The essence of trading is survival, and only then comes profit. Therefore, before each operation, think carefully about whether your actions are reasonable and whether your capital is safe. You need to develop a trading mindset that belongs to you, continuously optimizing and improving it. Although the advice from the crypto circle academicians may not make you rich overnight, it can help you stay in the game. Only those who survive in the crypto space for the long term and persist until the end can achieve the results they desire. I hope you understand.

I am a warrior in the crypto circle, always protecting the retail investors. I wish my followers financial freedom in 2024. Let's work hard together!

Crypto Circle Academician: October 2, 2024 Ethereum (ETH) Latest Market Analysis Reference

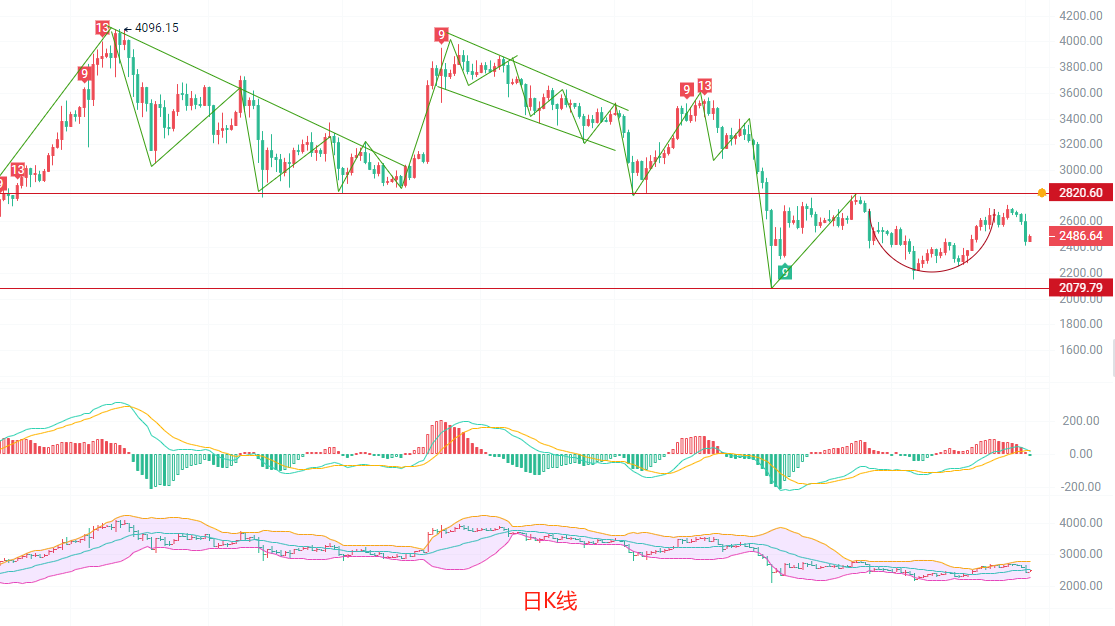

For two consecutive days, I have been going long at the 2600 mark. After two days of breaking the premise, I exited. Fortunately, my instincts are sharp. The long positions failed twice in a row. You can see that the daily K-line dropped from 2660 to 2400 yesterday, which can be considered a small-scale liquidation. At this time, being able to avoid liquidation is impressive. You must have a sense of safety awareness; only in this way can you avoid every liquidation and prevent being decentralized.

Looking at the order book, Ethereum's current price is testing the 2500 resistance level. Currently, the daily K-line has broken the EMA trend indicator and has a short-term stretch. You can pay attention to the upper EMA30 resistance level at 2540. Therefore, for short-term longs, watch the pressure ahead. If the pressure is not broken, exit the long position. You can try going short. The MACD death cross has formed and is starting to shrink. The bullish trend will not end unless it breaks 2530. Pay attention to the Bollinger Bands' middle resistance level at 2525. The KDJ is still pointing down, and the main trend is bearish.

After the four-hour K-line broke the EMA trend indicator, it began to continuously move down in a mesh-like alternating spread. EMA15 is also pushing down towards the EMA120 resistance level at 2550. The MACD shows a decrease in volume and a bottom divergence. The DIF and DEA are expanding downwards, and the Bollinger Bands are opening. The lower support level to watch is 2460. The Bollinger Bands are starting to contract, indicating that the trend is leaning towards sideways movement in the short term. Therefore, today's market will likely consolidate at the bottom.

Short-term reference: Safety first. Remember that the market is never 100% certain, so always set stop-losses. Safety first, small losses with big gains is the goal.

For longs at 2400 to 2430, target 2480 to 2510, with a stop-loss of 30 points.

For shorts at 2530 to 2550, target 2480 to 2450, with a stop-loss of 30 points.

Specific operations should be based on real-time data from the order book. For more information, you can consult the author. There may be delays in article publication; the suggestions are for reference only, and risks are borne by you.

This article is exclusively contributed by the Crypto Circle Academician and represents the unique views of the Academician. In-depth research has been conducted on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above views and suggestions may not be real-time and are for reference only. Risks are borne by you. Please indicate the source when reprinting. Manage your positions reasonably and avoid heavy or full positions. The Academician also hopes that all investors understand that the market is always right. If you are wrong, you should reflect on where the problem lies. Do not let the profits that should be yours slip away. There is no need to be smarter than the market. When a trend comes, respond to it; when there is no trend, observe and remain calm. It is not too late to act once the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, the earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards passion. Gains and losses often occur unexpectedly. Develop the habit of strictly setting stop-losses and take-profits for each trade. The Crypto Circle Academician wishes you happy investing!

Warm reminder: The above content is solely created by the author of the public account. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。