Original Author: 0xLouisT (L1D Partner)

Compiled by|Odaily Planet Daily (@OdailyChina)_

Translator|Azuma (@azuma_eth)_

Editor's Note: The meme token Three Arrowz Capitel (3AC), conceptualized around the bankrupt fund Three Arrows Capital, has unexpectedly gained popularity recently, with former partners Su Zhu and Kyle Davies publicly supporting it. Dex Screener shows that the token once peaked at a price of $0.192, corresponding to a market cap of up to $170 million.

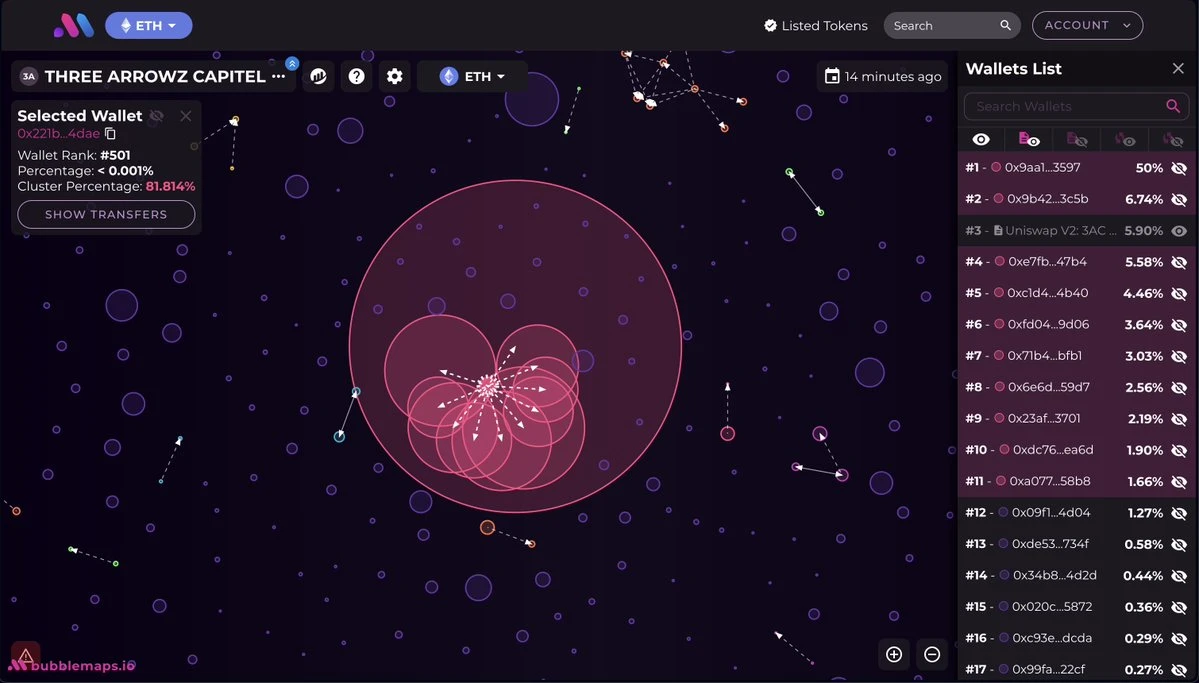

However, data from Bubblemaps indicates that 80% of the token's supply is controlled by a single cluster. Additionally, according to the latest article by L1D partner 0xLouisT, there seems to be more to the story behind the launch of this token.

Below is the full text by 0xLouisT, compiled by Odaily Planet Daily.

Three days ago, Su Zhu and Kyle Davies launched a meme fund called Three Arrowz Capitel, attached to the token 3AC (hereafter referring to this token).

Analysts on Bubblemaps quickly discovered that 80% of the token's supply is concentrated within the same cluster (https://x.com/bubblemaps/status/1839771568953503957). Driven by curiosity, I delved deeper—what exactly are Su Zhu and Kyle Davies doing? Do these former billionaires really want to make a comeback?

Pre-sale

On-chain records show that 3AC raised 750 ETH (approximately $2 million) from about 25 investors during its private pre-sale. The wallets participating in the pre-sale are closely related to the Milady team, Bobo team (@bobocoineth), jez (@izebeleth), ctrl (@maybectrlfreak), Pandora (@PandoraERC404), and the OX.FUN team.

Issuance

The issuance of the 3AC token is quite interesting.

The team roughly split all private placement funds in half, allocating 317 ETH (approximately $850,000) to the Uniswap V2 liquidity pool, with a lock-up period of one year; the remaining 336 ETH (approximately $880,000) is distributed across eight wallets belonging to teams that previously targeted the launch of 3AC. Most of these wallets currently show profits ranging from 10 to 30 times their cost basis.

Additionally, there is a noteworthy sniper address, which may have been leaked by an insider. This address used BananaGun to purchase $320,000 worth of 3AC, which at its peak soared to $1.23 million. It cashed out at the peak but later changed its mind and bought back the same amount of tokens a few minutes later—now, those 3AC tokens that were once worth $1.23 million have dropped by over 50%.

Token Economic Model

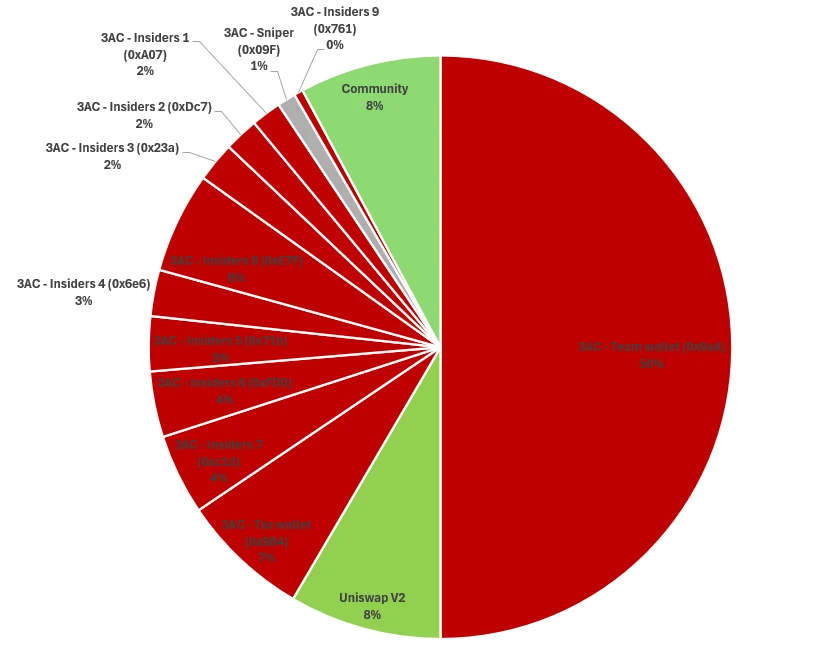

If you think that the "low circulation, high FDV" token chip data is quite poor, then the 3AC "low circulation, high conspiracy" token chip structure is even more exaggerated.

In addition to the eight wallets mentioned above that had previously targeted a large supply of tokens, 3AC also allocated 50% of its supply to itself (address: 0x9aA17AF45fE866f88A9a82Eb55fA250c2fF43597).

The token also imposes a 1% transaction tax on every buy and sell, with the tax collected going to a tax address (address: 0x9B427aC936B8B25266Cd9DA54C667A8ba2353C5B), which has accumulated over 7% of the total supply of 3AC.

A few hours ago, most (but not all) of the tokens in these wallets were consolidated into a main team and insider wallet (address: 0x60244d0DD5FDebE73E2E25577d78Ad1Ad07f2430).

At this point, we can simply summarize the token economic model of 3AC. In the diagram below, the shares of the team and insiders are marked in red, while the community and liquidity shares are marked in green.

8% Community;

8% Liquidity;

84% Team and Insiders;

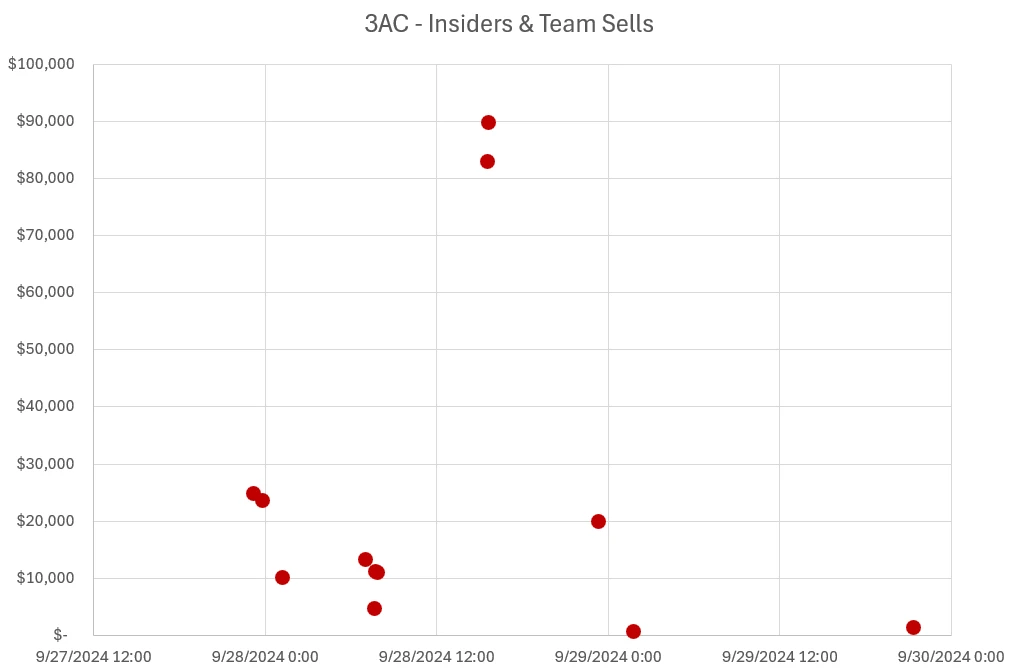

Pre-sale participants have already begun receiving their allocations of 3AC tokens, with initial token allocations valued between $25,000 and $100,000. It is worth noting that less than 25% of pre-sale participants have sold their initial shares. Nevertheless, some pre-sale participants have already cashed out multiple five-figure amounts.

At this point, it is not difficult to see that purchasing 3AC means you need to choose to trust a small group of insiders who control over 84% of the supply, which is why some people refer to it as a "cabal token."

Whether to participate in this gamble is up to you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。