Written by: IOSG Ventures

1. Business Models in Crypto

Recently, there has been much criticism regarding the value accumulation of Ethereum and L2. The rapid exploratory development of Ethereum and L2 has brought challenges to their value assessment. This article attempts to provide some directions for thought. Before discussing how to specifically view the business models of Ethereum and L2, let’s first look at the overall business models present in the Crypto space.

1.1 "Enterprise" Type

Core: Control + Monopoly (Permissioned), Price Discrimination Leads to Profit

The focus of this model is on achieving revenue goals through a high level of control over services and protocols, which is no different from traditional business practices. Decentralization here is highly dispensable; it only needs to reach a level acceptable to users. Essentially, as a profit-oriented company, it must ensure efficient operation, and there should be no transfer of control rights.

For such projects, competition lies in the business model, specifically the ability for price discrimination, the speed of response to user needs, and the ability to drive user growth. Tokens primarily serve as a means for customer acquisition and assetization.

Taking the Solana Foundation as an example, its high level of control over the ecosystem can be said to even approach the degree of having a monopoly. Solana claims to be the Global Onchain Nasdaq and has consistently emphasized fundamentals, especially its business model and profits, which form the core value of this narrative. Solana's revenue largely comes from MEV income, which is the price discrimination generated after monopolizing block space, while the SOL asset itself serves as a concentrated assetization tool.

1.2 "Protocol" Type

Core: Permissionless Participation (Asset Issuance, Business), Open and Relatively Fixed Fee Standards

The focus here is on creating open, almost unchangeable protocol standards, governed by DAOs and foundations with minimal intervention, allowing the protocol to operate autonomously. The use of the protocol is permissionless, and the profit model is open and difficult to change; anyone can use the protocol to create markets and assets for their own business or profit. "Protocols" often have an assessment of their degree of autonomy, meaning there is a range of decentralization, with the minimum being that the team retains the right to update the protocol and is subject to market supervision; at the extreme, they may relinquish their update rights and leave the product to the market, with varying degrees of hard or soft decentralization governance differences. Tokens here play more of a role in dividends and governance.

For such projects, the test is the sustainability of product operation, the sustainability of demand, and the network effects brought by the timing of entry. Often, early adopters who find product-market fit (PMF) have a significant competitive advantage.

1.3 "Asset" Type

Core: Focus on the Value of the Asset Itself

This includes BTC, Memecoins, decentralized algorithmic stablecoins, etc. The asset itself gains consensus based on its characteristics, and its empowerment continues based on this. The attributes of the asset include three aspects: first, the consensus and network effects brought by being an "early adopter" in specific scenarios, such as BTC as a store of value, USDT as a payment medium, and ETH for asset issuance; second, the mechanism attributes of the asset, including rarity, deflationary mechanisms, price anchoring, etc.; third, the broad acceptance and dissemination brought by its symbolic significance, such as BTC widely understood as "digital gold," ETH as "programmable credit currency," and the cultural effects of Memecoins.

For such projects, the test is the strength of consensus and the asset's adoption and continuity capabilities.

In the Crypto world, different projects and assets correspond to the above business models or combinations of models. We can also attempt to evaluate the current state of Ethereum and L2 from this perspective.

2. What is the Business Model of L2?

2.1 Current Positioning of L2

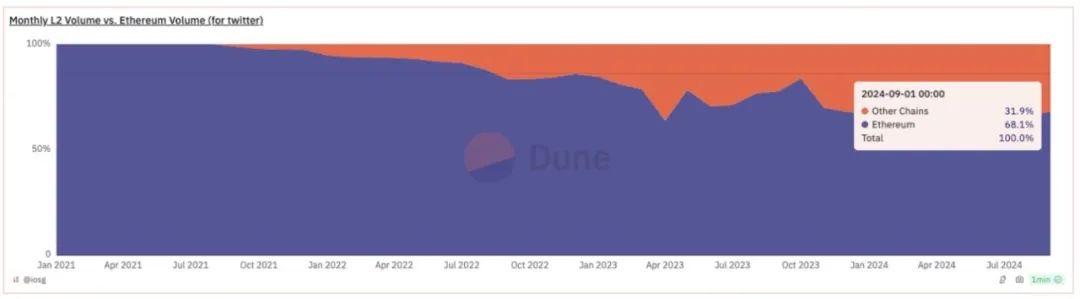

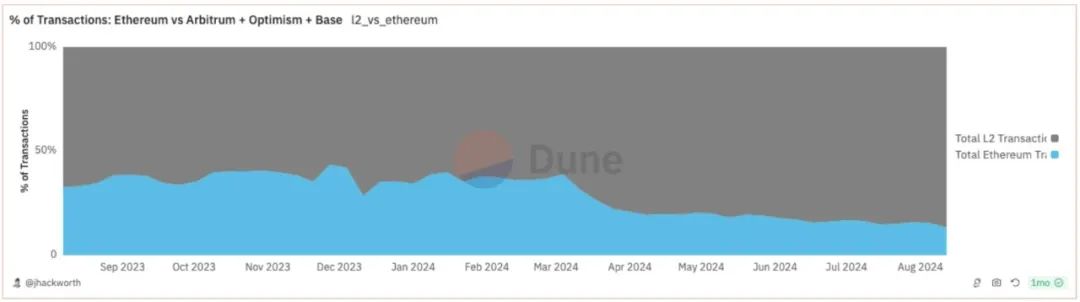

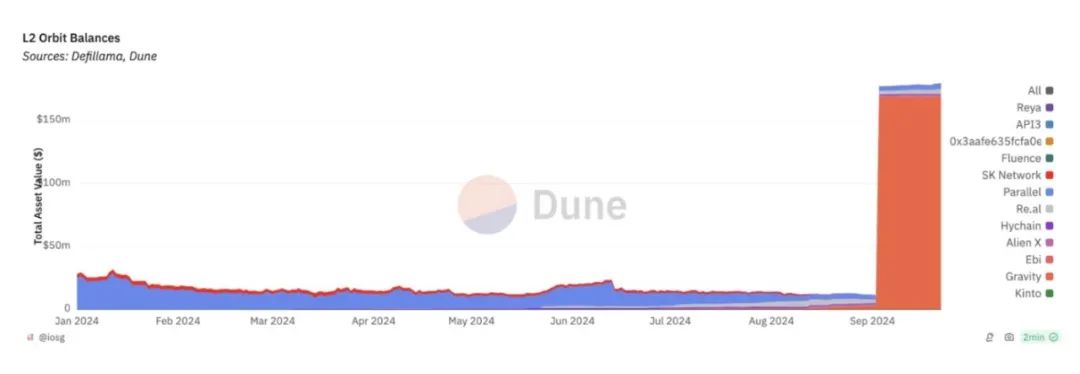

The initial positioning of L2 was to scale Ethereum, to accommodate Ethereum's transactions. This goal has been achieved to a certain extent. From the perspective of offloading Ethereum transactions and bringing incremental growth, it has been relatively successful. Currently, L2 has become an important part of the Ethereum ecosystem, accounting for 85% of the total transaction count and 31% of the transaction volume, becoming a crucial component of Ethereum's fundamentals.

Source: Dune Analytic

Source: Dune Analytic

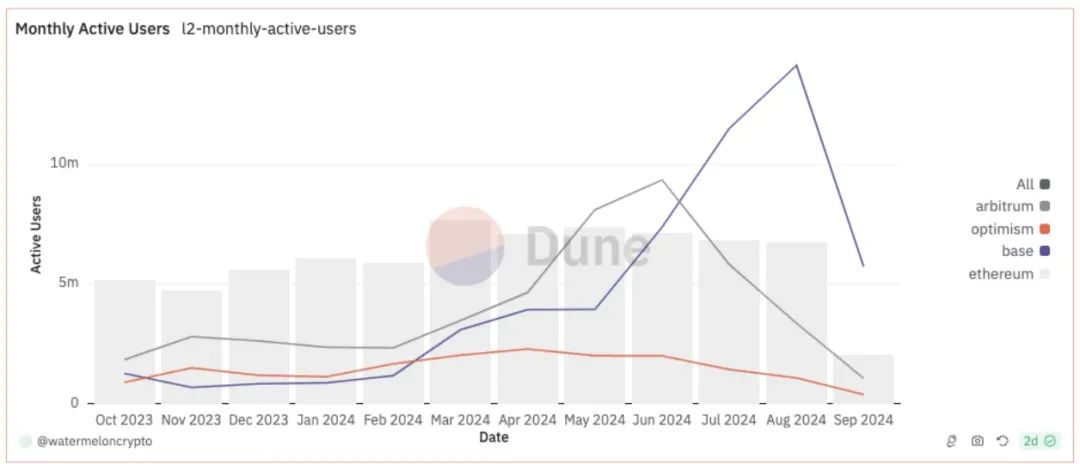

The number of active addresses is 3-4 times that of Ethereum.

Source: Dune Analytic

Due to the low transaction costs of L2, the actual increase in overall transaction data for Ethereum may be somewhat inflated, but the impact of L2 adoption can still be observed.

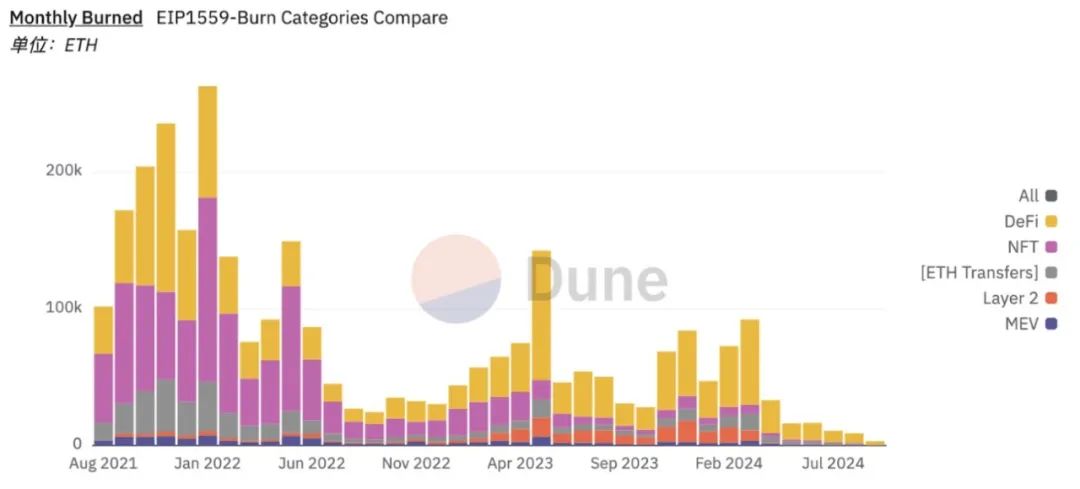

However, L2 has not brought a proportional increase in revenue to Ethereum under such transactions. The revenue brought by L2 mainly falls into two categories: the first is DA fees, which were transaction data fees before EIP4844 and are Blob fees after EIP4844. The second is MEV; apart from the current Based Rollup, L2 has completely absorbed this revenue into its own pockets, and in the short term, the expectation of returning benefits to Ethereum is low. This has effectively led Ethereum into inflation, and the concept of ultrasound money is gradually fading.

Source: Dune Analytic

Source: Dune Analytic

Here, let’s explain why DA fees cannot contribute to L2's revenue towards L1.

- DA only generates priority fees, i.e., monopoly pricing power, when it reaches saturation.

- DA in an unsaturated state is a commodity; in the long run, users can hedge and seek alternatives.

- The growth rate of DA demand is disproportionate to the growth rate of supply. L2 has a large proportion of bot transactions, which do not have the same necessity as real user transactions. If the C-end costs brought by DA fees are too high, this part of the trading will naturally slow down. Therefore, the assertion that transaction numbers will increase several times until Blob saturates is not a reasonable conclusion.

Essentially, scaling itself contradicts DA charging; in the pursuit of continuous scaling, profit should not be designed based on the congestion of transactions. The architecture of Ethereum L2 inherently reflects this. Previously regarded as ETH's Beta asset, it still narratively holds that title, but it has increasingly diverged from the fundamentals. In the future, L2's revenue will no longer imply Ethereum's revenue. The two should have their own valuation systems.

2.2 What Are the Different Business Models of L2?

2.2.1 Universal L2

Universal L2 refers to a general-purpose L2 that seeks to become an application ecosystem in itself. Many early Universal Rollups have moved towards a consortium model, and the currently well-performing Universal Rollups have mostly innovated in their profit distribution mechanisms to better incentivize developer innovation and retention, as well as active user participation. The trend for L2 is gradually to rely less on Ethereum and maximize its customizability through modular solutions.

The management approach of Universal L2 is to expand outward from various core teams, facing competition directly from external L1s. The revenue acquisition of Universal L2 is almost 100% captured under its profit distribution mechanism.

This positioning aligns more with the "enterprise" model we described, suitable for valuation through a model similar to Alt L1, meaning its value is assessed based on its ecosystem, fundamentals, especially revenue. Compared to Alt L1, its advantage lies in fully leveraging Ethereum's community and ecosystem, as well as the liquidity of ETH. Its disadvantage is that its token assetization capability is relatively lacking, and its customer acquisition ability is slightly inferior compared to Alt L1.

2.2.2 Consortium L2

Consortium L2, like Ethereum, has its own layer and second layer (L2/L3). The difference between a consortium and Ethereum is that issuing L2/L3 within the consortium requires permission, which ensures the business model of consortium L2.

Early Universal L2s have transitioned to consortium L2s, which often means that after gaining a certain level of market attention, consortium L2s are usually better businesses. The pre-transformation Arbitrum and Optimism, as well as the recent zkSync and Initia, are all striving in this direction. For consortium-type L2s, they are essentially developing their own L1 ecosystem while still relying on Ethereum's security and using ETH as a settlement currency. The characteristic of consortium L2s is that they change the internal business model and participants of the ecosystem through their management capabilities. Therefore, viewing consortium L2s as a "protocol" with a higher degree of centralization is more fitting.

Source: Dune Analytic

Consortium L2s are more often seen as a controlled version of Ethereum, similar to ecosystems like Optimism, which still delegate the task of application development. The difference from Ethereum is that this delegation is more strategically significant. Through permissioned models and centralized management, they can concentrate resources, expand synergies, and allow excellent resources to come in to share liquidity and the ecosystem, feeding back into the original ecosystem through revenue channels after the new ecosystem is launched. This is also why companies like Coinbase and Sony choose Optimism. Leveraging the "enterprise" capabilities of L2, they hope to see more breakthrough applications emerge.

Previously, we mentioned that the "protocol" type has different degrees of decentralization. In the exploration of protocol decentralization, there are often cases of chains or applications escaping, such as the earlier DyDx in the Arbitrum ecosystem and the later TreasureDAO. Balancing the degree of protocol decentralization while developing and consolidating its ecosystem is the core measure of the value of consortium L2.

2.2.3 Appchain L2

Appchain L2 is more of an application with a new business model and value capture. Its valuation should return to the application itself plus the new value brought by the L2 business model, regardless of whether the application itself aligns more with the "enterprise" or "protocol" model. Most App Rollups will choose to attach themselves to consortium L2s, benefiting from lower startup costs while having a stronger ecological radiation effect to rely on.

Appchains currently rely heavily on consortium L2 and RaaS, as the cost of building a chain is very low. However, the design of chain adaptability and supporting infrastructure (such as data browsers) still requires investment. For Appchains, the visible benefits include more effective utilization of tokens and capturing MEV, while the trade-off is the loss of the Lego effect and stronger liquidity on a single chain. When considering input-output, not all applications are suitable to become Appchains; suitable applications have strong endogenous cycles, such as Perp DEX and Gamefi. In the long run, losing the narrative heat of transforming into L2 makes it more important to reasonably assess ROI.

3. How Does L2 Affect Ethereum's Business Model?

After the Merge, especially following EIP1559, Ethereum continued to capture high priority fees and MEV from the limited block space transaction volume, even with significant L2 scaling and before EIP4844. After L2 scaling, it effectively relinquished the MEV from these transactions and reduced the priority fees from L1 native transactions. Following EIP4844, it also gave up this portion of income as DA. This active relinquishment of such profits is not typical behavior for a business. In fact, Ethereum has never developed into the "enterprise" model we defined. The concession of these profits is essentially allowing the DA and settlement layers to maintain a high degree of decentralization and autonomy, maximizing space for L2 to develop as large an ecosystem and as many applications as possible with minimal economic burden, even at the cost of some decentralization.

3.1 Ethereum as an L2 Issuance Protocol

Since establishing the Rollup Centric path, Ethereum has moved towards a more "protocol" rather than "enterprise" direction. Although some requirements for Rollups have been proposed, such as L2beat Rollup stages, there has been no actual interference. Currently, Vitalik has proposed some Ethereum Alignment requirements that will steer Ethereum's "protocol" governance model towards a more cohesive direction. However, it remains a highly autonomous "protocol," with the long-term effect of issuing Ethereum L2.

Currently, Ethereum L1 still carries over half of the entire ecosystem's transaction volume. In the long run, Ethereum provides a highly decentralized, autonomous, censorship-resistant, and secure permissionless issuance L2 platform (settlement layer).

Generally, the model of a permissionless issuance platform involves extracting a certain percentage from new asset issuance and trading, such as Uniswap extracting user transaction fees, Pumpdotfun charging users for token issuance in its early days, and prediction markets extracting user trading fees, etc.

Therefore, while Ethereum is an L2 issuance protocol, it did not set up profit gates through L2 in the early stages. This has led to the emergence of many L2 ecosystems that rely on Ethereum's liquidity and community but do not contribute revenue to Ethereum, indicating that Ethereum is the "protocol" model that pursues decentralization and autonomy the most. Looking at successful non-permissioned protocols like Uniswap, they have opened fee switches on pools with absolute monopoly positions and network effects, attempting to extract fees after achieving network effects, within a scale acceptable to users, which is an advantage of centralized management. Currently, for Ethereum, on one hand, it is making some attempts at fee gates through Based Rollup, while on the other hand, it does not strongly pursue profits, allowing the previously unprofitable L2 ecosystem to continue to grow rapidly.

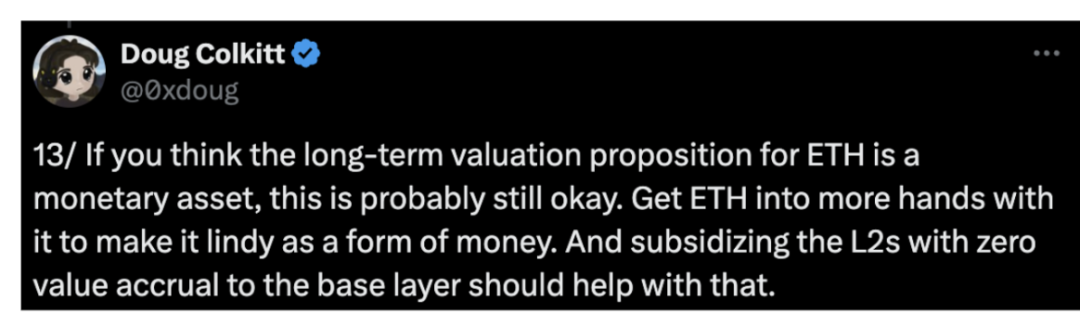

3.2 Ethereum as a Store of Value Asset & Programmable Trust Currency

ETH has long been difficult to value through the "enterprise" or "protocol" models because the early L1 business model no longer holds after scaling. After all, a business willing to relinquish its profits and a protocol willing to permanently turn off the fee switch should not be valued from the traditional enterprise & protocol fundamental perspective.

The original intention of Ethereum to relinquish its fundamentals was to provide more space for the overall ecosystem's development. As the ecosystem flourishes, Ethereum's value will ultimately rest on the monetary value of ETH. So, what potential value can the flourishing Ethereum ecosystem and ETH bring to each other?

Some believe it is the security attributes brought by ETH. However, some tech enthusiasts who are anti-crypto and believe in the value of distributed networks argue that P2P networks should not be tied to specific and speculative currencies to provide incentives for nodes. Some believe incentives should be provided in a less speculative manner, such as stablecoins or early PoW mining forms. The decentralization pursued by distributed networks and the continuous cost reduction in capital-intensive PoS mining are not inherently compatible and require many governance improvements. At the same time, the security value of ETH itself is influenced by its price, exhibiting considerable reflexivity. We have mentioned these two points in our previous discussions on economic security. Currently, whether in terms of incentives or security models, ETH is performing well, but in the long run, it may not be its strongest suit.

So, what is the most important value of ETH in relation to the Ethereum network that will be recognized by the market?

Source: @0xdoug

We may find some clues from Ethereum's development history, which has five highlights so far:

- Direct token issuance

- DeFi Summer liquidity mining

- Liquid staking

- L2 mining

- Re-staking AVS mining

The earliest direct issuance of token assets through Ethereum opened a new world for asset issuance and allowed Ethereum to find its initial PMF. Since then, the main development milestones of ETH have been closely related to asset issuance.

During the DeFi Summer era, the asset issuance model evolved into liquidity mining, which not only made ETH a supporting asset for asset issuance but also turned it into a liquidity benchmark with pricing capability. Thus, ETH found its second PMF—liquidity pricing asset. From then on, asset issuance in the Ethereum ecosystem would always consider liquidity improvement.

Liquid staking, while addressing the demand for staking, also enhances the value of liquidity pricing. After this, asset issuance gradually introduced the property of ETH time opportunity cost mining, which is staking, marking Ethereum's third PMF.

L2 mining is a manifestation of this asset issuance + liquidity pricing + time cost mining. By bridging ETH to L2, staking and mining native tokens/DeFi protocol tokens while providing liquidity, this liquidity flows to various protocols through the liquidity engine on L2. The three PMFs of ETH converge.

Re-staking and AVS mining represent another realization of the three converging. Liquid re-staking protocols release liquidity, similar to EigenLayer's re-staking protocol providing staking, indefinitely mining AVS native tokens through time cost.

Ethereum continuously repeats and improves this model, creating demand and value for ETH itself in asset issuance and DeFi use cases. It also reinforces ETH as the first choice in both interest-bearing assets and asset issuance, as well as liquidity provision, ensuring that ETH is distributed to protocols and users, becoming the primary focus of infrastructure and the first choice of value currency in users' minds within the Ethereum ecosystem.

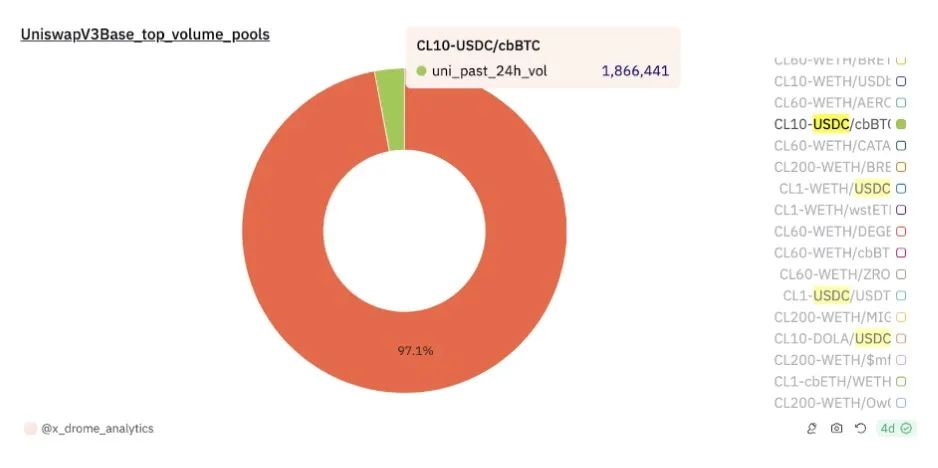

Currently, the competition for this value is not intense, as over 80% of currency pairs in mainstream Uniswap pools are settled in ETH. However, ETH still faces some potential competition, including competition from L2 native assets and derivative assets in terms of value storage, such as $cbBTC on Base, and competition from off-chain liquidity brought by Intent Networks.

USDC/WETH vs USDC/cbBTC, Source: Dune Analytic

USDC/WETH vs USDC/cbBTC, Source: Dune Analytic

But in the long run, the network effects brought by building around ETH and the demand growth from the incremental market of economic activities will, as Myles said, make all value more valuable.

4. Conclusion

The valuable business models in Crypto include three categories: enterprise, protocol, and the currency itself. The main differences between the first two lie in the centralization control, monopoly, adjustment, and price discrimination capabilities of the protocol, which also has varying degrees of pursuit for autonomy. The currency itself is based on the network effects generated from early use in a specific traction scenario.

Due to the early positioning of Ethereum and its L2 strategy, Ethereum's value has been pushed towards the permissionless "protocol" and ETH "currency" levels. Furthermore, due to Ethereum's vision, leadership structure, and early L2 strategy, Ethereum has half-actively and half-passively relinquished revenue from L2, reducing the burden on L2 to open up growth space. Although the standards for Ethereum Alignment from the Ethereum Foundation are becoming clearer, the overall open and autonomous positioning also means that Ethereum is no longer positioned as a purely "enterprise."

The powerful early L2 ecosystem has evolved into consortium L2, which is essentially a more centralized leadership, permissioned L2 issuance "protocol," continuing Ethereum's mission in a more centralized manner. Universal L2 has returned to competition at the L1 level as an "enterprise," with advantages in startup aspects compared to L1s outside the Ethereum ecosystem but disadvantages at the token level. The value of Appchains should return to the "application" itself after improvements in the business model (leaning more towards "enterprise" or a higher degree of centralization in "protocol"), requiring more consideration of the ROI of the chain. The relatively centralized vigorous development of L2 is based on Ethereum's highly decentralized model, sacrificing revenue to provide support and space.

Ethereum, under the premise that DA has been proven not to be a suitable business model, is gradually positioning itself as a permissionless L2 issuance protocol that has relinquished profit gates. It actively gives up its monopoly power in the existing market, hoping to exchange it for the ability to generate blood in the incremental market. How L2 alliances and some enterprise-like L2s can bring new increments without the burden of "taxing" Ethereum is Ethereum's biggest gamble.

The value of Ethereum as a currency comes from the continuous asset issuance and liquidity games on Ethereum. The five PMF Moments continuously bring value and usage inertia to the ETH asset itself. As the overall ecosystem of Ethereum expands, ETH, as the most valuable asset within the ecosystem, plays a crucial role in every stage from the launch to operation of the new ecosystem, relying on ETH's strong network effects. As the ecosystem stabilizes, while some native assets/wrapped assets will play a supplementary role, they are unlikely to affect ETH's absolute share.

If there comes a day of prosperity for the future L2 ecosystem, ETH, with its network effects, will still gain substantial returns in adoption from increments, even if it does not necessarily have a monopoly effect. At that time, Ethereum will gradually establish a value form dominated by ETH assets.

After understanding Ethereum's trade-offs as an ecosystem and the value positioning of ETH and L2, we are more confident that L2, as a driving force of the Ethereum ecosystem, will advance lightly with a business interest-driven model, rapidly opening up the ceiling of use cases with rich technical architecture choices, multi-directional development, and advantages of internal vertical integration. Meanwhile, ETH will emerge as the asset with the most network effects, discovering value alongside the flourishing of the entire ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。