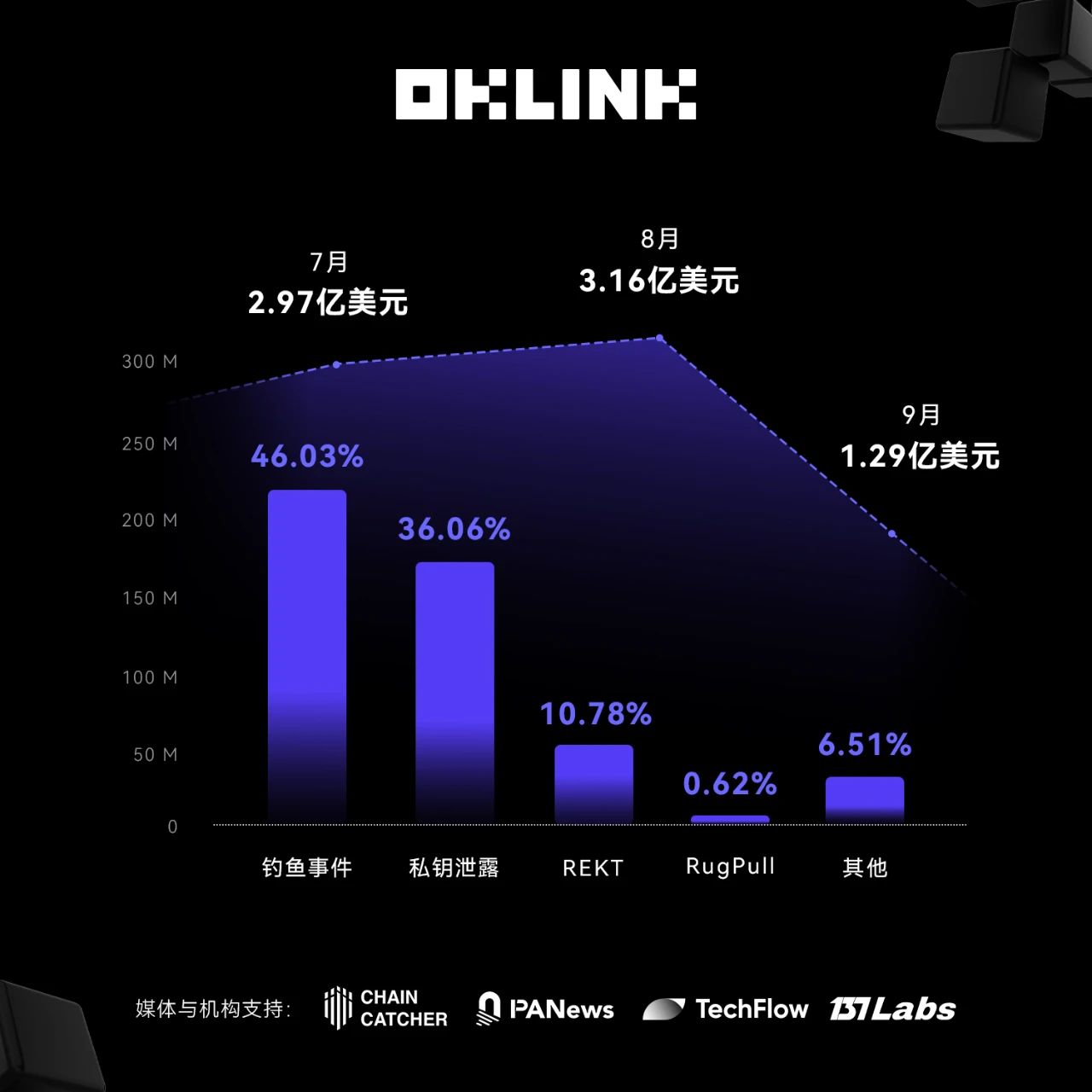

In Q3 2024, the total on-chain losses across the network amounted to approximately $743 million, an increase of 58% compared to the previous quarter. A total of 110 major attack incidents occurred, including 61 cases of fraud and phishing, resulting in losses of $340 million, accounting for 46.03% of the total losses.

According to OKLink data statistics, losses due to private key leakage amounted to approximately $270 million, accounting for 36.06%. REKT incidents resulted in losses of about $80.42 million, accounting for 10.78%. RugPull incidents caused losses of approximately $4.61 million, accounting for 0.62%.

During July and August, significant losses of about $300 million were incurred each month, while total losses in September sharply decreased by 57%. Nevertheless, challenges remain due to security risks such as phishing incidents and private key leaks, which are highly random and pose significant threats. OKLink reminds everyone to enhance their security awareness and not to trust any unverified signature requests, especially when authorizing "Permit" or involving fund transfers, and to verify the authenticity of signatures.

At the same time, properly safeguard your private keys and mnemonic phrases, never disclose them to anyone, and avoid saving them through screenshots or on insecure devices.

Largest Security Incident - Phishing Scam

On August 19, a potential victim reportedly lost 4,064 BTC, valued at approximately $238 million, due to a phishing attack. This substantial amount was quickly transferred through multiple platforms such as ThorChain, eXch, Kucoin, ChangeNow, Railgun, and Avalanche Bridge after being stolen.

Largest Security Incident - Private Key Leakage

On July 18, WazirX exchange suffered a loss of approximately $235 million due to the leakage of multi-signature wallet private keys.

Largest Security Incident - REKT

On September 3, Penpie was attacked due to a reentrancy vulnerability in its reward protocol, resulting in losses of approximately $27.34 million.

Largest Security Incident - RugPull

On July 21, ETHTrustFund experienced a RugPull, stealing approximately $2 million worth of cryptocurrency on Base.

Case Analysis

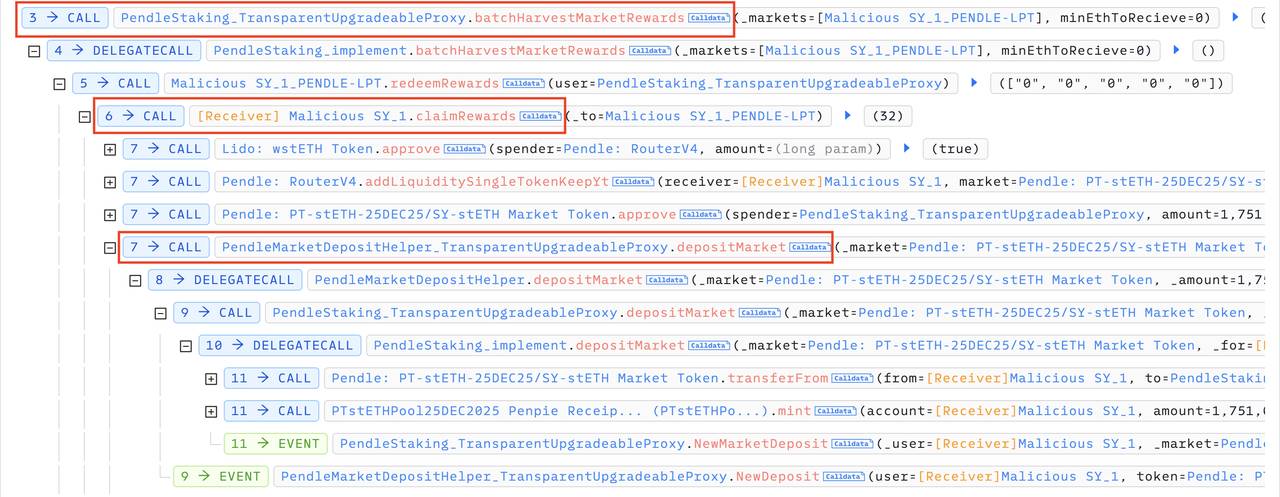

On September 3, the Penpie contract suffered a reentrancy attack, where the attacker added liquidity to the contract during the reentrancy phase to impersonate the reward amount, thereby obtaining the existing reward tokens within the contract. The asset loss reached $27.34 million.

- The attacker created a malicious SY1 token contract on the Pendle protocol to establish a malicious SY1PENDLE-LPT market. The attacker then used this malicious SY1PENDLE-LPT market to create a new collateral pool on Penpie, depositing a large amount of SY1_PENDLE-LPT tokens into that pool;

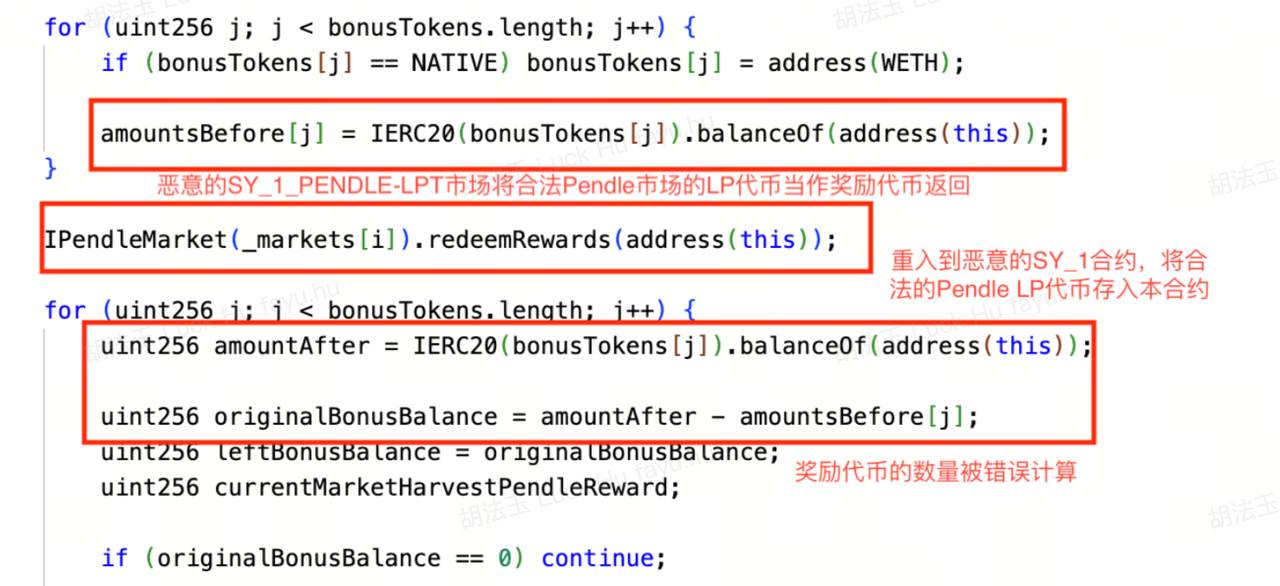

- The attacker obtained a large amount of wstETH, sUSDe, egETH, and rswETH tokens through a flash loan and deposited them into the SY1 token contract as rewards generated by the SY1 token contract. The attacker then called the Penpie.batchHarvestMarketRewards function, which triggers the claimRewards function of the SY1 token contract, expecting to receive reward tokens from the SY1 token contract;

- However, in the claimRewards function of the SY_1 token, the attacker exploited the reentrancy vulnerability of the Penpie protocol to deposit the wstETH, sUSDe, egETH, and rswETH tokens obtained from the flash loan into the corresponding Pendle market, and deposited the LP tokens obtained into the Penpie protocol.

Since this operation occurred during the call to the Penpie.batchHarvestMarketRewards function, Penpie mistakenly treated these newly deposited tokens as reward tokens and sent these incorrectly calculated reward tokens to the RewardDistributor contract. Because the attacker was the only depositor in this malicious Pendle market, they could claim all the rewards;

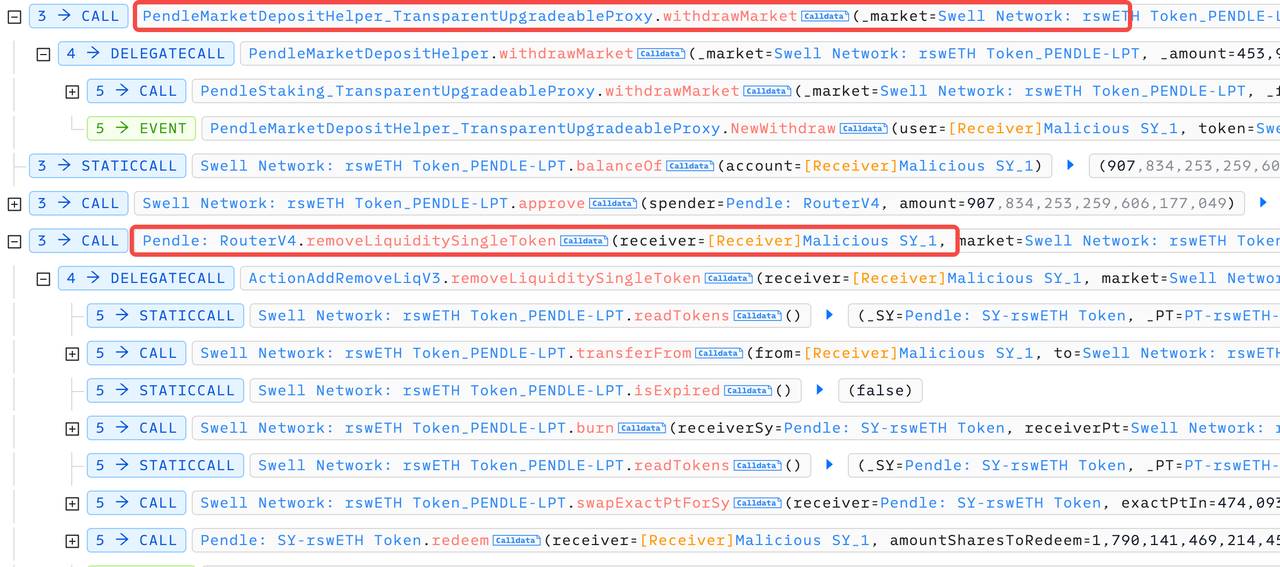

- Finally, the attacker redeemed all Pendle-LP tokens from Penpie, then redeemed wstETH, sUSDe, egETH, and rswETH from Pendle and repaid the flash loan.

OKLink Tips

OKLink reminds users to carefully verify on-chain addresses when performing on-chain operations to avoid losses due to address tampering. It is recommended to regularly check and revoke contract authorizations that are no longer in use to prevent malicious contract abuse. Make reasonable use of on-chain tools to secure operations; OKLink provides token authorization queries, address monitoring, contract comparisons, and other functions to easily manage token authorizations and keep contract risks under control. Click the bottom left corner "Read the original" to experience it.

Maintain rationality when facing high-yield projects, especially those lacking transparency or audit reports, and be cautious of falling into RugPull and REKT traps.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。