As the 2024 U.S. presidential election approaches, global attention is focused on this event that could reshape the economic landscape.

Election Preview: Global Markets Await Tension

With less than two months until the 2024 U.S. presidential election, global markets are in a state of tension, closely monitoring the evolving political landscape. As a pillar of the global economy, the United States (US) has significant influence over international economic trends, trade policies, and investment flows. Therefore, this election is not only a domestic affair but also a global event with far-reaching implications for economic stability, trade dynamics, and geopolitics. Following President Biden's withdrawal from the race on Sunday, Kamala Harris's support within the party surged, leading Trump by 3 percentage points among registered voters.

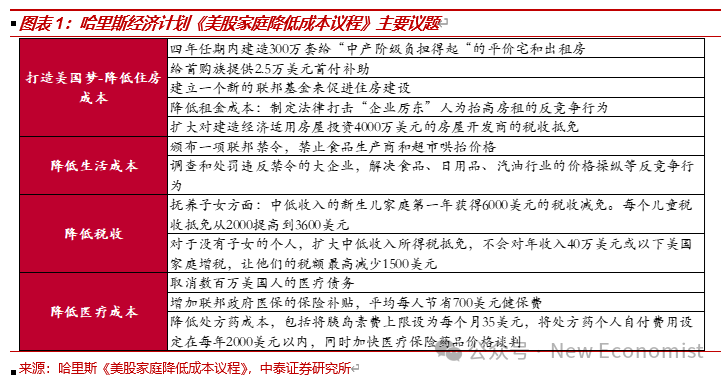

Harris Policy Analysis: Fairness and Fiscal Challenges

Harris's policy proposals embody the concept of "outcome fairness," focusing on reducing the cost of living for the middle class, improving housing issues, adjusting tax policies, and expanding social welfare. Her tax policy advocates for higher tax rates on high-income individuals and large corporations, which would reduce direct pressure on the Federal Reserve to cut interest rates, as her policies rely more on fiscal policy rather than monetary policy to stimulate the economy. However, large-scale fiscal spending can easily trigger inflationary pressures, especially leading to a rise in the medium to long-term inflation center. The Congressional Budget Office (CBO) predicts that the primary deficit rate for fiscal year 2025 may be significantly increased. Adjustments to deficit tax policies will affect corporate investment enthusiasm and the consumption behavior of high-income groups, potentially triggering capital outflows and impacting the international competitiveness of the U.S.

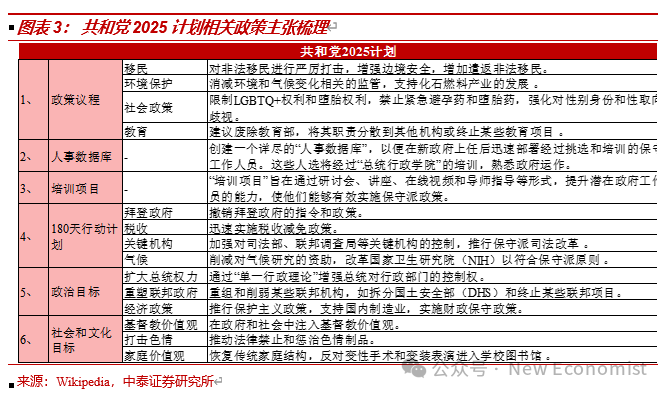

Trump's Economic Strategy: Interest Rate Cuts and Trade Wars

Trump's economic policy proposals are completely different from Harris's. Trump is more inclined to abandon the "strong dollar policy" and promote the depreciation of the dollar through more aggressive interest rate cuts and other loose monetary policies. In fact, it has been proven that during his presidency, Trump pressured the Federal Reserve to cut interest rates and criticized its rate hike policies, especially in an election year, where the Fed's interest rate decisions are likely to be influenced by political factors, compromising its independence. Trump believes that tax cuts, increased tariffs, and adjustments to monetary policy are the best ways to promote U.S. economic growth and revive manufacturing. Additionally, tariff policies could trigger a new round of global "trade wars," exacerbating international trade frictions. According to analysis from the Peterson Institute for International Economics, Trump's tariff plan could lead to a reduction of 675,000 jobs in the U.S. and an increase in the unemployment rate by 0.4%. The Wharton School's budget model at the University of Pennsylvania predicts that Trump's economic plan will increase the federal deficit by $5.8 trillion over the next decade. Reports indicate that Trump has expressed multiple times, both publicly and privately, his desire for the dollar to maintain its status as the world's reserve currency, and has discussed with his campaign team's economic advisors that if he wins a second term, he will target certain BRICS countries. Sources reveal that possible measures include implementing export controls, increasing tariffs, and accusing others of currency manipulation.

Final Impact of the U.S. Election Results

Supriya Menon, head of multi-asset strategy for Europe, the Middle East, and Africa at Wellington Management, wrote in a report that the most significant impact of the November U.S. election results on financial markets relates to trade and foreign policy. The policies of Republican candidate Trump and Democratic candidate Harris "could exacerbate the fragmentation of global trade." The primary economic consequence of tariffs is that they may exacerbate inflation in the short term, while changes in fiscal policy could also affect inflation, thereby influencing interest rate expectations and the dollar. Regardless of who ultimately wins the election, the U.S. fiscal deficit is expected to expand significantly, increasing the risk of economic recession.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。