As one of the most active crypto venture capital firms, HashKey Capital regularly analyzes each Web3 sector internally. In the first half of 2024, we "open-sourced" our internal sector analysis and insights as our contribution to the industry.

The authors of this article include (in alphabetical order): Arnav Pagidyala, Harper Li, Jack Ratkovich, Jeffrey Hu, Junbo Yang, Jin Ming Neo, Stanley Wu, Sunny He, Xiao Xiao, Yerui Zhang, Zeqing Guo.

Ethereum

Zero Knowledge

ZKVM & ZKEVM

In the first half of 2024, we observed an increasing number of ZKEVM projects beginning to shift towards ZKVM architecture, with the PSE team under the Ethereum Foundation being a representative example. Taiko has already been collaborating with Risc0 on ZKVM, and Scroll is also preparing in this area. The catalyst driving this shift is Plonky3, which outperforms Halo2 in terms of performance (though slightly less stable) and enhances user experience.

Current virtual machines available in this field include: ZKWASM, Succinct's SP1, a16z's JOLT, and Risc0. Additionally, Polyhedra's ZK Prover performs excellently and plans to develop a virtual machine in the future. Aztec and Mina are also developing their respective virtual machines, but their performance benchmarks have not yet been released.

Key factors driving broader adoption will depend on several aspects, such as proof costs, proof efficiency, and development time. It is currently widely believed that zkVM is well-suited for building and deploying verifiable applications, warranting further attention.

ZK Middleware

In terms of middleware, we see that the activity of proof verification systems remains high, with Brevis, Alignlayer, and Nebra collaborating with Eigenlayer for security. Due to the relatively high cost of zk proofs, the market is gradually shifting towards adopting hybrid solutions of OP and ZK to improve proof efficiency. In terms of applications, catalysts such as verifiable AI and verifiable off-chain data will bring more application demands, and these innovative areas deserve attention.

MEV, Chain Abstraction / Account Abstraction, Intent

MEV Developments:

● At Flashbots, the team has been experimenting and developing products utilizing Intel Software Guard Extensions, recently attempting to use Trusted Execution Environments (TEEs) for privacy computing on the Ethereum Virtual Machine. These use cases include storing and processing sensitive data, ensuring that auction bidding is protected from tampering and data leaks.

● Fully Homomorphic Encryption (FHE) has also emerged as a potential solution against MEV, as it keeps data encrypted at all times, eliminating the possibility of selective reordering.

Block Builders

According to data from relayscan, the block building market is highly concentrated among a few builders, including some high-frequency trading firms known for meeting their own trading needs. Currently, beaverbuild, titan builder, and rsync builder are the most dominant and profitable builders in the market. This centralization phenomenon has sparked further research into the design of block auction mechanisms aimed at maintaining Ethereum's censorship resistance.

Relay

Relay continues to play a crucial role in block supply, with over 90% of blocks transmitted through relays. Titan builder launched Titan Relay this year, which has seen rapid growth since its launch.

When evaluating Relay, several factors need to be considered:

- Performance and reliability, which can be analyzed through metrics such as uptime, latency, and bidding failures.

- The scalability of the Relay refers to its ability to serve a large number of validators.

In the MEV space, we have previously invested in several successful projects, including Primev, the inventor of preconfirmation, Titan, the leader in the block building market, and FastLane, one of the few successful MEV systems aside from Flashbots. In the next phase, how MEV-related projects achieve value capture and successfully design tokens will be critical questions.

Chain Abstraction and Account Abstraction:

Chain abstraction is a persistent and key concept for achieving large-scale user adoption, aimed at enhancing user experience by making users unaware of the existence of blockchain, or even not knowing which chain they are using. NEAR, as one of the early pioneers in this field, has launched multi-chain signature functionality, allowing one account to be used across different chains. Supported chains include Bitcoin, Ethereum, Cosmos ecosystem chains, Dogecoin, XRP Ledger, TON network, Polkadot, and more.

Refer to the CAKE framework proposed by Frontier.tech, which includes permission layers, solver layers, settlement layers, etc. Account abstraction (AA) can also be included in the permission layer. The AA field is mainly divided into two categories: smart contract wallets and modular services. As mentioned in our 2023 sector review, smart contract wallets play a crucial role in providing a seamless user experience through intent-centered design.

Significant progress in this field includes:

- The number of AA accounts has exceeded 12 million, with UserOps calls exceeding 49 million.

- The number of weekly active smart wallet accounts is also on the rise, with Polygon still being the network with the most smart accounts. Another popular platform is Base, which may benefit from the launch of the Coinbase smart wallet, which has compatibility features.

With the inclusion of EIP-7702 in Ethereum's Pectra upgrade, this will bring a more seamless and user/developer-friendly experience, as it aims to improve the previous account abstraction (AA) design, such as ERC-4337, which had high costs and lacked native support for converting EOAs (Externally Owned Accounts) into smart accounts. Therefore, it is worth focusing on whether improvements at the infrastructure level can lead to new applications.

In addition to AA, other tracks worth paying attention to in the field include strategy engines, intent frameworks, and preconfirmation. Projects related to intent are still actively being developed, and their specific performance and PMF remain to be observed.

Bitcoin

Bitcoin Rollup attracted significant attention earlier. However, over time, interest seems to have waned, as we observed at the Bitcoin Asia event. The number of emerging projects has decreased, and fundraising appears to be challenging in the current environment. Nevertheless, we still witness some notable technological breakthroughs, such as BitVM. Some Rollup projects are exploring integration with BitVM. BitVM has recently innovated rapidly, for example, creating the BitVM cross-chain bridge. This bridge can be used for large cross-chain transactions, while smaller transactions are expected to continue relying on multi-signature or HTLC exchanges to improve economic efficiency. For more details, please refer to previous research.

Overall, despite the challenges faced by Rollup, technological developments like BitVM may still provide opportunities for Rollup, such as interoperability.

Yield-Oriented Bitcoin Strategies

Yield-oriented strategies are also gaining attention, with more projects offering wrapped BTC to holders, providing users with yields while also making it easier to achieve TVL. For example, projects like Mezo integrate multiple products, where Rollup is just one of many components, along with other products like tBTC and Acre's stBTC (liquid staking).

In this field, we continue to exercise caution, investing in teams with clear technological advantages, well-defined market strategies, or proven successful experiences.

Asset Protocols: BRC20, Runes, Atomicals, RGB, Taproot Assets

The performance of BRC-20 tokens remains weak, with ORDI performing poorly compared to the beginning of the year, and overall, not many highlights or improvements have been found in BRC20. Although Runes sparked strong interest after the Bitcoin halving, this interest has gradually faded, consistent with the trend of declining network activity and fees. The integration of Taproot assets with the Lightning Network may reignite market interest and momentum.

Overall, under the premise of sustainable adoption of Bitcoin assets, infrastructure providers serving this growing asset class may become attractive investment opportunities.

Bitcoin Staking

Staking (restake) is a feature that originally did not exist in Bitcoin but was later modified. The emergence of this track is due to its ability to address both the demand for BTC yield on the funding side and the need for products to be tied to the Bitcoin main chain.

Staking can be roughly divided into three categories based on slashing mechanisms:

- Slashing the principal: Babylon is an example of this method.

- Slashing interest (losing yield opportunities): CoreDAO mainly focuses on reducing potential yields rather than slashing the principal.

- No slashing: This category includes self-custodied second-layer networks (such as Rollups aimed at increasing TVL and promising yields) and projects like BounceBit that are more finance-oriented, where users' Bitcoin is managed by asset management teams to generate yields.

The earliest staking (restake) track, Babylon, has already formed its own ecosystem, and many applications related to Bitcoin will consider leveraging Babylon to establish a connection with the main chain. Projects related to staking within the Babylon ecosystem mainly focus on achieving auxiliary functions, as detailed in the Babylon ecosystem section.

This track is expected to resemble EigenLayer, producing some applications and infrastructure, with market performance and ecosystem development awaiting further observation after the mainnet launch. For example, the Babylon mainnet reached its limit shortly after launch. We remain optimistic about Babylon's future development.

Bitcoin DeFi, MEV

BTCFi: Recently, there have been many projects related to Bitcoin financial applications (BitcoinFi, BTCFi). Currently, the focus is still on lending and stablecoin applications. Various methods, such as locking assets on Bitcoin while processing the logic of issuing assets on L2, or choosing different asset issuance methods, will lead to different trade-offs.

Wrapped BTC: WBTC, tBTC, FBTC, and SolvBTC have recently garnered significant attention. Competition in this field is expected to intensify. For instance, Solv Protocol has witnessed tremendous demand through extensive partnerships, DeFi integrations, and cross-chain composability, prompting the protocol to secure over 13,500 Bitcoin staked. As more projects seek to leverage Bitcoin in DeFi applications, we anticipate further intensification of competition in this area.

Bitcoin DEX and Related Applications: On-chain DEX still primarily use PSBT, while some projects like Satflow employ pre-confirmation strategies in the mempool, although this approach carries the risk of being replaced.

MEV: The activation of RBF and the introduction of new types of assets have made the MEV landscape on Bitcoin more active. Projects like Rebar aim to establish MEV infrastructure similar to what Flashbot has done on Ethereum, while projects like Alkimiya focus on the fee/block space market. Currently, MEV-related activities mainly stem from transaction acceleration services. We will continue to monitor the ongoing developments in this area and observe how new projects continuously launch various services to mitigate the negative impacts of MEV on users. For more details, please refer to our previous reports.

Bitcoin Technological Developments

OP_CAT

Although OPCAT is an easy-to-implement opcode, its activation introduces many functionalities, ranging from relatively simple Merkle tree verification (hash of two elements) to more complex operations like transaction input verification using aggregated Schnorr signatures. However, concerns about its flexibility may introduce some unpredictable risks. In May 2024, OPCAT was enabled as a soft fork in the Bitcoin trial client (a client on the signet network). The soft fork method has also been subject to various debates and uncertainties during the last Taproot upgrade. Not only the content of the upgrade itself but also the process of how the soft fork upgrade occurs has been a topic of discussion, so OPCAT may not be enabled in the short term; if enabled, it will certainly be accompanied by various controversies. Other soft fork upgrades follow a similar pattern, including OPCTV (which has already been widely debated in 2022), APO, and others.

BitVM

BitVM has made significant breakthroughs in enhancing Bitcoin's expressiveness, with BitVM2 improving upon previous designs, enhancing the verification capabilities for complex computations, and reducing trust assumptions. Recent key developments have focused on the development of the BitVM bridge, which has reached a certain level of maturity and security, potentially achieving testnet/mainnet launch maturity by the end of 2024. The BitVM bridge may primarily handle large assets, leaving room for the continued existence of other cross-chain bridges. Alternative cross-chain solutions to the BitVM bridge through multi-signature bridges or atomic swaps still hold practicality for end users, providing faster and lower-cost alternatives. Additionally, we may see the establishment of new validator networks built on BitVM2 in the future.

Channel and Joinpool-like Solutions

Solutions related to channels and Joinpool have made significant progress. These solutions allow two or more users to share a UTXO on the main chain, while off-chain allocations (vTXO) can be executed based on business logic. When users wish to exit, they can return to the main chain for settlement through unilateral exits.

In addition to Hedgehog, recent attention has mainly focused on Ark. Burak launched Ark v2, offering higher capital efficiency and proposing a related concept called Brollups.

Statechain is another interesting solution, similar to the Joinpool-based UTXO Mercury Layer. The Mercury Layer has made significant progress in this area, while new projects like Mach are developing the underlying infrastructure.

Bitcoin, as the largest asset, has historically been viewed as digital gold. However, with innovations like BitVM2, OP_CAT, and Bitcoin staking, we are witnessing more applications for Bitcoin. Although the Bitcoin DeFi ecosystem remains relatively nascent compared to Ethereum's DeFi ecosystem, we believe these catalysts will enable the Bitcoin DeFi ecosystem to achieve similar success in the future.

Solana

Institutional Interest

During Consensus, Paypal announced the launch of PYUSD on Solana. Since then, the market capitalization of PYUSD has rapidly grown due to integrations with some large DeFi protocols on Solana, such as Kamino Finance, Jupiter, and Orca. Another signal indicating institutional interest in the field is Stripe's announcement of re-entering Solana, allowing users to accept and make USDC payments.

Solana Labs, the company behind Solana, announced the launch of Bond, a blockchain-based platform aimed at enhancing brand interaction with customers, potentially accelerating institutional adoption.

In addition to the growing institutional interest in Solana, we also noted a high focus on themes like Blinks and memecoins, which are primarily aimed at retail consumers.

Solana Action and Blockchain Links (Blinks)

At the end of June this year, Solana launched Solana Actions and Blockchain Links (Blinks), creating a more seamless experience for retail users joining Web3. Through the Solana Action API, users can convert any transaction into a blockchain link and share it on any interface.

The impact of Blinks lies in enabling application developers (especially Web2 developers) to more easily embed on-chain operations across devices and platforms. Accordingly, dedicated browsers (or components) can intuitively display these elements, including links, QR codes, push notifications, buttons, and more.

This approach aligns with Solana's goal of driving mass adoption. Currently, there are about 155 projects in the Blink ecosystem, all of which need to undergo official review before adoption. Among them, 25 projects have specifically registered Blink domain names, while others have registered Blink compatibility. The community has shown strong interest in blnk.fun and BlinkEditor (although the official Twitter account for BlinkEditor is currently suspended). This process is similar to Pump.fun, where users can issue tokens by simply setting parameters like quantity, price, and description. Once shared on platforms like Twitter, users can directly purchase the token without leaving the platform. Additionally, well-known projects like Jupiter Exchange and Pump.fun are also integrating Blinks.

Solana's Meme Culture

On Solana, memecoins remain an important component of the ecosystem, and the launch of pump.fun further validates this observation. Pump.fun allows anyone to issue memecoins at no cost, leading to a surge of memecoins flooding the ecosystem. Since its launch in January this year, the protocol has generated nearly $50 million in revenue. However, despite the lowered barriers to issuing tokens and the increase in project numbers and transaction volumes, we have noticed a lower probability of success for projects.

Notable developments on Solana include the launch of the token extension feature, allowing tokens to have more customizable functionalities based on different project needs. With the anticipated launch of the Firedancer client, this not only brings diversified validation clients but also significantly increases network throughput and reduces costs, thereby solidifying its appeal to developers and users.

TON

TON performed exceptionally well in the first half of 2024, recording over a 200% increase, attributed to the rush of mini-programs developed on TON to attract Telegram's vast user base. Our focus on TON can be summarized in the following points:

- Active Ecosystem on Telegram: With approximately 900 million monthly active users, Telegram is attractive to developers seeking a share of the market. Coupled with in-app wallets and built-in fiat deposit channels, we are optimistic about Telegram bringing a large number of Web2 users into Web3.

- Compared to other popular messaging applications (like WeChat), we believe TON has the potential to replicate WeChat's success in large-scale monetization. WeChat currently has 1.3 billion monthly active users, with about 400 million active in the gaming sector. Gaming is the most popular category among mini-programs, followed by e-commerce and daily services. The top 100 mini-games generate $1.3 million in revenue quarterly, while popular games can achieve monthly revenues of up to $15 million.

Notcoin is a tap-to-earn game on TON that gained widespread attention in the first half of 2024. With over 40 million users, Notcoin sets a positive example and provides motivation for developers, investors, and retail users to join the TON ecosystem. However, this has also led to traffic inflation and a certain degree of over-speculation.

In terms of ecosystem development, TON launched an ad revenue-sharing mechanism in February this year, allowing channel owners to receive 50% of ad revenue, settled in TON. Currently, TON has established an ecological fund of $90 million and a $220 million community incentive program specifically for investment and grant distribution. In terms of compliance, TON has introduced the TON Star Coin model, directly linked to the Apple Store, allowing users to purchase in-game virtual items through Apple Pay, while Telegram will still use TON for settlements to project parties. For on-chain recharge needs, most applications have bots that support third-party recharges instead of adopting a one-size-fits-all approach.

However, Telegram CEO Pavel Durov was recently arrested on charges of cyber and financial crimes, and the network disruption caused by TON's native meme coin, DOGS, has become a detrimental factor for the ecosystem. While this is a cause for concern, the team behind TON has reiterated that the project will continue to operate. Given our focus on the TON ecosystem, the team will await further developments in infrastructure to enhance the ecosystem's maturity.

Restaking

Eigenlayer

In the first half of 2024, restaking became one of the hottest topics, with Eigenlayer being a major driving force behind this trend.

The success of Eigenlayer is reflected in several aspects:

- The total value locked (TVL) reached a peak of $20 billion.

- Eigenlayer's restaking feature has spawned at least 5 liquidity restaking tokens (LRTs) and over 20 active validator services (AVS). This has revitalized the Ethereum DeFi space, represented by Pendle and AAVE.

- Eigenlayer has successfully transformed its narrative from merely providing shared security (offering additional rewards for Ethereum nodes) to playing an important role in supplementing the Ethereum governance system.

At the core of Eigenlayer are its AVS. Currently, there are 16 active AVS, with only EigenDA supporting Eigen token restaking, involving 3.7 million ETH. Other AVS, such as Omni and Eoracle, hold between 800,000 to 2 million ETH, totaling at least $2 billion in assets for security assurance. ZK (zero-knowledge) projects align well with AVS, as they can reduce costs and improve efficiency by offloading some ZK verification tasks to off-chain validators. If the infrastructure based on AVS strongly substitutes the existing Ethereum ecosystem, it will enhance the effect of the Eigen token and support its price.

In terms of LRTs, different projects have adopted various designs and strategies, leading to varied performances. However, overall, the performance of LRTs largely depends on the overall market performance and whether EigenLayer shows strong results in the future. Despite initial successes, we need to pay attention to the challenges LRTs may face in the future. The over-financialization of LRTs could impact the stability of the Ethereum on-chain ecosystem. Competition in this area is expected to intensify, leaving little opportunity for new entrants.

Babylon

Babylon is a platform that allows Bitcoin holders to stake Bitcoin to secure proof-of-stake (PoS) chains without the need for trust.

According to the Babylon official website, there are currently 91 listed ecological projects covering 7 categories: Layer 2, DeFi, liquid staking, wallets and custodians, Cosmos, finality providers, and Rollup infrastructure. Among them:

- Wallets and custodians: Mainly mature wallet and custody solutions.

- Finality providers: Primarily staking services.

- Cosmos: Mainly older projects within the Cosmos ecosystem.

There are fewer new projects in these three categories. New projects are mainly concentrated in Layer 2, liquid staking, and DeFi:

- Layer 2: Bison Labs, BSquared Network (our portfolio company), Lorenzo, Map Protocol, etc.

- DeFi: Kinza Finance, LayerBank, Levana, Mars Protocol, Stroom, and Yala Finance (portfolio companies).

- Liquid staking: Bedrock, Chakra, Lombard, pSTAKE, Solv, Nomic, PumpBTC.

Additionally, we see other protocols like Satlayer building restaking platforms on Babylon, while Nubit enhances its Bitcoin-native data availability layer using Babylon.

As many DeFi yield projects revolve around Bitcoin, the demand for generating yield from idle Bitcoin is evident. We expect more projects to offer Bitcoin liquid staking services, and as the Bitcoin yield/Bitcoin DeFi narrative continues to develop, we may see capital flowing into Bitcoin from other ecosystems.

Modularity

Data Availability (DA)

There are few participants in the data availability (DA) space, including Ethereum, Celestia, EigenDA, Avail, and NearDA, with varying progress among these projects. DA projects primarily focus on security (including data integrity and network consensus), customizability, interoperability, and cost. The DA field in the first half of 2024 presents a complex landscape; for example, Celestia's DA token has fallen from historical highs, while competitor Avail raised $75 million in its latest Series A funding round, led by Founders Fund, Dragonfly, and Cyber Fund.

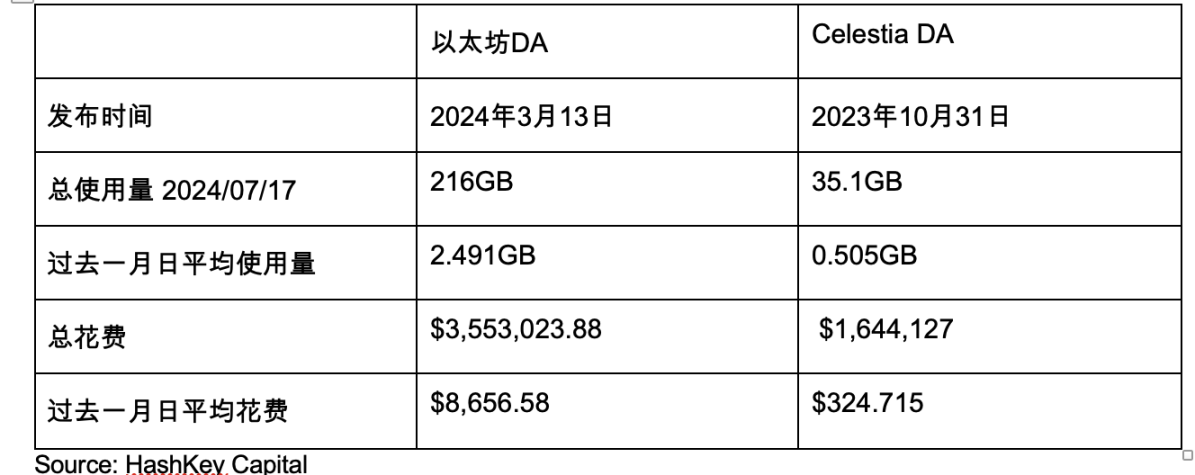

In the DA space, the main competitors are Ethereum and Celestia. When comparing Celestia and Ethereum, we see that Ethereum remains the preferred choice for rollups.

The main users of Ethereum DA include Taiko, Base, Scroll, Arbitrum, and OP Mainnet. In contrast, Celestia's main users include Orderly, LightLink, Manta Network, Lyra, and Hokum. Although Ethereum DA is more expensive, its demand and usage have surpassed Celestia, resulting in significant revenue growth for Ethereum.

As the DA field matures and competition intensifies, the market has approached saturation, and the key to project success lies in customer acquisition and ecosystem activity. Projects should also focus on other areas, such as decentralized exchanges (DEXs), gaming, bridges, and payments, to achieve scale. In addition to serving as pure data availability services, offering different services will also help attract and retain customers more easily.

Overall, we see increasing competition in the data availability space, with participants competing more fiercely on pricing, which may pose challenges to their long-term profitability.

Rollup Frameworks & RaaS

In the rollup space, Arbitrum, Base, and OP Mainnet have a clear lead, with Arbitrum in the forefront. Base, supported strongly by Coinbase, is narrowing the gap and branding itself as a consumer application hub, launching applications like Farcaster and Friend.tech.

OP Rollups and ZK Rollups have achieved varying degrees of success, with OP Rollups based on OP Stack leading the way. Overall, RaaS (Rollup-as-a-Service) is provided by four main solutions: Arbitrum Orbit, OP Stack, ZK Stack, and Polygon CDK, each with its own advantages and disadvantages. However, the common outcome among these different RaaS providers is the continuous increase in the number of rollups.

Leveraging the advantages of OP Stack, there are opportunities to unify OP Stack chains through concepts like OP Superchain, such as through shared ordering. In addition to scaling Ethereum through high throughput performance, these rollups can also differentiate themselves by implementing AA features and introducing persistent and popular consumer applications. As they continue to face challenges from L1s like Solana and Sui, this will help maintain their competitiveness.

In the sequencer track related to rollups, there haven't been many new projects recently, and existing projects are mainly focused on optimizations in three areas: UX, MEV, and decentralization.

As the difficulty of deploying rollups decreases, Rollup-as-a-Service providers will compete in various aspects, including ecosystem scale, cross-chain interoperability, and comprehensive modular toolkits equipped with full integration.

DePIN

As one of the most enduring use cases in blockchain technology, DePIN has gained significant attention in the first half of 2024, attributed to Solana's appeal as a DePIN application hub and immense interest in the AI field. The intersection of AI and crypto highlights the growing synergy between these two domains. Node sales have become a very popular monetization strategy in 2024, proving successful in launching communities and raising additional revenue for projects. However, despite widespread attention, DePIN's returns over the past three months have been underwhelming.

IoT Sensors / Wearable Devices

This area encompasses various IoT sensors and consumer wearable devices, such as watches, bands, rings, etc. The core proposition of this field lies in data collection, utilizing Web3 technology to make data more accessible and monetizable. A key issue in this submarket is incentivizing users to participate in data mining and earn rewards through data distribution, which has not achieved widespread success compared to Web2 solutions. For wearable devices, the top three consumer purchase motivations are (1) health and wellness, (2) fitness tracking, and (3) enhanced accessibility to smartphones and other smart devices. Providing a satisfactory user experience during community launches, along with sustainable token economics and value accumulation mechanisms, is crucial.

Data Market

In this field, the key challenges are the scalability and adoption rates of data markets. Creating an isolated data market can be particularly challenging in data-rich environments.

Wireless Networks

In the wireless network space, many projects are attempting to use Web3 concepts to improve penetration rates, but aside from a few successful projects (like Helium Network), common issues include poor user experience, compatibility problems, and insufficient service reliability. In 2024, due to various factors such as cost, geographic location, and economic development, internet penetration rates remain low in certain global regions. Community-supported wireless networks can fill this gap, drawing on the successful experiences of the Helium network.

AI x Crypto:

The immense demand for artificial intelligence sparked by OpenAI's ChatGPT has led to a surge in the demand for storage, computing, and networking resources. Centralized AI infrastructure providers face various issues, including high entry barriers, resource mismatches, and uncontrollable data. In this context, blockchain technology has emerged as a viable solution, encouraging active participation from users and communities through mechanisms like token incentives.

AI will also be one of the most actively observed segments in the DePIN field moving forward, primarily because training AI and machine learning models indeed requires a significant amount of computing power. DePIN projects encourage users to share their idle computing resources through distributed networks and incentive mechanisms, which can generate substantial actual income. This model has considerable cost-effectiveness advantages over centralized services. Existing projects in the market have already demonstrated their value in practical applications, covering scenarios such as AI model training and inference services, as well as providing rendering capabilities for games, indicating that the demand in this field is indeed real.

In the computing infrastructure domain, privacy protection can be added to computing networks, such as data privacy and model privacy. The core principles of blockchain technology are secure and privacy-preserving verification. In this regard, although various methods (such as ZKML, OPML, TEEML) have different trade-offs, they are all continuously evolving.

Previously active data tracks are increasingly integrating with AI to serve AI needs. The main factor distinguishing the effectiveness between large models comes from the datasets. The directions of the data track include: providing data sources (data DAOs), data-related infrastructure (vector databases, knowledge graphs, decentralized databases, etc.), and data privacy (FHE, TEE, etc.).

These developments highlight the growing attention on data-driven AI ecosystems and emphasize the importance of data privacy and decentralized infrastructure in future AI applications. Here are some key participants driving the robust growth of AI in the crypto space:

- Data sources, labeling, markets: Grass, Vana, Dria, DIMO, Hivemapper, Sahara Labs, Ocean Protocol, Singularity Net

- Computing networks: Aethir, io.net, Akash Network, Bittensor, Filecoin, Render, Nosana, Ritual AI, Gensyn AI, Together.ai

- Verification networks: Modulus Labs, Giza, Ora, Vana Labs, Aztec

- Proxy networks: ChainML, MyShell AI, Spectral Labs, Autonolas, Fetch.ai, Delysium

- AI-driven applications: Kaito.ai, 0xScope, Ringfence AI, Kai-Ching

Significant Trends in AI and Crypto

- With the exponential growth in demand for AI and machine learning training, computing power has become an extremely valuable resource. Many projects have emerged aiming to aggregate computing resources globally to meet this demand.

- As foundational models become more widespread, increasing attention is also being directed towards fine-tuning and optimizing models to meet specific business needs.

- No-code/low-code platforms have seen more innovations in deploying personalized AI agents. In Web3 AI, notable projects include MyShell AI, Hyperbolic Labs, Prime Colony, and Wayfinder.

Looking ahead, areas such as artificial intelligence, the Internet of Things, decentralized wireless (DeWi), and decentralized energy within the DePIN field are worth further attention.

RWA

The Real World Assets (RWA) sector remains a cornerstone of cryptocurrency, tightly linking Web3 technology with traditional asset classes. Real world assets bring numerous benefits to cryptocurrency, such as diversified real returns and easier access to illiquid or private asset classes. The sector continues to make significant progress in this regard, from the formation of tokenized consortium charters, Mantra's $500 million real estate tokenization, Blackrock's BUIDL fund, to significant investments in Securitize and Ironlight to promote the adoption of tokenized assets.

There are many asset classes within real world assets, but the most focused areas are private credit and U.S. Treasury bonds. The top three issuers of U.S. Treasury bonds are the Blackrock BUIDL fund, Franklin Templeton's U.S. Government Money Market Fund, and Ondo Finance's USDY. In the private credit space, competition is dominated by several key players such as Maple Finance, Centrifuge, and Goldfinch Finance. The estimated size of private credit in traditional finance is $15 trillion, expected to grow to $28 trillion by 2028. In contrast, Web3 private credit remains relatively small, but the growth prospects are promising.

In terms of tokenized commodities, gold remains the dominant asset, with the top two commodities being Paxos Gold and Tether Gold.

In the realm of tokenized collectibles, this field remains quite niche and isolated, making it crucial for projects to generate lasting demand and provide asset composability for tokenized collectibles.

Institutional Demand for Tokenization

Institutional investors are increasingly interested in utilizing blockchain technology to tokenize financial products. However, most executives still prioritize regulatory risks, resulting in limited exposure to public blockchains. To advance in this field, attention must be paid to market structure development, default risk management, and liquidity management. Only by focusing on compliance and infrastructure security can participants in the real world asset space capture retail and institutional adoption. A notable player making significant progress in the blockchain space is Avalanche. Through Avalanche Evergreens, the network has established partnerships with several institutions, including Citi, JP Morgan, and ANZ, demonstrating its appeal to institutions and successfully providing a secure, customizable, and efficient on-chain RWA platform. Currently, we are excited about narratives related to RWA, including RWA index tokens, RWA-backed stablecoins, and RWA-supported DeFi use cases.

RWA adoption may be driven more by institutions than by retail users. However, as regulatory policies become clearer, we expect more projects to emerge, offering a variety of tokenized securities beyond Treasury bonds to meet different investors' risk preferences, encouraging investors to increasingly embrace the concept of RWA.

Gaming and Entertainment

In the first half of 2024, market sentiment towards gaming remains low, aside from TON mini-games. The better-performing games include TON mini games like Notcoin, Catizen, Hamster Kombat, and others.

Ecosystem

In addition to the Telegram gaming ecosystem discussed in the TON section, IMX, Polygon, and Ronin remain popular gaming chains based on daily active unique wallets (UAW). Ronin continues to lead in the primary gaming ecosystem, benefiting from games like Pixels that have strong gaming communities, achieving 600,000 UAW over seven days. It has approximately 3.8 million monthly active users (MAU) on its network. Ronin remains attractive to small and medium-sized games, as the ecosystem can provide user traffic for game developers. To date, Ronin has attracted over 12 game studios. Additionally, Ronin has partnered with Polygon's CDK to enable zkEVM, allowing developers to launch their own L2 chains on Ronin. This could serve as a positive catalyst for RON.

On the other hand, IMX primarily covers mid to large-scale games and continues to attract major Web2 game studios by providing comprehensive deployment solutions. Immutable has launched a $20 million ecosystem support program in collaboration with Netmarble's subsidiary Marblex to further promote the development of the gaming ecosystem on Immutable zkEVM.

We continue to welcome studios entering the Web3 space, as well as game developers and KOL founders who are adept at learning, sensitive to crypto culture, and user-centric.

Gaming and AI

The combination of gaming and AI has not yet shown significant progress. Gameplay remains highly centralized, and consumer-driven, AI-generated content in Web3 is still in its early stages. Interest in applying AI in NPCs, companions, and scripting is primarily concentrated among B2B game developers.

Overall, the gaming ecosystem is highly competitive, with the key being to balance incentives and community building. Strategies focused on cultivating loyal users, such as providing high-quality gaming experiences, active user feedback, and strategic partnerships, may play an effective role in achieving long-term success.

SocialFi

SocialFi has become a hot topic, summarized by the continuation of Friend.tech, the breakout of Farcaster, and the explosion of Ton/TG social applications, driven by three main factors.

Friend.tech

Since its launch in 2023, Friend.tech has sparked ongoing discussions about the longevity and sustainability of its model. Although the initial release was very successful, user activity has declined this year. The V2 version released in May 2024 generated new interest by introducing paid group clubs, innovative fee structures, and high APY features, leading to a temporary surge in user numbers. However, criticism from the community regarding token liquidity and airdrop distribution, along with fierce competition from other social platforms, has led to user engagement stabilizing again. Despite doubts about its long-term viability, the launch of friend.tech has introduced a new model to the social finance space, with three key insights: (1) the potential for tokenizing social influence, (2) paid group clubs in Web3, and (3) social assets with cross-platform interoperability.

Breakthrough of Farcaster:

This year, Farcaster has made significant progress, becoming the dominant player in the field. In contrast, most other social protocols have faded from the spotlight, with some seemingly on the brink of decline. The Frames launched by Farcaster received positive feedback, introducing a new way of social, on-chain interaction using a familiar Web2 interface, significantly enhancing Farcaster's user experience, leading to a surge in DAU and attracting the attention of crypto developers and users. Additionally, the combination of Farcaster with meme tokens, particularly the success of tokens like Degen, has significantly driven user growth and activity on the platform. Airdrop activities effectively boosted user engagement and fostered the formation of a vibrant community.

The Farcaster ecosystem can be roughly divided into the following categories:

● Clients: Warpcast, Recaster, Supercast, ampcast, Farcord, Firefly, far.quest, etc.

● Decentralized applications (dApps): Jam.so, DeBox, Paragraph, CasterBites, Unlonely, Bountycaster, Wildcard, AlfaFrens, etc.

● Tools: sharecaster, Alertcaster, Searchcaster, Farcaster storage, farcaster.vote, etc.

● API services: Neynae, Pinata, Airstack, etc.

Overall, the success of the SocialFi sector is mixed, with network effects remaining a key factor in determining project success. In this field, we focus on projects that can overcome cold start issues and attract a diverse user base, requiring them to provide a Web2-like user experience while finding a delicate balance between rewarding creators and platform growth.

DeFi

The growth of DeFi in the first half of 2024 is primarily attributed to the significant attention on Eigenlayer, which introduced the concept of restaking to Ethereum, and Ethena, a hedge-neutral stablecoin that has accumulated over $3 billion in TVL.

Stablecoins have received renewed attention from developers, with more RWA-backed fully collateralized stablecoin projects attempting to replicate the success of Maker and Tether. Despite the increased interest, finding lasting use cases for stablecoins on-chain remains challenging, as they are currently mainly used on centralized exchanges. This may pose challenges for decentralized stablecoin projects that hope to provide value through native governance tokens.

Eigenlayer dominated much of the attention in the first half of 2024, with ecosystem projects like Ether.Fi, Pendle, and Renzo leveraging the surge of interest in restaking to capture significant market share. Despite the attention, Eigenlayer has not fully met user expectations, partly due to a weak macro environment.

From a blockchain perspective, Ethereum continues to lead in TVL (Total Value Locked). Blast and Base performed significantly in the first half of 2024. With the launch of various incentive activities, Scroll's TVL has exceeded $1 billion.

In non-EVM chains, the largest TVL contributor in Solana is Jito's JitoSOL, with other catalysts including a thriving meme culture and lending ecosystem. Chains related to BTC have also attracted interest, but maintaining that interest remains challenging due to a decline in TVL after incentive programs ended.

The recently popular CeDeFi model reflects the demand for sustainable, secure returns on on-chain assets. Whether through ENA fee mining or RCH's options structuring, the ultimate payers are users of centralized exchanges.

DeFi has demonstrated its ability to attract capital through lucrative yields. Currently, AAVE remains a major destination for funds across many Layer 2 and public chains, while Uniswap continues to be a primary liquidity pool. However, the key to long-term success lies in whether the protocol can accumulate value for holders and meet long-term expectations. As the number of chains increases, liquidity is gradually dispersed, presenting opportunities. Diverse DeFi solutions meet different needs, thereby driving potential demand for intent-driven platforms.

Institutional Services

From late last year to early this year, the market generally expects 2024 to be a record year for institutional adoption of cryptocurrencies with the approval of ETFs, with trading infrastructure, institutional-grade staking, CeFi lending, yield-generating stablecoins, and derivatives platforms being promising directions to bet on. From a primary perspective, investors are indeed betting on these directions, with representative projects completing financing this year including Securitize (raised $47M), Bitstamp (acquired for $200M), Flowdesk (raised $50M), Sygnum (raised $40M), Kiln (raised $17M), and Agora (raised $12M). However, the public market currently benefiting from ETFs mainly includes Coinbase, while other companies that are easier to list are primarily mining companies. From our perspective, we increasingly view this track as part of the fintech sector. Looking at the global financing trends of fintech-related companies, the amount of financing has been continuously declining, with Q1 2024 being the lowest quarterly level for fintech financing since 2017, and investors favoring later-stage companies that are already self-sustaining and close to profitability. However, the positive aspect is that crypto-related fintech companies are relatively active in this large field, mainly concentrated in early +A rounds.

In summary, we are still focusing on trading infrastructure, institutional-grade staking, CeFi lending, yield-generating stablecoins, and derivatives platforms as our main observation directions. In terms of investment, we are particularly interested in companies that have demonstrated growth potential and stability.

Conclusion

Although this summary does not cover all our findings, it highlights some key insights we gained in the first half of 2024. As a leader in the crypto venture capital space, HashKey Capital is committed to supporting innovative projects across various fields. If you are developing a groundbreaking project, we welcome you to reach out to us!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。