Zhou Yanling: 10.3 Bearish Momentum Strong, Achieving Great Success Today, Continue to Short if Resistance is Not Broken

The ADP data on Wednesday had little impact, with 143,000 private sector jobs added in September, exceeding the expected 120,000. The data was not significantly different, supporting the continued rise of the dollar, slightly bearish for the cryptocurrency market. Although the data was bearish, the actual effect after the announcement was not obvious; instead, there was a wave of upward movement in the relative trend, followed by a decline after midnight. Clearly, the short-term trend is still dominated by bears. Currently, everyone is waiting for Friday's non-farm payroll data while also paying attention to the speeches of Federal Reserve officials to find any clues regarding policy direction. Additionally, do not forget to continue monitoring changes in geopolitical situations. The war in the Middle East is escalating, with Iran launching missiles abroad and purging internal traitors. The old Western powers in Europe and America are increasing military support for Israel, making the probability of the Middle East war expanding quite high; the likelihood of cryptocurrency prices breaking down for safe-haven reasons is also significant. Furthermore, be cautious of the risk of wash trading before any breakdown; most breakdowns this year have been accompanied by varying degrees of wash trading tactics.

From a technical perspective, Bitcoin's daily line closed yesterday with a long upper shadow. After such a closing pattern, the daily adjustment will continue, and the short-term market shows that Bitcoin is facing key pressure with a clear doji or top formation, indicating an overall downward trend. In terms of short-term indicators, the current MACD histogram is negative and gradually shortening, showing that bearish momentum is weakening, and a rebound or sideways consolidation is expected in the short term. The RSI is currently around 40, close to the oversold zone but not yet entering it, indicating that market sentiment is cautious and has not formed a strong buying signal. Therefore, the daytime trading is expected to be similar to the previous two days, basically maintaining a sideways consolidation. Today's market is expected to move in the evening, and specific operations should continue to focus on shorting below resistance levels.

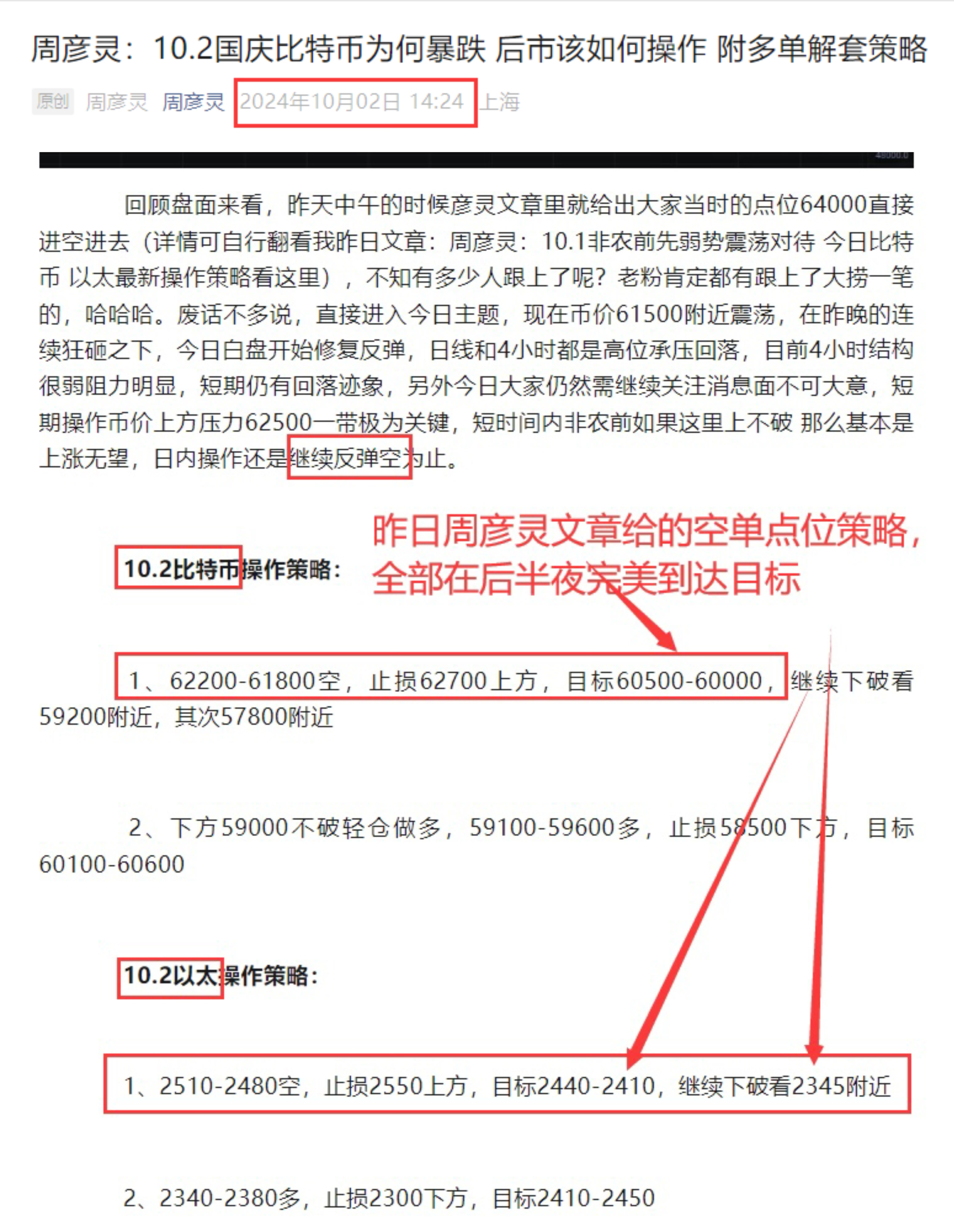

10.3 Bitcoin Trading Strategy:

Short at 62200-61700, stop loss above 62700, target around 60500-60000, continue to look for a breakdown towards 59000.

Long at 59000-59500, stop loss below 58500, target 60200-60700.

10.3 Ethereum Trading Strategy:

Short at 2430-2400, stop loss above 2470, target 2330-2300-2265.

Long at 2270-2300, stop loss below 2230, target 2335-2370.

[The above analysis and strategies are for reference only. Please bear the risk yourself. The article review and publication may have delays, and the strategies may not be timely. Specific operations should follow Yanling's real-time strategies.]

This article is exclusively shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for over ten years, currently mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV, and other cryptocurrency contract/spot operations. For more real-time community guidance, consultation on unblocking positions, and learning trading skills, you can follow the teacher's public account: Zhou Yanling to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。