The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens.

Today's article theme is only four words: harmony brings wealth. On the military and political levels, they are greater than everything else; all analysis seems so naive in the face of the moment before war. Lao Cui has not slept all night, resolving countless positions, and finally at this moment can share some insights with everyone. Life is unpredictable; many friends trading contracts may have already been liquidated or are on the verge of liquidation. This is the crypto world, where life is unpredictable, capable of giving everyone infinite surprises, but can also bring everyone back to zero overnight. The rise and fall are constant; many friends are asking Lao Cui about the subsequent trends. Now the fate of the entire crypto world has been handed over to Israel and Iran. We are not afraid of large-scale wars, but small-scale conflicts will inevitably cause losses in the crypto world. Financial stability is beneficial for the growth of the crypto world, but retaliatory wars are likely to be difficult to control. Even the Americans cannot control the situation, so do not hold too high expectations for Lao Cui's analysis.

Today, we will not discuss linear aspects; discussing linear matters at this stage would be too naive. From a purely military perspective, Iran does not have the intention to escalate the war. If they did, they would have directly stepped onto Israeli territory under a barrage of missile attacks. Currently, the military impact may stop here. This depends on the statements from both sides today. If the war can stop here, the market will still maintain a growth state. It can be said that the situation in the past week has been dominated by the war. From the perspective of core interests, Iran's retaliatory measures have already achieved their initial goals, and there is no reason to escalate the war. Israel also has no reason to escalate the situation, as there are already three opponents in the Middle East. Continuing to fire at Iran would only make the situation harder to control. We can only see if Israel can accept this blow. If Israel can speak to stop the conflict with Iran, well, overall, harmony brings wealth, and the biggest loss from both sides' exchanges is actually the crypto world.

There is no need to look too much at the capital level; the panic caused by the war has directly led to a mass exodus of retail investors. Since neither Israel nor Iran are holders in the crypto world, this wave of war is different from previous ones and will not cause asset transfers. In the short term, for a rebound to occur, the two sides must reach a consensus to not spread the impact of the war, and the crypto world can rebound. Regarding your layouts, Lao Cui will first talk about my own layout. From beginning to end, I still firmly believe that a bull market will come, and I have also added ten percent to my position during this decline (only in spot). As long as there is a decline, it must be primarily for adding positions. In a bear market, not adding positions means that when the bull market arrives, it will be very difficult for everyone to enter the market, and there may not even be opportunities to enter. If you want to wait for the right time to enter, it would be wise to wait until this military conflict ends before entering. My entry was entirely due to the fact that I had to add to my existing spot positions.

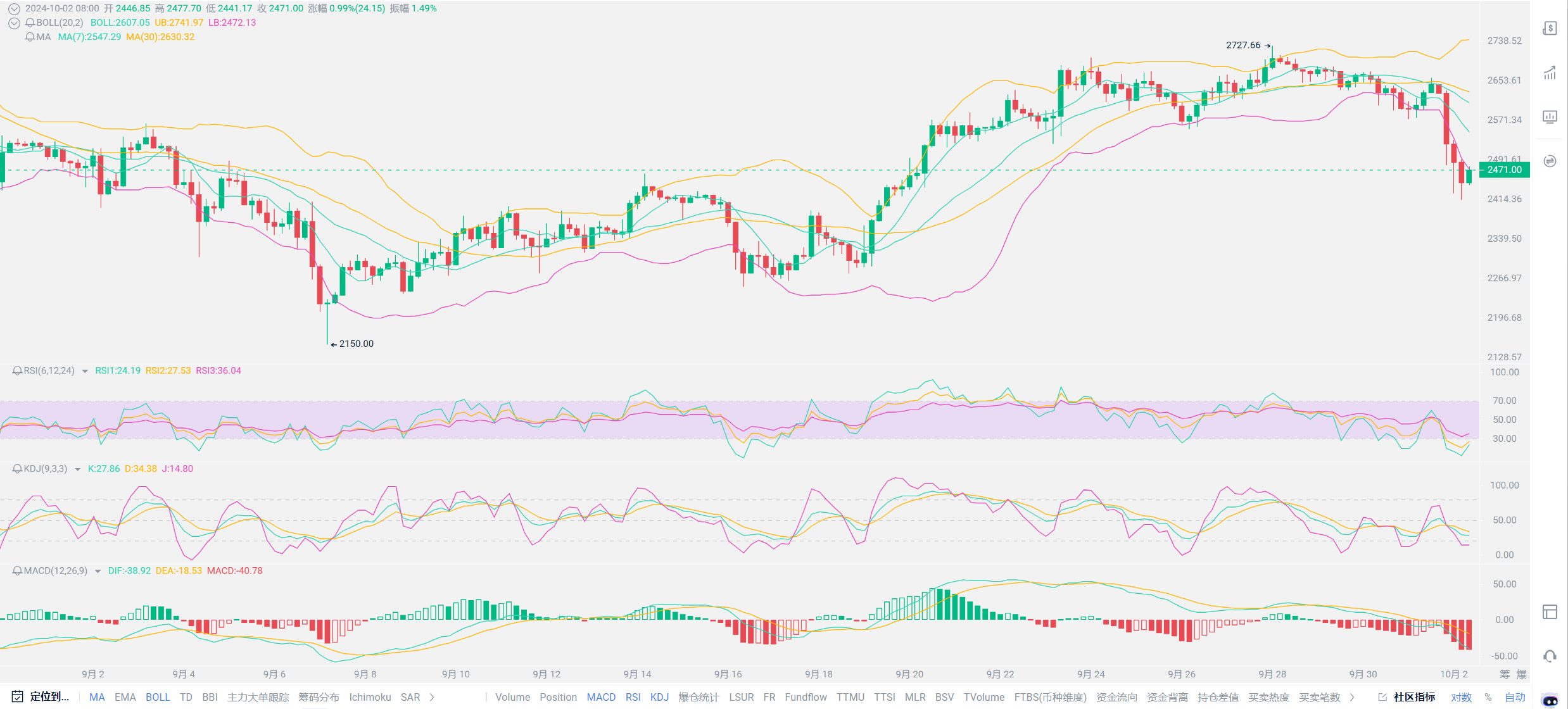

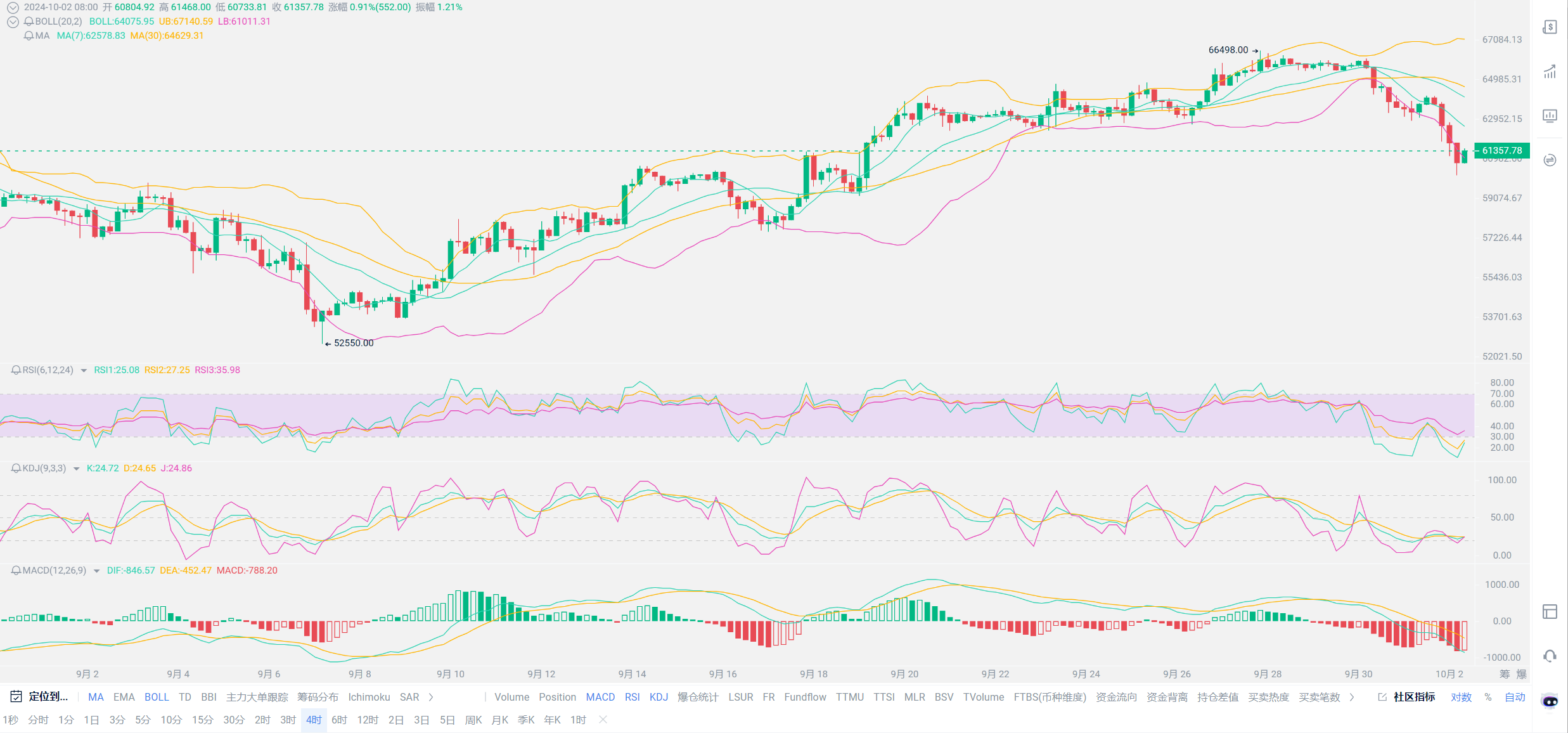

For spot users, everyone’s entry point is around 2300, and there is a potential profit of 100 points if you want to exit. From my personal experience, it is still necessary to observe both sides' attitudes. The overall performance of the crypto world has been relatively bright; Ethereum has been quite strong, while Bitcoin dropped from 64000 to the 60000 mark overnight, with Ethereum only fluctuating by 200 points, in the 2600-2400 range, indicating Ethereum's strength. Holding spot Ethereum requires a preparation of more than six months; the short-term impact of this war will not harm the overall trend. However, one thing that will change significantly is the bulk commodities, energy, and gold markets. The continuation of the war will definitely lead to growth in these three areas. Many friends do not understand why the crypto world reacts so violently whenever a local war begins. This is because the crypto world currently belongs to tech stocks, which are typical future stocks. As long as there is a real war impact, it will certainly reduce the future tech stocks.

Lao Cui summarizes: From a broad perspective, the overall trend impact is not strong. As long as the war is clear, the crypto world will continue to maintain a bullish trend. For spot users, maintaining a diversified entry is the absolute trend. Contract users should try to maintain a wait-and-see attitude; small positions can attempt to enter some long positions, but as long as the war continues, long positions cannot be held. Currently, there are still users holding long positions in the market; today there will be some rebound and repair phenomena, and everyone can choose their suitable exit points. It is important to note that the continuation of the war can be said to be determined by the statements from both sides today, which will be a factor in the short-term trend of the crypto world. For spot users, my thought remains to respond to changes with consistency; ultimately, the impact of the war is only the first wave, and the subsequent continuation of the war's trend will not have a significant impact on the crypto world. Users with ample assets can observe the fluctuations in the energy market and bulk commodities without too much worry. The bull market will not end because of the war; the central idea is to focus on the statements from both sides. If there are uncertainties, it is best to consult Lao Cui before making decisions. Although I cannot resolve the impact of the war, general advice still holds certain reference value. Today's trend will definitely revolve around a bullish repair market (provided that the war does not escalate or spread), and there will be no alternation between bull and bear. Whenever the war ends, the bull market will continue its trend.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。