The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and refuse any market smoke bombs.

The National Day holiday is approaching, and I believe that many old fans in the coin circle are feeling a bit excited. The bull market's initiation phase every year basically starts around National Day. Will everyone still have this mindset this year? Even Lao Cui holds some hope for this, as this year's coin circle is completely in a phase of favorable timing, location, and harmony. If there can be an explosion during the National Day period, it would indeed confirm the bull market theory. Enough small talk, let's return to our market. Many friends have recently been attracted by Lao A, drawing a lot of attention and funds. The Lao A market has indeed caused some impact on the coin circle. Recently, the market fluctuations have made Lao Cui a bit tempted; in just four days, several coins' market values have increased, with a terrifying growth of 10 trillion. The peak market value of the coin circle is only 2 trillion US dollars. Congratulations to everyone surviving in Lao A, remember to exit early after making a profit and secure your gains.

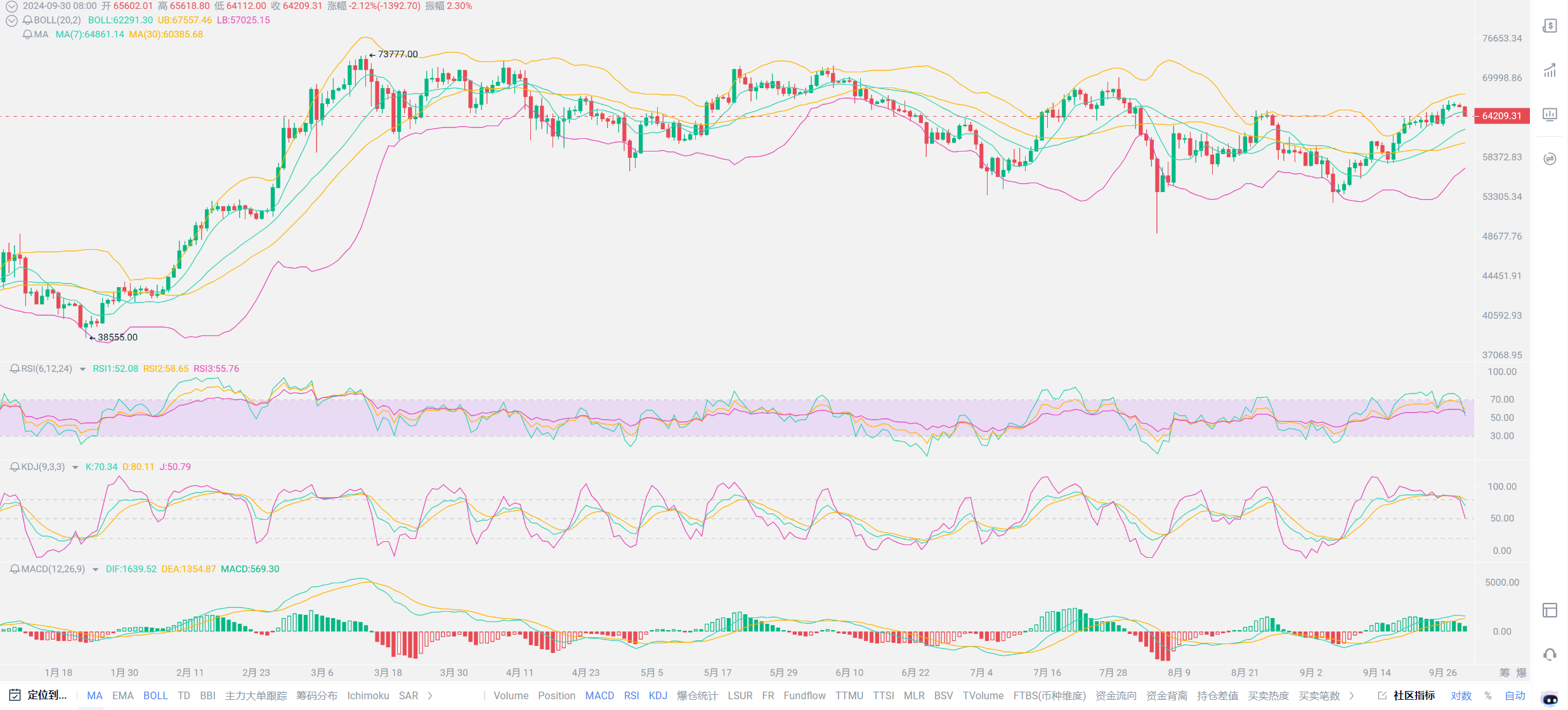

Back to our coin circle market, in the four-hour chart, the last candle closed at eight o'clock in the morning, surprisingly forming a large bearish candle, with today's pullback depth reaching nearly 60 points. Fortunately, it seems that the 2600 level has been defended. On the moving average front, the seven-day and thirty-day moving averages in the four-hour chart have formed a crossover. The two prices are alternating, showing a strong selling intention that outweighs the buying intention. Coupled with the Bollinger Bands, the coin price is running between the middle and lower bands, and there is a tendency to break below the lower band. However, the overall shape is gradually opening up, and the Bollinger Bands are leaning towards a bullish run, which somewhat suggests an entry point for everyone. The values and shapes of RSI, KDJ, and MACD are relatively stable, with no obvious bullish or bearish signals appearing. Overall, the technical indicators are slightly leaning towards the bullish side, and it might be a good choice for everyone to consider entering the market at this stage.

Next, let's take a look at the news indicators, mainly still influenced by Lao A. In just a few days, it has attracted a lot of retail investors' attention, so the short-term capital volume, including domestic and foreign investors, can be said to have absorbed too many chips. As the old saying goes, there is definitely a competitive relationship between markets, which has also led to the relative stagnation of capital in the coin circle. This makes Lao Cui recall when the stock god Buffett sold off American assets, especially his holdings in Apple, and shifted to the Chinese market. At that time, Lao Cui didn't fully understand this move, but now with the current trend, although I can understand this operation, it is too late, and I have to admire the investment vision of foreign capital. Of course, this is not to sing the blues for the coin circle; the issue of capital absorption in the coin circle is not too significant. After all, after the liquidity injection, the capital inflow into the coin circle will not be a problem. It is only a short-term impact on the coin circle; the overall situation is not too concerning.

Secondly, I want to mention that the U.S. interest rate cuts have led many to believe that American data will look better, so many friends are also eyeing the U.S. stock market. The interest rate cut will indeed bring a wave of growth. Lao Cui's suggestion is still to hope everyone can keep their capital in the coin circle market, whether it is altcoins or mainstream currencies, their growth trend will definitely be stronger than traditional capital markets. This is not because Lao Cui is in the coin circle that I encourage everyone to invest in it. Since Lao Cui shifted from the Lao A market to the coin circle market in 2016, I have always believed that the coin circle market is the mainstream of financial growth. In the next five years, as long as policies do not fully regulate the coin circle, the coin circle market will always maintain a larger growth space than traditional capital markets. If everyone has enough capital, try to choose to invest most of it in the coin circle, while other markets can be used as a risk hedging option. The U.S. financial market is probably not as simple as everyone thinks. Lao Cui was able to layout spot and contract users at 2300 because I was certain that the U.S. would definitely cut interest rates. Lao Cui is not in a hurry to exit, and you don't need to doubt.

Everyone should be clear that the U.S. interest rate cuts prove that Lao Cui's thoughts in April and May of this year were valid. As long as the U.S. can cut interest rates in September, it will prove that the previously published employment and non-farm data were fabricated. You can recall when Yellen visited China; Lao Cui had already mentioned that interest rate cuts would not be delayed until the end of the year. If the U.S. had any means, they would not seek help from abroad. The root of the international financial crisis is completely unresolved, with increasing unemployment and declining income. Even if domestic real estate can return to previous highs, it still belongs to a situation of having a price but no market. Looking at the essence of the problem, everyone knows how much fluff there is in the current growth trend. The U.S. still maintains high inflation, while we maintain high deflation; neither can fundamentally solve the problem, and one day there will be an explosion. Therefore, investments in other markets can only be treated as speculation. If you have laid out in Lao A and the U.S. stocks in advance, and have already made a profit, you must control yourself and secure your gains to avoid falling into a passive situation.

As the U.S. increases liquidity in the future, the issue of capital aggregation in the coin circle will improve. Currently, the only factors that can influence the overall situation in the coin circle are the U.S. elections and policies regarding the coin circle. Other aspects of the coin circle market currently have no reason to decline. Even if other markets explode, it can only have a temporary impact. The listing of Bitcoin and Ethereum is enough to prove the recognition of traditional capital, and there will be buyers at the bottom. Therefore, for investments in the coin circle, any time there is a pullback is always the best time for everyone to enter the market. Lao Cui rarely has such a certain moment. We may be experiencing an unprecedented era of great change. The main theme of the market is thinking that 2025 will be the bull market for the coin circle. No matter when it comes, everyone just needs to remember one thing: the bull market will definitely come. If you do not enter the coin circle market before the bull market, when the bull market arrives, it may not give you another opportunity to enter. Whether in the spot or contract market, early layout is necessary, and proper position control ensures that capital can survive in the coin circle market. Everyone will definitely be able to obtain rich profits that other markets cannot provide. If you cannot grasp the timing of entry, you can ask Lao Cui; rest assured, I will not charge you. Finally, it is the moment to test everyone's courage.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between bullish and bearish positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。