Master Discusses Hot Topics:

This week's PMI data continues the trend of the third quarter: the manufacturing PMI remains weak and sluggish, while the services PMI remains strong. The US September ISM Services PMI is at 54.9, significantly better than expected, showing a clear increase from August, and expanding for the third consecutive month, with the expansion rate in September being the fastest since February 2023.

On the other hand, the ISM Manufacturing PMI shrank for the sixth consecutive month on Tuesday. The services index is 7.7 points higher than the manufacturing index, which temporarily disproves the recession.

However, the overall liquidity issue has a significant impact, and the escalation of the situation in the Middle East has led to overall market weakness. Therefore, even though the recession is disproven, the market sentiment boost is limited.

Of course, tonight's unemployment rate data will have a greater impact on the market. Regarding liquidity improvement, there are slight signs, and Master will continue to track whether it will progress further.

Additionally, the important non-farm payroll data is coming up. If the data is stronger than expected, the US dollar will strengthen, and cryptocurrencies may face downward pressure. If the data is weaker than expected, liquidity expectations will improve, which will be beneficial for the cryptocurrency market.

It's a common saying that the news is often used by the main players as a tool to implement their trading strategies through market fluctuations. The main players utilize market sentiment, liquidity, and trading volume before and after news releases to control the market, accumulate positions, and distribute.

Because the main players and speculators essentially buy news and sell facts, the market will also fluctuate violently when major news is announced. It is impossible to use conventional technical indicators for trend analysis at this time; entering the market is speculation, not investment!

In the cryptocurrency market, the short-term impact of news should not be over-interpreted. What is important is to have a clear judgment on the long-term trend of the market and to avoid chasing highs and cutting losses.

Master Looks at Trends:

With the increase in Bitcoin's volatility, the bearish atmosphere in the market has significantly increased.

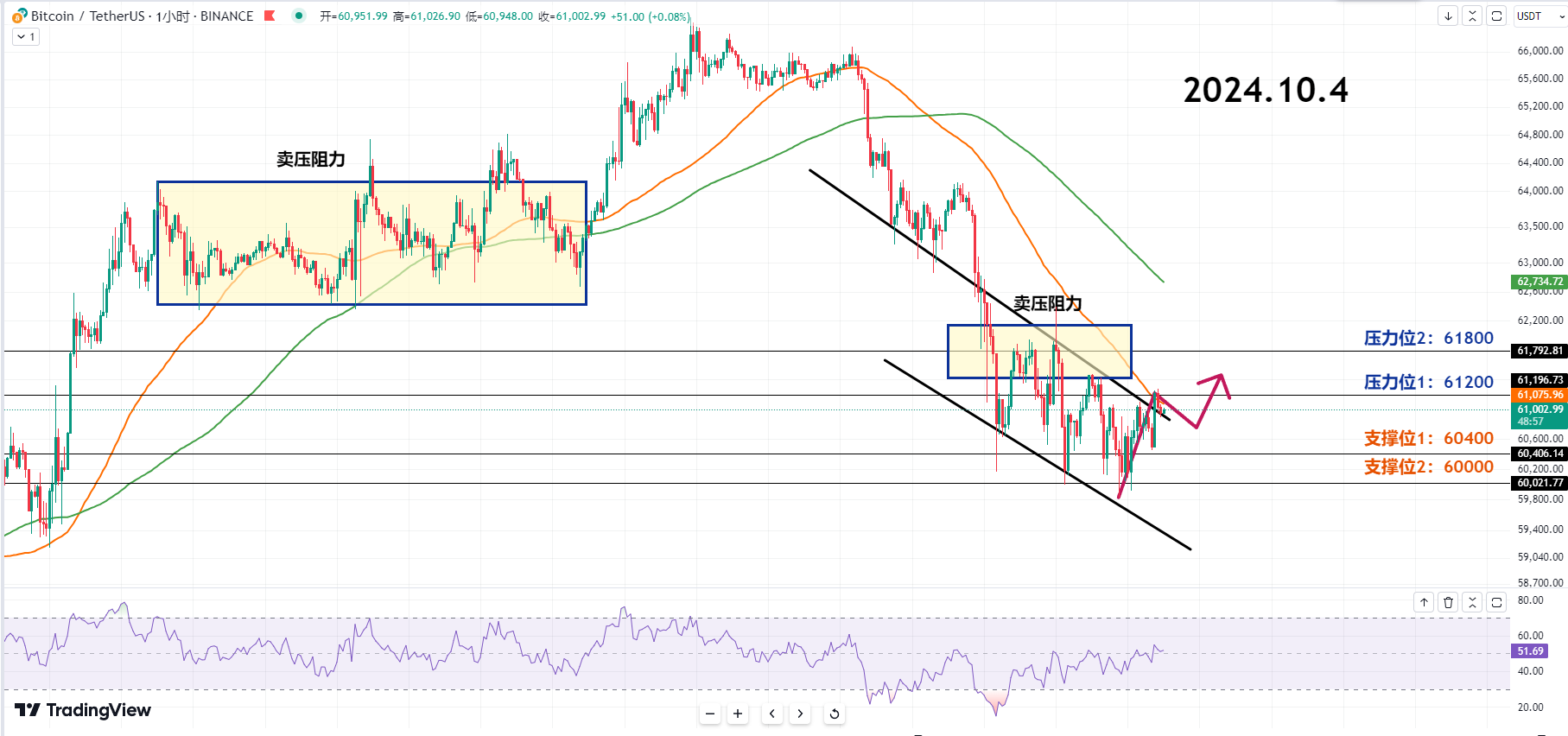

Yesterday, Bitcoin briefly held above 60K and showed a rebound. Although the rebound strength has increased, to further rebound, it needs to break through several resistance levels, so sufficient trading volume must enter to increase the likelihood of a breakout.

From a technical analysis perspective, although it has broken above the descending channel, due to low trading volume, if it returns to the descending channel again, the sideways consolidation may continue. It is recommended to pay attention to whether it can raise the low points.

Resistance Level Reference:

First Resistance Level: 61200

Second Resistance Level: 61800

Currently, it is retracing below the first resistance level. If it breaks through this range, the rebound strength will increase and may turn 61K into a support level.

Due to the current low trading volume, it is insufficient to determine whether a further rebound will occur. Therefore, attention should be paid to changes in trading volume in the upper selling pressure range, while also monitoring short-term adjustments and conducting trading operations cautiously.

Support Level Reference:

First Support Level: 60400

Second Support Level: 60000

Currently, the first support level (60.4K) is viewed as the area for forming the current low point. If it can hold above 60.4K, it can be judged that the low point is rising, and this can be seen as an entry opportunity.

Only when the chart shows a rebound and raises the low points can it be determined that the short-term trend has changed. If it loses 60.4K and touches 60K again, the probability of digesting the selling pressure below will be high, and the likelihood of further decline will increase.

Today's Trading Suggestions:

In today's trading, although the rebound strength has increased compared to the previous day, due to the lack of trading volume, it is recommended to pay attention to the upper resistance levels. Look for entry opportunities for long positions in the lower price range.

If entering at an inappropriate price range, the position may be prolonged, and the risk-reward ratio will worsen. Due to the high volatility in the market, with significant fluctuations up and down, it is advisable to be patient and wait for better entry points.

10.4 Master’s Short-term Orders:

Long Entry Reference: Enter in batches in the 59700-60000 range, with a stop loss of 500 points, target 60400-61200 (can go long if it does not break the daily EMA200!)

Short Entry Reference: Enter in batches in the 61800-62100 range, with a stop loss of 500 points, target 61200-60400

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot contract trading techniques, operational skills, and knowledge about candlesticks, you can add Master Chen for learning and communication, hoping to help you find what you want in the cryptocurrency circle. Focused on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% following the trend; daily updates of macro analysis articles across the network, mainstream and altcoin technical indicator analysis, and spot medium to long-term price prediction videos.

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。