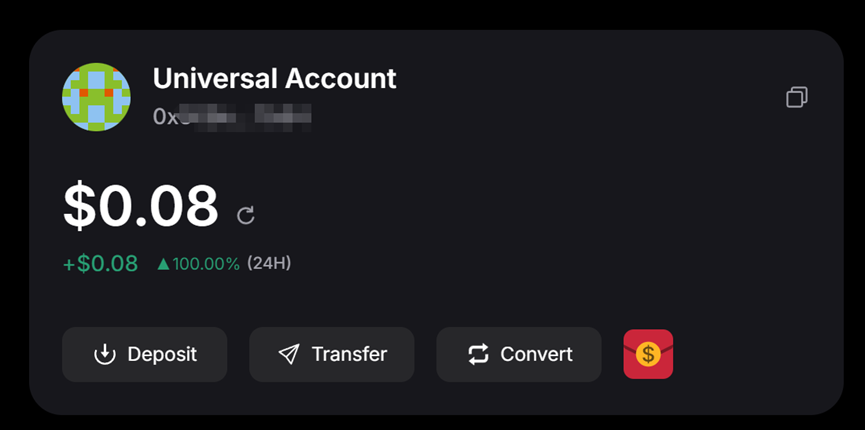

During the holiday, I tried out the unified account of Particle Network. This is quite similar to a cross-chain product I envisioned before—rather than making cross-chain transactions in the form of a bridge, it creates a universal account, allowing cross-chain transactions through deposits and withdrawals.

Think back to the last time you used a cross-chain bridge; it might not have been L0 or similar, but rather a centralized exchange, such as Binance or OKEx.

The reasons are that the fees are relatively low, and people are very familiar with the deposit and withdrawal scenario. The deeper reason is that many people feel fear towards unknown scenarios, such as cross-chain authorization and waiting for funds to arrive.

The interesting point about @ParticleNtwrk is that it proposes to do chain abstraction (although the term "chain abstraction" itself is quite abstract). In simple terms, it creates a virtual unified account for your multi-chain assets, allowing you to use and manage liquidity from other chains.

For example, if you want to cross-chain, you need to first deposit into this account. Once the funds arrive, you can transfer them to other chains or specified accounts. Therefore, compared to cross-chain bridges, it is actually closer to the experience of Binance or OKEx.

The design of this product is quite clever; why is that?

In traditional cross-chain bridges, there is a certain fear of the unknown regarding the two steps of authorization and the waiting period for funds to arrive, especially for those who rarely use cross-chain services. They worry about accidentally clicking on malicious authorizations, getting stuck in some step of the cross-chain process, and facing unknown risks.

In contrast, the Universal Account uses the terms "deposit" and "transfer," which are much more familiar to everyone, thus naturally reducing the psychological pressure when using it.

User experience (UX) is actually built up from these small details.

Moreover, the transfers with the Universal Account are quite fast; the entire process of deposit and withdrawal is completed in about one minute. I understand that there might be a fast mode for certain amounts. After all, depositing OP USDT on Binance can take hundreds of blocks, and withdrawals require verification, which can take twenty to thirty minutes at times.

I also went through its documentation. Particle's L1 is not used for running applications but for initiating and verifying transactions (for example, checking if user operations were successful, or if the LP role transferred intermediary tokens to the target chain).

The nodes above reach consensus on transactions, similar to the multi-signature in traditional cross-chain bridges or exchanges.

These nodes stake their native currency, Parti, and BTC staked in Babylon, providing a double insurance and enhancing robustness.

Furthermore, there is a distinction between the unified account and cross-chain bridges: the unified account allows for real-time liquidity management, while cross-chain bridges lock one asset to retrieve another. If there is no need to pre-cross assets to use a new chain's dApp, and if users can call upon any multi-chain assets in real-time, the logic of user interactions on the chain may change significantly.

So I say, this product form is quite interesting and aligns with good product philosophy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。