Strength does not need to be overly displayed; the key is to gain recognition from more people. On the investment journey, doing well for oneself is more important than proving one's strength to others. Whether it’s a mule or a horse, you’ll know once you take it out for a walk.

As a veteran in the cryptocurrency space, I have always been committed to providing beneficial advice to everyone, hoping that you can avoid detours and mistakes in this market. Although I speak earnestly, the path of investment must still be explored by yourself; learning is endless, and the experiences gained are the true wealth!

Here, I wish my fans financial freedom in 2024. Let’s work hard together!

Cryptocurrency Scholar: Bitcoin (BTC) Latest Market Analysis on 2024.10.4

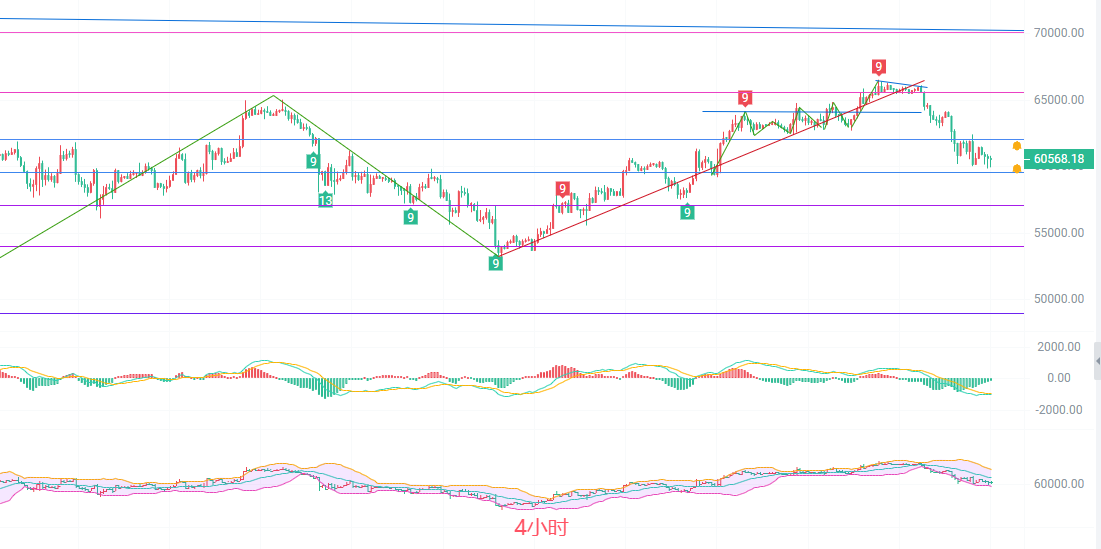

It’s already 2 AM, and the current price of Bitcoin is 60,600. The support and resistance level is at the 60,000 mark, with effective support. You can try going long, aiming for the previous high. The daily K-line resistance point is at the EMA15 trend line of 62,500, which is worth paying attention to.

Looking at the technical indicators, MACD is contracting downwards, with DIF and DEA expanding downwards from a high position. The lower Bollinger Band is at 58,100, the middle band is at 62,500, and KDJ is expanding downwards into the oversold zone. The overall trend suggests that there won’t be significant market movements before the non-farm payrolls, so you can consider swing trading.

In the short term, the four-hour K-line is consolidating below the EMA trend indicator. The EMA15 trend pressure level is at 60,600, and the next EMA30 pressure level is at 62,500. There is a probability of a rebound in the overall trend. Even if a new low is broken in the short term, a rebound is likely, so you can try going long at the support level. MACD has been contracting and accumulating, with DIF and DEA showing a bottom divergence. The Bollinger Band is entering a box pattern downwards, with the middle band pressure level at 62,000. KDJ is contracting inward, and the consolidation trend is evident, so going long at support is effective. After the pressure level is clearly effective, you can take profits on long positions and plan for shorts.

Short-term strategy reference: The market is never 100% certain, so always set stop-losses. Safety first; small losses and big gains are the goal.

For shorts, target the range of 61,800 to 62,200, with targets at 61,000 and 60,500. If broken, look at 60,000, with a stop-loss of 300 points.

For longs, target the range of 60,100 to 59,800, with a defense at 59,000 to 58,500. The target is 59,000 to 59,500. If broken, look at 60,000, with a stop-loss of 500 points.

Specific operations should be based on real-time market data. For more information, you can consult the author. There may be delays in article publication; the suggestions are for reference only, and risks are borne by the reader.

This article is exclusively contributed by the Cryptocurrency Scholar and represents the scholar's unique viewpoint. In-depth research has been conducted on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above viewpoints and suggestions may not be real-time and are for reference only. Risks are borne by the reader. Please indicate the source when reprinting. Manage your positions reasonably and avoid heavy or full positions. The scholar also hopes that all investors understand that the market is always right. If you are wrong, you should reflect on where the problem lies. Don’t let the profits that should be yours slip away. There is no need to be smarter than the market; when a trend comes, respond to it; when there is no trend, observe and remain calm. It’s not too late to act once the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, the earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards passion. Gains and losses often happen unexpectedly. Develop the habit of strictly setting stop-losses and take-profits for each trade. The Cryptocurrency Scholar wishes you happy investing!

Warm reminder: The above content is solely created by the author of the public account. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。