The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens.

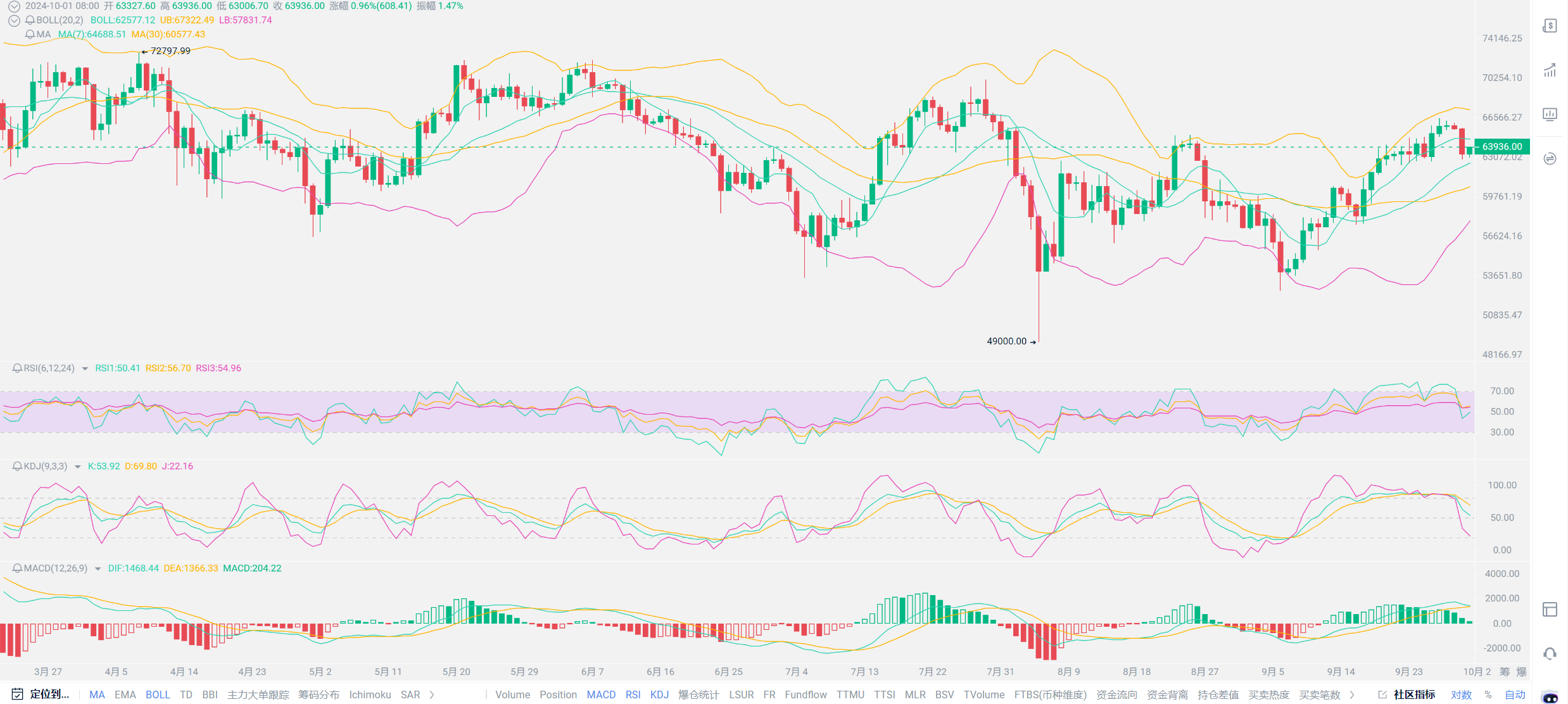

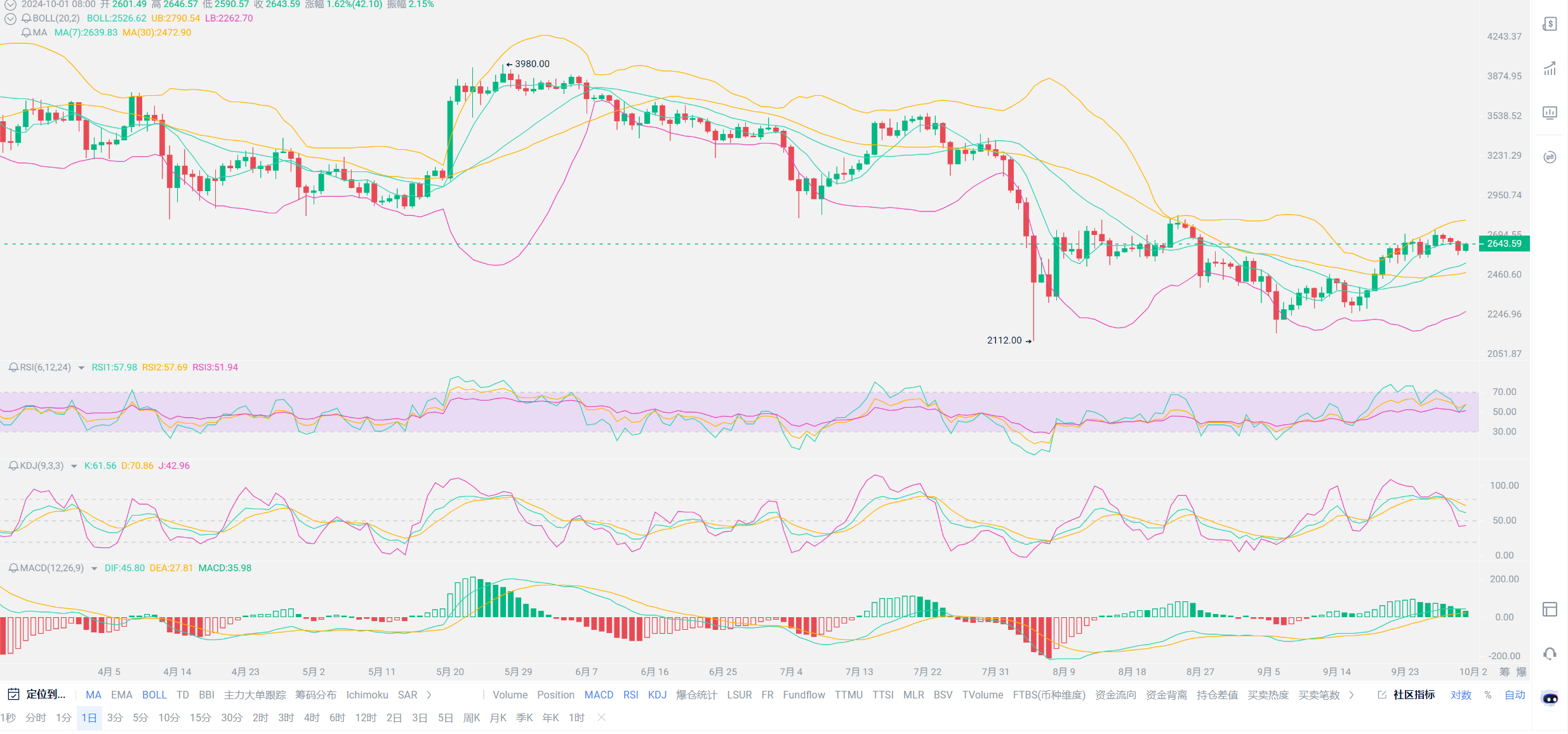

Ethereum has started to close with bearish candles for three consecutive days, leading many friends to question whether the bulls can continue. Today's article will give everyone a boost of confidence. First, in the daily chart, the moving averages have hardly been affected by the short-term bears, and both the values and trends are generally leaning towards a bullish market. Coupled with the Bollinger Bands, the coin price is still operating between the middle and upper bands, with the upper band slightly turning down, while the middle and lower bands still lean towards an upward breakout. This suggests a potential narrowing, and in line with the moving averages, the buying intention remains stronger than the selling side, with the only drawback being the level of capital. In the past two days, whether it is selling or inflow of funds, the overall trading sentiment has not been strong, and the trading volume is far below previous data. There are too many markets available for investment, which has indeed caused a certain degree of diversion. The overall pullback of Ethereum has currently only stopped at the 2572 position, and at this stage, the bulls are counterattacking. Today's closing situation may affect the subsequent trend.

Among other data, the trends and values of KDJ, RSI, and MACD are all very normal, showing no signs of overselling or overbuying. This situation is a typical sign of consolidation, so everyone can rest assured that there won't be a deep pullback for the time being. As the old saying goes, as long as there is no news, it is a bullish trend. Directly speaking from a financial perspective, it is important to understand that not only is the U.S. lowering interest rates, but all countries are implementing monetary easing policies. Under such resolute execution conditions, it will inevitably lead to a large amount of currency circulation in the overall financial market. Historically, the last round of monetary easing policies coincided with the bull market phase of the entire cryptocurrency sector. The period from 2011 to 2021 was when Bitcoin experienced rapid growth. Additionally, with specific directives, Bitcoin is now listed and has the ability to be supported by traditional capital. It can be said that for these two cryptocurrencies, any significant decline in the future must consider the power of traditional capital. For ordinary investors, being listed will reduce a considerable amount of risk. You can refer to the price charts before the listing; Bitcoin and Ethereum, the two representatives, almost experience a major drop every two months, with the most frequent occurrence being once a month. Currently, the frequency of black swan events is also decreasing.

This is the support capability of being listed. Whether there is a significant rise or fall, it does not belong to the attributes of a healthy financial market. Only steady operation is most beneficial for the cryptocurrency sector. From the daily chart, the entire trend of Ethereum, since the new low of 2150, has surged above 2700, with each step taken very solidly, without the explosive situation of the 2021 bull market where it surged 700-800 points in a day. So far, including Bitcoin's listing, in the entire growth space, people are hearing less and less about the entry of large capital and the inflow of large amounts of funds. The less this situation occurs while maintaining steady growth only indicates that the cryptocurrency market is gaining recognition. More and more capital is hiding its entry into the cryptocurrency sector, and the instance of Russia transferring state-owned capital has already demonstrated the capabilities of the cryptocurrency sector. In Lao Cui's eyes, this is a high recognition of the cryptocurrency sector, which has gained its place in the financial market.

After discussing the long-term growth, let's take a look at the short-term risks. Lao Cui has mentioned the short-term risks multiple times in previous texts. As long as the capital in October can support the growth of the cryptocurrency sector, the key observation now is where the capital that Old A has escaped to will flow next. This is very crucial. If it can flow into the cryptocurrency sector, it will perfectly fill the gap of insufficient capital after the interest rate cut. Then there is the issue of the U.S. presidential election; who will win and what the future president's view on the cryptocurrency sector will be. Don't think that if Trump comes to power, it will definitely be beneficial for the cryptocurrency sector. A politician's words need to be carefully considered, and whether Trump can fulfill his promises after becoming president is another matter. We can consider the worst-case scenario, which is that Trump makes unfavorable remarks about the cryptocurrency sector, or that capital does not gather in the cryptocurrency market. Even if these two worst-case scenarios occur, Ethereum will at most drop back to its original position. It will only become increasingly difficult to break the 2000 mark, and there will be no excess in Ethereum at 2000.

Of course, everyone should not be blindly confident. Military and policy aspects can still influence the trend of the cryptocurrency sector, with military influence being less significant than political aspects. Military events may even temporarily benefit the growth of the cryptocurrency sector. When people are busy escaping, the best way for capital to be carried conveniently is through the cryptocurrency sector. A mobile phone, a computer, or a hard drive can take away all your wealth. In the short term, the cryptocurrency sector may still see some growth. However, the political aspect is not necessarily the same. The joint statement from the four major banks in the country directly led to a significant downturn in the cryptocurrency sector. Military factors will slowly reduce the growth trend of the cryptocurrency sector, while political factors can directly lead to a major waterfall in the cryptocurrency sector. Therefore, regarding the future trend of the entire cryptocurrency sector, it is important to understand that with the arrival of monetary easing, the listing of these two and even the downward trend in exchange rates are all beneficial for the growth of the cryptocurrency sector. Currently, there is no reason for the cryptocurrency sector to decline, and the bullish trend is very clear.

Lao Cui summarizes: For the long-term perspective mentioned by Lao Cui, it is definitely based on a six-month unit. If the capital you enter the cryptocurrency sector cannot last for half a year, then do not refer to Lao Cui's articles. For contract users, going long in the short term is definitely better than going short. Reading Lao Cui's articles is like the saying goes, do not fight for immediate gains and losses; the final victory can only be determined when the profits are realized. The cryptocurrency market before listing is a speculative market, and for contract users, it can be said that making profits is very easy. The golden time for the formation of a market is when all the rules have not yet been established, and the best growth period and rapid expansion period are definitely when the rules have just been established. Currently, the cryptocurrency sector is still in a golden growth period, so the returns over the next ten years will definitely be greater than all financial markets, maintaining a 50% annual return. Lao Cui believes that many people in the cryptocurrency sector can achieve this standard. Other markets do not have the ability to allow everyone to achieve financial freedom. The current cryptocurrency sector possesses this attribute, and I hope everyone can seize this opportunity. At the end of the article, I wish everyone a happy National Day, family happiness, and doubled profits. Anyone who does not understand can ask Lao Cui. Lao Cui will accompany everyone 24/7 during the National Day!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, with the ultimate goal of winning the game. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。