Key Indicators: (Hong Kong Time September 23, 4 PM -> Hong Kong Time September 30, 4 PM):

BTC/USD unchanged ($63,500 -> $63,500), ETH/USD down 1.5% ($2,640 -> $2,600)

BTC/USD December (year-end) ATM volatility decreased by 2.6% (59.4 -> 56.8), December 25d risk reversal volatility decreased by 0.5% (3.2 -> 2.7)

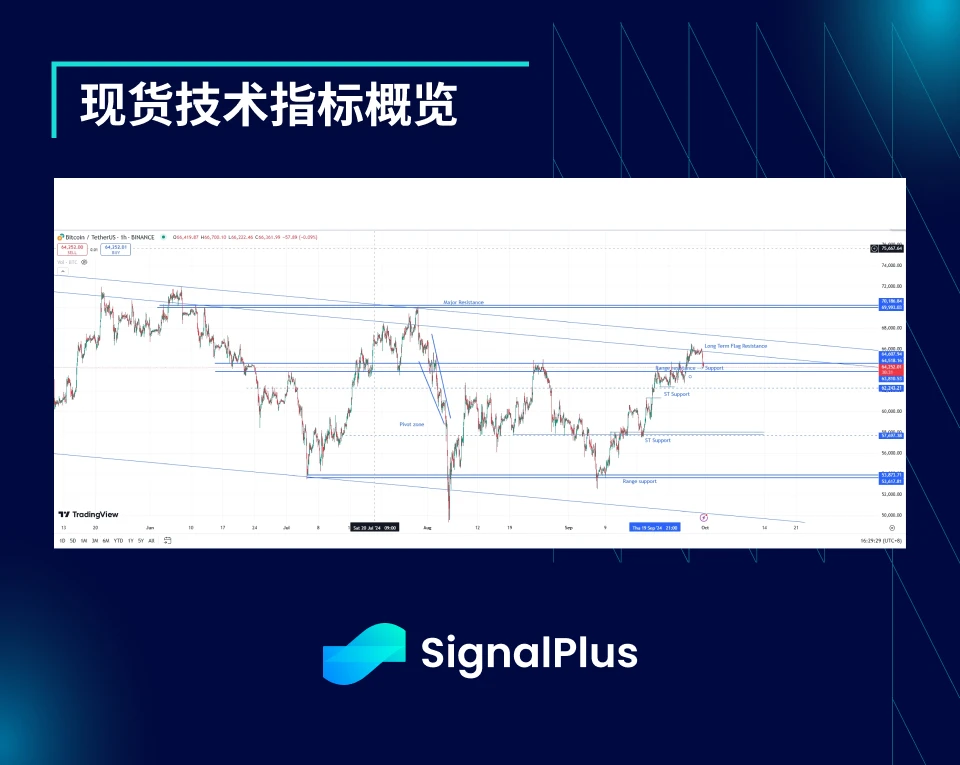

Spot Technical Indicators Overview

The market briefly broke through the key resistance level of $65.2-66k, but the price action was once again blocked here, marking the first challenge to the long-term flag resistance as a failure so far.

The resistance in this range can now be viewed as short-term support; if broken, the price may drop to $62.5k.

Long-term structurally bullish, but short-term tactics remain neutral; patience is needed to wait for a clear signal to break $66k before considering adding new long positions.

Major Market Events:

China has finally introduced the long-awaited stimulus policy, sparking a new bullish trend in regional stock markets and boosting growth expectations. If China's stimulus policy is successful, its transmission effect is expected to keep global inflation at a high level, which may lead to a decline in real interest rates globally, especially against the backdrop of most G10 countries (excluding Japan) being in a rate-cutting cycle. As a result, cryptocurrency prices rose at the beginning of the week, challenging local range highs, but then retreated, ultimately remaining unchanged for the week.

Despite favorable comments for cryptocurrency from the Harris camp last week, the polling results for the U.S. presidential election have returned to a near 50/50 situation. It is expected that both camps will continue to court the cryptocurrency community before the election, so we need to remain cautious about this news, especially regarding any potential 'policy shifts' from Harris / the Democratic Party.

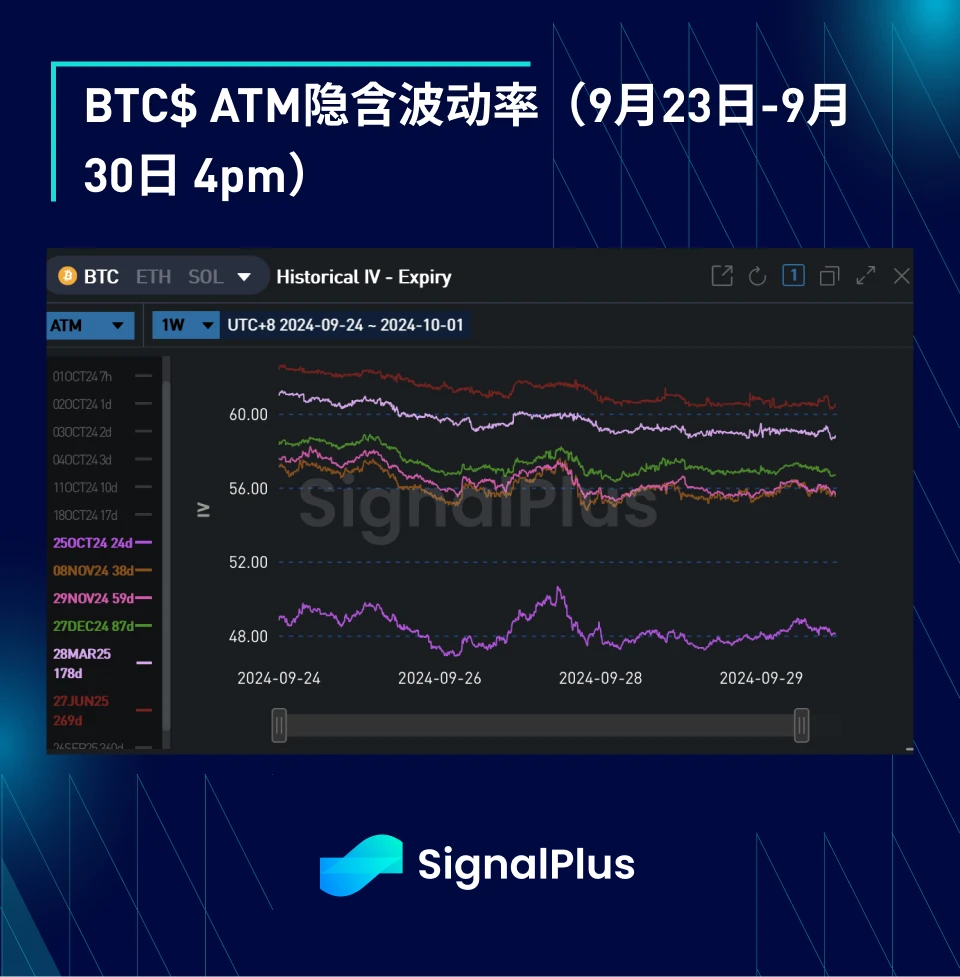

ATM Implied Volatility:

BTC $ATM Implied Volatility (Hong Kong Time September 23-30, 4 PM)

Actual volatility remains extremely low, with spot prices rising from $63.5k to $66k last week, but there were large sell orders before the key resistance level. High-frequency trading and fixed-term actual volatility are around 35%, while intraday implied volatility is in the 45% - 50% range.

Due to the lack of upward momentum in actual volatility and no new catalysts, volatility prices have dropped significantly this week. The volatility of options expiring in November has decreased by over 2vol. The current risk-friendly macro environment seems to support a "buy the dip" strategy, but this strategy tends to suppress volatility. A substantial price breakthrough will require more relevant news, such as the U.S. election or support for Trump.

We expect that as spot prices consolidate in the $62.5-65.5k range (failing to break the upper resistance), Gamma (which also affects front-end implied volatility contracts) will remain weak in the coming weeks.

As the market removes risk premiums from the implied volatility curve, election event volatility has decreased again; with less than 4 weeks until the election, market attention will inevitably shift to the next potential catalyst in this cycle, and we expect event volatility pricing to rise as the election approaches.

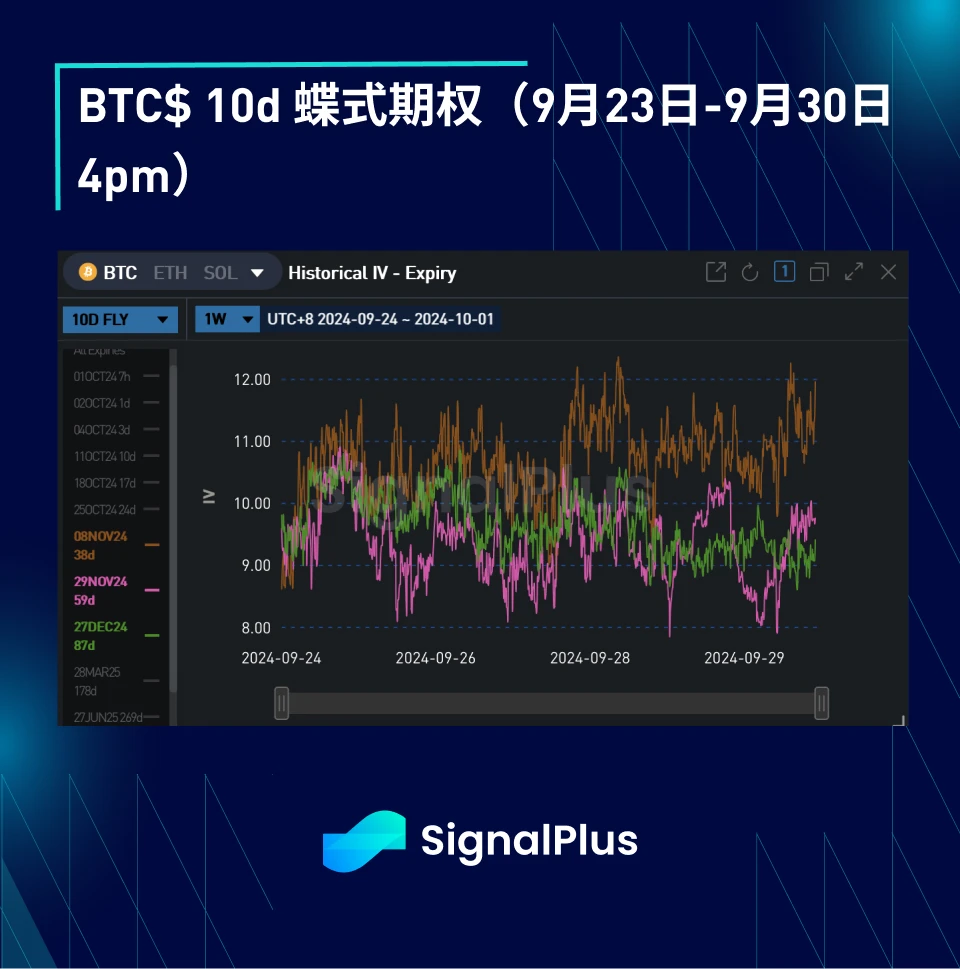

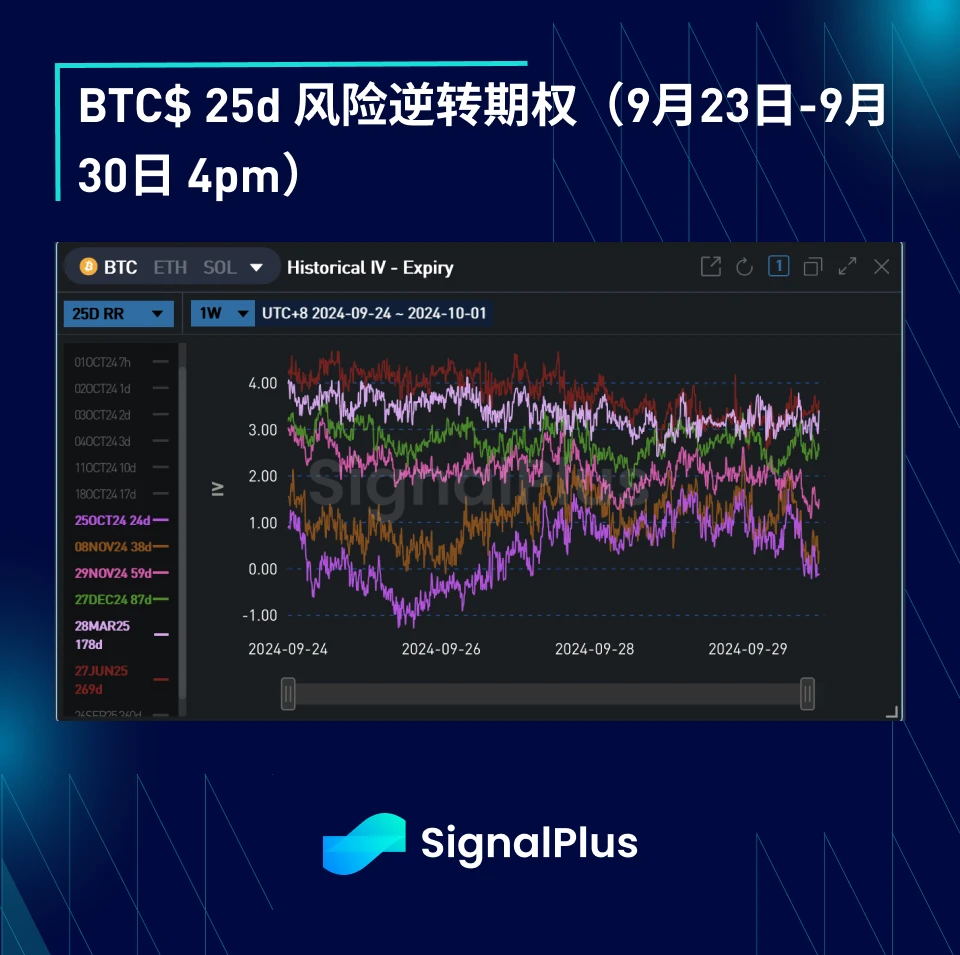

Skew/Convexity:

Despite the rise in spot prices mid-week, skew prices retraced last week's upward trend as both actual and implied volatility declined. The covered call strategy and poor volatility performance when spot prices rise led to the liquidation of skew positions.

Due to increased market demand for price breakthroughs on both sides, the butterfly spreads have risen this week, especially during the election period, which has driven up the pricing of November butterfly spreads. We anticipate that volatility will rebound on either side of the $60-70k range, making this pricing generally reasonable.

Wishing you good luck this week!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。