Babylon, Chakra, Bedrock, B², Solv Protocol, and others to conduct a series of pre-staking, farming, and other activities, resulting in high yields for users, especially from a series of staking activities in the Binance web3 wallet.

• Macroscopically, BTCFi has greater potential compared to ETHFi and SolFi, as the latter two have already passed the explosive growth phase of TVL, while BTCFi remains a blue ocean. From this perspective, BTCFi products have higher yield expectations.

Ecosystem Richness

• The Ethereum ecosystem includes DeFi, NFTs, RWAs, and Restake, among others. Traditional top projects like Uniswap, AAVE, Link, ENS, etc., have seen further growth in real user adoption and effective usage frequency. Since 2023, many Ethereum liquidity staking/restaking protocols like Lido and EigenLayer have attracted significant capital.

• On Solana, the total TVL of DEX Raydium and liquidity solution Kamino Finance is close to $1B, making them two leading projects in the Solana DeFi ecosystem. In terms of TVL, Jupiter, Drift, Marginfi, and Solend follow closely behind. Solana is also a PoS blockchain, with most funds concentrated in Liquid Staking, with Jito being the leading project.

• For BTCFi, the first consideration is the asset categories and TVL within the FI. According to data from CryptoCompare and CoinGecko, the market size of BTCFi reached approximately $10 billion in 2023. This figure includes the total locked value (TVL) of Bitcoin in the decentralized finance (DeFi) ecosystem, as well as the market size of Bitcoin-related financial products and services. The number of Bitcoin holders is also continuously increasing, indicating an influx of new user groups and new capital. The approval of ETFs has also propelled BTC into a super bull market driven by a price surge, with new wallets holding BTC on-chain gradually increasing.

• In addition to BTC itself, there are already a rich variety of asset types participating in BTCFi. For example, inscriptions and runes are layer-one assets based on the BTC network; RGB++, Taproot assets are layer-two assets based on the BTC network; WBTC on the ETH chain, various wrapped/staked assets representing staked BTC, such as LST or LRT certificates; these assets expand the liquidity of FI, making future FI scenarios more diverse.

• In terms of protocols and ecosystem projects, the Bitcoin ecosystem is in an explosive phase, with a large number of projects emerging, including Layer 2, and increasing VC funding, attracting market attention. For example, Merlin and Bouncebit focus on the BTC layer-two network; lending protocols like BlockFi and Celsius Network; stablecoin protocols like Satoshi Protocol and BitSmiley; staking protocols like Babylon and Pstake, as well as restaking protocols like Chakra and Bedrock.

Conclusion

In this rapidly evolving digital age, as global institutions and tech giants enter the space, the number and complexity of public chains continue to increase. However, Bitcoin (BTC) maintains its unique position; 1 BTC will always equal 1 BTC. Its value has stood the test of time and has proven its potential as a long-term appreciating asset. BTC is not just a string of numbers or code; it is a highly liquid and practical asset, demonstrating its unique value in simplifying cross-border transactions, supporting electronic payments, and its wide application in the financial sector.

Investor demand for BTC liquidity is growing, and developers are actively exploring Bitcoin's programmability to unlock its full potential. BTCFi has emerged in this context, not only satisfying the market's thirst for BTC liquidity but also further promoting the activity of the BTC network by increasing the use cases for Bitcoin. As the BTCFi ecosystem continues to develop, we witness healthy competition among protocols, which not only reduces the risks of centralization but also fosters the maturity and diversification of the entire BTC ecosystem.

Looking ahead, BTCFi will continue to serve as an innovation engine in the crypto finance sector, driving the Bitcoin network towards higher levels of financial applications and global participation. With ongoing technological advancements and a continuously expanding market, BTCFi is expected to become a bridge connecting traditional finance and the cryptocurrency world, providing global users with richer, safer, and more efficient financial services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。