Some funds have chosen to take profits and wait on the sidelines, compounded by escalating geopolitical risks.

Written by: 1912212.eth, Foresight News

The calls for October have been rising since September, but the market has played a trick on the public. On September 30, after the upward momentum of BTC showed signs of exhaustion, it plunged from $65,000, even dipping below the $60,000 mark today, with a lowest quote of $59,828. Ethereum also fluctuated with Bitcoin, dropping from $2,700 to just above $2,300, nearly reaching $2,100, almost setting a new low in months. The gains of some altcoins since mid-September have also quickly been wiped out by more than half.

In terms of contracts, according to coinglass data, $278 million was liquidated in the past 24 hours, with $219 million from long positions. The total open interest in BTC futures contracts across the network has also fallen below $32 billion.

The much-anticipated "Rising October" has just begun, yet the market performance is so bleak. What is the reason behind this?

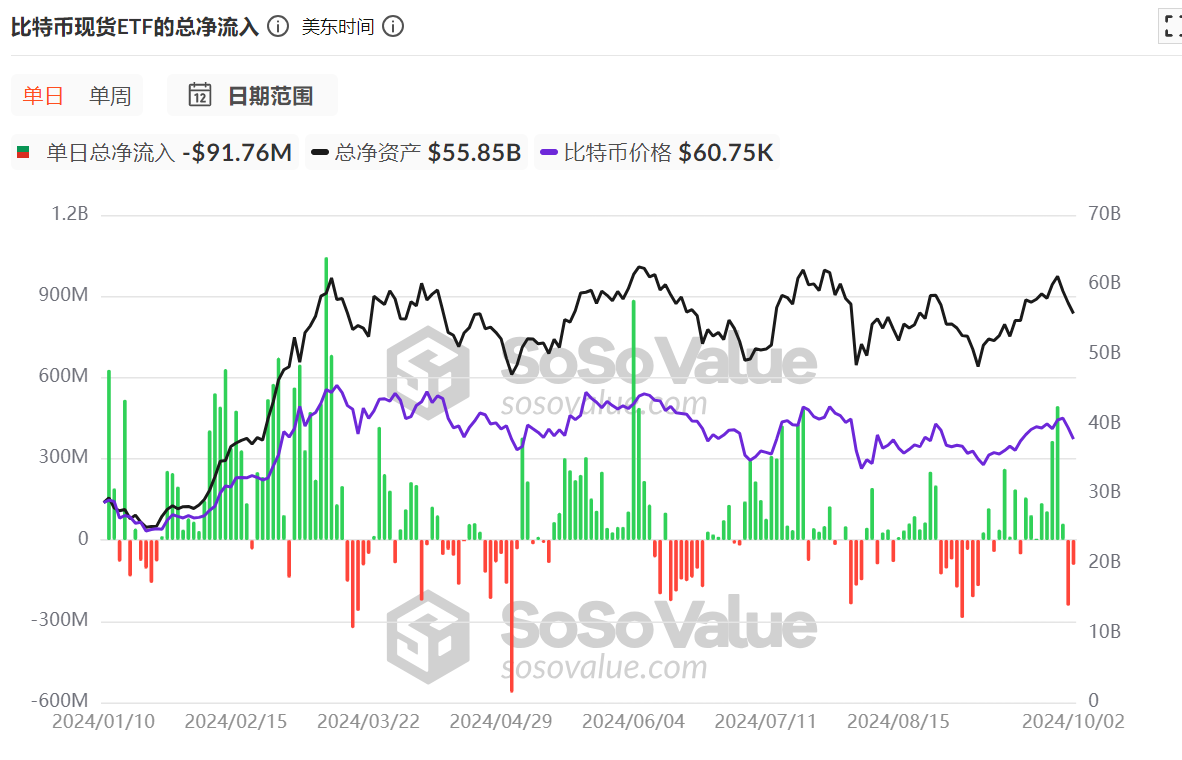

Bitcoin Spot ETF Data Shows Large Outflows for Two Consecutive Days

Data shows that since September 12, there has only been a small net outflow on the 18th of that month, with large net outflows in the remaining weeks. However, as October arrived, the data became less optimistic. On October 1, the single-day net outflow was $242.5 million, and on October 2, it continued with a net outflow of $91.76 million.

Nansen's chief research analyst Aurelie Barthere had warned at the end of September that the Federal Reserve had just injected more vitality into this bull market, but the prices of risk assets had already reflected much of it. Considering the asymmetric risks of a downturn, a safer strategy would be to reduce crypto holdings during market rebounds.

Some over-the-counter funds have chosen to take profits and wait on the sidelines. The total net outflow of $230 million over two consecutive days has significantly reduced buying power, increasing selling pressure.

Escalating Geopolitical Risks

On the evening of October 1, Iran launched a large-scale missile attack on Israel, codenamed "Real Commitment 2." The attack lasted about 45 minutes, with approximately 200 missiles fired at Israel, causing widespread destruction and casualties, particularly in central cities like Tel Aviv. This move is seen as Iran's passive retaliation against a series of recent actions by Israel and a serious warning to Israel.

In response to Iran's missile attack, Israel reacted quickly and firmly. While the specifics of any retaliatory actions may be kept confidential due to military strategy, the Israeli government has made it clear that it will not tolerate such attacks and plans to take further action. Reports indicate that Israel plans to carry out significant retaliatory actions in the coming days, potentially targeting oil production facilities and other important strategic targets within Iran.

Currently, expectations for a significant interest rate cut by the Federal Reserve have weakened, and with the escalation of tensions in the Middle East, market concerns have returned, leading to a general decline in global stock markets and rising oil prices. Investors are waiting for Israel's response to the Iranian attack and the U.S. non-farm payroll data for September tomorrow night.

BTC and other crypto assets, as highly liquid risk assets, are the first to be negatively impacted in geopolitical conflicts, showcasing their volatility. Investors often choose to sell and wait for changes when faced with uncertain concerns, exacerbating downward pressure on the market.

Market Outlook

QCP Capital: Middle Eastern geopolitical issues should not distract investors; the market's willingness to buy risk assets remains strong

QCP Capital stated in an official post that the conflict between Israel and Iran is escalating. The impact on crypto is much greater, with BTC closing down 4%. It seems to have found some support around the $60,000 level, but further escalation could push BTC down to $55,000. While Middle Eastern geopolitics will attract attention, the shallow sell-off indicates that the market's willingness to buy risk assets remains strong. This minor setback should not distract from the bigger picture.

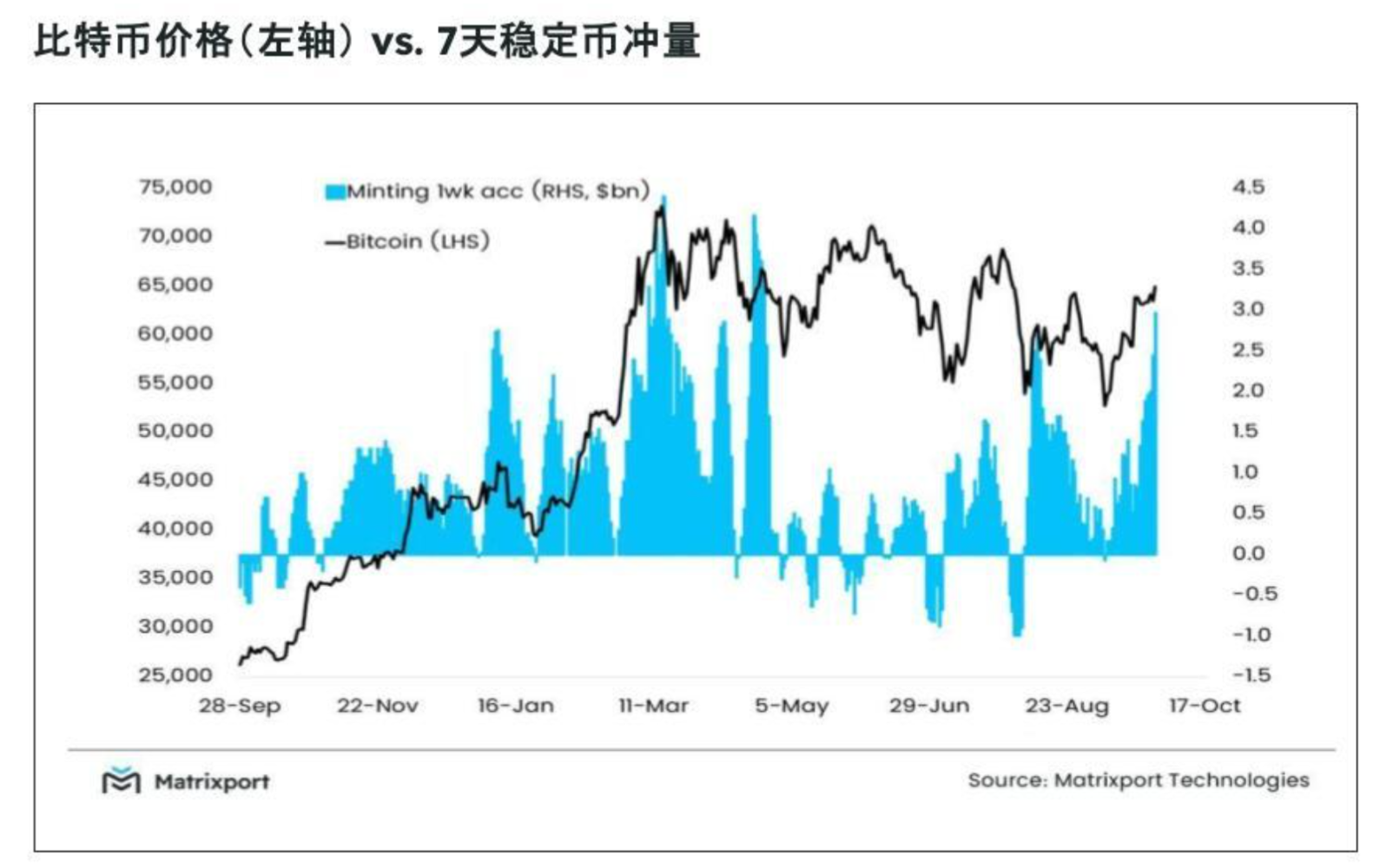

Matrixport: Institutional confidence is strengthening; surge in stablecoin minting boosts Bitcoin bullish momentum

Matrixport released a research report stating that recently, the minting of stablecoins has surged to its highest level since the peak in March-April, indicating that new fiat funds are flowing into the crypto market, which is a bullish signal. In February 2024, a similar surge in stablecoin issuance drove Bitcoin prices significantly higher. If this minting momentum continues, Bitcoin prices are expected to rise further. Notably, since the FOMC meeting on July 31, the pace of stablecoin minting has noticeably accelerated, reflecting increased institutional confidence in a low-interest-rate environment, thereby boosting optimism in the crypto market.

CryptoQuant Analyst: Bitcoin is expected to rise to the $85,000-$100,000 range in Q4

CryptoQuant analysts stated that Bitcoin is entering a positive seasonal phase, but the increase in demand is key for BTC prices to reach $100,000 in the fourth quarter. As of 2024, Bitcoin's performance is similar to that of 2016 and 2020 up to September. CryptoQuant analysts noted that institutional demand brought by U.S. Bitcoin exchange-traded funds (ETFs) is crucial for further growth in Bitcoin prices. "If ETF demand continues to accelerate, it could drive prices up in the last quarter of 2024. On-chain data valuation indicators suggest that, in the context of recovering demand and seasonal tailwinds, Bitcoin may target the price range of $85,000-$100,000 in the fourth quarter."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。