Original Author: insights4.vc

Original Translation: Deep Tide TechFlow

The cryptocurrency asset market has experienced exponential growth over the past decade, leading to increased participation from both retail and institutional investors. However, this growth has also highlighted significant regulatory challenges, particularly in the European Union, where a fragmented regulatory approach has resulted in legal uncertainty and inconsistency among member states. The lack of a unified framework hinders market development, creates barriers to market entry, and raises concerns about consumer protection and market integrity.

Regulatory Objectives

MiCA aims to address these challenges by:

Establishing a single regulatory framework: Creating a comprehensive set of rules applicable to all EU member states and the European Economic Area (EEA).

Strengthening consumer and investor protection: Implementing measures to protect investors and reduce risks associated with cryptocurrency assets.

Ensuring market integrity and financial stability: Introducing oversight mechanisms to prevent market abuse and systemic risks.

Promoting innovation and competitiveness: Encouraging the development of cryptocurrency assets and blockchain technology in a regulatory environment that fosters trust and transparency.

Overview of MiCA

Scope and Applicability

MiCA applies to:

Cryptocurrency asset issuers: Entities that offer cryptocurrency assets to the public or wish to trade on EU trading platforms.

Cryptocurrency asset service providers (CASPs): Companies that provide services related to cryptocurrency assets, such as custody, trading, and operation of trading platforms.

Stablecoin issuers: Entities that issue asset-referenced tokens (ARTs) and electronic money tokens (EMTs).

MiCA does not apply to:

Regulated cryptocurrency assets: Financial instruments covered by existing EU financial services legislation (such as MiFID II, EMD, and PSD2).

Central Bank Digital Currencies (CBDCs): Digital currencies issued by central banks (CBDC).

Key Definitions and Classifications

Cryptocurrency Assets

Cryptocurrency assets are defined as a digital representation of value or rights that can be electronically transferred and stored using distributed ledger technology (DLT) or similar technology.

Classification of Cryptocurrency Assets

Asset-Referenced Tokens (ARTs):

Tokens designed to maintain stable value by referencing multiple fiat currencies, commodities, or cryptocurrency assets.

Example: Tokens pegged to a basket of currencies or commodities.

Definition of Electronic Money Tokens (EMTs):

Tokens referencing a single fiat currency.

Function similarly to electronic money and are regulated under the Electronic Money Directive.

Example: Stablecoins pegged to the euro at a 1:1 ratio.

Other Cryptocurrency Assets:

Includes all other cryptocurrency assets not classified as ARTs or EMTs.

Includes utility tokens and certain payment tokens.

Example: Tokens used to access services or products.

Overview of the Regulatory Framework

Requirements for Cryptocurrency Asset Issuers

Utility Tokens

Definition: Tokens intended to provide digital access to a good or service, based on distributed ledger technology (DLT), and accepted only by the issuer.

Regulatory Requirements:

White Paper: Issuers must draft and publish a white paper containing detailed information about the project, rights and obligations, risks, and technology.

Notification: The white paper must be submitted to the competent national authority before publication.

Exemption Clauses:

If the tokens are provided for free.

If the issuance is limited to fewer than 150 persons in each member state.

Total consideration does not exceed €1 million within 12 months.

Definition and Regulatory Requirements for Asset-Referenced Tokens (ARTs)

Definition: Tokens that maintain stable value by referencing multiple assets.

Regulatory Requirements:

Authorization: Issuers must obtain authorization from the competent authority.

White Paper: Stricter white paper requirements apply, and approval from the competent authority is required.

Governance and Compliance: Obligations to enhance governance, conflict of interest policies, and complaint handling.

Reserve Assets: Requirement to hold reserve assets to support the issuance of tokens, including relevant rules for custody and investment.

Definition and Regulatory Requirements for Electronic Money Tokens (EMTs)

Definition: Tokens referencing a single fiat currency.

Regulatory Requirements:

Authorization: Issuers must obtain authorization from a credit institution or electronic money institution.

Redemption Rights: Obligated to provide redemption at face value at any time.

Robustness Requirements: Capital requirements and standards for fund protection should be comparable to those under the Electronic Money Directive.

Cryptocurrency Asset Service Providers (CASPs)

Obligations and Licensing

Scope of Services:

Custody and asset management of cryptocurrency assets.

Operation of trading platforms.

Exchange services between cryptocurrency assets and fiat currencies.

Exchange services between cryptocurrency assets.

Executing orders on behalf of clients.

Issuance of cryptocurrency assets.

Receiving and transmitting orders.

Providing advice on cryptocurrency assets.

Portfolio management of cryptocurrency assets.

Licensing Process for Cryptocurrency Asset Service Providers (CASPs)

Licensing Process:

Application: Submit detailed information, including business plans, governance arrangements, and internal controls.

Capital Requirements: Minimum capital requirements range from €50,000 to €150,000, depending on the services provided.

Suitability and Integrity: Assessment of the suitability of management and significant shareholders.

Passporting Rights: Once authorized, CASPs can utilize passporting rights to provide services across the EU.

Operational Requirements for Cryptocurrency Asset Service Providers (CASPs)

Operational Requirements:

Organizational Structure: A sound governance framework, including a clear organizational structure and effective operational procedures.

Protection of Client Assets: Measures to protect client cryptocurrency assets, including asset segregation and security protocols.

Complaint Handling: Establish procedures for timely and fair handling of client complaints.

Conflict of Interest Policies: Identify and manage potential conflicts of interest.

Outsourcing: Ensure that outsourcing arrangements do not affect the quality of internal controls and the ability of regulators to monitor compliance.

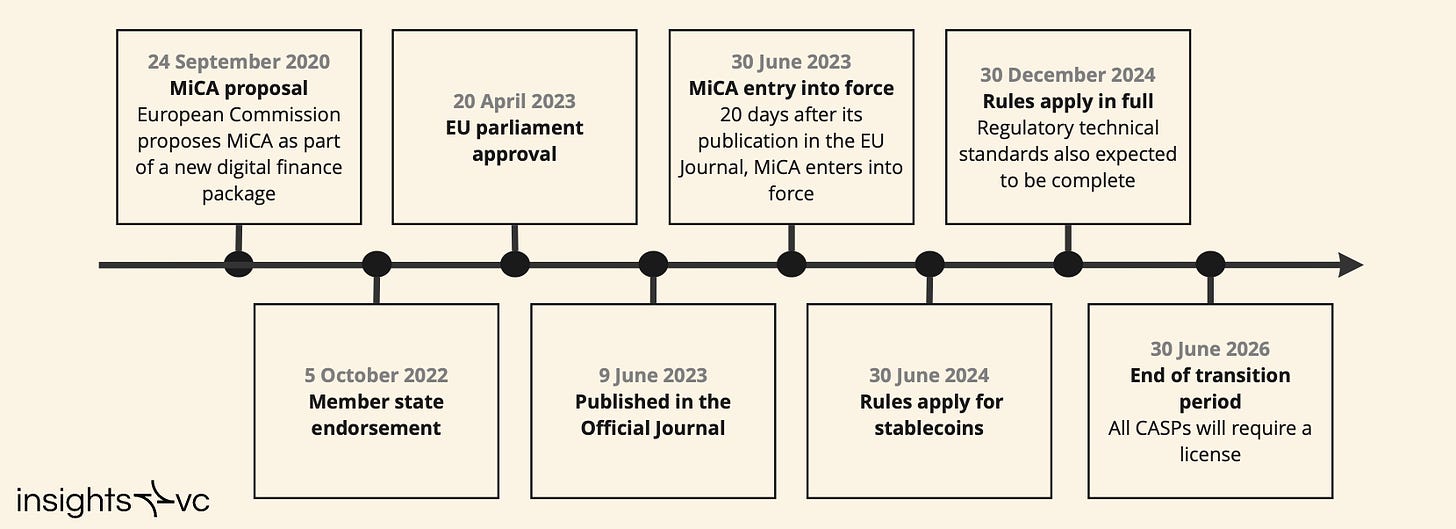

June 9, 2023: MiCA comes into effect.

June 30, 2024: Rules related to stablecoins (ARTs and EMTs) begin to apply.

December 30, 2024: Full applicability of MiCA to other cryptocurrency assets and CASPs.

Transitional Provisions:

Grandfathering Clause: CASPs that have provided services under existing national laws can continue to operate until December 31, 2025, or until they obtain MiCA authorization, whichever comes first.

National Opt-Out: Member states may opt out of the grandfathering clause, requiring earlier compliance with relevant regulations.

Impact on Swiss Web3 Companies

Although Swiss companies are not located within the EU, they often interact with the European market. Understanding the impact of MiCA is crucial for Swiss Web3 companies to ensure their continued market access and compliance.

Use Case 1: Issuing Utility Tokens

Scenario: A Swiss company establishes a foundation and issues utility tokens intended for use within its ecosystem, aiming to classify them as utility tokens under Swiss law.

Impact of MiCA:

- Token Classification: Under MiCA, these tokens may be classified as cryptocurrency assets that require a white paper unless applicable exemptions exist.

White Paper Requirements

Content: Must include comprehensive information about the issuer, project, rights attached to the tokens, risks, and underlying technology.

Notification: If the issuance is directed at EU residents, the white paper must be notified to the EU competent authority.

Reverse Solicitation Limitations

- MiCA restricts reliance on reverse solicitation. Actively marketing to EU residents will trigger compliance obligations.

Strategic Considerations

Avoid Active Marketing: Limit marketing activities within the EU to avoid triggering MiCA requirements.

Establish EU Presence: Consider setting up a subsidiary within the EU to facilitate compliance.

Legal Advice: Hire EU legal counsel to assist in navigating regulatory obligations.

Use Case 2: Providing Custody and Trading Services

Scenario: A Swiss company provides custody and trading services for digital assets, targeting EU clients.

Impact of MiCA:

As a CASP, Authorization:

The company must obtain authorization from the competent authority of an EU member state to provide services within the EU.

Establishing EU Presence:

- Requires setting up a legal entity within the EU and following MiCA's authorization process.

Operational Requirements:

- Implement a robust governance, risk management, and compliance framework in accordance with MiCA.

Tax Considerations:

Substance Requirements: Ensure the EU entity has sufficient substance to meet regulatory and tax obligations.

Cross-Border Taxation: Address potential tax liabilities arising from cross-border operations.

Strategic Considerations

Jurisdiction Selection: Choose an EU member state with a regulatory-friendly environment (e.g., Liechtenstein, France, Germany).

Leverage Existing Framework: Utilize existing compliance frameworks to streamline the authorization process.

Engage with Regulators: Early communication with regulators in the chosen member state can facilitate smoother authorization.

Compliance Strategic Considerations

Addressing Reverse Solicitation Limitations

Definition: Reverse solicitation refers to providing services at the independent initiative of the client, without any solicitation or advertising by the service provider.

MiCA Restrictions:

Limits reliance on reverse solicitation to evade regulatory requirements.

Actively marketing or targeting EU clients will trigger MiCA compliance obligations.

Recommendations:

Marketing Practices: Review and adjust marketing strategies to ensure compliance.

Documentation: Maintain clear records to demonstrate that any services provided under reverse solicitation were initiated by the client.

Establishing Presence in the EU

Benefits:

Helps comply with MiCA regulations.

Access to the EU single market through passporting rights.

Considerations:

Jurisdiction Selection: Assess the regulatory environment, costs, and readiness of regulatory authorities.

Substance Requirements: Ensure the EU entity has actual operations, management, and control capabilities in that jurisdiction.

Tax Implications: Address potential tax residency and cross-border taxation issues.

Leveraging Regulatory Advantages in Specific EU Member States

Favorable Jurisdictions:

France: Early implementation of crypto regulations, integrated into financial regulatory authorities.

Liechtenstein: Comprehensive legislation aligned with MiCA, including provisions for staking and NFTs.

Germany: Established a framework for cryptocurrency assets and plans to align with MiCA.

Advantages:

Regulatory Clarity: Clear guidelines and supportive regulatory authorities.

Fast Authorization: Potentially accelerates the authorization process.

Recommendations:

Regulatory Interaction: Engage in dialogue with regulatory authorities to understand their expectations.

Local Partnerships: Consider collaborating with local companies that have extensive experience in the regulatory environment.

Tax Implications Analysis

Cross-Border Tax Considerations

Tax Residency: Determine tax residency based on the management and control of the EU entity.

Permanent Establishment: Risks of creating a permanent establishment in the EU will lead to profit taxation.

Transfer Pricing: Comply with transfer pricing regulations for transactions between Swiss companies and EU entities. Substance and connection requirements.

Economic Substance: Demonstrate genuine economic activity in the jurisdiction to meet tax authority requirements.

Function and Risk Allocation: Clearly delineate functions, assets, and risks between entities.

Documentation: Maintain robust documentation to support tax positions and meet compliance obligations.

Policy and Regulatory Dynamics

Enforcement Environment in EU Member States

Variability in Enforcement:

Some regulatory authorities may adopt stricter enforcement measures (e.g., BaFin in Germany).

Other regulatory authorities may be underprepared, leading to inconsistent enforcement.

Industry Response:

Companies may face uncertainty regarding regulatory expectations.

Importance of monitoring regulatory dynamics and making necessary adjustments.

Relationship with Existing Regulations (e.g., MiFID II)

MiCA and MiFID II:

MiCA covers cryptocurrency assets not classified as financial instruments under MiFID II.

Reclassification: Adjust national laws to avoid overlap and ensure clarity.

Regulatory Scope:

Assess whether activities fall under MiCA, MiFID II, or other regulations.

Recommendations:

Conduct a comprehensive legal analysis to determine applicable regulations.

Stay updated on amendments to national laws aligning with MiCA.

International Coordination and Comparative Studies

Global Regulatory Environment:

UK: Developing its own regulatory framework with a detailed approach.

USA: A fragmented regulatory environment with ongoing policy debates.

Asia-Pacific: Leading in centralized intermediary regulation, but varying approaches to decentralized regulation.

Impact on Swiss Companies:

Cross-Border Compliance: Need to navigate multiple regulatory systems in international operations.

Regulatory Arbitrage Risks: Attention to differing standards and enforcement practices.

Recommendations:

Engage in policy discussions and industry groups to influence and stay informed about global dynamics.

Consider aligning internal policies with international best practices.

Cryptocurrency Regulations Outside the EU

United States

The regulatory environment for cryptocurrency in the United States is complex and evolving, with frequent enforcement actions and ongoing legal debates.

In 2022, the U.S. introduced a new framework allowing regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to oversee the crypto industry. The SEC has been particularly active, filing lawsuits against major firms like Ripple, Coinbase, and Binance for alleged violations of securities laws. In 2023, a district court ruled that Ripple's sale of XRP to institutions constituted a securities offering, but sales on exchanges did not. Additionally, in November 2023, a court overturned the SEC's rejection of Grayscale's Bitcoin ETF, leading to the approval of Bitcoin and Ethereum spot ETFs in early 2024. Despite these developments, SEC Chairman Gary Gensler emphasized that ETF approvals should not be seen as a broader adaptation for other crypto securities. Thus, the regulatory environment in the U.S. remains uncertain and challenging, requiring companies to navigate federal and state laws with the help of legal counsel and establish robust compliance procedures.

China's Cryptocurrency Regulation

China has taken a strict stance on cryptocurrency, banning all related activities.

The People's Bank of China (PBOC) has prohibited crypto enterprises, declaring them illegal public financing. Bitcoin mining was banned in 2021, and all cryptocurrency trading was also declared illegal that year. Companies must exit the Chinese market and relocate to more favorable jurisdictions, as any contact with China poses significant legal risks.

Cryptocurrency Regulation in Hong Kong

Hong Kong is gradually becoming a key player in the cryptocurrency space, with a regulatory framework aimed at encouraging innovation while protecting investors. The Securities and Futures Commission (SFC) is responsible for licensing and compliance oversight of virtual asset service providers, including centralized and decentralized exchanges. In 2023, Hong Kong launched a new licensing regime for crypto exchanges, implementing strict anti-money laundering (AML) and know-your-customer (KYC) requirements to ensure market transparency and security. The city has also accepted security token offerings (STOs) and listed crypto-related products such as Bitcoin and Ethereum ETFs. Additionally, Hong Kong is exploring stablecoins and a potential digital Hong Kong dollar (e-HKD), positioning itself as a growing hub for digital assets in Asia.

Cryptocurrency Regulation in Canada

Canada offers a positive regulatory environment with clear guidelines. Cryptocurrencies are considered commodities, and Canada was the first country to approve a Bitcoin ETF. All crypto companies are classified as money services businesses (MSBs) and must register with provincial regulators, subject to oversight by the Financial Transactions and Reports Analysis Centre (FINTRAC). Profits from cryptocurrencies are subject to capital gains tax. While Canada provides market opportunities for compliant businesses, companies must adhere to strict registration and reporting obligations.

Cryptocurrency Regulation in the United Kingdom

The UK has established a comprehensive regulatory framework that incorporates cryptocurrencies into existing financial regulations. In 2022, the House of Commons recognized cryptocurrencies as regulated financial instruments. The Financial Services and Markets Act 2023 further expanded financial regulation to cover all cryptocurrencies. Trading in crypto derivatives is prohibited, and investors must pay capital gains tax on crypto profits. Companies must comply with extensive regulatory requirements, including KYC and AML standards, aimed at enhancing market stability and investor confidence.

Cryptocurrency Regulation in Japan

Japan is known for its progressive stance, integrating cryptocurrencies into its financial system. Cryptocurrencies are considered legal property, and all crypto exchanges must register with the Financial Services Agency (FSA). The Japan Virtual Currency Exchange Association (JVCEA) acts as a self-regulatory organization. Trading profits are classified as miscellaneous income, which has significant tax implications for investors. Japan provides a transparent and business-friendly regulatory environment, although companies must invest in compliance infrastructure to meet stringent regulatory requirements.

Cryptocurrency Regulation in Australia

Australia offers a clear regulatory framework that balances innovation with consumer protection. Cryptocurrencies are classified as legal property and are subject to capital gains tax. Crypto exchanges must register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and comply with AML and counter-terrorism financing (CTF) obligations. In 2023, Australia announced plans to establish a new regulatory framework, expected to be finalized in 2024. Australia is open to innovation and has potential plans to launch a central bank digital currency (CBDC), but companies must prepare for upcoming regulatory changes to ensure compliance and maintain market competitiveness.

Cryptocurrency Regulation in Singapore

Singapore is a crypto-friendly jurisdiction with a robust regulatory framework.

The Monetary Authority of Singapore (MAS) regulates exchanges under the Payment Services Act (PSA) and launched a framework for stablecoin issuers in 2023. Singapore does not impose capital gains tax, which is attractive for long-term investors. The clear regulations and favorable tax policies make Singapore an ideal market, although businesses must navigate advertising restrictions and obtain necessary approvals for stablecoins.

Cryptocurrency Regulation in South Korea

South Korea has strict regulations to protect users and ensure financial integrity. Crypto exchanges must register with the Korea Financial Intelligence Unit (KFIU), and privacy coins were banned in 2021. The Virtual Asset User Protection Act of 2023 designated the Financial Services Commission (FSC) as the primary regulatory authority. Companies face stringent regulatory requirements and must establish partnerships with local banks for real-name verification to ensure compliance and user safety.

Cryptocurrency Regulation in India

India's regulatory stance on cryptocurrencies is cautious, with ongoing debates and interim measures. Cryptocurrencies are neither fully legalized nor banned. A 30% tax is levied on crypto investments, with a 1% tax deducted at source (TDS) applicable to transactions. The 2022 Finance Bill defined virtual digital assets as property and set tax requirements for income generated from them. Regulatory uncertainty poses operational risks for companies, such as increased compliance costs, while high taxes may impact profitability, forcing them to reassess market strategies.

Cryptocurrency Regulation in Brazil

Brazil is moving towards integrating cryptocurrencies into its financial system. In 2023, Brazil enacted a law legalizing the use of cryptocurrencies as a means of payment, with the Brazilian Central Bank designated as the regulatory authority. The legalization of cryptocurrencies as a payment method opens new opportunities for companies, but they must comply with the relevant regulations set by the Brazilian Central Bank to ensure compliance and effectively leverage this emerging market.

Conclusion

Opportunities and Challenges under MiCA

MiCA presents both opportunities and challenges for Web3 companies in Switzerland and Europe:

Opportunities and Challenges:

Market Access: A unified framework facilitates access to the entire EU market, enabling businesses to operate more easily.

Investor Confidence: Enhanced regulatory oversight may increase investor trust, attracting more capital into the market.

Innovation Environment: Clear rules can encourage innovation within defined boundaries, driving industry development.

Challenges:

Compliance Burden: Meeting regulatory requirements requires significant resource investment, which may pressure small businesses.

Regulatory Uncertainty: Variability in enforcement and preparedness among member states may lead to market imbalances across countries.

Competition: Increased compliance requirements may raise entry barriers, posing greater challenges for new entrants and intensifying competition among existing players.

Prospects for the Development of European Web3 Companies

Web3 companies must adopt a strategic approach to navigate the evolving regulatory environment:

Proactive Compliance: Preparing in advance and engaging with regulatory authorities can facilitate a smooth transition.

Collaboration: Partnering with industry groups and legal experts to influence policy and share best practices can drive industry growth.

Adaptability: Staying flexible to timely adjust business models and strategies in response to regulatory changes.

This report aims to provide a comprehensive understanding of the MiCA regulations and their implications. Companies are advised to seek professional legal counsel based on their specific circumstances to ensure full compliance with all regulatory obligations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。