Original Author: Shlok Khemani

Original Title: "Actively Validated Services, How EigenLayer is unshackling crypto entrepreneurship"

Original Translation: zhouzhou, BlockBeats

Editor's Note: EigenLayer is changing the way entrepreneurship operates in the crypto space, similar to how AWS transformed the startup economy before it. By providing a reliable pool of validators (operators), EigenLayer enables new protocol developers to easily access technical services without needing to stake their native tokens. This not only reduces startup costs but also allows projects to provide security through established assets (like ETH), thereby decreasing the need for token issuance. As more innovative projects emerge, EigenLayer may lead the next wave of entrepreneurship, inspiring further experimentation and development.

NFTs, DAOs, and DeFi have been crucial primitives in gradually disrupting the financial system. Shared security is another key component of this evolution. EigenLayer has become an important player in this ecosystem, with its token set to become transferable on September 30.

We see this as Web3's "AWS moment"—a pivotal point, akin to the mid-2000s when server costs decreased, leading to a reduction in the costs of crypto economic security. Today's article will delve into how Actively Validated Services (AVS) work and the logic behind them.

The progress of civilization is measured by how much more we can accomplish without thinking. — Alfred North Whitehead

At the end of 2002, eight people attended a tech conference hosted by Amazon at its headquarters in the old Pacific Medical Center. Despite the small turnout, this meeting became a turning point for Amazon's fate, the startup economy, and even the development of capitalism. On this day, Amazon launched the first version of Amazon Web Services (AWS).

Jeff Barr was one of the eight attendees at the AWS launch event and soon joined the AWS team. He is now the Chief Evangelist for AWS and frequently explains new AWS features through the Lego blog. (Image Source)

The checklist for starting an internet company in the 1990s and early 2000s (not exhaustive): physical servers, networking equipment, data storage, software licenses for databases and operating systems, secure facilities for hardware, a team of system administrators and network engineers, and robust disaster recovery and backup solutions. All of this would cost at least $250,000 and the setup process could take months or even a year.

Surprisingly, these infrastructure costs had little correlation with the unique products or services of the company. Whether you were starting a pet store or a social media platform, you had to go through the same process from scratch. It is estimated that 70% of engineering time was spent on building and maintaining data centers, with only 30% dedicated to actual business.

By introducing cloud computing, AWS fundamentally changed the economic model for startups through a flexible pay-as-you-go model, eliminating the upfront investment of time, energy, capital, and manpower. Transforming infrastructure from capital expenditure to operational expenditure allowed small teams with revolutionary ideas to quickly launch and validate their hypotheses. Many of these teams eventually grew into companies like Stripe and Airbnb.

Around the same time, an anonymous programmer named Satoshi Nakamoto changed the structure of capitalism in another way. He found a method for globally distributed computers to reach consensus without needing to trust each other, solving a problem that had plagued computer scientists for decades—a groundbreaking innovation in the history of technology.

While Nakamoto's Bitcoin primarily utilized this trustless distributed system to maintain a payment ledger, Vitalik Buterin founded Ethereum, expanding its functionality to support any general computation. Over time, other applications of such systems gradually emerged—from decentralized storage networks like Filecoin to oracle networks like Chainlink, which can securely provide real-world data to blockchains.

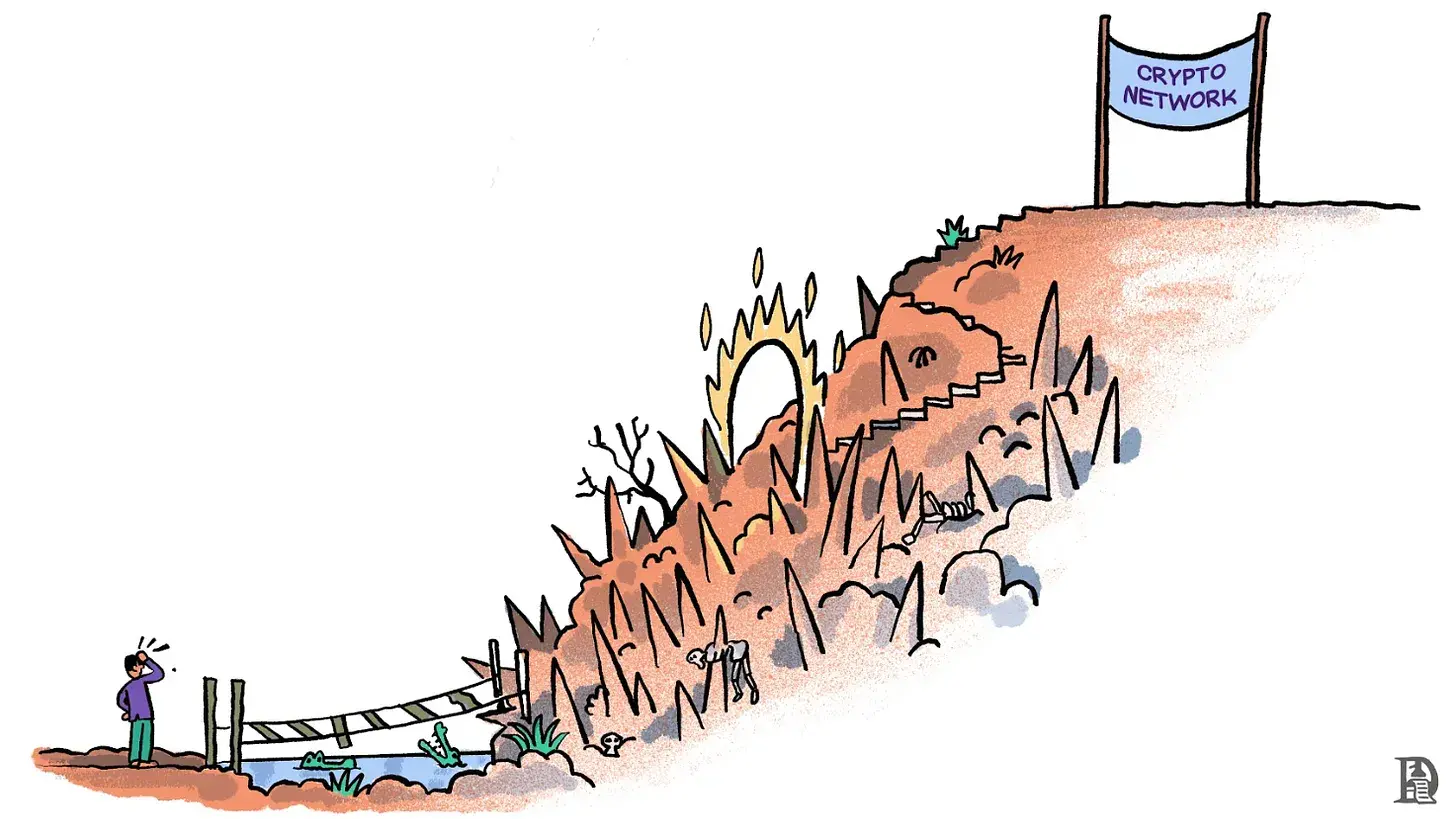

However, building such a decentralized network from scratch is a process akin to creating an internet company before AWS—costly, resource-intensive, and often unrelated to the core issues the network aims to solve. Given that many of these networks involve real-world funds from the outset, any mistakes can have catastrophic consequences.

When a problem affects enough people, solutions will emerge. Amazon made it easier to start an internet company, and now the EigenLayer team is providing similar support for those looking to build trusted distributed computing networks. Each network built on EigenLayer is referred to as an "Actively Validated Service" (AVS).

Before diving deeper into AVS, we first need to understand why launching a distributed network is so challenging.

Challenges

Let’s revisit the core issue: you have a global computer network where each computer operates independently, and you need to reach consensus on a common fact among these mutually distrustful nodes. This fact can be anything—a token balance in an account, the stock price of NVIDIA, the result of a complex computation, or the availability of files on the network.

Nodes in these networks may have incentives to manipulate the facts, such as falsely reporting a token balance that is higher than the actual amount. However, as long as the majority of nodes in the network agree on the actual truth, malicious actors can be ignored. When a majority of nodes agree on a state that deviates from the truth, the situation becomes dangerous, and the network is threatened.

Nakamoto cleverly combined concepts from cryptography and game theory to create Bitcoin's proof-of-work (PoW) system to solve this problem. Today, most networks use a variant of PoW—proof-of-stake (PoS)—which includes four key elements:

- Cryptography: Prevents identity spoofing and ensures the integrity and authenticity of data in the network.

- Reward Mechanism: Real participants (validators) receive economic incentives through user transaction fees and newly minted tokens in the network.

- Penalty Mechanism: Malicious actors face economic penalties; validators must stake the network's native tokens to participate, and if they engage in malicious actions, their staked tokens may be destroyed (slashed).

- Distribution of Power: Having more well-distributed and staked validators makes the network more resilient to attacks.

PoS networks allow ordinary users to delegate their tokens to validators and earn a portion of the validators' rewards. However, this method also exposes users to risks—if the chosen validator acts maliciously, the user's stake may be slashed.

On some blockchains (like ETH and Solana), protocols allow stakers to exchange their native tokens for liquid tokens (for example, Lido provides stETH tokens for Ethereum stakers), and these derivative assets are known as liquid staking tokens (LSTs).

In this context, imagine you are a team looking to build a PoS network from scratch. You first need to find a group of validators—those with technical expertise and hardware who are willing to join your network. You might find these individuals on Discord and X (formerly Twitter). However, to attract their attention among numerous competing projects, you need to either excel in marketing or secure substantial venture capital support.

Once you have their attention, convincing them to join your network is no easy task. Remember, validators either stake their own capital as collateral or need to expend effort to attract others to stake. Since your network is still in its early stages, the value of the token may not be high. Why would validators risk acquiring a token that could plummet at any moment, especially when they are already facing volatility risks from other network assets?

Your best strategy might be to increase rewards: offering higher returns to validators (and stakers) to compensate for the greater risks they are taking, which also explains why the annual percentage yield (APY) for staking in nascent networks is often high. But the problem is that high issuance is effectively an indirect cost to the entire network, which could dilute the token's value.

Even if you successfully address these challenges, the number of validators in the early stages may still be below the ideal state. The scarcity of validators reduces network security, making it more susceptible to majority attacks. Additionally, you need to consider other factors, such as the geographical distribution of validators, creating secure and audited client software, and planning infrastructure elements based on the project's specific needs, including data availability, transaction ordering, confirmation services, and block proposals.

Similar to internet startups before the advent of AWS, these steps are both time-consuming and resource-intensive, and they are not directly related to the core issues your network is trying to solve.

Security as a Service

Recently, I explored how the internet has spawned a new generation of enterprises (platforms) that create value by efficiently connecting supply and demand. In the scenario we just discussed, there is a group of validators—the "supply side"—who want to earn money by providing technical services while minimizing financial risks. The "demand side" consists of emerging blockchain protocols looking for trusted and reliable validators to secure their networks.

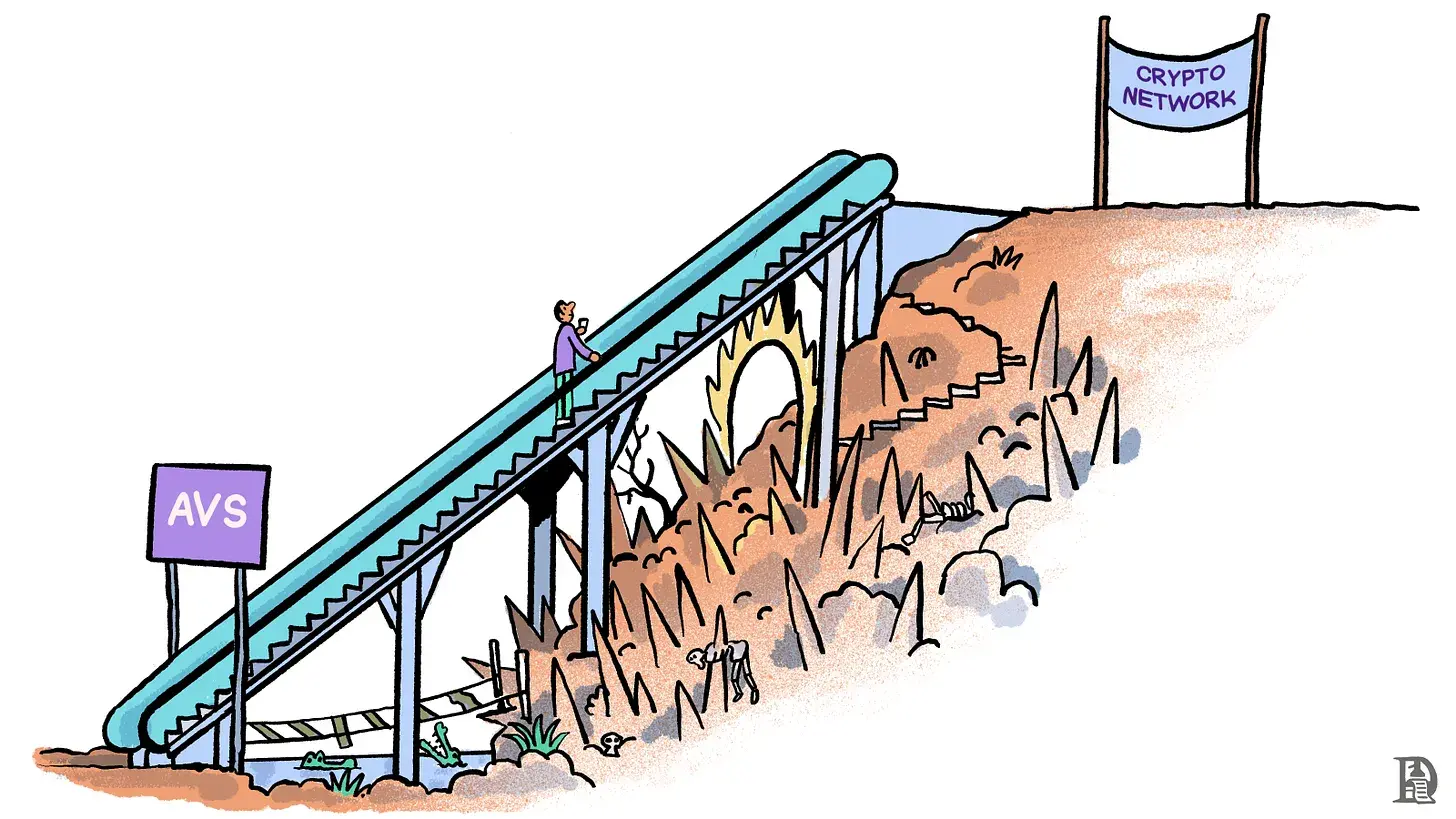

EigenLayer, as a platform, perfectly fills this gap by connecting validators (referred to as "operators") with networks seeking their services (referred to as "Actively Validated Services" or AVS).

Now, let’s think from the perspective of new protocol developers:

First, EigenLayer provides a set of verified and trusted validators (referred to as "operators") who commit to validating multiple services, including emerging ones. This addresses your initial challenge: how to find reliable validators?

Second, EigenLayer's most significant breakthrough is the separation of "rewards" from "penalties," allowing operators to protect your network without needing to stake your native tokens. EigenLayer requires them to deposit (or attract staking) existing assets such as ETH and liquid staking tokens (LST). If malicious behavior occurs, these assets will be slashed.

This separation means that stakers and operators can avoid the risk of holding additional new tokens; they can earn extra returns by holding mature assets they already trust. (Saurabh's analysis of “inter-subjectivity” explains how EigenLayer enhances capital efficiency.)

From the protocol's perspective, this model eliminates the need to compensate validators through token issuance (which could lead to token inflation). Instead, you can benefit from stronger security assurances provided by ETH as collateral. In fact, this flexibility even allows you to choose not to issue tokens if you don't want to!

Finally, you can carefully select a cluster of operators based on the specific security needs of your product. Before integrating them into your network, you can weigh the validators' technical capabilities, the scale of staked assets, geographical locations, and their security records in other networks. This selectivity is a luxury compared to the daunting task of building a network from scratch.

As one security risk diminishes, another arises—dependency on EigenLayer itself. However, EigenLayer is not an independent blockchain but a set of smart contracts deployed on Ethereum. Ethereum boasts over 6,000 nodes and 860 billion dollars in funding support. While smart contract risks still exist, Ethereum itself is the most secure entity in the blockchain space.

You might ask, "What are the 'rewards'? How does the economic model built on EigenLayer operate?"

Protocols can reward operators and delegators with any ERC-20 token. In practice, this gives AVS two options:

Distribute rewards using established tokens (like ETH or stablecoins). In this case, the relationship between operators and AVS is transactional—operators provide services, and AVS pays them with widely accepted currency. EigenDA, the first AVS, initiated operator rewards by distributing ETH to operators and delegators.

Distribute rewards using their own tokens. This approach is closer to the economic model of traditional crypto networks. While this model gives AVS the flexibility to pay for security through token issuance (rather than directly using ETH/stablecoins), they must also convince operators that their tokens will retain value. If they fail to do this, attracting operators will be difficult, as they are likely to sell the AVS tokens immediately upon receipt.

Initially, 10% of the AVS rewards will be allocated to operators, with the remainder going to stakers, but this parameter will become flexible in the future. Additionally, to "enhance incentive alignment," EigenLayer plans to distribute rewards equivalent to 4% of the initial $EIGEN supply, encouraging delegators and operators to participate in the network.

EigenLayer's strong value proposition has attracted various projects seeking to deploy as AVS. The list includes some common projects—such as rollup chains needing operator services, data availability services, bridging, oracle networks, and sorting layers.

However, considering that operators can theoretically support any type of computation (not limited to state transitions), we have also witnessed many innovative and experimental projects utilizing EigenLayer for development. These projects include decentralized physical infrastructure (DePin) networks, AI inference engines, zero-knowledge proof co-processors, privacy-oriented protocols (including TEE, FHE, MPC), zkTLS networks, and even policy engines for smart contracts.

The Great Liberation

Earlier, I made a relatively bold statement that AWS changed the essence of capitalism. Before AWS, the high capital requirements for starting a company meant that founders either had to self-fund or seek investment from external sources (friends, family, venture capital). This financial barrier effectively excluded most of the global population from internet entrepreneurship, making it an exclusive activity for wealthier or privileged regions.

By dismantling these constraints, AWS not only simplified the processes for existing entrepreneurs—a relatively small group—but also unleashed the creativity and imagination of many who previously thought entrepreneurship was beyond their reach. This democratization sparked a wave of entrepreneurial experimentation. While many projects fail, successful ones drive unprecedented economic productivity and enhance human convenience.

From the perspective of individual entrepreneurs, cloud computing opened up a range of possibilities—from attempting to build the next billion-dollar enterprise to individual developers like Pieter Levels earning millions annually, or anything in between.

We are excited about EigenLayer and AVS because they unlock similar opportunities for trustless distributed networks. If you have an idea that requires multiple computers to operate without mutual trust, you can now quickly realize it through AVS.

From governance chains to zkTLS networks, we have witnessed many previously unfeasible experiments. As more entrepreneurs realize that the human and financial capital required to build such systems has significantly decreased, we expect to see even more experimentation.

Most will fail.

But a few will surely guide the future direction of this industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。