Federal Reserve Chairman Powell stated that there will be two more interest rate cuts this year, totaling 50 basis points.

Overnight, the US stock market has temporarily not been affected by the sharp drop in the Nikkei index. The daily line shows slight fluctuations but still maintains an upward trend. Continuing the previous viewpoint, as long as there is no false breakout, the probability of a systemic crash in the global stock market is relatively low. The US dollar index has been fluctuating around 100 for six weeks, which shows that the status of the dollar is indeed solid, but it is also a final struggle. After the offshore yuan broke 7, there are signs of a short-term rebound. The recent surge in A-shares may be another strong medicine for the dollar.

Although what I am about to say may provoke some pro-Western individuals, it is a fact: the dollar tide most wants to harvest from China. However, we have withstood the pressure on the yuan exchange rate, and A-shares are currently advancing rapidly (A-shares are indeed undervalued, but this kind of sudden rise is not healthy. An investment market that relies on invisible hands for intervention is not sustainable, and it may not align with my personal investment logic).

Furthermore, the bond market is the second largest bond market in the world. As of September 30, the total outstanding amount of the mainland bond market reached 169 trillion. On the 24th, China's 10-year bond yield fell below 2% for the first time! A-shares have sounded the horn for a counterattack. The judgment on this is that the policy is "first monetary, then fiscal," with the market "first rebounding, then reversing."

Bitcoin

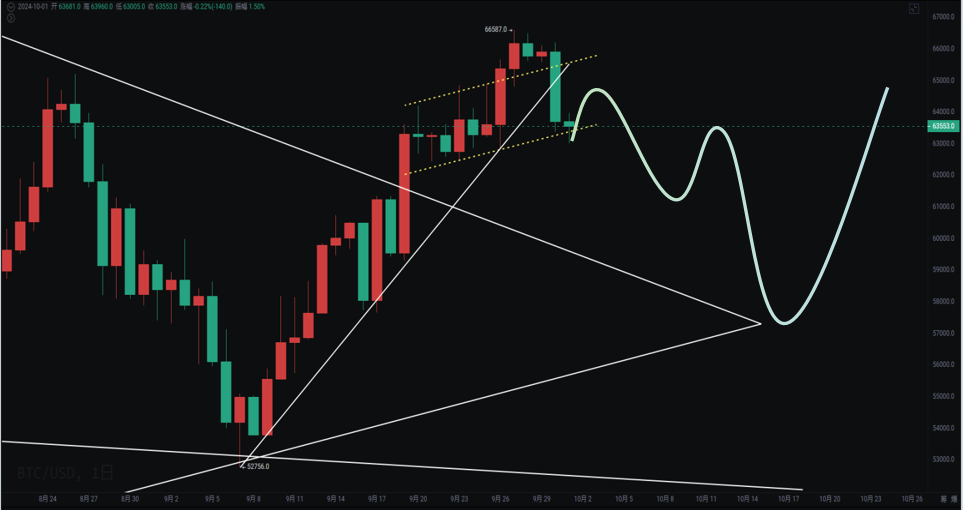

The upward trend on the daily line has broken down, and the rebound continues to look for a correction. This wave is expected to see 56,000—57,000. This is a rising flag pattern, and once the upward trend is broken, the probability of continuation is very high. Looking at the daily MACD, every time it crosses above the zero axis, it brings a wave of market movement, followed by various short-term top divergences leading to a correction on the daily line. This back-and-forth has become tiresome.

On the 4-hour chart, there is support at the bottom of the 62,300—64,800 fluctuation channel. If the rebound pressure at 64,300 cannot be broken, it will continue to correct.

Support: Pressure:

Ethereum

Ethereum also mentioned yesterday that its decline and rebound are slightly stronger than Bitcoin, as the ETH/BTC exchange rate is catching up. However, the upside potential for Ethereum is limited, and Bitcoin's downward direction will also pull it down. Altcoins are experiencing varying degrees of correction, and at that time, grasp the opportunity to re-enter. Support levels are at 2,500 and 2,300.

In this market, do not FOMO. In a fluctuating market, if Bitcoin rises, look for 100,000; if it falls, look for a bear market. The pattern has not been broken yet, and it still needs to grind. Altcoins are difficult to have independent trends during the altcoin season. Only when Bitcoin breaks 74,000 will a one-sided market start, and the profit effect of altcoins will be fully realized.

Support: Pressure:

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

The article is time-sensitive and for reference only, updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。