Crypto Circle News

October 5 Hot Topics:

1. A whale transferred 1 million EIGEN from Binance for staking, totaling 3.01 million EIGEN staked.

2. Nick Timiraos (Fed spokesperson): The September employment report may close the door for the Fed to cut interest rates by 50 basis points next month.

3. IcomTech founder David Carmona sentenced to nearly 10 years in prison for involvement in a "cryptocurrency Ponzi scheme."

4. CryptoQuant: 1. With the decline in U.S. Treasury yields and the rise in gold, Bitcoin has potential upside.

5. Ubisoft will launch NFTs on Arbitrum through Magic Eden.

Trading Insights

Current state of the crypto market: 1. Funds are not flowing into the crypto market: Despite China's monetary easing and the U.S. dollar interest rate cuts, more funds should theoretically flow into the market. However, the reality is that this liquidity has not significantly entered the crypto space. Investors prefer traditional assets like stocks and real estate over higher-risk crypto assets. 2. Increased unlocking and cashing pressure from project parties and institutions: In previous cycles, ordinary investors had more opportunities to participate early in quality projects, such as through ICOs or launchpads. However, now many new projects are funded through private placements, leaving ordinary investors unable to participate. When these projects enter the public market, early venture capitalists have already reaped multiple returns. When their tokens unlock, they often choose to sell for cash, creating continuous selling pressure in the market and driving down prices. 3. The altcoin market is too fragmented: Many new tokens have a high fully diluted valuation (FDV), but the actual circulation is very low. This means that the number of tokens circulating in the market is very small relative to the total supply. At the same time, the number of new tokens with high FDV is excessive, further dispersing liquidity in the altcoin market. As locked tokens gradually unlock and enter the market, there will be continuous downward pressure on prices. 4. Lack of confidence from external investors: Significant market volatility and previous negative events, such as the collapse of the FTX exchange and the Luna project, have led many external investors to adopt a wait-and-see attitude towards the crypto market. 5. Lack of new market hotspots: In this cycle, we have not seen innovations that can attract public attention to drive market sentiment, as ICOs, DeFi, and NFTs did in the past.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White community this week. Congratulations to the friends who followed along; if your trades are not going well, you can come and test the waters.

The data is real, and each trade has a screenshot from the time it was sent.

Search for the public account: Big White Talks Coins

BTC

Analysis

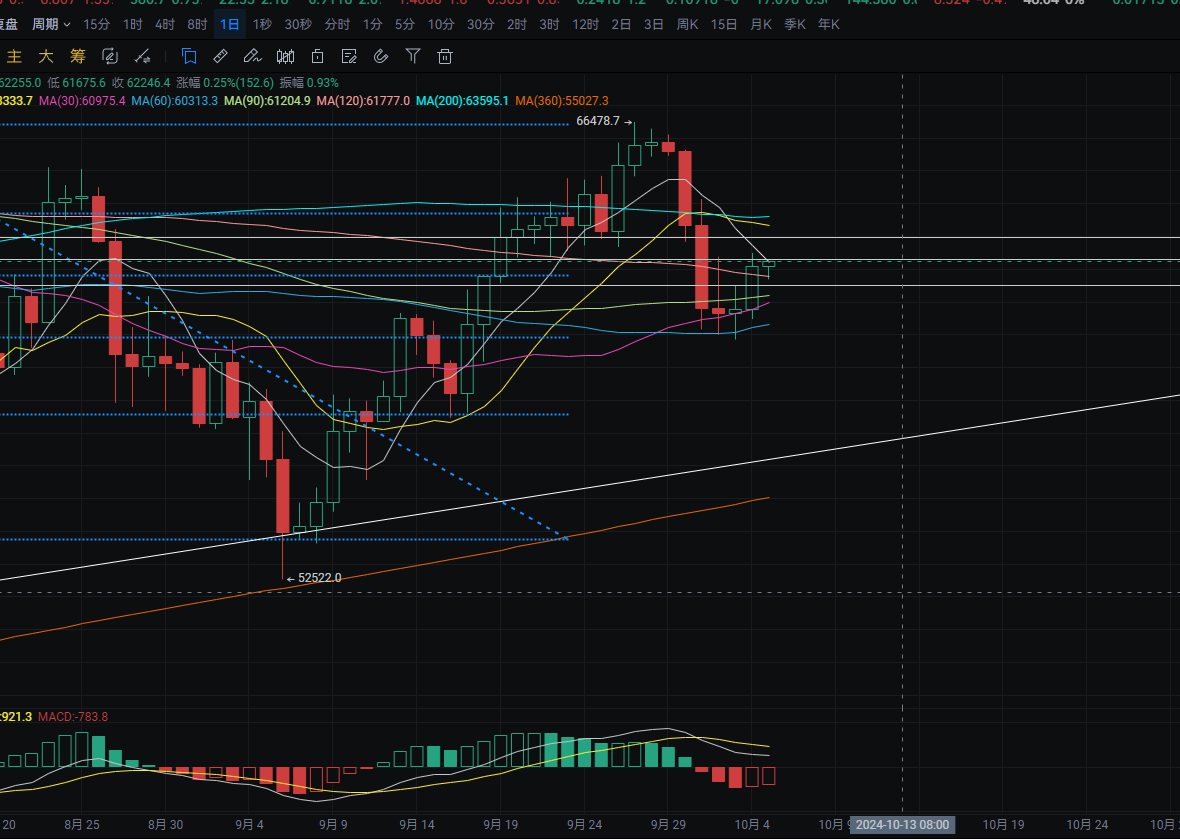

Bitcoin's daily chart showed a rebound yesterday, bouncing from a low of 60,500 to a high of around 62,500, closing near 62,100. The support level is around MA120; if it breaks, it could drop to around MA90. A pullback can be used to buy near this level. The resistance level is near the MA7 moving average; if it breaks, it could reach the upper MA14. The MACD shows a decrease in bearish momentum. The four-hour chart shows support near MA14; a pullback can be used to buy near this level. The resistance level is near MA120, with the MACD showing an increase in bullish momentum. A short-term buy can be considered near 61,500, with a rebound target of around 62,300-63,000.

ETH

Analysis

Ethereum's daily chart showed a rebound yesterday, bouncing from a low of around 2,340 to a high of around 2,440, closing near 2,415. The resistance level is near MA30, while support has formed near 2,320 after multiple tests. A pullback can be used to buy near this level. The MACD shows a decrease in bearish momentum. The four-hour chart shows resistance near MA200 and support near MA14; a pullback can be used to buy near this level. The MACD shows an increase in bullish momentum, forming a golden cross. A short-term buy can be considered near 2,358-2,320, with a rebound target of around 2,420-2,450. A mid-term buy can be considered near 2,265, with a rebound target of around 2,430-2,490.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific trading advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。