EIGEN On-Chain Data Analysis

First, let’s summarize for everyone:

1) Total supply is 1.67 billion, with an initial circulation of 187 million.

2) 100 million has been staked, and there are already 10 million in Binance trading. After removing other exchanges, there are approximately 20 to 40 million still on-chain, which is potential selling pressure.

3) From a short-term perspective, after removing the staked amount and the unclaimed 110 million, the actual circulation is 80 million, with a circulating market value of 320 million USD. It seems manageable; we can play around a bit.

4) From a long-term perspective, the project team has distributed a large amount of locked tokens across many addresses and mixed them. This little trick is obvious to anyone; the intent for dark box operations is glaringly apparent, similar to the strategies of OP and ARB. Therefore, I will keep my distance from long-term positions.

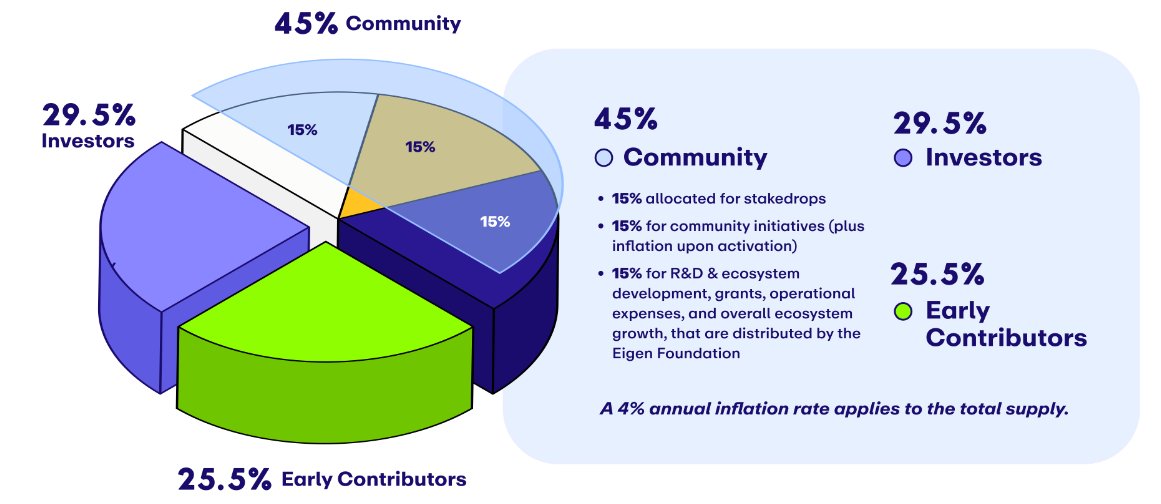

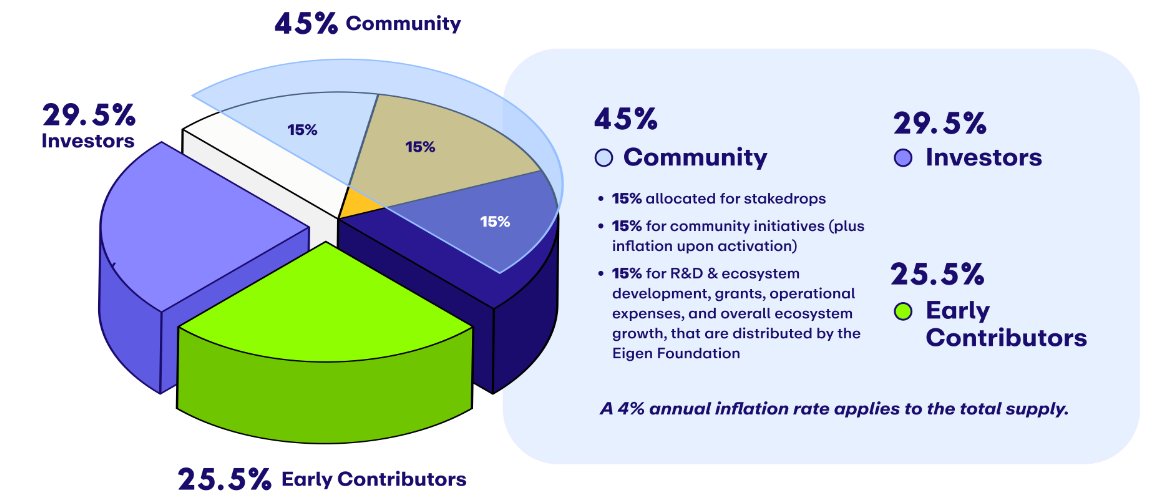

The initial supply of EIGEN TGE is 1,673,646,668.

TGE date is October 1, 2024.

Annual inflation rate is 4%.

Early contributors: 25.5%

Unlocking method: Locked for one year, then unlock 4%, with an additional 4% unlocked each month.

Investors: 29.5%

Unlocking method: Locked for one year, then unlock 4%, with an additional 4% unlocked each month.

Community: 45%

Stakedrops: 15% of the total supply is used for staking, approximately 251,047,000 EIGEN. Of these, 186,582,000 EIGEN were claimed in the Stakedrops of the first and second quarters. As of September 30, 2024, approximately 158,774,855 EIGEN have been claimed.

Community incentives: 15% of the total supply is distributed to users, developers, and community contributors through incentive programs and grants. They are not locked but are not circulating.

Research and ecosystem growth: 15% of the total supply is used to support ecosystem development, research programs, and operational expenses of the Eigen Foundation. They are not locked but are not circulating.

- Unlocking method: Tokens will be unlocked over one year, with an initial lock-up period, followed by proportional releases.

According to the official documentation, the circulating EIGEN at TGE is only the amount from two airdrops, which is 186 million tokens.

From on-chain data, the current on-chain EIGEN is 1.68 billion.

Holding address 1: Community portion, allocation ratio 45%, which is 753 million tokens. This address holds 464 million tokens. The transferred portion was given to airdrop addresses and then dispersed into multiple wallets. There is mutual mixing in between, aimed at obfuscating tracking. This is similar to the practices of OP and ARB.

Holding address 2: Team and investor portion

Allocation ratio 55%. This address was generated from a black hole and transferred 836 million tokens. This corresponds exactly to the share of the team and investors. However, the project team still dispersed the tokens into many wallets. Some addresses also conducted multiple transfers. This is as disgusting as OP and ARB.

Holding address 3: Staking address, with a total of 98.27 million staked.

Holding address 4: Project team’s dispersed token address.

Holding address 5: Binance exchange.

Holding address 6: Project team’s dispersed token address.

Holding address 7: Project team’s dispersed token address.

Holding address 8: Airdrop wallet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。