Original Author: 1mpal

Original Translation: Luffy, Foresight News

I love Web3 games, and a significant portion of my funds is invested in game NFTs and tokens. However, I am very pessimistic about pure game tokens.

The market needs normalization. Currently, I have no good feelings towards game projects that have completely lost growth momentum since their TGE.

If I were a trader, I would think that those trading Memecoins or betting on the booming AI sector are smart people. There is currently no reason to bet big on game tokens, and the actual situation in the market reflects this. There are many reasons for this, but the main reason is that game tokens lack the key factors to support their overvalued market valuations.

1. Game Tokens Are Overvalued

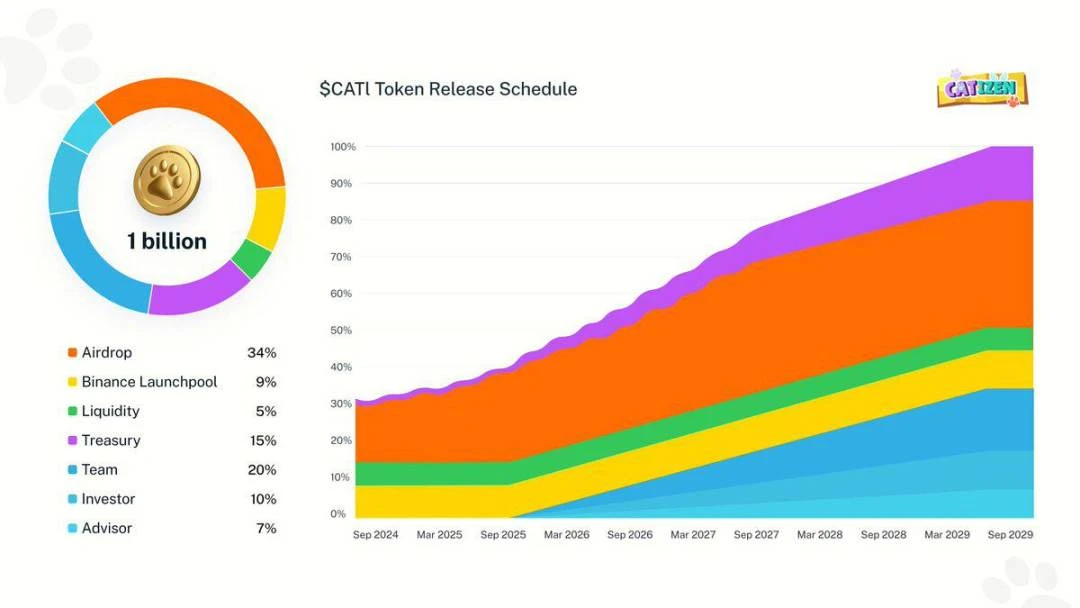

Very few Web3 games can match their market valuations. Even when calculated by circulating market cap rather than FDV, Web3 games are overvalued. For example, CATIZEN is one of the standout games recently, currently valued at about $200 million, assuming its annual revenue is $20 million.

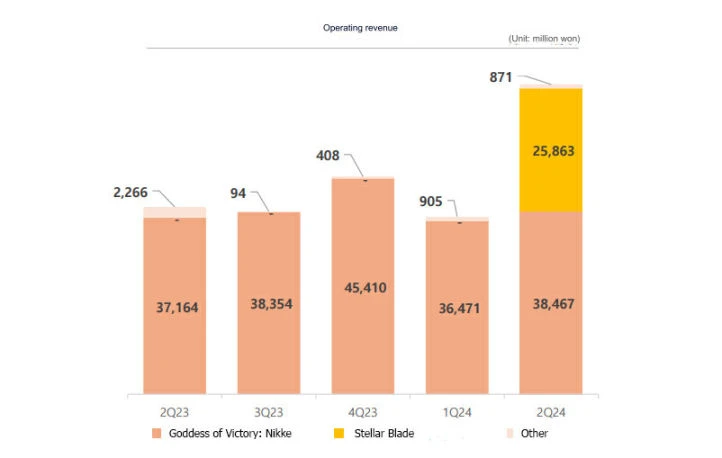

To simplify understanding, you can compare tokens to stocks to assess their valuations. The South Korean game company Shift Up recently went public with a market cap of about $2.4 billion and 2023 revenue of $140 million. The market considers it overvalued because it has huge future potential.

Nexon has a market cap of $16.3 billion and annual revenue of $3 billion. Krafton has a market cap of $12.3 billion and annual revenue of $1.5 billion. Take-Two Interactive has a market cap of $26.3 billion and annual revenue of $5.3 billion. For most large game companies, annual profits typically account for 10-20% of their market cap.

Token economics is built on the premise that games will grow unconditionally.

Taking CATIZEN as an example, from a market cap perspective, it seems like a very healthy project, but the problem lies in the unlocking mechanism. Mainstream game companies need financing to scale, but the tokens of Web3 game projects are automatically unlocked.

In fact, pure game projects cannot achieve growth without infrastructure. Unless there are special circumstances, most games have the highest number of users at launch and then show a slow decline, which is a common situation. In other words, the idea of self-appreciation for Web3 games goes against market laws.

2. Memecoins Are More Attractive Than Game Tokens

The ability to discover low market cap gems in trading is a valuable skill, and the simplest and most reliable signal is trading volume. Low trading volume means the market is not very interested, which naturally leads to weak upward momentum. Who wants to trade in an industry that has been declining since its listing?

If you are a gambler, when liquidity returns to cryptocurrency, which token would you bet on?

Comparing the charts of NEIRO, CATI, and HMSTR on Binance, we can see a clear distinction. Although CATI significantly outperforms traditional Web3 games in terms of game revenue and also excels in external social media revenue compared to HMSTR, the market performance is not ideal. On Binance, the trading volume of NEIRO and CATI differs by about 10 times.

Considering the current market sentiment and the willingness to list on exchanges, this is one of the worst times for game tokens to conduct TGE. Games are inevitably driven by venture capital, and projects that cannot compete in the current market will quickly exit through NFT sales, node sales, and TGE. Therefore, trading and holding memecoins is better than game tokens.

I believe the three principles that determine stock prices are: expectations of the company's future value, the company's performance record, and market supply and demand fluctuations. Currently, game tokens have no performance record, supply exceeds demand, and unless they have special marketing strategies, their future competitiveness as pure games is unreliable.

While comparing game tokens to stocks may not be entirely appropriate, it still has reference value. The key lies in which projects have the key to drive market narratives. If a company's future value solely depends on its game, it will not survive. It needs infrastructure; it needs technological momentum.

Alternatively, unlock all tokens from the start and let the market decide the price.

Final Thoughts

I believe that the cryptocurrency market will see significant growth in the first quarter of 2025. Like many others, I enjoy Web3 games, but I feel that the FDV of pure Web3 game tokens needs to be lowered. Of course, if you have infrastructure or a technological moat (like a gaming chain), you can achieve a higher valuation. But right now, many games, despite their high valuations, only serve the game itself.

This may be the worst time for game projects, or it can be seen as a normalization process. This year, I participated in several rounds of KOL financing for game projects, most of which were losses. The entry of VCs has driven FDV higher and the token lock structure contradicts the law of averages.

However, some game projects will survive this process, and we hope to bet on those that can expand into platforms and infrastructure based on revenue. Remember, the market is driven by one or two giants, and we are in a position ahead of traders, allowing us to prioritize selecting the main players. However, our weakness may be an obsession with the future of games. Even if we love games, we need to try to commercialize them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。