Original | Odaily Planet Daily (@OdailyChina)

On October 2, Tether CEO Paolo Ardoino stated, “USDT may have initially been just a cryptocurrency, but today it is the most widely used digital dollar in the world,” expressing pride in USDT's current transcendent market position and diverse application scenarios.

As the mastermind behind the “largest stablecoin by market capitalization in the cryptocurrency market,” he certainly has reason and confidence to say such things. After all, stablecoins have always been regarded as the “lifeblood of cryptocurrency” as a “cornerstone product” of the industry.

Following the collapse of the UST algorithmic stablecoin issued by Terraform Labs in May 2022, mainstream stablecoins like USDT and USDC, which are pegged to U.S. Treasury bonds, have gradually become the “cash cow business” for generating stable cash flow in the industry, attracting increasing attention. The market has also begun to view the flow and supply growth of stablecoins as one of the indicators for cycle judgment.

Odaily Planet Daily will provide a brief interpretation of USDT and its issuer Tether in this article for readers' reference.

Tether's Expansion: Starting with Cryptocurrency, Not Just Cryptocurrency

As Tether CEO Paolo Ardoino mentioned, USDT was initially just “a cryptocurrency,” but over time, its usage has far exceeded the scope of “cryptocurrency” and has become a “widely used digital dollar.” Specifically, it has been widely applied in various scenarios such as cross-border payments, daily consumption, and cryptocurrency exchanges.

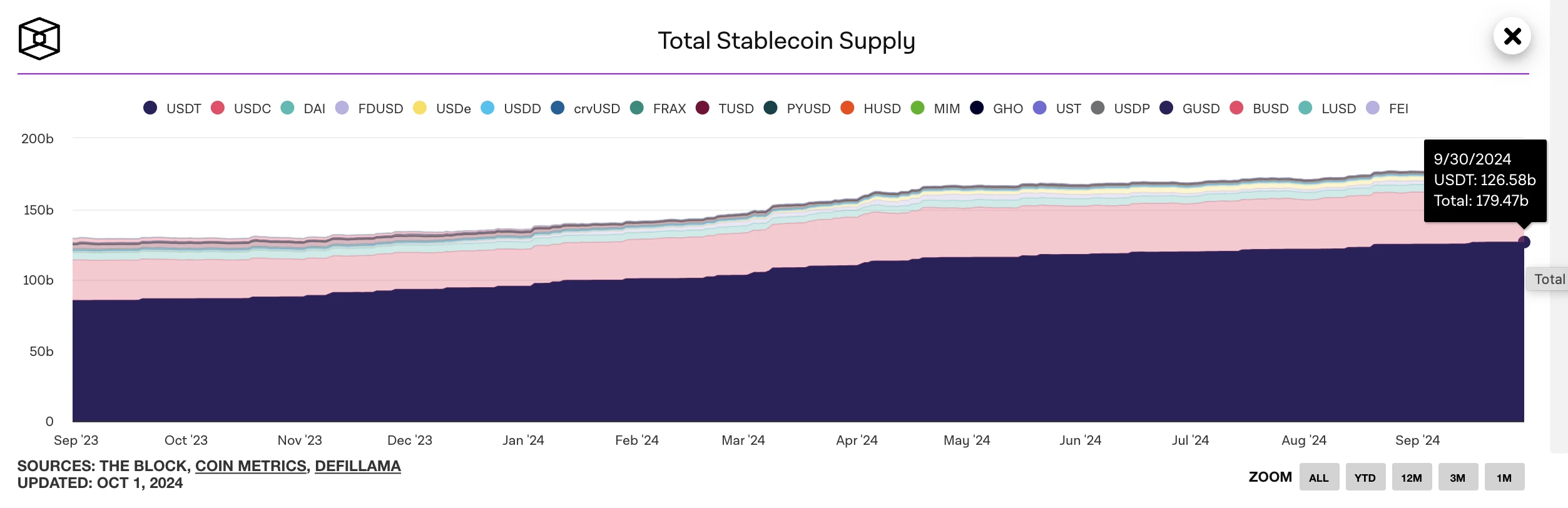

Since 2014, USDT's growth has been steadily increasing. In August 2021, the market capitalization of the stablecoin sector first surpassed $100 billion, with USDT ranking first with a market capitalization of over $65 billion. According to the latest data from IntoTheBlock, USDT's total market capitalization has now exceeded $126 billion, setting a new historical high (Odaily Planet Daily note: the Tether official website shows that the net issuance of USDT is $119,640,575,156.23).

On July 31 of this year, Tether released its Q2 2024 financial report, which showed that its profit for the first half of 2024 reached a record high of $5.2 billion, with net operating profit reaching $1.3 billion, marking the best performance ever. Additionally, Tether's holdings of U.S. Treasury bonds exceeded $97.6 billion, also setting a historical high. According to a previous report by the Wall Street Journal, the funds flowing through the Tether network in 2023 were nearly as much as those processed by global payment giant Visa, with a net profit of $6.2 billion for the year. In other words, Tether's profit for the first half of 2024 is already close to its total profit for 2023. In comparison, asset management giant BlackRock's net profit for common shareholders last year was only $5.5 billion. It’s no wonder that many industry insiders in the cryptocurrency sector exclaimed: “Stablecoins are indeed a stable and profitable ‘good business’!”

Specifically, the usage scenarios of USDT include the following aspects:

Cryptocurrency Market: The “General Equivalent” of Digital Assets

According to information from Tether's official website, exchange users and individual users are its main customer groups. After all, Paolo Ardoino has always been the CTO of the cryptocurrency exchange BitFinex, a title that still appears in his personal account profile; moreover, USDT has become a commonly used medium in daily transactions as the “general equivalent” of cryptocurrency.

Main partner exchanges of USDT

Areas with Severe Inflation: The Best “Substitute for National Currency”

With the development of the global economic situation, some countries and regions are experiencing severe inflation. Building on the “peer-to-peer payment system” legacy of Bitcoin, USDT has become a “substitute for national currency” in many inflation-stricken areas.

Tether CEO Paolo Ardoino previously stated in a media interview: “In countries like Argentina and Turkey, USDT provides a lifeline as a substitute for volatile national currencies. Before USDT was widely adopted, people in inflation-stricken countries had to turn to the black market to obtain dollars (Odaily Planet Daily note: because the global economic system is priced in dollars and the dollar has relatively strong anti-inflation capabilities).”

He also mentioned: “USDT works much better outside the U.S. In the U.S., there are 15 different layers of transmission for the dollar. You have banks, credit cards, debit cards. You have Venmo, PayPal, Cash App, etc.… But who needs a dollar? Imagine a person living in Haiti earning $1.34 a day. How do they pay a $5 transaction fee? These markets cannot afford to pay $5 or $6 in fees for each transaction on Ethereum or other chains.”

This is also one of the reasons why TRON has become the blockchain network with the most stablecoin transactions. Latest data** shows that the total authorization amount of USDT on the TRON network is as high as $61.8 billion, while the total authorization amount on Ethereum is around $55 billion.**

To add, thanks to stablecoin trading and the previous SunPump-driven meme coin craze in the TRON ecosystem, the total revenue of the TRON network in Q3 reached a record $577 million, setting a new historical high, a 43% increase compared to Q2 of this year.

USDT issuance information

International Trade: A “Payment Tool” Recognized by Many

As an important part of the global economic system, international trade (including cross-border e-commerce and other industries) has an urgent and vast demand for quick payments, and USDT has, to some extent, become one of the “payment tools” recognized in this field. After all, compared to the complex, costly, and rule-heavy global SWIFT banking wire transfer system, USDT's advantages are undoubtedly significant: efficient, convenient, stable, and lower cost, with related advantages also explained on Tether's official website.

Of course, with pros come cons; the convenience, anonymity, and high liquidity of USDT also provide a “cushion for gray and black market industries.” As previously mentioned in the Wall Street Journal: “While Tether does vet the identities of direct customers, its vast secondary market remains unregulated. According to a UN report from January this year, USDT is the preferred choice for money laundering in Southeast Asia.”

Reasons merchants choose USDT

Tether's Business Model: The Cryptocurrency Version of the “Federal Reserve”

Looking closely at Tether and its stablecoin USDT's business model, its revenue model and profit sources mainly come from the following aspects:

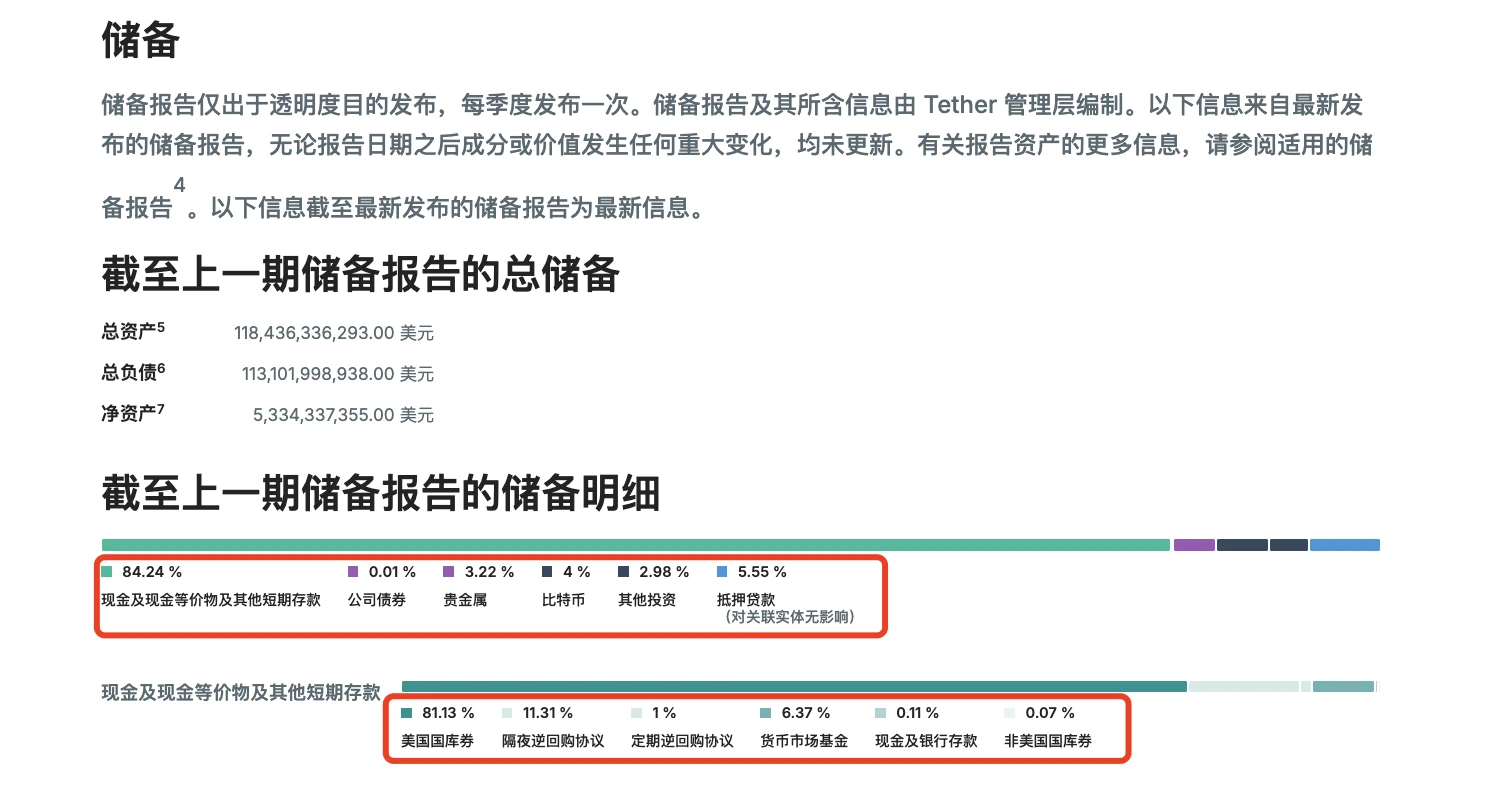

U.S. Treasury Yield: Profit from U.S. Treasury Bonds

According to U.S. Treasury bond holding data, as of July this year, Japan holds $1,115.7 billion in U.S. Treasury bonds; China holds $776.5 billion; South Korea holds $122.7 billion; and Germany holds $101.6 billion. In other words, if Tether were a country, its holdings of U.S. Treasury bonds would be comparable to Germany's and close to South Korea's.

Tether CEO Paolo Ardoino has previously stated: U.S. Treasury bonds provide support for USDT, and if USDT holders want to cash out, they can easily convert it to dollars. At the same time, interest will flow into Tether's treasury. He added, “We (effectively) increase the elasticity of dollar ownership, so no country or decision-maker can sell hundreds of billions of U.S. Treasury bonds at once. USDT and Tether are the best friends of the dollar.”

Earlier in August, he also mentioned: Due to rising interest rates, Tether has achieved extremely high profits over the past two years, currently earning a profit of 5.5% from reserves, with Tether accumulating approximately $11.9 billion in profits over the past 24 months. According to Tether's Q2 report, Tether ranks 18th among countries holding U.S. Treasury bonds.

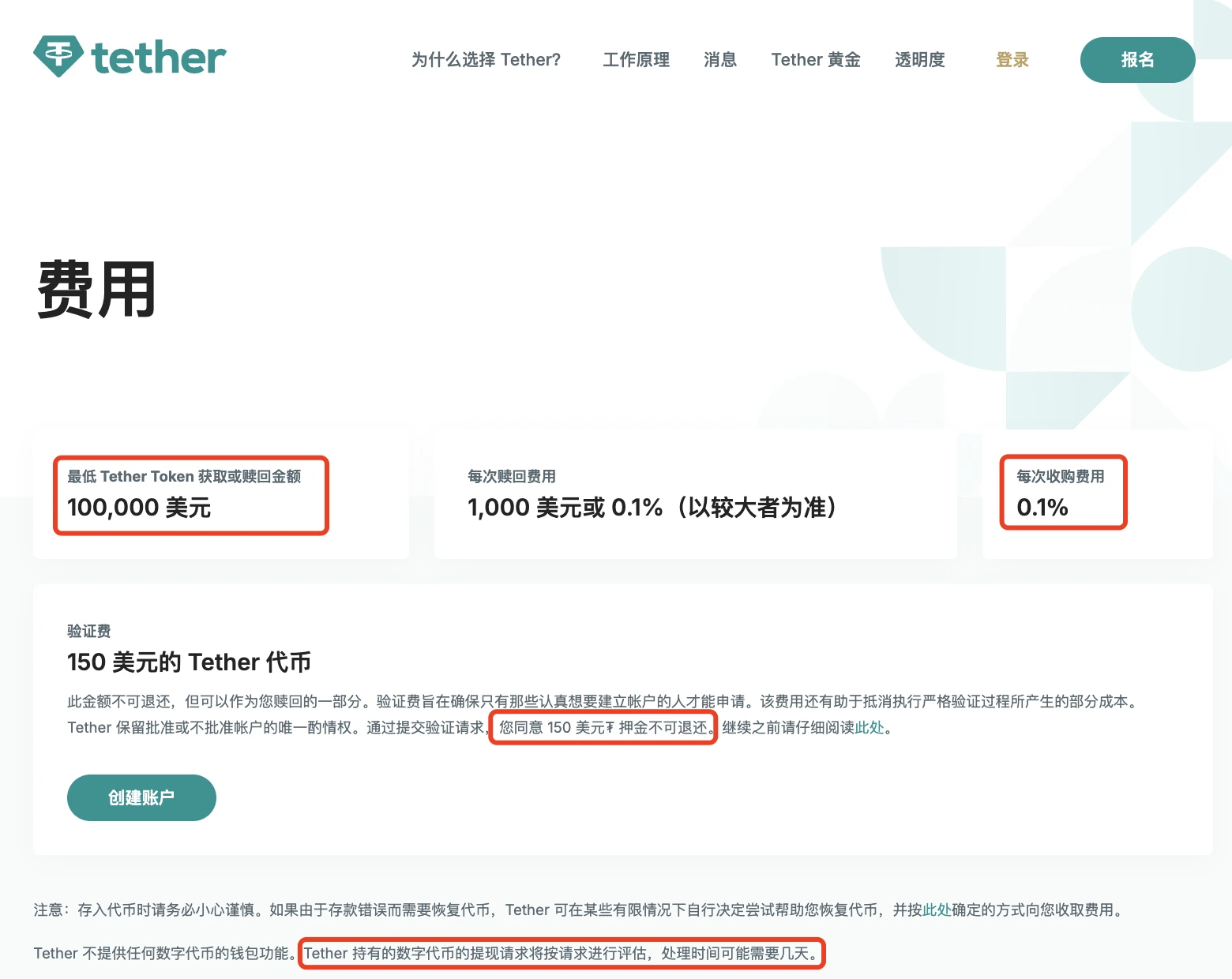

Redemption Fees: Transaction Fees as a Source of Profit

According to Tether's official website, users must meet requirements such as “a minimum amount of $100,000 and a fee of 0.1% for each redemption” during the process of redeeming dollars, with a transaction fee of either $1,000 or 0.1% (whichever is greater). Additionally, users creating an account directly on Tether's official website will need to pay a verification fee of $150, which will be treated as a non-refundable deposit. It must be said that the “stability” of the stablecoin business is not only reflected in the 1:1 peg of the token to the dollar but also in its relatively stable sources of business profit—still the unshakeable truth in the cryptocurrency industry—“transaction fees are the best business model.”

Investment Returns: A Generous Investor Making Moves

In addition to the above business income, as a company with annual profits in the billions, Tether is also a “frequent investor.”

Previously, Tether CEO Paolo Ardoino stated in an interview that “Tether has ample funds and is venturing into unfamiliar new fields such as artificial intelligence, planning to challenge Microsoft, Google, and Amazon. The company has already acquired a majority stake in the neural implant technology startup Blackrock Neurotech and invested in data center operator Northern Data Group, whose infrastructure is used to train AI models.”

It is worth mentioning that although Tether has not yet seen returns from these two investments, its “intermediaries” have already reaped significant rewards. For details, refer to the article: “Wall Street Journal: Behind Tether's $1.5 Billion Spending, the ‘Intermediaries’ Earned Handsomely”, which mentions that Christian Angermayer, a tech investor and entrepreneur commissioned by Tether for investments, invested about $1.5 billion in two companies he holds shares in and earned a substantial commission from the transactions.

Moreover, Tether's investment landscape is not limited to hot tech fields like AI; it previously invested 1 billion dollars in Latin American agricultural giant Adecoagro. Before that, Tether had expanded its business into green energy, Bitcoin mining, artificial intelligence, and educational programs. For instance, it collaborated with the digital payment platform Rezo Money to promote blockchain education in Guinea; similar educational initiatives are also underway in Thailand and Indonesia.

In the cryptocurrency field, its most recent move was a strategic investment of $1.5 million in Sorted Wallet, a platform aimed at promoting financial inclusion in Africa and South Asia. It is evident that Tether, as a “pioneer in cryptocurrency user education,” is highly focused on “potential markets” outside of Europe and the U.S.

Other Income: Returns from Gold Reserves and Cryptocurrency Investments

In addition, according to official information, Tether's reserve assets also include precious metals like gold and cryptocurrencies such as Bitcoin, which can provide certain asset returns and profits. It is noteworthy that the current details of reserve assets have changed significantly compared to the first release of reserve asset details in March 2021, reflecting Tether's transformation in asset reserves in recent years:

Reserve Asset Details as of March 31, 2021 are as follows:

75.85%: Cash and cash equivalents, other short-term deposits, commercial paper

12.55%: Secured loans

9.96%: Corporate bonds, funds, precious metals

1.64%: Others (including digital tokens)

Tether's latest reserve report information

It can be said that holding the issuance rights of USDT, Tether, despite facing regulatory pressures from various countries and regions, can be regarded as the “Federal Reserve of the cryptocurrency field” given its current influence and transcendent market position.

Tether's Future Path: Becoming a Super Dominant Player Among “One Super and Many Strong”

Of course, the strong capital-raising ability of the stablecoin business naturally attracts significant attention from various institutions and platforms. In addition to the closely following stablecoin issuer Circle and its USDC, there are currently many stablecoin products on the market.

Overview of Stablecoin Landscape Classification

According to information mentioned in a previous article by Messari researcher Addy titled “Overview of Stablecoin Market Products and Their Features”, the stablecoin landscape can be roughly divided into dominant players (i.e., USDT and USDC), centralized alternatives, Treasury-backed stablecoins, decentralized stablecoins, lending-type stablecoins, and new design stablecoins including DYAD.

New and Old Competitors Compete

With the recent approvals of Bitcoin spot ETFs and Ethereum spot ETFs, the compliance and mainstreaming process of the cryptocurrency industry has reached a milestone, and stablecoins, as important infrastructure products, have also attracted a gradual increase in participation from both new and old players.

Previously, MakerDAO gradually converted DAI to USDS, while PayPal-supported PYUSD flourished on both Solana and Ethereum networks. On the other hand, established platforms like Robinhood and Revolut have also entered the fray. Although Robinhood later denied speculation about the company entering the stablecoin market and confirmed that Robinhood (HOOD) has no plans to launch its own stablecoin in the short term. Johann Kerbrat, Vice President and General Manager of Robinhood Crypto, stated, “Currently, we have no immediate plans to launch a stablecoin. Rumors are always interesting, but we are not really spending time on this.” According to sources, Robinhood is “exploring” a stablecoin, but specific details have yet to be determined.

Defilama Stablecoin Section Top 16

The Long Road to Compliance

Currently, most of Tether's funds are managed by financial services company Cantor Fitzgerald, whose CEO Howard Lutnick regularly guarantees the stablecoin issuer; in addition, like other competitors, Tether undergoes the same auditing process by large accounting firms, currently partnering with independent third-party accounting firm BDO Italia.

Despite this, Tether still faces regulatory pressures, including the “Lummis-Gillibrand Stablecoin Payment Bill” proposed by U.S. senators in April this year (Odaily Planet Daily Note: This bill aims to implement strict regulations similar to those for banks on stablecoins with issuance exceeding $1 billion and encourages more banks to participate in the stablecoin market) and the new “MiCA” legislation introduced by the EU in June this year (Odaily Planet Daily Note: This legislation prohibits stablecoins from conducting more than 1 million payment transactions or exceeding $215 million in payment transactions daily. Notably, stablecoin issuer Circle subsequently received permission under this legislation to sell its USDC and EURC stablecoins across Europe).

In summary, for USDT and Tether to maintain their transcendent position in the stablecoin field, they will still need to make considerable efforts in future market competition.

Conclusion: Stablecoins May Be the Best “RWA Product”

According to CryptoQuant's research director Julio Moreno, the recent rise in stablecoin market value may contribute to the potential upward trend of Bitcoin and other major cryptocurrencies; the growing market value of stablecoins is a key factor driving the rise in cryptocurrency prices, as they provide liquidity to the crypto market. Currently, the reserves of USDT on cryptocurrency exchanges have reached a historic high of $22.5 billion, as he mentioned: “Stablecoins are like the blood of the cryptocurrency market,” and there is a high correlation between Bitcoin prices and net inflows of stablecoins in September this year.

To some extent, the net inflow of exchange stablecoins can serve as one of the indicators for predicting Bitcoin prices. As the crypto market swings with the global political and economic situation, stablecoins, being one of the cryptocurrencies most closely linked to real-world assets and crypto assets, undoubtedly play a certain “barometer” role.

USDT Reserve Amount on Exchanges

On the other hand, stablecoins represented by USDT, which are pegged to the dollar at a 1:1 ratio, may also be seen as the “best RWA (Real World Asset) product.” Of course, stablecoins issued by centralized institutions still face a series of issues, such as de-pegging risks, centralized blocking processes, and risks of money laundering in gray and black markets. In this regard, the independent non-profit stablecoin rating agency Bluechip, established in July 2023, regularly rates stablecoins from six dimensions: stability, management, technical implementation, decentralization, governance, and external factors, facilitating a more comprehensive understanding and risk prevention of stablecoins in the market.

Regarding future development directions, market participants are concerned about whether Tether will subsequently launch its own stablecoin blockchain network. Tether CEO Paolo Ardoino previously stated in an interview, “Although the company is strong in technology, the future blockchain may become a commodity, so launching a blockchain on our own may not be the right choice. Tether holds a ‘neutral’ attitude towards blockchain. For us, blockchain is just a transmission layer.”

As a “blood type” of the “crypto blood,” whether USDT can connect to more “economic organs” in the future may still need time to verify.

_More information:

_

https://ethereum.org/en/stablecoins/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。