In yesterday's homework, it was mentioned that the negative impact of localized wars would definitely be influenced by today's non-farm payroll data. As a result, today's non-farm payroll data significantly exceeded expectations. Although there are doubts about the data from the Bureau of Labor Statistics, data is data, and the impact on user sentiment is the most direct. Therefore, the U.S. stock market has risen well, and under the influence of the U.S. stock market, #BTC and cryptocurrencies have also seen a good increase.

So, the current cryptocurrency market relies on the U.S. macroeconomy. Whether or not this is acknowledged as a reason, it is an unchangeable fact. Therefore, the shift in U.S. monetary policy applies to both the U.S. stock market and the crypto market; this is a change brought about by trends. Currently, the trend is shifting from monetary tightening to monetary easing. There may be pitfalls along the way, but the outcome will definitely lead to easing.

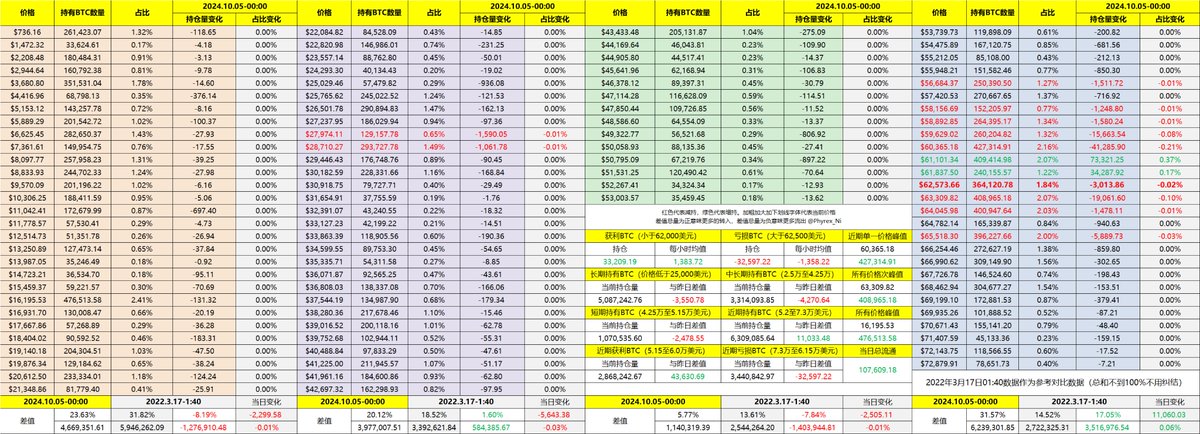

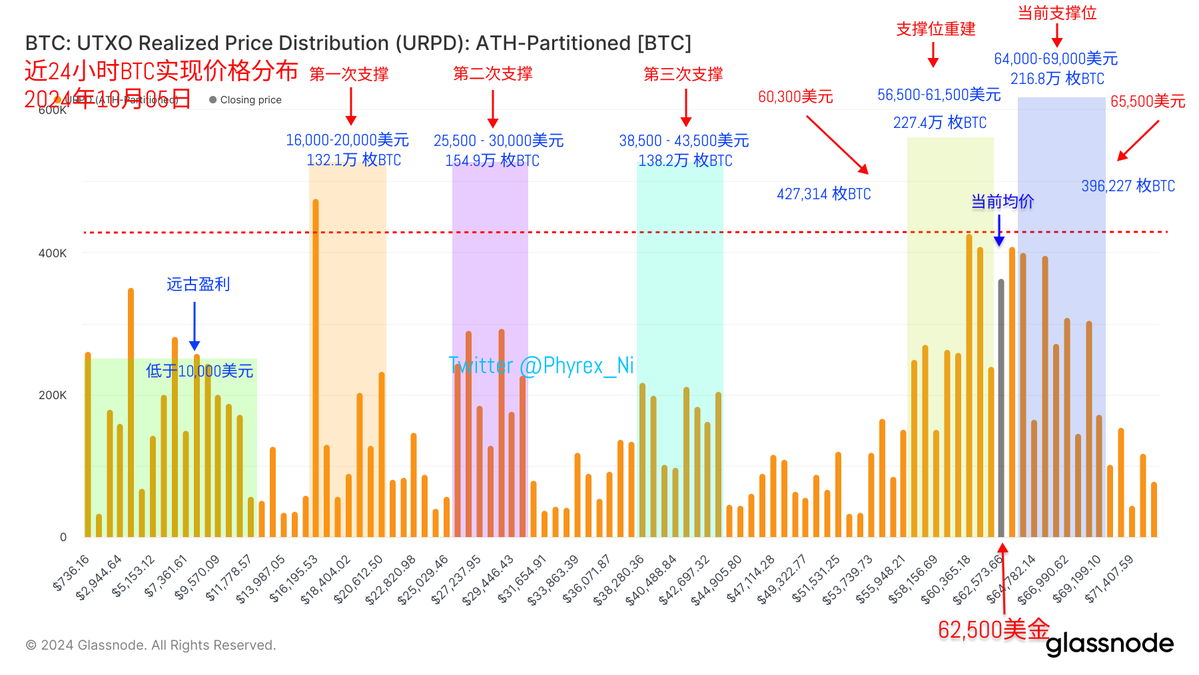

Looking back at the data, during price increases, the turnover is always relatively low, and the resulting panic is minimal. However, during price declines, it is very easy to trigger panic among short-term investors. Therefore, today's selling focus is still on short-term profit investors, meaning that the investors who bought in at the bottom yesterday are the ones exiting the market the most today. Short-term users are currently the most direct: buy at the bottom, sell when it rises, and cut losses when it falls.

Earlier investors have not shown significant changes. They should be used to this data by now. Until there is a new breakthrough above $70,000, earlier investors are unlikely to see much change. I have said this countless times and will say it again: low prices can no longer entice long-term holders to part with their tokens.

Support levels are also discussed daily. It is evident that investors in the $64,000 to $69,000 range show no signs of further exiting the market. The concentrated positions at this level remain very stable, which will have a minimal impact on prices.

The data has been updated. Address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。