Original Title: A New Framework For Identifying Moats In Crypto Markets

Original Author: Robbie Petersen, Analyst at Delphi Digital

Translation: Ismay, BlockBeats

Editor’s Note: In the current competitive crypto market, the concept of moats is no longer limited to traditional liquidity and TVL. With the rapid development of DeFi applications, relying solely on liquidity advantages is no longer sufficient to remain undefeated in the long term. This article delves into how crypto applications can establish truly defensive moats through brand differentiation, user experience, and the continuous rollout of new features. By analyzing cases like Uniswap and Hyperliquid, we reveal that continuous innovation is key to resisting competition and capturing value in this uncertain industry.

The success of any company—whether a tech giant or a century-old establishment—can be attributed to its moat. Whether it’s network effects, user switching costs, or economies of scale, moats ultimately allow companies to escape the natural laws of competition and sustainably capture value.

While defensiveness is often a factor considered by cryptocurrency investors in hindsight, I believe that in the current market context, the concept of moats is even more important. This is because there are three unique structural differences in crypto applications:

Forkability: The forkability of applications means that the barriers to entry in the crypto market are lower.

Composability: Due to the interoperability of applications and protocols, the switching costs for users are inherently lower.

Token-based user acquisition: Using token incentives as an effective user acquisition tool means that the customer acquisition cost (CAC) structure for crypto projects is inherently lower.

These unique attributes collectively accelerate the competitive dynamics of crypto applications. Once an application turns on the "charging switch," not only will countless other indistinguishable applications offer similar but cheaper user experiences, but some applications may even subsidize users through token incentives and points.

Logically deducing, in the absence of a moat, 99% of applications will inevitably fall into a "price war," thus unable to avoid the fate of commoditization.

While we have many precedents and insights into understanding moats in traditional markets, we lack a corresponding framework that can explain these structural differences. This article aims to fill that gap by exploring the fundamental elements that constitute a sustainable moat and identifying the few applications that can sustainably capture value.

A New Framework for Assessing Application Defensiveness

Warren Buffett, the "king of defensiveness," has a simple yet effective method for identifying defensible companies: he asks himself, "If I had a billion dollars and started a business to compete with this company, could I capture a significant market share?"

By adjusting this framework slightly, we can apply the same logic in the crypto market while considering the aforementioned structural differences: "If I fork this application and invest $50 million in token subsidies, could I capture and maintain market share?"

When answering this question, you are essentially simulating competitive dynamics. If the answer is "yes," then it is likely just a matter of time before an emerging fork or indistinguishable competitor erodes that application's market share. Conversely, if the answer is "no," then that application likely possesses the traits I believe are common to all defensible crypto applications.

"Non-forkable" and "Non-subsidizable" Characteristics

To better illustrate my point, take Aave as an example. If I were to fork Aave today, no one would use my forked version because it would not have enough liquidity for users to borrow from, nor would it have enough users to borrow that liquidity. Therefore, in lending markets like Aave, TVL and bilateral network effects are "non-forkable" characteristics.

However, while TVL does provide a certain level of defensiveness for lending markets, the key is whether these characteristics are also immune to subsidies. Imagine a well-funded team not only forks Aave but also designs a $50 million incentive program to acquire Aave's users. If a competitor can reach a competitive liquidity threshold, users may have little incentive to switch back to Aave, as lending markets are essentially indistinguishable.

It is important to clarify that I do not believe any team will successfully siphon off Aave in the near term; subsidizing $12 billion in TVL is no small task. However, I believe that other lending markets that have not yet reached this scale risk losing significant market share. Kamino recently provided a precedent in the Solana ecosystem.

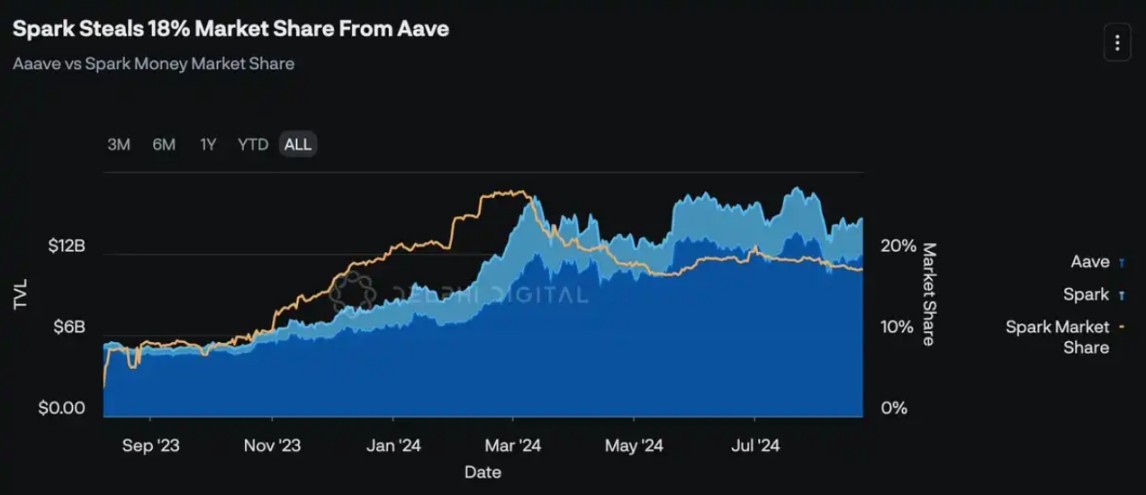

Additionally, it is worth noting that while large lending markets like Aave may be able to withstand the threat of emerging competitors, they may not be entirely defensible against horizontal integration from adjacent applications. For example, MakerDAO's lending division, Spark, has already captured over 18% of the market share from Aave since launching its Aave fork in August 2023. Given Maker's market position, they are effectively able to attract and retain users as a reasonable extension of the Maker protocol.

Therefore, in the absence of other characteristics that cannot be easily subsidized (such as collateralized debt positions (CDPs) embedded in the DeFi market structure), the structural defensiveness of lending protocols may not be as strong as one might imagine. Asking again—if I fork this application and invest $50 million in token subsidies, could I capture and maintain market share?—I believe the answer is indeed affirmative for most lending markets.

Frontends Will Capture More Value

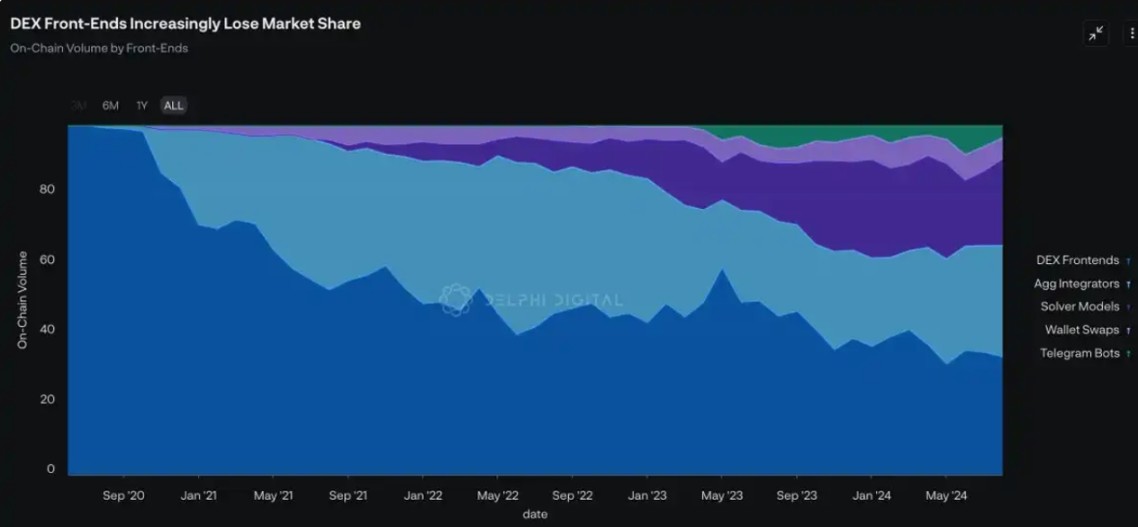

The popularity of aggregators and forked frontends complicates the defensiveness issue in the DEX market. Historically, if you asked me which model is more defensible—decentralized exchanges or aggregators—my answer would clearly be decentralized exchanges. After all, the frontend is merely a different perspective on the backend, and the switching costs between aggregators are inherently lower.

In contrast, decentralized exchanges have a liquidity layer, and the switching costs for using a forked trading platform with less liquidity are much higher, leading to more slippage and worse net execution results. Therefore, given that liquidity is non-forkable and harder to subsidize at scale, I previously believed that DEXs had stronger defensiveness.

While this view still holds in the long term, I believe the balance may be shifting towards frontends, with more and more value being captured by frontends. My reasoning can be summarized in four points:

Liquidity is More Commodity-like Than You Think

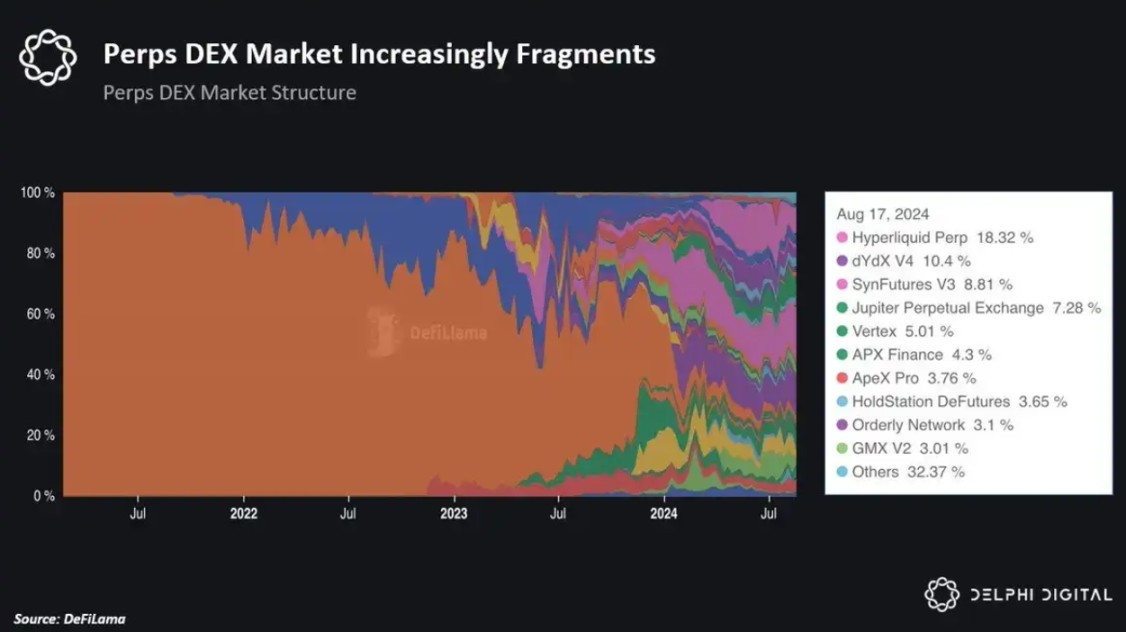

Similar to TVL, while liquidity is inherently "non-forkable," it is not immune to subsidies. There are many historical precedents in DeFi that seem to validate this logic (e.g., SushiSwap's siphoning attack). The structural instability of perpetual contract markets also reflects the fact that liquidity alone cannot serve as a sustainable moat. Countless emerging perpetual contract DEXs have been able to quickly gain market share, indicating that the barriers to launching liquidity are inherently low.

In less than 10 months, Hyperliquid has become the highest-volume perpetual contract DEX, surpassing dYdX and GMX, which previously held over 50% of the perpetual market share.

Frontends Are Evolving

Today, the most popular "aggregators" are intent-based frontends. These frontends outsource execution tasks to a network of "solvers" who compete with each other to provide the best execution for users. Importantly, some intent-based DEXs also tap into off-chain liquidity sources (such as centralized exchanges and market makers). This allows these frontends to bypass the liquidity launch phase and immediately provide competitive, if not better, execution results. Intuitively, this undermines the role of on-chain liquidity as a defensive moat for existing DEXs.

Frontends Control Relationships with End Users

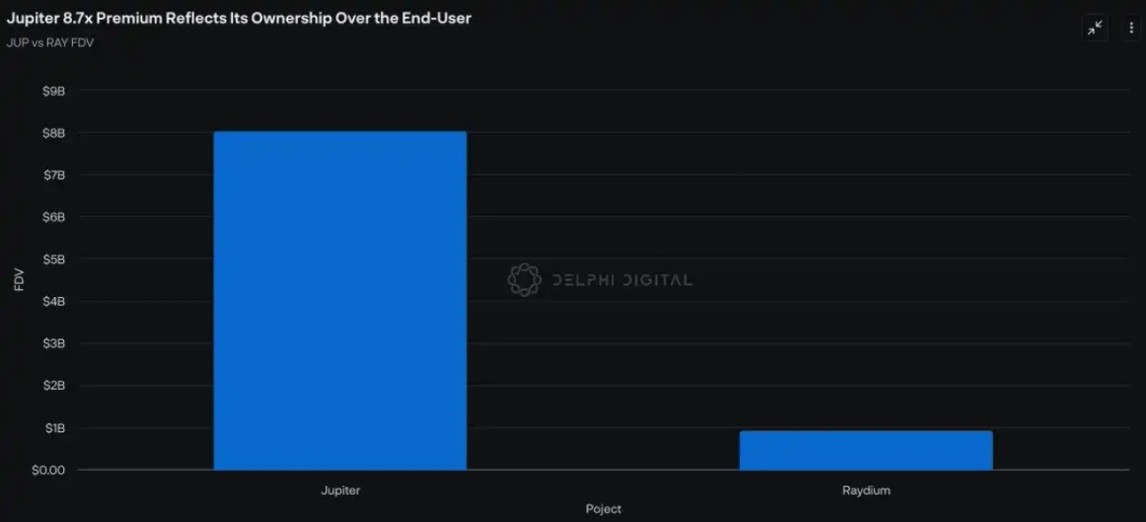

Frontends that capture user attention possess disproportionate bargaining power, enabling them to secure exclusive partnerships and even achieve vertical integration. Through their intuitive frontend design and control over end users, Jupiter has become the fourth-largest on-chain perpetual contract DEX. Additionally, Jupiter has successfully integrated its own launch platform and SOL LST, and plans to establish its own RFQ/solver model. Given Jupiter's close relationship with end users, the premium on JUP is at least somewhat justified, although I expect this gap to narrow over time.

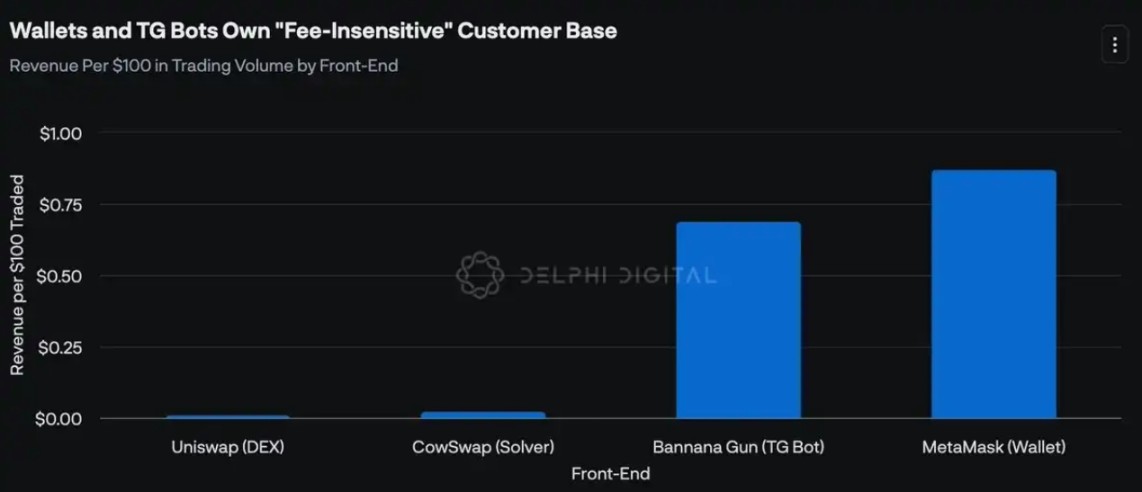

Moreover, as the ultimate frontend, no application is closer to end users than wallets. By connecting retail investors on mobile, wallets possess the most valuable order flow—"fee-insensitive traffic." Given that the switching costs for wallets are inherently high, this allows wallet providers like MetaMask to strategically sell convenience rather than optimal execution to retail investors, cumulatively earning over $290 million in fees.

Furthermore, while the MEV supply chain will continue to evolve, one thing will become increasingly clear—value will disproportionately accumulate in the hands of participants with the most exclusive order flow. In other words, all current initiatives aimed at redistributing MEV—whether at the application layer (like DEXs considering LVR) or at a more fundamental level (like crypto mempools, trusted execution environments, etc.)—will disproportionately benefit those closest to the order flow origin, meaning protocols and applications will become increasingly "thin," while wallets and other frontends will become increasingly "thick" due to their proximity to end users.

I will elaborate on this point in a future report titled "The Fat Wallet Theory."

Building Moats for Applications

To be clear, I expect liquidity network effects to create an inherent winner-takes-all dynamic in large-scale markets; however, we are still far from that future. Therefore, in the short to medium term, relying solely on liquidity may still be an ineffective moat.

Instead, I believe liquidity and TVL are more like prerequisites, while true defensiveness may come from intangible assets such as brand, differentiation in user experience (UX), and most importantly—the ability to continuously roll out new features and products. Just as Uniswap was able to overcome Sushi's siphoning attack because they possessed the ability to "innovate beyond Sushi," Hyperliquid's rapid rise can be attributed to the team building arguably the most intuitive perpetual contract DEX to date and continuously launching new features.

In simple terms, while liquidity and TVL can be subsidized by emerging competitors, a team that continuously rolls out new products is non-replicable. Therefore, I expect a high correlation between applications that can sustainably capture value and those backed by ever-innovating teams. In an industry where moats are nearly impossible to exist, this is undoubtedly the strongest source of defensiveness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。