Projects in the Binance ecosystem are least likely to remain active, with one-third of teams ceasing operations.

Author: Lattice Fund

Translated by: Deep Tide TechFlow

Introduction

Last year, we released a review of the seed stage in 2021 to gain a clear understanding of the trends during that year. How many companies have shipped to the mainnet? How many found product-market fit? Who launched tokens?

With the 2024 report, we now turn our focus to 2022 to better understand the progress and trends of cryptocurrency in the seed stage. This report analyzes over 1,200 publicly disclosed cryptocurrency pre-seed and seed rounds since 2022, providing insights into trends across the entire industry, specific sectors, and ecosystem levels. As with our previous reports, we are open-sourcing our database for further exploration and analysis. We invite your feedback and welcome any corrections; please feel free to contact us at hi@lattice.fund.

Executive Summary

Projects from 2022 received funding during one of the most prosperous periods in cryptocurrency history. Teams announcing funding this year likely benefited from the bull market of 2021 and early 2022. Given the market bubble, we expect these metrics to show negative impacts compared to teams funded during the bear market. Our analysis confirms these expectations but also reveals positive outcomes.

Since 2022, nearly 1,200 companies have collectively raised $5 billion in investments, a 2.5-fold increase from the previous year. Here are the key highlights:

Breakthroughs in 2022

Every year has some significant success stories, and 2022 was no exception.

In infrastructure, we saw the re-staking protocol Eigenlayer, wallet-as-a-service provider Privy, and parallel EVM Sei all raise seed round funding. Notably, each of these teams helped launch a broader narrative.

In the DeFi space, the breakthrough stories of 2022 include Perp DEXs like Vertex and Apex, as well as the specialized NFT exchange Blur.

Gaming is a major consumer segment, with nearly $700 million in investments. Despite the large influx of funds, the two biggest success stories raised relatively little. Pixels and PlayEmber each raised less than $3 million in seed round funding.

Launching in a Challenging Market

Despite facing a bear market, nearly three-quarters of projects successfully launched products on the mainnet. Compared to 2021, product-market fit (PMF) and follow-on funding have become more challenging, both seeing significant year-over-year declines.

18% of the cohort has shut down or stopped development, up from 13% in 2021.

Only 12% of teams secured follow-on venture capital, a sharp decline from 50% in 2021.

Only 15% of projects launched tokens, down from 50% in 2021.

Renewed Focus on Infrastructure and CeFi

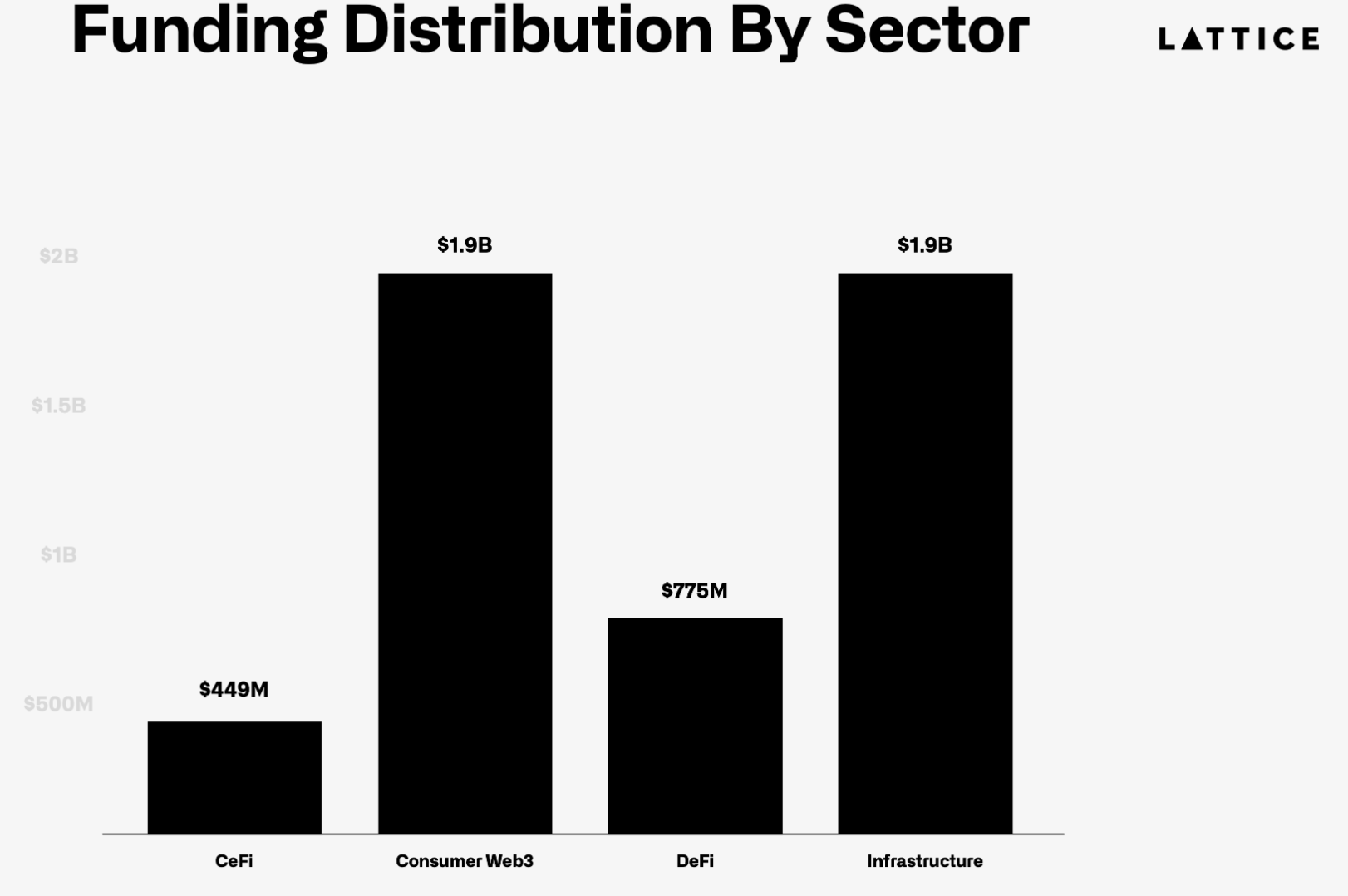

After the detours of 2021, investors returned to more proven areas like infrastructure and CeFi, investing nearly $2 billion and nearly $450 million in these sectors, respectively, which is a threefold and twofold increase from 2021 figures.

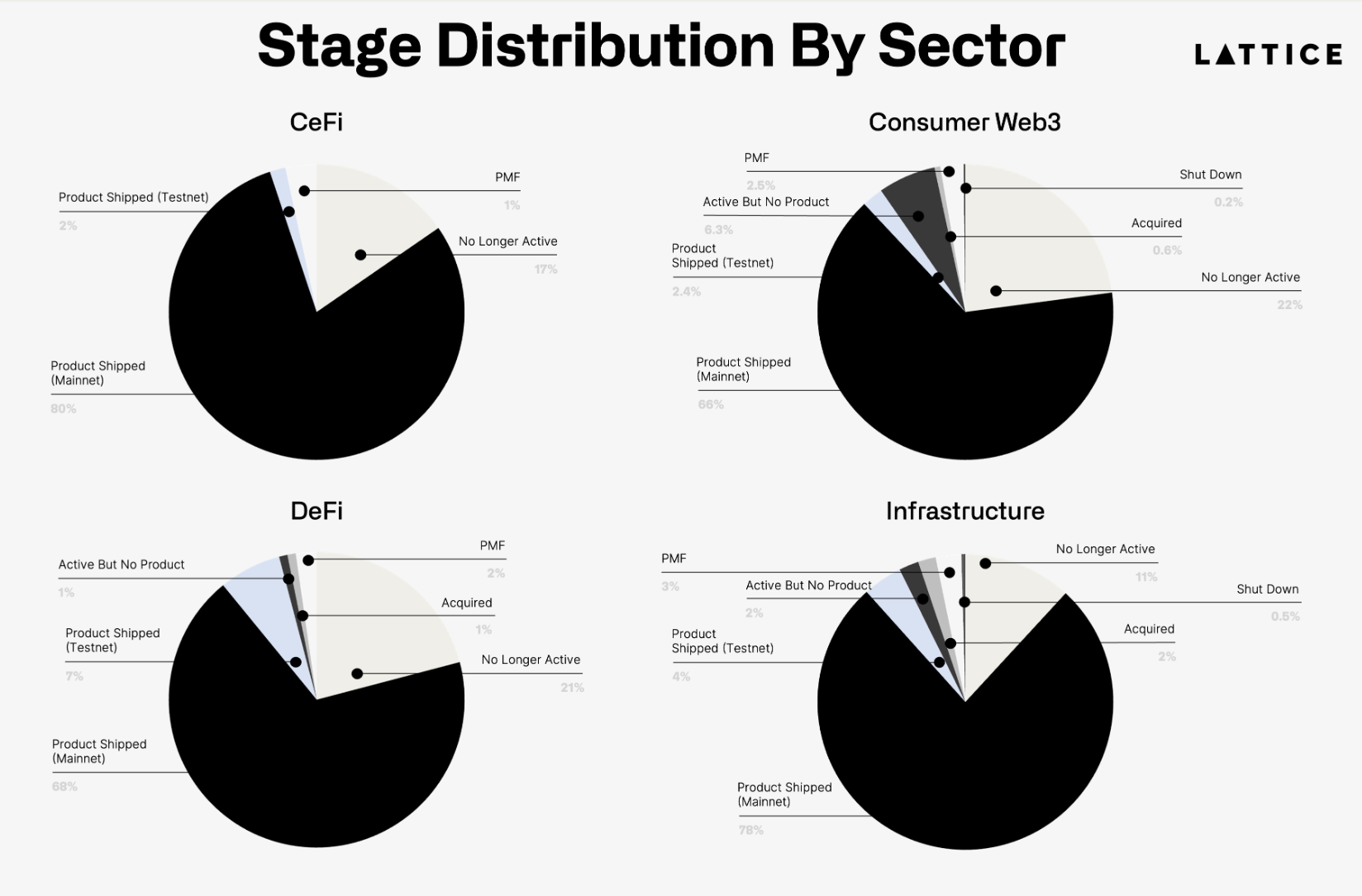

80% of CeFi projects and 78% of infrastructure projects have launched on the mainnet, reflecting strong investor confidence in these areas.

The results at the application layer are more complex, with 66% of consumer Web3 products and 68% of DeFi teams delivering products to the mainnet.

Consumer teams are more likely to cease operations, with the proportion of closed teams nearly double that of infrastructure teams.

Payment (86%) and wallet (90%) projects are the most likely to launch on the mainnet.

Ethereum Leads, Bitcoin Endures

In terms of fundraising, Ethereum remains the dominant first-layer ecosystem, while Bitcoin projects continue to show resilience.

$1.4 billion was invested in Ethereum-based projects, followed by nearly $350 million in Solana-based projects.

Fundraising in the Polkadot ecosystem saw a significant decline, down 40% year-over-year.

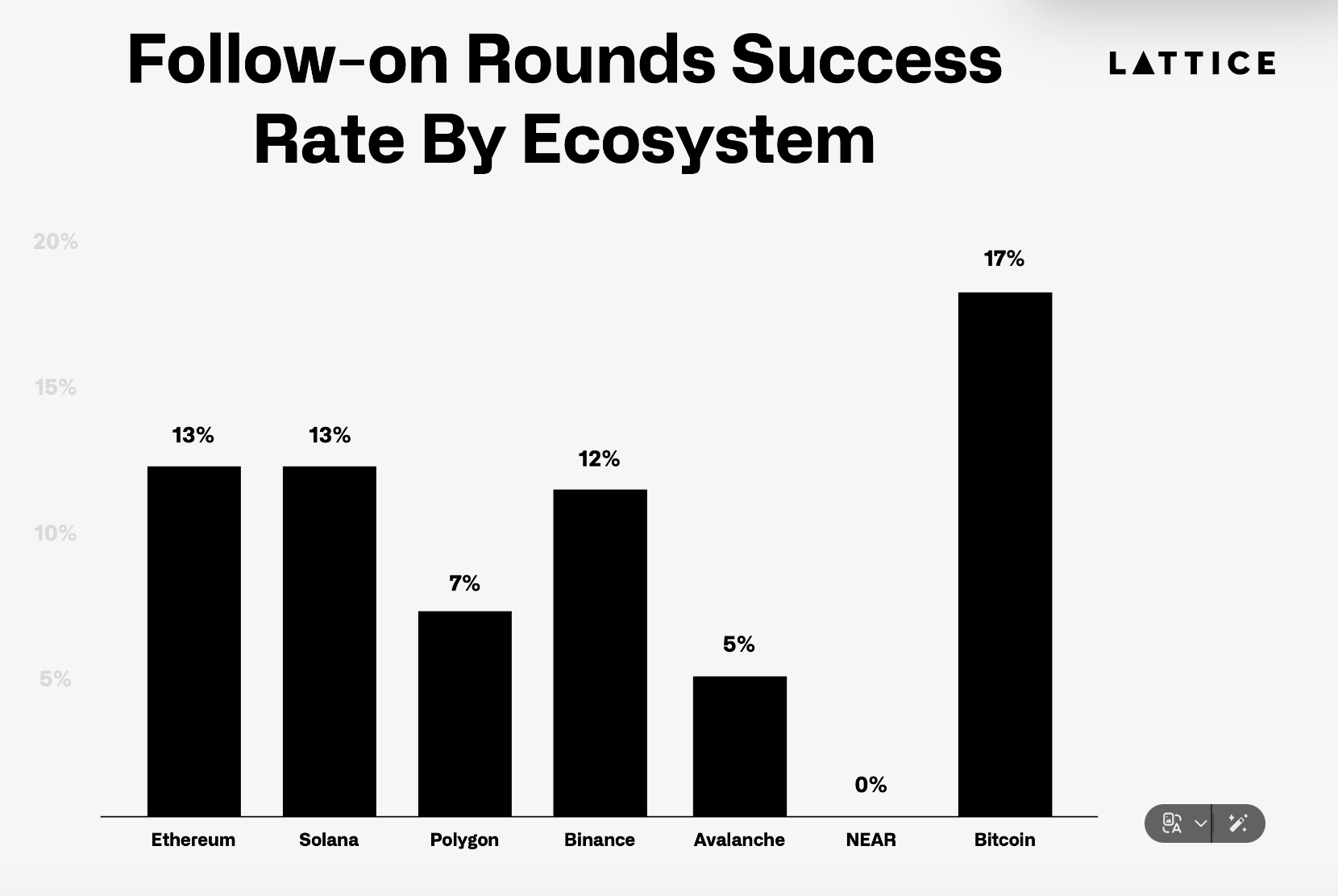

Teams building on Solana and Ethereum are equally likely to secure follow-on funding.

In contrast, no teams in the NEAR ecosystem were able to raise follow-on funding.

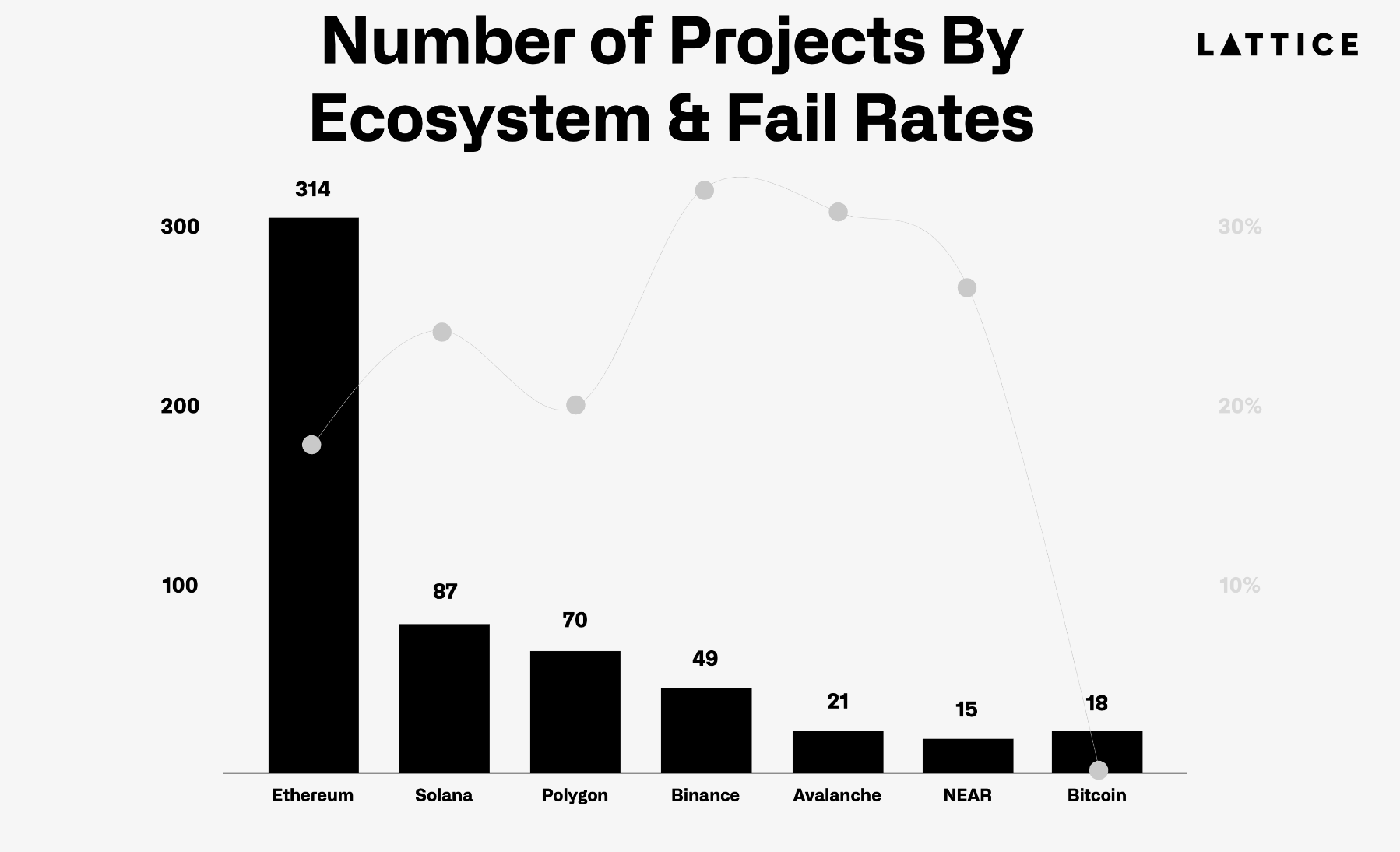

Projects in the Binance ecosystem are least likely to remain active, with one-third of teams ceasing operations. Solana's failure rate has also doubled compared to 2021, reaching 26%.

Bitcoin projects persist, with 100% of teams still active two years later.

Methodology

This report is based on a combination of first-party data supplemented by insights from Messari, Root Data, Crunchbase, and other sources. To assess the progress of the seed stage market, we categorized each company by stage, including "active but not delivered" and "no longer active," with additional breakdowns by ecosystem and industry. While we have made every effort to ensure data accuracy, we acknowledge that errors may occur due to reliance on third-party data. In the ecosystem, we only included those ecosystems with more than 15 teams able to raise first-round funding in the charts.

One of the most challenging aspects of this analysis is determining whether a project has achieved product-market fit (PMF). Unlike the objective milestone of "product delivery," PMF is often subjective and can be fleeting, especially in the rapidly changing crypto market. We combined on-chain data from analytics providers like Dune Analytics and DeFiLlama with information from company websites and blogs to make these determinations.

(Note: Lattice's accompanying graphic categorizes the analyzed products from left to right into stages such as active but not delivered, product delivered, PMF achieved, token launched, no longer active, acquired, and shut down.)

Seed Round Project Status

Our review of the seed stage began with internal analysis aimed at identifying projects gaining attention but not yet raising follow-on funding, which could become targets for Lattice. However, it turned out that this data was sufficient to share with the broader industry.

This research is valuable as it reveals the health of various sectors, ecosystems, and the broader early market over time. Given that most seed stage teams raise funds to sustain operations for about two years, we decided to use this timeframe to review the seed year.

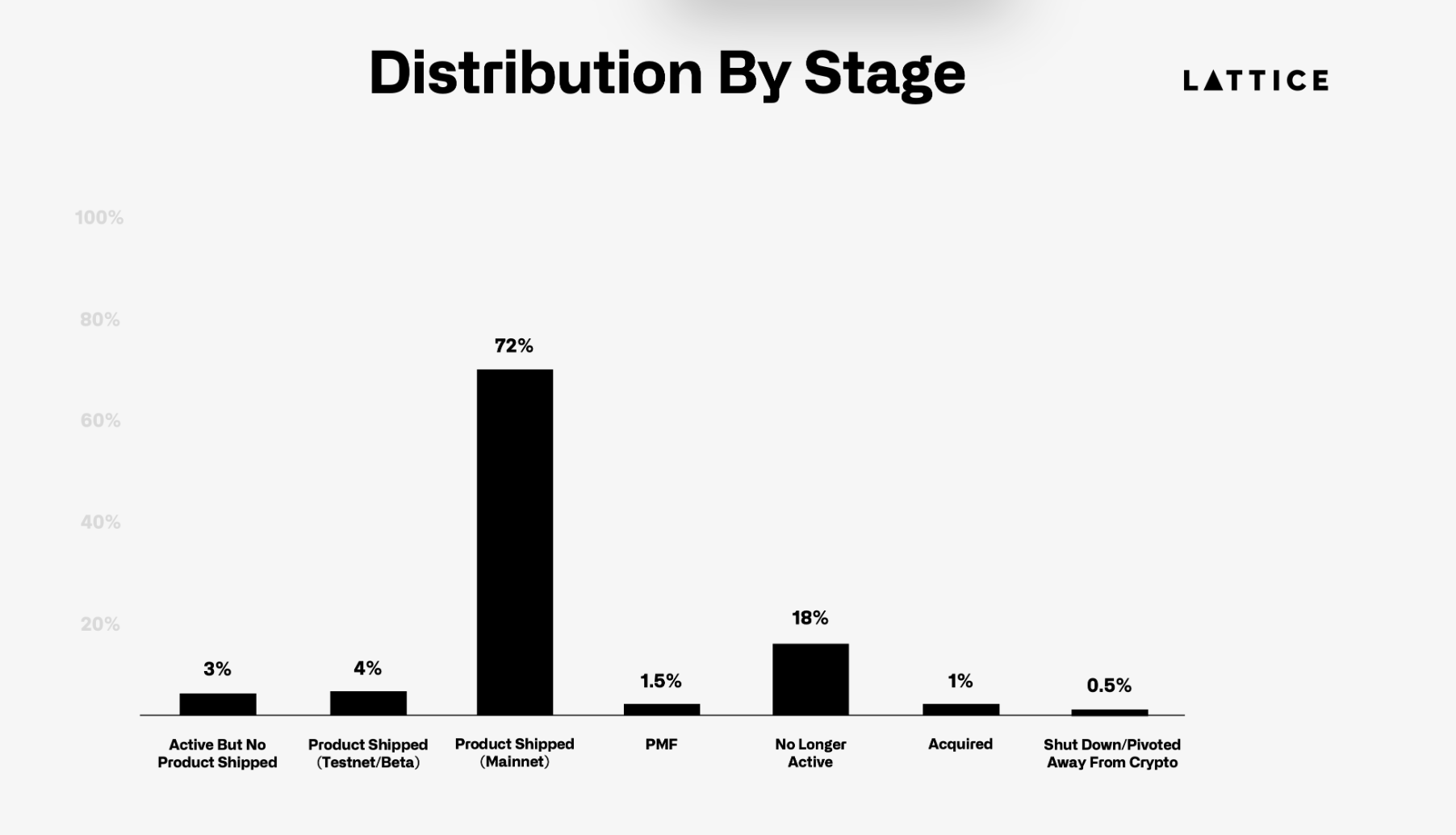

In 2022, over 1,200 cryptocurrency companies raised over $5 billion in seed and pre-seed funding. Reviewing this cohort, 72% of companies have launched on the mainnet or an equivalent network, up from 66% last year. Meanwhile, 18% of projects either failed to deliver or have shut down, consistent with last year's data. However, the most significant decline is in teams seeking PMF, which has dropped to nearly 1.5%. It is worth noting again that it is difficult to assess how attractive off-chain projects actually are, so we may miss some teams with early PMF.

During the bear market, attracting users became increasingly difficult as retail interest waned. Hot sectors in 2022, such as NFTs, the metaverse, and gaming, are not attracting users as they did two years ago. In contrast, infrastructure projects serving other cryptocurrency companies have proven to be more resilient. A prime example is Eigenlayer, which announced seed round funding in January 2022 and successfully expanded its AVS listing strategy, with middleware projects eager to collaborate.

This serves as a good reminder that **today's hot sectors do not always emerge with investor interest. For example, the *metaverse* sector had 75 teams raise nearly $280 million, but none found PMF, and over **21% of teams have shut down, making it hard to hear anyone talk about the *metaverse*. Compared to DePIN or **AI, they had almost no registrations in 2022 but are two of the hottest topics today.

(Data chart showing that 72% of seed round financing projects in 2022 have launched on the mainnet)

Venture Capital Tightens Wallets

Teams in 2022 raised funds during one of the most prosperous periods in cryptocurrency history. Teams announcing funding in 2022 likely did so before the collapses of Terra and FTX, which led to a deep freeze in the market. Although overall funding increased by 92% compared to 2021, the follow-on market tells a different story. Only 12% of teams in 2022 were able to raise more funds in the past two years. This stands in stark contrast to 2021, when nearly one-third of teams secured follow-on funding.

Interestingly, the number of token launches has also declined year over year, with only 15% of teams in the 2022 cohort launching tokens, down from 50% in 2021. This significant decline can be attributed to two main factors: 1) The 2022 cohort likely missed the bull market window, with many teams rushing to launch products in the first half of 2024, only to exhaust themselves throughout the summer. 2) Due to declining DeFi liquidity, the launch of decentralized exchanges (DEXs) has become less popular, and token issuance has shifted to centralized exchanges (CEXs). CEXs now charge high listing fees, often reaching seven figures, and require a significant portion of the token supply. The saturation of the token market, combined with the selectivity of CEXs and the diminished appeal of DEX launches, has made it more challenging to bring tokens to market.

Flying to Infrastructure

Investment in infrastructure has doubled compared to 2021, reflecting a clear shift in investor focus. While interest in infrastructure seems to wane by the end of 2024, it has been the most favored industry throughout 2022 and 2023. In contrast, DeFi is the only industry to see a year-over-year decline in investment, which may be due to the consequences of DeFi's rapid money-making schemes and Ponzi economics that surged in the summer of 2020.

Investors are reaping rewards by following the infrastructure trend, as these teams are most likely to secure follow-on funding and launch on the mainnet. In contrast, DeFi and consumer teams are more likely to launch tokens but also more likely to shut down. The application layer is feeling the pressure—without additional funding, teams are forced to either launch tokens or close down.

(The pie chart shows that seed round financing projects across various tracks generally have over 70% already delivered on the mainnet (black portion); however, most have not found PMF.)

Not All Ecosystems Are Equal

Cross-ecosystem development reveals significant differences in project success rates. Nearly 80% of Ethereum-based projects have delivered products, outperforming Solana, which has only 61% delivery, down from 75% in 2021. While Solana has clearly weathered the bear market well, the massive influx of capital at the end of 2021 may have led to an oversupply of funds.

The failure rate of 2022 seed stage teams remains consistent with that of 2021 teams, but significant differences have emerged within ecosystems. As observed last year, teams within the Binance ecosystem are the most likely to shut down, and now teams in the Avalanche ecosystem have joined this trend. Notably, the failure rate of Solana-based projects has doubled, with over 25% of teams ceasing operations. This increase may be due to the influx of speculative capital during the bull market, leading to overexpansion and subsequent attrition during the particularly challenging period Solana faced post-FTX. However, it is clear that teams that have survived this difficult phase have been rewarded. Additionally, it is worth emphasizing the resilience of Bitcoin ecosystem teams, which not only continue to deliver but also demonstrate extraordinary persistence, reflecting the reliability of the Bitcoin network itself.

The follow-on funding landscape in 2022 reveals a significant decline across all major ecosystems. Only 13% of Ethereum-based projects were able to secure additional funding, down from 31% in 2021. Similarly, only 13% of Solana startups raised follow-on funding, a sharp decline from 30% last year. Notably, ecosystems like Flow, StarkNet, and NEAR have struggled to attract further investment, with their projects failing to secure follow-on funding, highlighting the challenges these platforms face in maintaining developer and investor interest. This is particularly interesting given the amount of capital that flowed into each ecosystem's foundational layer at the end of 2021 and into 2022, with Dapper Labs raising nearly $600 million in 2021, NEAR raising $500 million in 2022, and Starkware raising nearly $200 million in 2021 and 2022.

What Comes Next

The situation for 2022 vintage projects is more challenging than in 2021. Finding PMF remains a challenge in a sideways market without a significant influx of new retail net participants. Some teams have turned to hot sectors for retail participation today (such as gambling-related applications). Furthermore, the significant reduction in teams securing follow-on funding will limit these teams' time to pivot to new opportunities. Finally, the substantial increase in seed stage startups and the tightening of the token issuance market mean that more teams are vying for narrower token issuance opportunities.

Complicating all these issues is the fact that investors have shifted their focus to today's hotter sectors (such as DePIN and AI) and ecosystems (such as Base and Monad). This underscores that returns do not come from chasing the current hot trends but rather from what will be hot 1-2 years down the line.

We have no doubt that the seed stage market in cryptocurrency will remain healthy, with nearly all funds actively participating, including a16z's newly launched crypto startup school. For this cohort of teams hoping to secure Series A and beyond funding, the robustness of the later-stage market remains a concern. Even within our own portfolio, we see that shifts in narrative can impact founders' ability to raise funds.

Notable Industries and Trends

Privacy-Enhancing Applications

Recently, there has been an increase in investment in privacy-enhancing technologies, with two trends in privacy infrastructure emerging over the past year: Zero-Knowledge Transport Layer Security (ZK TLS) and Fully Homomorphic Encryption (FHE). ZK TLS adds a privacy-enhancing layer to secure communications on the current internet. Projects like Opacity are collaborating with Lattice portfolio companies like NOSH to enable Nosh to leverage existing web2 delivery markets. In this example, drivers log in to the Nosh driver app using DoorDash credentials, which the protocol treats as proof of identity. As the demand side of the network matures, drivers can deliver for DoorDash through the Nosh driver app, and if the order comes from the protocol network (rather than DoorDash), the driver can earn tokens. We expect to see more use cases for this new privacy primitive.

Similar to ZK TLS, advancements in FHE infrastructure could lead to a new class of encrypted applications, from private DeFi to DePINfied data collection. An early practical example of this technology is sharing sensitive health information with AI companies. Lattice portfolio company Pulse is using a DePIN flywheel to collect health data that can be monetized by allowing researchers to analyze encrypted genetic data to identify patterns or biomarkers without accessing the raw genetic information, thus maintaining confidentiality. As privacy infrastructure advances and merges with broader trends—namely, AI agents and decentralized physical infrastructure networks (DePIN) for data collection—it may open the door to a new wave of consumer and enterprise-focused applications.

Augmented Reality Applications and Infrastructure

Broader technological trends are significantly influencing the direction of cryptocurrency founders' efforts and the flow of investor capital. We have witnessed this with the surge of AI-related startups from 2023 to 2024 following the large-scale improvements from OpenAI. With Apple, Meta, and Snap all launching significant strategies in the AR space, we expect to see an increasing number of crypto startups emerge as AR-related technologies eventually reach the mainstream. An example from the Lattice portfolio is Meshmap, which is building a decentralized 3D world map. As the installation of AR devices is expected to explode in the coming years, 3D maps for application developers to build experiences will become crucial. The excitement for the metaverse in 2021 may have been premature, but the lessons reported last year and this year are that people are not paying attention to where Alpha can be generated.

Blockchain-Supported Collectibles Market

Collectibles trading is largely associated with digital asset trading (especially NFTs), but the blockchain-supported collectibles market is on the rise, from spirits markets like BAXUS to watch platforms like watch.io and Kettle. Collectibles trading is already a massive off-chain market but is plagued by issues such as lack of instant settlement, physical custody, and reliable authentication.

We believe these challenges present an opportunity for a "Blockchain-Enabled Collectibles Market" (BECM), designed specifically to meet the needs of collectibles traders. BECM enables instant transactions through cash settlement, significantly reducing settlement times from weeks to seconds by using stablecoins, and employs NFTs to represent physical assets held by trusted custodians. This model can unify fragmented markets, enhance liquidity, eliminate the burden of personal storage, and establish trust through authentication. BECM also supports financial innovations, such as borrowing against collectibles, making the act of collecting financially more vibrant. With these efficiencies, BECM has the potential to significantly expand the total addressable market for collectibles by introducing more traders, liquidity, and inventory.

Ecosystem Rotation

Our tables and charts only include ecosystems with more than 15 projects raising venture capital, with the minimum number being close to 15 projects, so those just excluded are not surprising. However, we expect significant changes in ecosystems, considering the trends we are observing, with Polkadot, NEAR, and Avalanche likely to be replaced by L2 ecosystems and emerging L1 and L2 ecosystems like Monad, Berachain, and MegaETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。