Original Author: Biteye Core Contributor Fishery

Original Compilation: Biteye Core Contributor Crush

As a decentralized computing system based on the Arweave platform, AO can support high-concurrency computing tasks, making it particularly suitable for big data and AI applications. Its unique narrative, which is one-of-a-kind across the entire network, has attracted considerable attention from players. However, AO's highlights extend beyond its narrative, with several intriguing features, such as:

How does AO create a healthy token distribution through a clever DeFi economic flywheel, leading to profit-making effects?

DAI mining yields are more than double that of stETH; how can users participate in cross-chain mining with AO?

The project team and users achieve a win-win situation, the unique narrative across the network, and the top-notch innovation in the DeFi space… How many noteworthy performances does AO actually have?

In this article, Biteye will answer the above questions and deeply analyze the AO economic model, revealing the surprises of AO step by step!

01 AO Project Background Introduction

AO is a decentralized computing system based on the Arweave platform, adopting an Actor-Oriented Paradigm, aimed at supporting high-concurrency computing tasks.

Its core goal is to provide trustless computing services, allowing an unlimited number of parallel processes to run, with high modularity and verifiability. By combining storage and computation, AO offers a solution superior to traditional blockchains.

On June 13, 2024, AO announced its token economic model, which features a fair issuance mechanism. This mechanism follows the "ancestral system," drawing on Bitcoin's economic design while innovating on the concept of liquidity incentives in DeFi.

The innovative aspects are particularly clever, and the performance after the mainnet circulation is highly anticipated. It boasts an impressive economic model, ranking among the top in the DeFi sector.

02 Token Issuance Rules

The total token supply of AO is set at 21 million, the same number as Bitcoin, highlighting AO's scarcity.

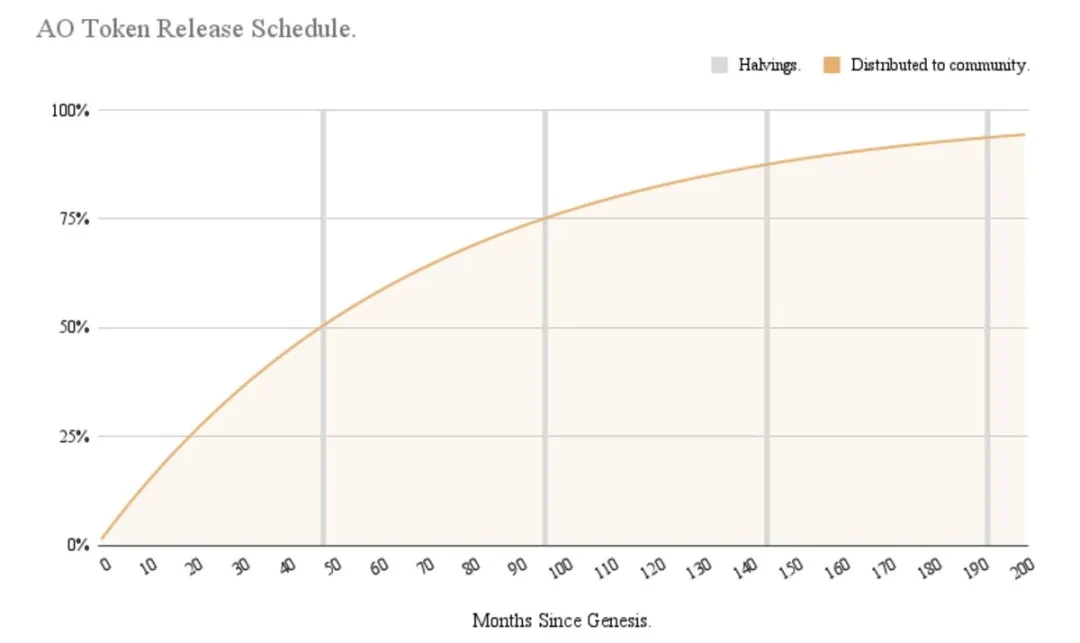

The token issuance adopts a halving mechanism every four years, but achieves a smoother issuance curve by distributing tokens every five minutes. The current monthly issuance rate is 1.425% of the remaining supply, which will gradually decrease over time.

In this round of bull market, amidst the industry chaos of massive VC token emissions, AO is commendable for adopting a 100% fair issuance model, discarding common pre-sale or pre-allocation mechanisms.

This decision aims to ensure that all participants have equal access opportunities, embodying the principles of decentralization and fairness pursued in the cryptocurrency field, with a very large vision.

The token distribution rules of AO can be divided into several key phases, each with its unique characteristics and goals:

Initial Phase (February 27, 2024, to June 17, 2024): This phase can be understood as an airdrop of AO to AR holders. AO adopts a retroactive minting mechanism, starting from February 27, 2024, where all newly minted AO tokens are 100% distributed to AR token holders, providing additional incentives for early AR holders. During this phase, one AR can earn 0.016 AO tokens as an incentive. If readers hold AR on exchanges or custodial institutions during this period, they can inquire about receiving AO after its official circulation on February 8 next year.

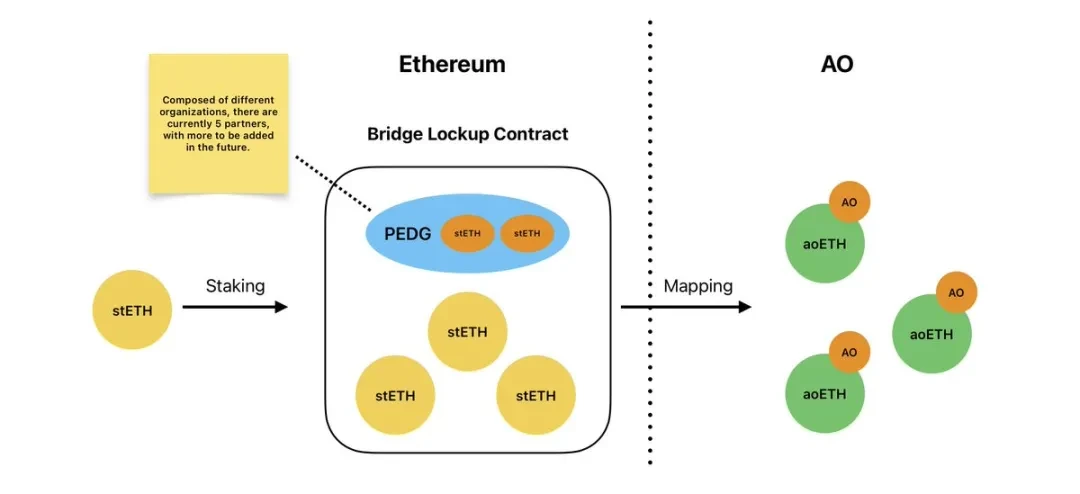

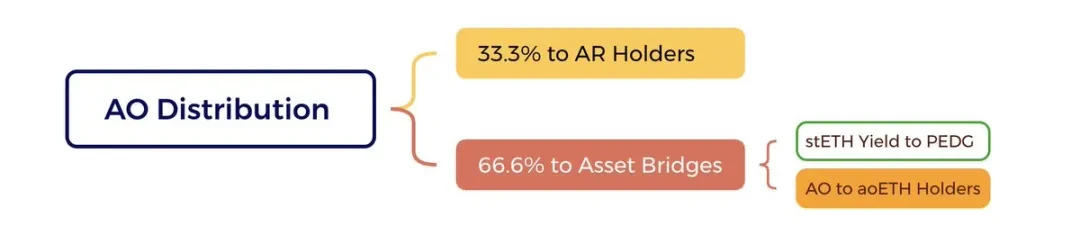

Transition Phase (from June 18, 2024): Starting from June 18, AO introduces a cross-chain bridge. In this phase, newly minted AO tokens are divided into two parts: 33.3% continues to be distributed to AR token holders, while 66.6% is used to incentivize asset bridging into the AO ecosystem. Currently, users can participate in this phase of token distribution by depositing stETH (more asset categories will be added in the future). This part is the main focus of participating in the AO ecosystem, which will be elaborated on below.

Mature Phase (expected around February 8, 2025): This phase marks the maturity of the AO token ecosystem. When approximately 15% of the total supply (about 3.15 million AO tokens) has been minted, AO tokens will begin to circulate. This timing is set to ensure that there is sufficient liquidity and participation in the market before the tokens start trading. In this phase, the distribution rules remain stable, continuing to follow the model of 33.3% for AR holders and 66.6% for bridging incentives.

Overall, about 36% of AO tokens will be distributed to Arweave (AR) token holders throughout the entire emission process (100% before June 18 + subsequent 33.3% distribution), reinforcing the close connection between AO and the Arweave ecosystem.

The remaining 64% will be used to incentivize external yields and asset bridging, aimed at promoting economic growth and liquidity enhancement within the ecosystem.

03 Economic Flywheel

AO's economic model also includes a novel ecosystem fund allocation mechanism, where users can continuously earn AO token rewards by bridging qualified assets through the AO fund bridge. This is akin to earning DeFi yields simply by bridging assets, which is very attractive to most people. The fund bridge is the core of the AO economic flywheel and the source of project team revenue under the fair issuance mechanism.

This represents a new way of playing that deserves detailed study. This section will clarify the principles.

First, we need to clarify that the assets obtained through cross-chain to earn AO must meet two requirements:

Quality Assets: These assets must have sufficient liquidity in the market, typically referring to assets from major public chains. This requirement ensures that the assets bridged to the AO network have broad market recognition and utility.

Yield-Generating: These assets must be tokens that can generate annual yields. Currently, stETH is a typical example. In the future, the team intends to introduce stSOL.

It is precisely these two requirements that allow the project team to sustain development and profitability while ensuring the fair issuance of AO.

In simple terms, the principle is that the interest generated during the user's stay of these yield-generating assets on the AO chain is paid to the project team, and correspondingly, the project team mints AO for the users.

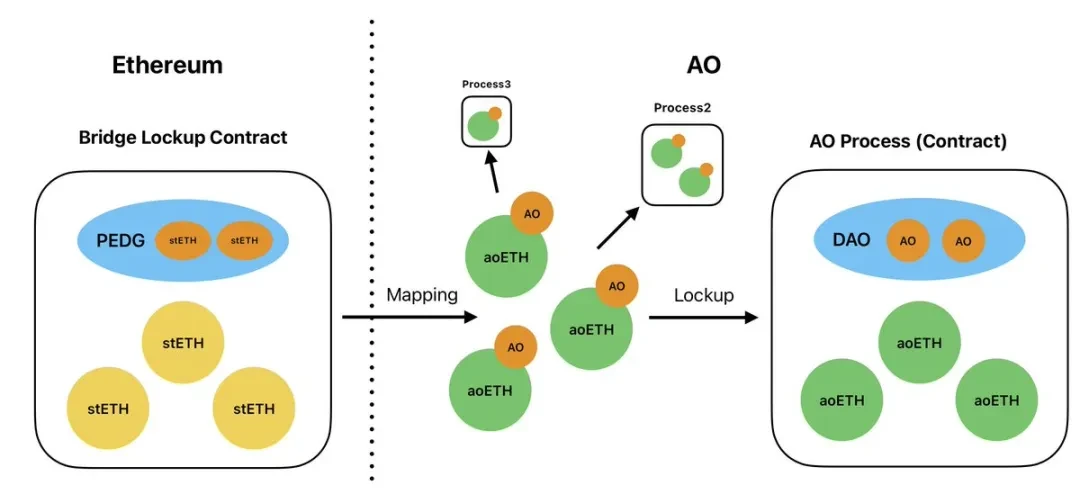

In the image, the PEDG (Permaweb Ecosystem Development Guild) receives all the interest from stETH.

Specifically, taking stETH as an example, if a user stakes 1 ETH in Lido, they will receive 1 stETH. A key feature of stETH is that its balance automatically increases over time, with the amount of increase depending on the yield generated from the staked ETH. Correspondingly, stETH can be redeemed 1:1 for ETH or traded back to ETH on the secondary market at nearly a 1:1 price.

With an annual yield rate of 2.97%, after one year, this 1 stETH, if left on the Ethereum mainnet without any action, will increase to about 1.0297 stETH, which can be redeemed back for 1.0297 ETH.

However, when this 1 stETH is bridged cross-chain through the AO asset bridge, the cross-chain bridge contract on the Ethereum mainnet will receive 1 stETH, and the user's AO chain address will receive 1 aoETH. It is important to note that aoETH will not increase its balance over time like stETH.

After one year, since the quantity of aoETH itself does not automatically increase over time, the amount of stETH in the Ethereum mainnet cross-chain bridge contract will exceed the total amount of aoETH on AO by the amount of interest generated in one year, meaning that even if all aoETH on the AO mainnet is bridged back to the Ethereum mainnet (in an extreme case), the stETH in the mainnet contract will still have a surplus, which constitutes the project team's revenue.

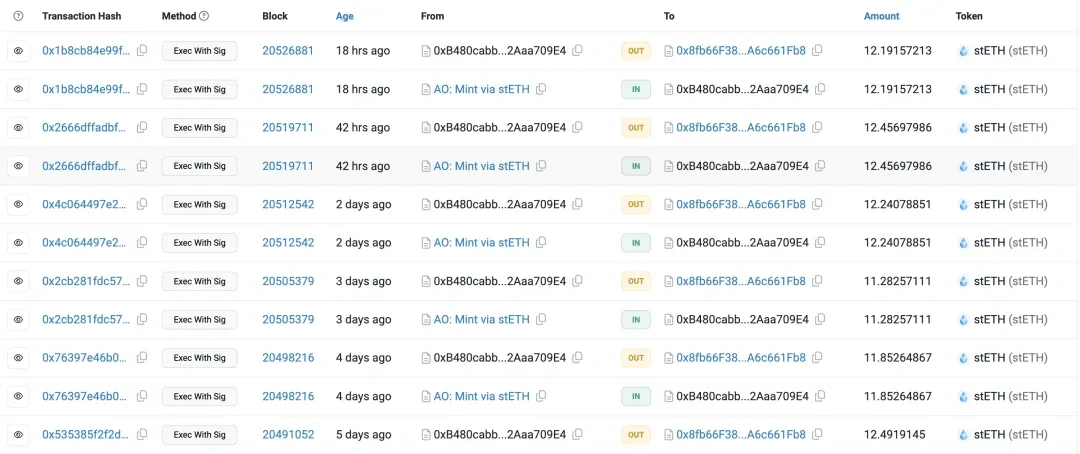

Currently, 151,570 stETH have been deposited into the AO cross-chain bridge. On-chain observations show that the project team uses bots to harvest daily, with daily earnings of about 12 stETH.

This will be a win-win transaction, achieving fair issuance of AO without the unattractive appearance of high FDV and low circulation VC tokens, while also allowing the project team to profit.

At a 3% stETH interest rate level, the team will profit from the interest generated by all stETH, amounting to about 4,500 ETH, along with over 50 million DAI deposited in DSR at a 6% interest rate, totaling about over ten million dollars in revenue.

This is undoubtedly an excellent mechanism for fair distribution, worthy of emulation by future projects.

Moreover, the design of the AO economic flywheel does not stop there.

In fact, the aoETH mentioned in the first half, which does not automatically increase its balance, is not a supporting role; it is also an indispensable main character in the economic flywheel.

It is important to note that holders of aoETH will receive minted AO, so it is also a yield-generating asset, with its native price being 1:1 with ETH. Thus, aoETH not only possesses the liquidity and price stability advantages of mainstream coins but can also generate yields from AO, which many people are optimistic about.

The Context of Yield Ownership

Such high-quality yield-generating assets naturally lead to new ways of playing.

The AO network has proposed an innovative "developer minting" model, which disrupts traditional project financing and distribution methods. This model not only provides developers with a new source of funding but also creates a low-risk investment avenue for investors, while promoting the healthy development of the entire ecosystem.

When developers create DeFi projects on the AO network, they need to lock AO native tokens and cross-chain assets to provide liquidity.

At this point, aoETH and other cross-chain assets become the preferred liquidity targets, as users lock aoETH in the developer's smart contract, which not only increases the total locked value (TVL) of the application but, more importantly, the AO tokens minted from these locked aoETH will flow into the developer's contract.

This achieves "developer minting," providing developers with continuous funding support. It is not hard to imagine that once stSOL is opened for minting AO, the DeFi prospects of AO will be even brighter.

For this reason, the project team no longer relies too heavily on VC funding, leading to a healthier token distribution. As the project develops and the locked aoETH increases, the AO tokens obtained by developers will also rise.

This will create a virtuous cycle: high-quality projects attract more funding, which in turn provides more resources to improve products, ultimately driving the development of the entire ecosystem. As a result, the entire AO chain's ecosystem will be healthier compared to the chain's ecosystem, leading to profit-making effects.

This innovative model not only simplifies the traditional investment process but also allows the market to more directly determine the flow of funds. Truly valuable applications will naturally attract more aoETH locking, thereby gaining more support in AO tokens.

This mechanism effectively tightly binds the interests of developers with the development of the ecosystem, incentivizing them to continuously create valuable applications.

This is undoubtedly a win-win situation. From the investors' perspective, using the annual yield of their held assets (rather than the principal) to support projects significantly reduces risk, which will further encourage investors to increase their investments.

Developers, on the other hand, can focus on product development rather than spending a lot of time and energy on financing and token distribution.

04 Participation Opportunities

Currently, cross-chain mining through the AO official bridge is the most stable way to obtain AO.

On September 5, DAI officially became the second asset that can mine AO after stETH.

The following will analyze how different risk preferences can participate in cross-chain mining AO from the perspectives of cost-effectiveness and security.

05 Cost-Effectiveness

AO has not yet circulated, so there is no price, making it impossible to calculate APR; it is still in the "blind mining" phase. Generally speaking, "blind mining" is more attractive than deterministic DeFi.

Assuming we use $1,000 worth of stETH and DAI to cross-chain mine AO, we will compare the cost-effectiveness of the two by predicting the final amount of AO obtained.

The results are quite surprising!

DAI mining AO yield forecast table on September 8

DAI mining AO yield forecast table on September 23

From the observations on September 8 and September 23, we have a jaw-dropping discovery:

On September 8, just three days after DAI mining began, which was still an early stage, the mining yield for DAI was 10.53579/4.43943 = 2.373 times that of stETH. As a legit project, the yield of stablecoins was not only not less than that of risk assets but was actually multiple times higher, which is very rare in the DeFi market over the past few years.

At that time, I also noticed this phenomenon and had two considerations: first, it was too early, and the market had not yet reacted; second, there were implicit risks.

Now, nearly 20 days after DAI mining began, the market should have digested the information, yet the yields for DAI and stETH still stand at 8.17534/3.33439 = 2.452 times, even higher than on September 8. Unbelievable!

Excluding the market reaction speed factor, there is only one consideration left—

06 Risks

In terms of financial asset attributes, the risk from the price volatility of stETH should be much higher than that of DAI. Even for staunch ETH believers who firmly hold ETH, they can still collateralize ETH to borrow DAI for arbitrage, at least to balance the interest rate difference between the two. However, the market has not acted this way. This is quite unreasonable.

Aside from financial risks, there is also contract risk.

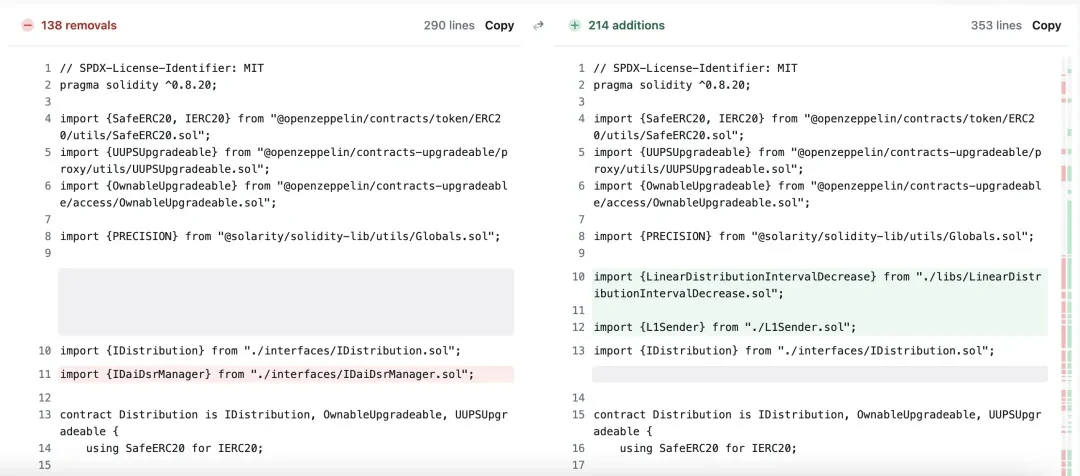

As mentioned earlier, the stETH mining of AO has undergone complex and intricate design, allowing the team to capture all the yields from stETH. Complex contracts can bring risks, but fortunately, the core code of the stETH mining contract uses the code from MorpheusAIs project Distribution.sol, which has stood the test of time. Relatively safe.

On the other hand, the DAI mining contract is a modified version of AO's contract based on Distribution.sol, which implements the function of depositing DAI into DSR, making it several levels more complex than the stETH receiving function.

Comparison of DAI mining contract and MorpheusAIs contract

Therefore, from the perspective of contracts, the stETH mining contract is significantly safer than DAI. However, this alone cannot fully explain the more than double cost-effectiveness of DAI compared to stETH. This remains to be discussed. (A little advertisement, everyone is welcome to join the group for discussion!)

07 Conclusion

Overall, AO is highly anticipated, whether from the perspective of fair issuance or the "developer minting" model: without VC dumping, and cleverly designed from the DeFi perspective, it represents a new form of project to some extent.

In terms of participation, Web3 is definitely about experiencing new things. However, when faced with incomprehensible situations (such as the excessive yield of DAI), one must be cautious and respectful of the market's choices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。