How Tokenization is Redefining Investment and Ownership?

Written by: Kalp

Translated by: Blockchain in Plain Language

This article will explore the vibrant world of Real World Asset (RWA) tokenization. Learn how blockchain technology is transforming the financial industry by converting physical assets like real estate and gold into digital tokens. Dive into conversations with key industry figures, grasp emerging trends, and understand how local innovations like KALP Tokenization are creating waves. The blog provides in-depth insights into key players and future trends, showcasing how tokenization is redefining investment and ownership.

Max and Ella are discussing a blog about the growing trend of Real World Asset (RWA) tokenization, which explains how blockchain technology is changing the way people invest in high-value assets like real estate and commodities. The blog highlights how tokenization breaks down barriers, the latest trends, and key players.

1. Leading Companies at the Forefront

1) JPMorgan Chase

Pioneering Blockchain with Onyx: JPMorgan Chase is at the forefront of blockchain innovation through its Onyx platform. Onyx aims to leverage blockchain technology to streamline financial transactions. The platform enables JPMorgan to issue and manage digital tokens, including tokenized bonds and stocks.

Testing and Implementation: JPMorgan has successfully tested the tokenization of various assets, including bonds and stocks. For example, they conducted a pilot program involving the issuance and trading of tokenized bonds on their blockchain platform. This not only showcases their technological capabilities but also highlights the potential of blockchain to enhance market efficiency, reduce settlement times, and lower transaction costs.

Widespread Impact: By integrating blockchain into their operations, JPMorgan demonstrates that this technology is not only applicable to tech startups but can also be adopted by traditional financial institutions. Their involvement indicates that blockchain is poised to drive transformation in traditional banking and finance, establishing their leadership in digital innovation.

2) Société Générale

Issuing Tokenized Bonds on Ethereum: As one of France's major banks, Société Générale has taken significant steps in asset tokenization by issuing tokenized bonds on the Ethereum blockchain. This initiative is noteworthy as it represents traditional financial institutions embracing blockchain technology to innovate core financial products.

Embracing New Technology: By utilizing the Ethereum blockchain, Société Générale is moving away from traditional financial methods and exploring the potential of blockchain to provide faster and more transparent financial transactions. The use of Ethereum smart contracts allows for automated processes, enhancing efficiency and reducing operational risks.

Impact on the Financial Industry: Société Générale's actions are a strong endorsement of blockchain's capabilities, emphasizing its potential to revolutionize the creation, management, and trading of financial products. Their efforts also contribute to the broader acceptance and application of blockchain technology in the financial sector.

3) Securitize

Streamlining Digital Token Issuance: Securitize focuses on simplifying the issuance process of digital tokens while ensuring regulatory compliance. Their platform helps businesses achieve asset tokenization and provides an efficient process for creating and managing these digital securities.

Compliance: One of Securitize's core strengths lies in its emphasis on compliance with securities regulations. The services they offer ensure that tokenized assets meet legal standards, which is crucial for maintaining investor confidence and ensuring market integrity.

Enhancing Market Liquidity: By providing a platform for the issuance and trading of compliant digital tokens, Securitize enhances market liquidity and accessibility. Their technology supports secondary trading of tokenized assets, allowing investors to buy, sell, and trade these digital securities securely.

4) Tokeny

Supporting Blockchain Integration: Luxembourg-based Tokeny assists institutions in transferring their assets to the blockchain. They focus on ensuring that the tokenization process meets security standards and regulatory requirements, which is vital for institutional adoption.

Platform Features: Tokeny's platform offers solutions for creating and managing tokenized assets, with a focus on security and compliance. They provide tools for secure token issuance, investor onboarding, and asset management, helping organizations smoothly and efficiently enter the tokenization space.

Building Trust and Reliability: By prioritizing security and regulatory compliance, Tokeny helps enhance trust in tokenized assets, encouraging institutional participation in exploring blockchain technology. Their efforts are driving the widespread acceptance and normalization of asset tokenization in traditional financial markets.

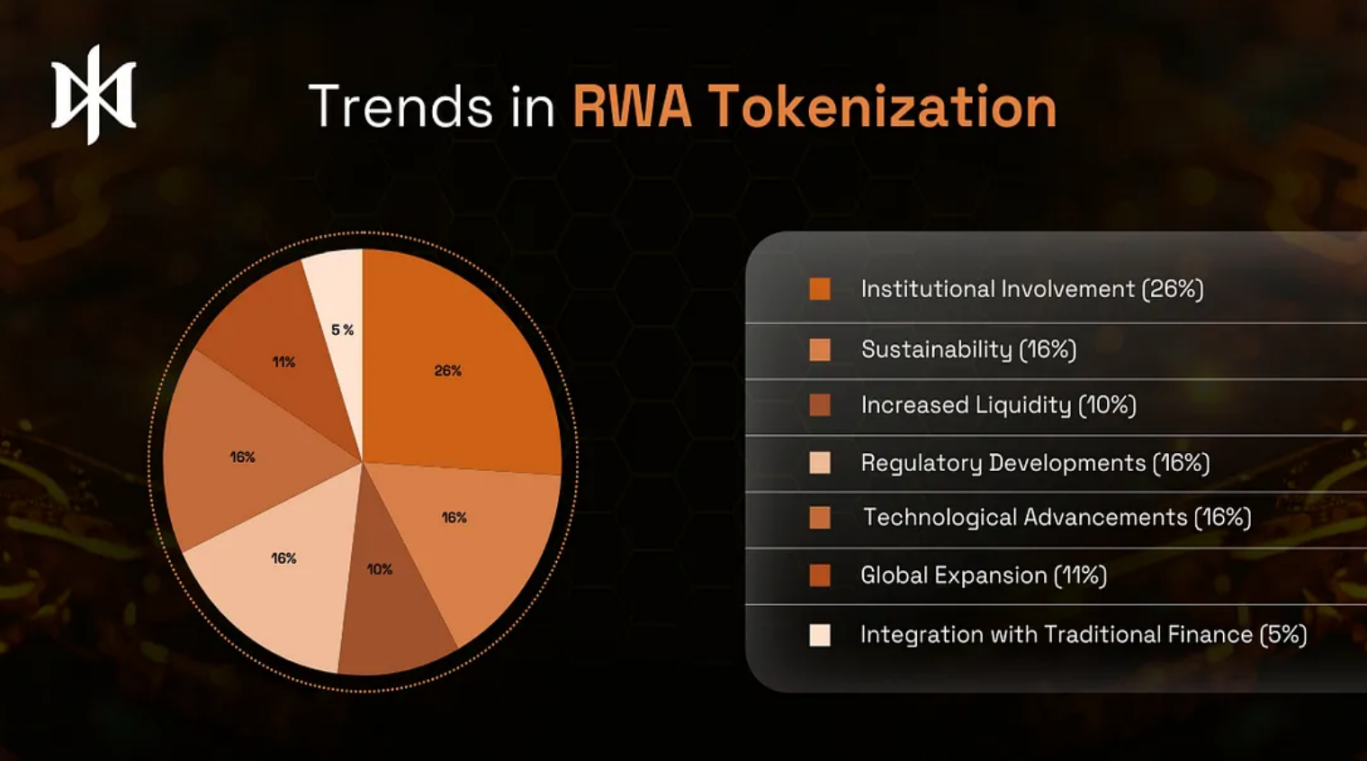

2. What are the Latest Trends in RWA Tokenization?

Institutional Participation: Major financial institutions, including BlackRock, Goldman Sachs, and Fidelity, are increasingly entering the tokenization space, enhancing the credibility and influence of the market.

Sustainability: The tokenization of sustainable assets, such as carbon credits and renewable energy projects, is on the rise, driving investment into environmentally friendly projects while providing financial returns.

Enhanced Liquidity: Tokenization improves the liquidity of previously illiquid or hard-to-access assets by allowing fractional ownership and easier trading.

Regulatory Developments: Evolving regulations and frameworks are shaping the tokenization landscape, with governments and regulatory bodies working to address legal and compliance issues.

Technological Advancements: Innovations in blockchain technology, such as smart contracts and decentralized finance (DeFi) protocols, are improving the efficiency and functionality of tokenized asset platforms.

Global Expansion: Tokenization is gaining widespread attention in various regions worldwide, with significant adoption trends observed in financial hubs like the United States, Europe, and Asia.

Integration with Traditional Finance: The integration of tokenized assets with traditional financial systems is deepening, including partnerships between blockchain platforms and traditional financial institutions.

Increased Market Segmentation: Tokenization is extending beyond traditional asset classes to niche markets and industries, including art, collectibles, and intellectual property.

Improved Transparency and Security: The use of blockchain technology brings greater transparency, traceability, and security to tokenization, addressing common issues in asset management.

Innovative Investment Tools: New investment products and tools are continuously emerging through tokenization, such as tokenized real estate funds and commodity-backed tokens, providing investors with diverse investment opportunities.

3. KALP Tokenization: Global Potential of a Local Story

Back in India, an innovative project called KALP is making waves. They have launched BIMTECH CBDC, a digital currency for transactions in an academic environment. Students, vendors, and administrators have all become part of this tokenized ecosystem. Over 1,300 transactions have been completed, showcasing how tokenization can be applied in real-world scenarios. KALP's GINI Token serves as transaction fees, ensuring the entire system operates efficiently, proving that even small ecosystems can benefit from tokenization.

Tokenization of Commodities

Tokenizing commodities like gold and oil has become a significant trend. Companies like Paxos and Tether Gold enable investors to hold tokens backed by physical gold reserves. This allows for easy trading or investing in commodities without dealing with the complexities of physical assets.

Paradigm Shift in Real Estate

Real estate is one of the most exciting areas for tokenization. Platforms like RealT and tZERO allow people to purchase fractional ownership of properties. This means you can invest in real estate without having to buy an entire property. It opens up real estate investment to everyone, not just the wealthy.

4. Navigating the Regulatory Environment

Governments around the world are beginning to recognize the potential of tokenization and are supporting this trend through regulatory measures. For example, the EU's Markets in Crypto-Assets Regulation (MiCA) and the increasing attention of the U.S. Securities and Exchange Commission (SEC) on tokenized securities are paving the way for widespread adoption of tokenization. As these regulations become clearer, institutions and individuals will find it easier to safely and legally tokenize assets.

In summary, the pace of global RWA tokenization adoption is accelerating, and it will change our perceptions of asset ownership and trading. Whether it’s giants like JPMorgan Chase or innovative local projects like KALP, tokenization is gradually becoming integrated into our daily financial lives. With the rise of trends like sustainability and fractional ownership, we are moving towards a more inclusive and efficient financial world.

5. Frequently Asked Questions

1) What are the trends in asset tokenization?

Asset tokenization is rapidly growing as it offers higher liquidity, fractional ownership, and more convenient investment opportunities. This trend is driven by advancements in blockchain technology and the increasing interest from retail and institutional investors.

2) Which countries are leading in the adoption of RWA tokenization?

Countries like the United States, Switzerland, and Singapore are at the forefront of RWA tokenization, thanks to their developed financial markets, supportive regulatory frameworks, and innovative technological ecosystems.

3) How are institutions participating in RWA tokenization?

Institutional participants, including major banks, asset management firms, and investment companies, are increasingly engaging in RWA tokenization to enhance liquidity, streamline operations, and open new investment avenues.

4) How large is the market for tokenization of real-world assets?

The RWA tokenization market is growing rapidly, expected to reach approximately $2 trillion by the mid-2020s, driven by increasing popularity and technological advancements.

5) What are the main challenges hindering global adoption of tokenized assets?

Key challenges include regulatory uncertainty, technological integration issues, and concerns about security and market fragmentation, which hinder the widespread adoption of tokenized assets.

6) What is the estimated market size for RWA tokenization?

As of 2024, the RWA tokenization market is estimated to be around $10 billion, reflecting the early but expanding stage of this field within the broader financial landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。