This article will explore the performance of airdrops in 2024 and the factors influencing their outcomes.

Author: Keyrock

Translation: Deep Tide TechFlow

Acquiring and retaining cryptocurrency users is challenging. Airdrops attract long-term engagement by offering free tokens, but often lead to rapid sell-offs. While some airdrops successfully boost user adoption, many fail. This article will explore the performance of airdrops in 2024 and the factors influencing their outcomes.

Key Points

Difficult to Sustain

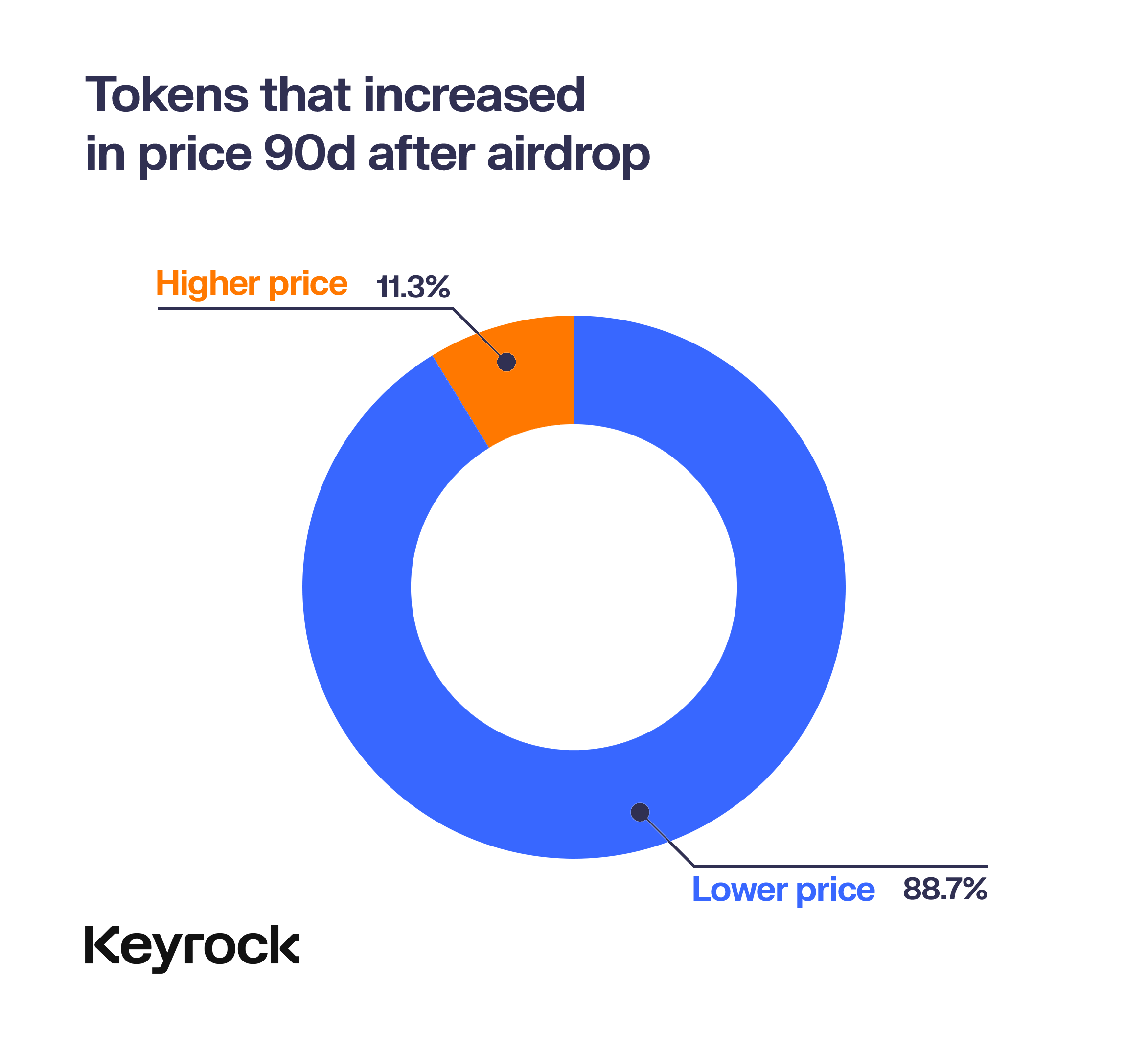

- Most airdrops fail within 15 days. In 2024, 88% of tokens depreciated within a few months, despite initial price surges.

Large Airdrops, Big Winners

- Airdrops distributing over 10% of the total supply show stronger community retention and performance. In contrast, those below 5% often face rapid sell-offs after launch.

Focus on FDV

- Inflated Fully Diluted Valuation (FDV) has the most significant impact on projects. High FDV constrains growth and liquidity, leading to significant price drops post-airdrop.

Liquidity is Crucial

- When there isn't enough liquidity to support high FDV, many tokens drop under sell-off pressure. Deep liquidity is key to price stability after airdrops.

A Tough Year

- In 2024, cryptocurrencies faced tough times, with most airdrops hit hardest. A few successful cases showed that smart distribution, strong liquidity, and realistic FDV were their successful strategies.

Airdrops: A Double-Edged Sword of Token Distribution

Since 2017, airdrops have been a popular strategy for distributing tokens and generating early hype. However, in 2024, many projects struggled to take off due to market saturation. While airdrops can still spark initial excitement, most trigger short-term sell-off pressure, leading to low community retention and abandoned protocols. Nevertheless, some standout projects have successfully emerged, proving that with the right execution, airdrops can still lead to sustainable long-term success.

Research Objective

This report explores the phenomenon of airdrops in 2024—distinguishing winners from losers. We analyzed 62 airdrops across 6 chains, comparing their performance across multiple dimensions: price trends, user feedback, and long-term sustainability. While each protocol brought its unique factors, the overall data clearly demonstrated the effectiveness of these airdrops in achieving their intended goals.

Overall Performance

When examining the overall performance of airdrops in 2024, most failed to perform well after launch. While a few tokens achieved substantial early returns, the majority faced downward pressure as the market reassessed their value. This pattern reflects a deeper issue within the airdrop model: many users may only be incentivized to participate for rewards rather than long-term engagement with the protocol.

For all airdrops, a key question arises—does the protocol have sustainability? After the initial reward distribution, can users still see value in the platform, or is their participation merely transactional? Our analysis, based on data from multiple time periods, revealed an important finding: for most of these tokens, enthusiasm waned quickly, often dissipating within the first two weeks.

Overall Performance

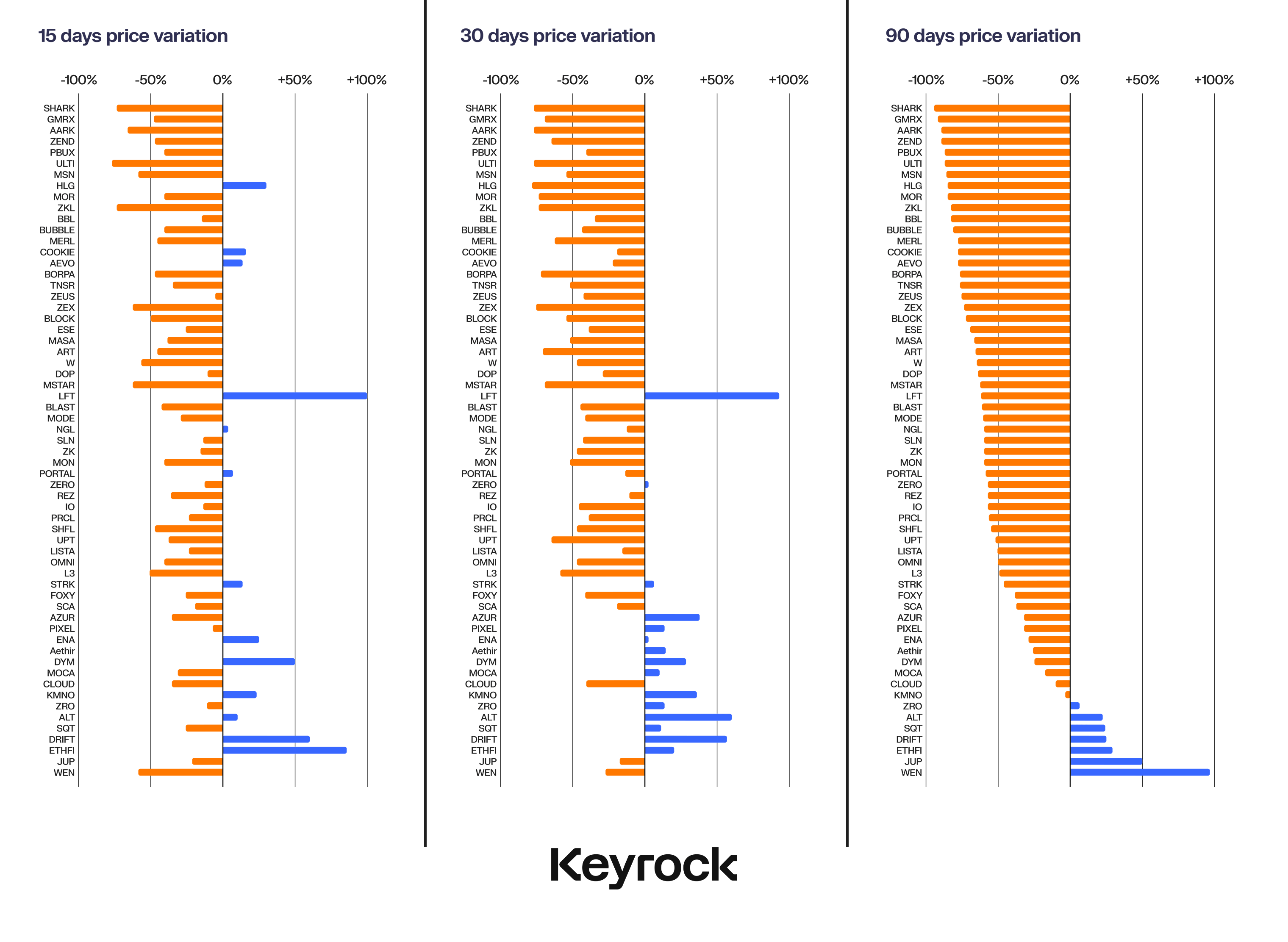

Observing price trends over 15, 30, and 90 days, it is evident that most price fluctuations occurred in the initial days following the airdrop. After three months, only a few tokens managed to achieve positive returns, with only a handful growing against the trend. Nevertheless, it is important to consider the broader context: during this period, the overall cryptocurrency market performed poorly, complicating the situation further.

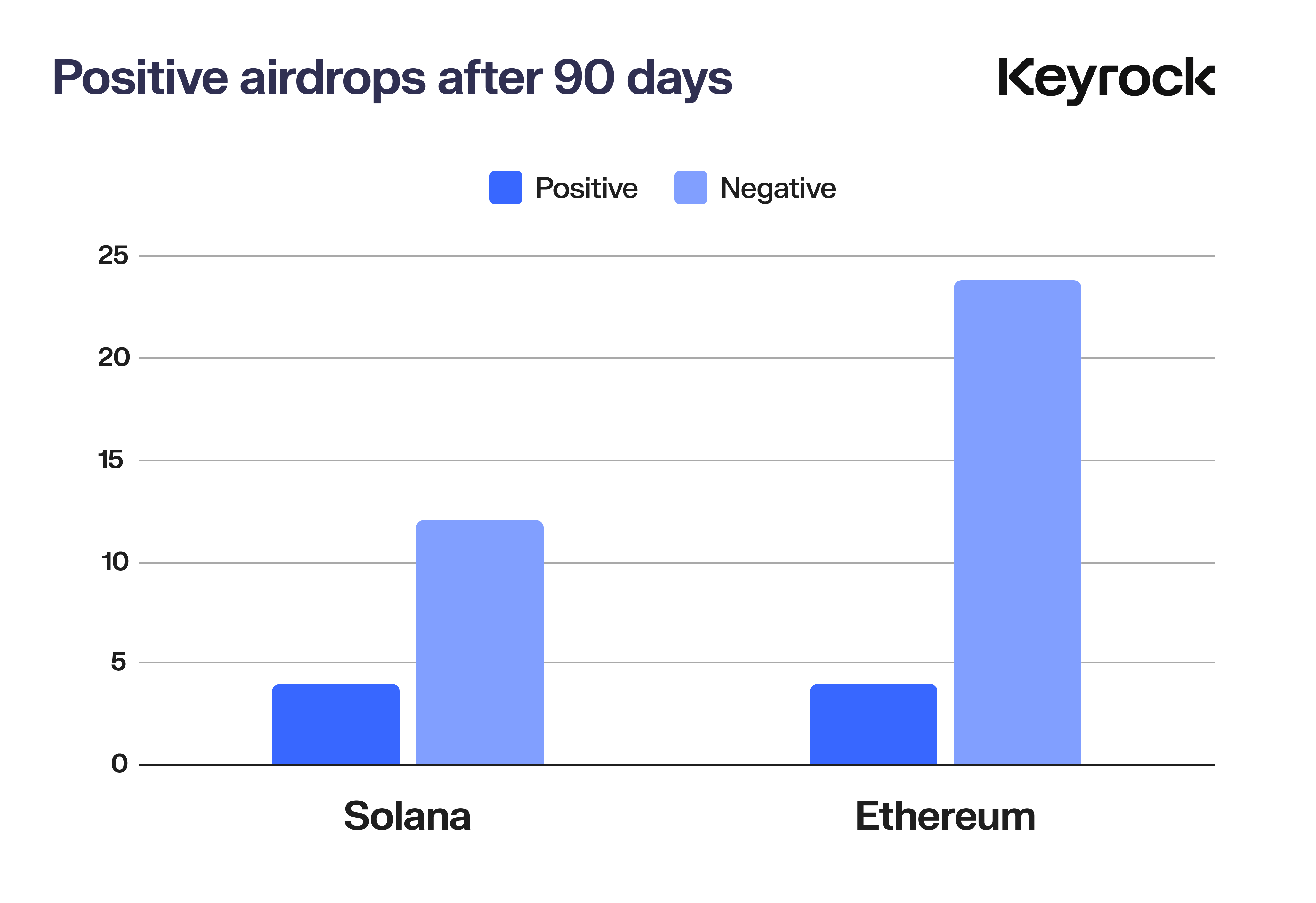

Chain Classification

Despite the overall poor performance, not all chains fared badly. Among the 62 airdrops we analyzed, only 8 achieved positive returns after 90 days—4 on Ethereum and 4 on Solana. BNB, Starknet, Arbitrum, Merlin, Blast, Mode, and ZkSync had no winners. Solana's success rate was 25%, while Ethereum's was 14.8%.

This is not surprising for Solana, as the chain has become a favorite among retail investors over the past two years and poses a real challenge to Ethereum's dominance. Given that many of the other chains we analyzed compete directly with it, it is not surprising that only the parent chain retained these select winners.

While we did not consider Telegram's Ton network, we want to emphasize that there have indeed been several successful airdrops on that network as enthusiasm and adoption increased.

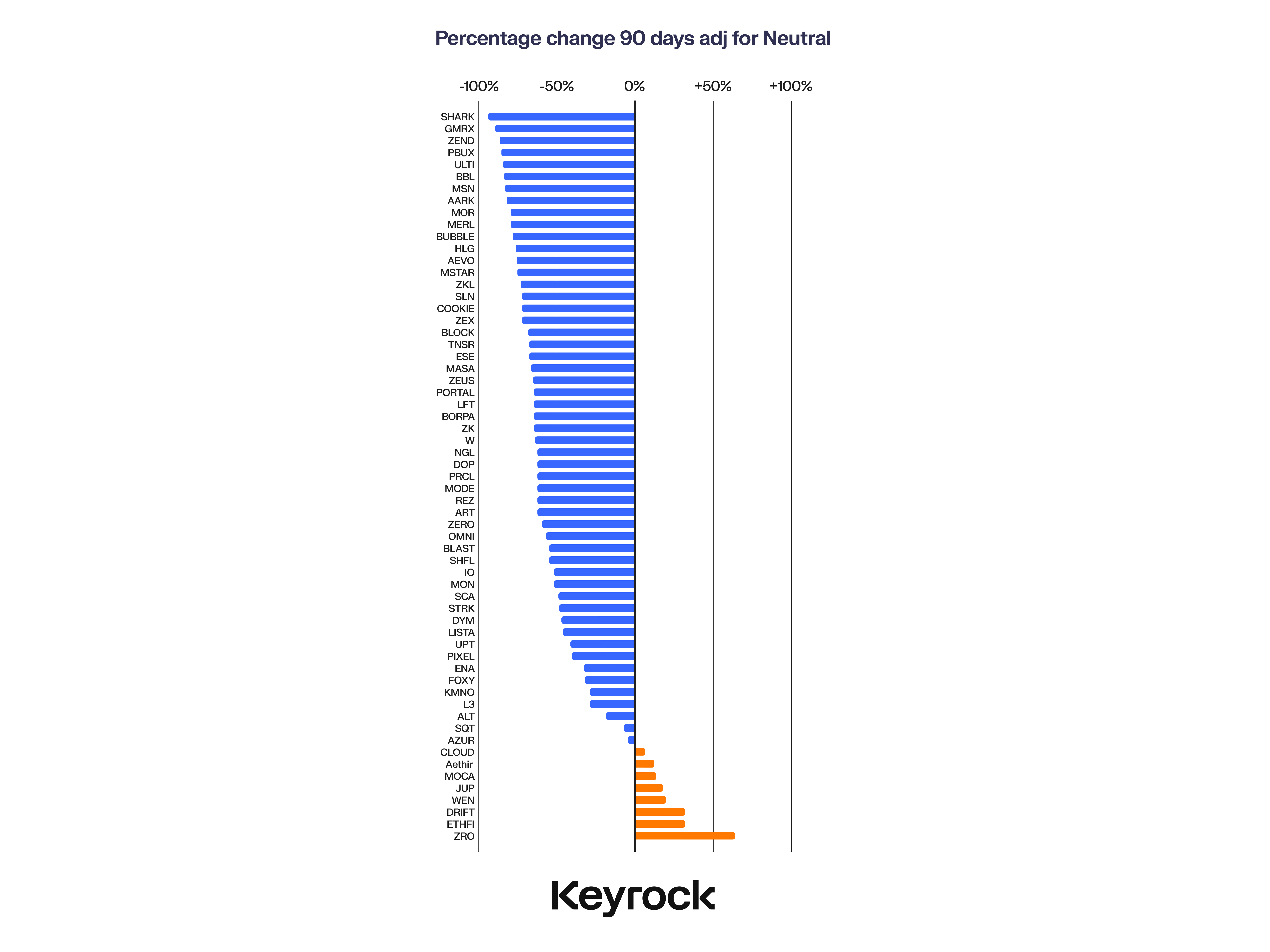

Standardized Performance

That said, what changes if we attempt to separate larger chains from their airdrops? Would the data differ if we accounted for the price movements of the parent tokens? When we standardized these airdrop prices against the performance of their respective ecosystems—for example, comparing airdrops on Polygon with the price movements of $MATIC, or airdrops on Solana with the price movements of $SOL—the results remained bleak.

Yes, the market has declined, retreating from the highs of 2023, but this is still insufficient to offset the decline of airdrops, whether compared to system tokens or other altcoins. These sell-offs are unrelated to the larger narrative but reflect the market's general concerns about short-term developments. When those already considered "mature" projects decline, people are even less willing to accept untested or "new" things.

Overall improvements are at best slight, with Solana and Ethereum experiencing maximum drawdowns of about 15% to 20% over some 90-day periods, but this still indicates that these airdrops are far more volatile than other assets and are only related to the overall narrative, not price trends.

Impact of Distribution on Performance

Another key factor influencing airdrop performance is the allocation of token supply. The amount of token supply a protocol decides to distribute significantly affects its price performance. This raises a critical question: does generous distribution yield returns? Or is a conservative approach safer? Does giving users more tokens lead to more positive price performance, or does it pose risks due to excessive distribution too quickly?

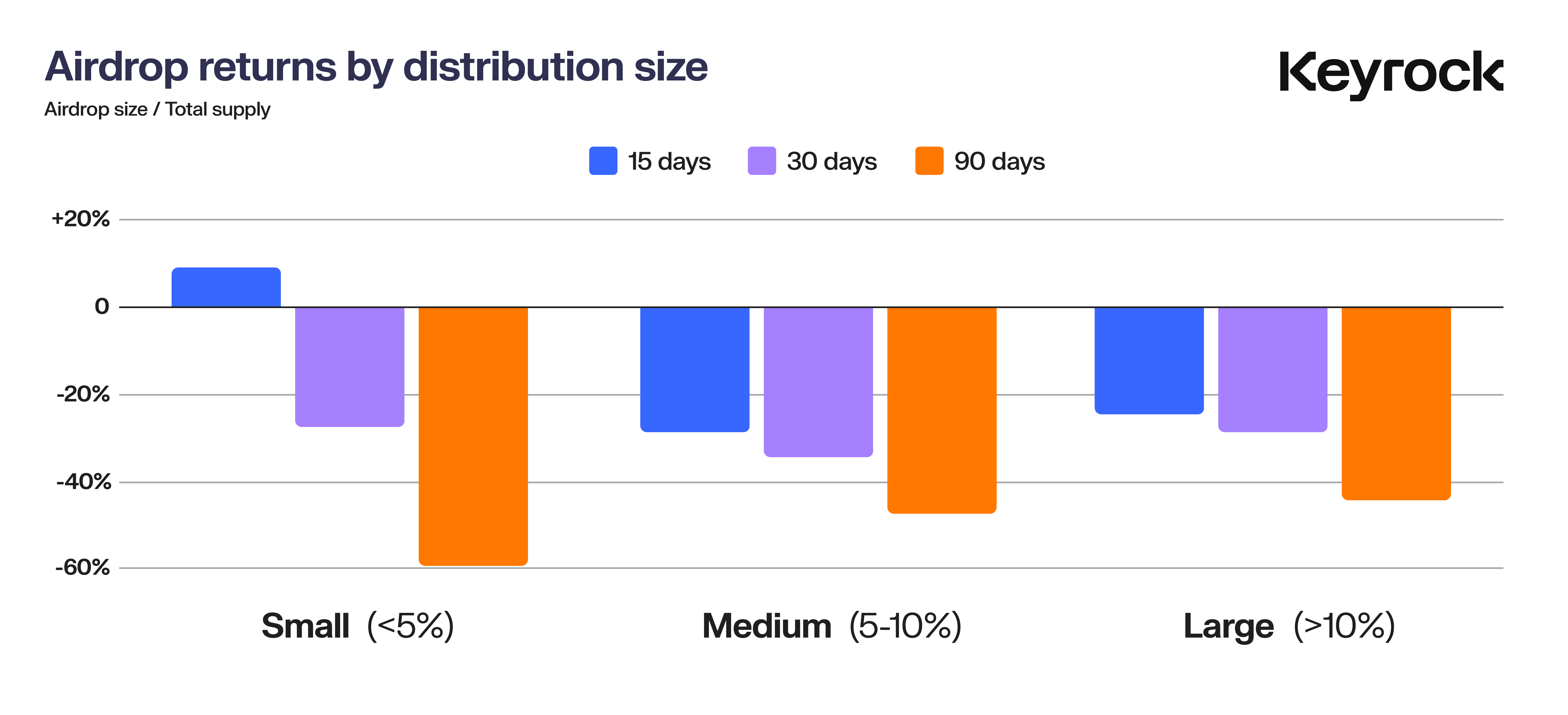

To this end, we categorized airdrops into three types:

Small Airdrops: 5% of total supply

Medium Airdrops: > 5% and ≤ 10%

Large Airdrops: > 10%

We then analyzed their performance over three time periods—15 days, 30 days, and 90 days.

In the short term (15 days), smaller airdrops (5%) performed better, possibly due to limited supply leading to less immediate sell-off pressure. However, this initial success is often short-lived, as tokens from smaller airdrops experience significant sell-offs within three months. This may be due to various factors: the initial low supply suppresses sell-offs, but over time, narrative changes or insiders begin to sell, prompting the entire community to follow suit.

Medium airdrops (5-10%) performed slightly better, balancing supply distribution and user retention. However, large airdrops (>10%) performed best over longer time frames. While these larger distributions carry greater risk in terms of short-term sell-off pressure, they seem to enhance community belonging. By distributing more tokens, protocols may empower users with greater stakes in the project's success. This, in turn, can lead to better price stability and long-term performance.

Ultimately, this data suggests that being more generous in token distribution pays off. Protocols that conduct generous airdrops often cultivate a more engaged user base, resulting in better outcomes.

Distribution Dynamics

Impact of Token Distribution

Our analysis shows that the scale of airdrops directly impacts price performance. Smaller airdrops create less initial sell-off pressure, but often see significant sell-offs within months. On the other hand, larger distributions do indeed generate more early volatility but ultimately lead to stronger long-term performance, indicating that generous distribution can encourage higher loyalty and token support.

Correlation of Distribution and Market Sentiment

Community sentiment is a key factor in the success of airdrops, although it is often difficult to quantify. Larger token distributions are generally perceived as fairer, giving users a stronger sense of belonging and participation. This creates a positive feedback loop—users feel more invested and are therefore less likely to sell their tokens, promoting long-term stability. In contrast, smaller distributions may initially seem safer but often lead to fleeting enthusiasm followed by rapid sell-offs.

While it is challenging to gauge the sentiment or "vibe" of the 62 airdrops, they remain important indicators of a project's lasting appeal. Signs of strong sentiment include active and engaged user groups on platforms like Discord, organic discussions on social media, and genuine interest in the product. Additionally, the novelty and innovation of the product often help maintain positive momentum, as they attract more engaged users rather than opportunists seeking short-term rewards.

Impact of Fully Diluted Valuation (FDV)

An important focus of the study is whether the Fully Diluted Valuation (FDV) at the token launch significantly impacts its performance post-airdrop. FDV represents the total market value of a cryptocurrency if all possible tokens were in circulation, including those not yet unlocked or allocated. It is calculated by multiplying the current token price by the total token supply, which includes circulating tokens, locked tokens, vested tokens, or future tokens.

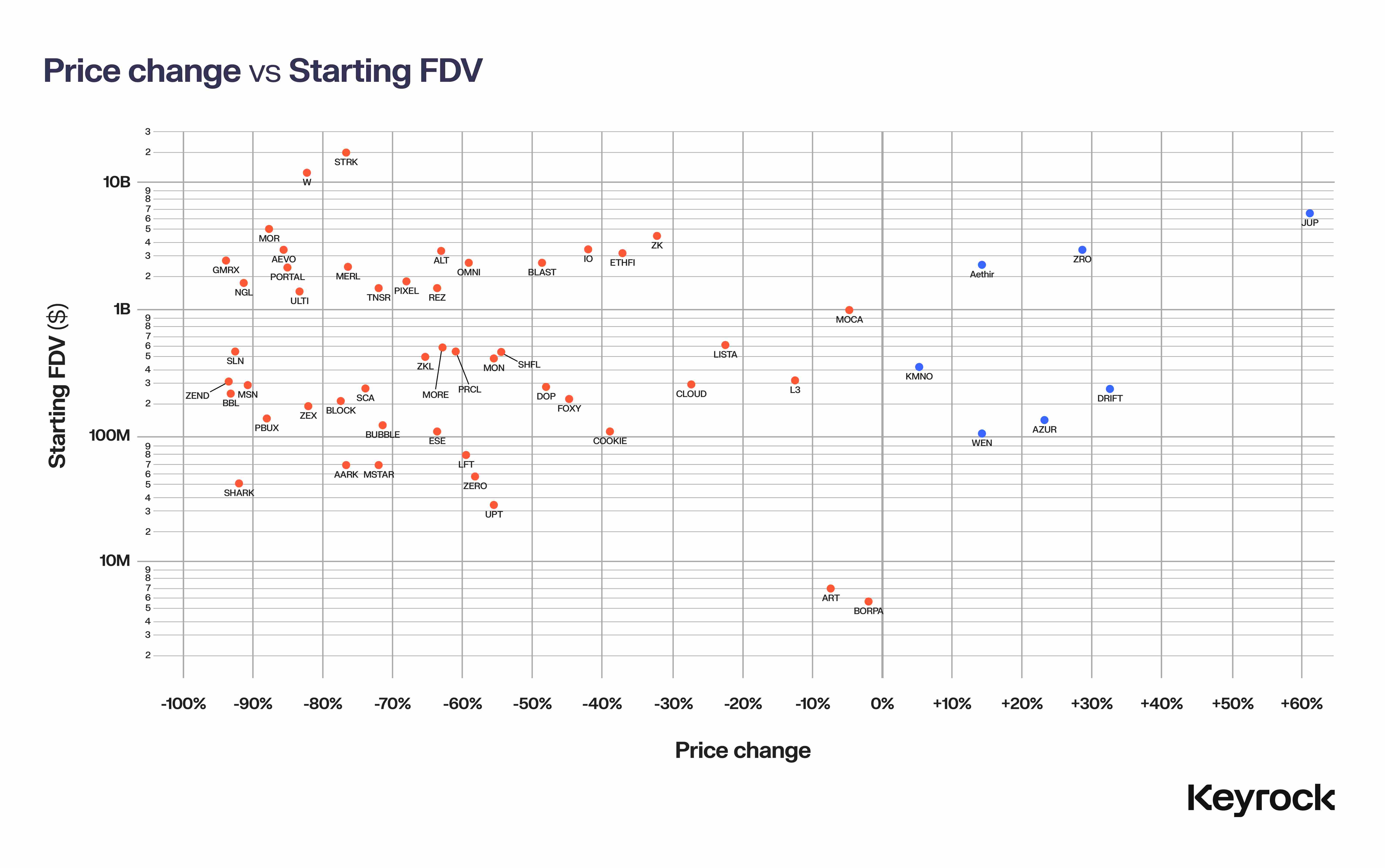

In the crypto space, we often see some projects' Fully Diluted Valuation (FDV) appearing excessively high relative to the actual utility or impact of the protocol at launch. This raises a critical question: are tokens penalized due to inflated FDV at launch, or does the impact of FDV vary by project?

Our data includes a variety of projects, ranging from those that launched with a moderate FDV of $5.9 million to those with an astonishing $19 billion—an astounding difference of 3,000 times.

When we plot this data, a clear trend emerges: the larger the FDV at launch, the higher the probability of a significant price drop, regardless of project type, hype, or community sentiment.

Reasons for the FDV Relationship

There are two key factors here. The first is a fundamental market principle: investors are attracted to the expectation of upward movement. Tokens with lower FDV offer room for growth and the psychological satisfaction of "early investment," enticing investors with the promise of future returns. On the other hand, projects with inflated FDV often struggle to maintain momentum, as the anticipated upside is limited.

Economists have long discussed the concept of "market space." As Robert Shiller pointed out, "irrational exuberance" quickly fades when investors feel that returns are constrained. In the crypto space, when a token's FDV indicates limited growth potential, that excitement can dissipate just as quickly.

The second factor is more technical: liquidity. Tokens with high FDV often lack the liquidity to support those valuations. When a large number of incentives are distributed to the community, even a small portion of users wanting to cash out can create significant sell pressure, while the other side lacks buyers.

Take $JUP as an example; this token launched with a fully diluted valuation (FDV) of $6.9 billion, supported by an estimated $22 million liquidity pool and market makers on launch day. This resulted in a liquidity-to-FDV ratio of only 0.03% for $JUP. In comparison, the meme token $WEN, with a 2% liquidity-to-FDV ratio, is relatively high among similar projects.

When we compare it to Wormhole, which launched with a fully diluted valuation (FDV) of $13 billion, to match the 0.03% liquidity ratio, Wormhole would need $39 million in liquidity across various venues. However, even considering all available liquidity pools, including official and unofficial liquidity, as well as liquidity from centralized exchanges, our estimate is close to $6 million, only a small fraction of the required amount. With 17% of tokens allocated to users, the potential unsustainability of market capitalization has already become apparent. Since launch, the price of $W has dropped by 83%.

As market makers, we understand that without sufficient liquidity, prices become very sensitive to sell pressure. These two factors combined—the psychological demand for growth potential and the actual liquidity needed to support high FDV—explain why tokens with high FDV struggle to maintain their value.

Data confirms this viewpoint. Tokens with lower FDV experienced price declines far below their initial values, while those that launched with high valuations suffered the most significant price drops in the months following the airdrop.

Overall Winners and Losers

To gain deeper insights into some projects, we selected one winner and one loser from this airdrop season for study. We will explore what they did right and where they went wrong, leading to the successful launch of one project and the less successful launch of another.

Airdrop Season: Case Studies of Winners and Losers

As we delve into the airdrop season, let’s examine a notable winner and a poorly performing project to analyze the factors that led to their starkly different outcomes. We will investigate what these projects did right—or wrong—that ultimately affected their success or failure within the community.

Winner: $DRIFT

First up is Drift, a decentralized futures trading platform operating on Solana for nearly three years. Drift has experienced many victories and challenges throughout its development, including several hacks and vulnerabilities. However, each setback forged a stronger protocol, evolving it into a platform that offers far more than just a simple airdrop farm.

When Drift's airdrop finally arrived, it was met with enthusiastic responses, especially from its long-term user base. The team strategically allocated 12% of the total token supply for the airdrop, a relatively large proportion, and introduced a clever bonus system that activated every six hours after the initial distribution.

Launching with a smaller market cap of $56 million, Drift surprised many, especially compared to other vAMMs (virtual automated market makers) that had fewer users and shorter histories but higher valuations. Drift's value quickly reflected its true potential, reaching a market cap of $163 million—a 2.9x increase post-launch.

The key to Drift's success lies in its fair and thoughtful distribution method. By rewarding long-term loyal users, Drift effectively filtered out opportunistic newcomers, fostering a more genuine community and avoiding the negative impacts commonly seen in such events.

What Makes Drift Unique?

Long History and Strong Foundation

Drift's mature history allowed it to reward its existing loyal user base.

With a high-quality, market-validated product, the team could easily identify and reward truly active users.

Generous Tiered Distribution

Allocating 12% of the total supply—a considerable proportion for an airdrop—demonstrates Drift's commitment to the community.

The phased release mechanism helps reduce sell-off pressure, maintaining value stability post-launch.

Crucially, the airdrop design aims to reward actual usage rather than merely artificially inflated metrics from yield farmers.

Realistic Valuation

Drift's conservative launch valuation avoided the pitfalls of overhype, keeping expectations at reasonable levels.

Sufficient liquidity was injected into the initial liquidity pool to ensure smooth market operations.

A lower fully diluted valuation (FDV) not only set Drift apart but also sparked broader industry discussions about overvalued competitors.

Drift's success is no accident; it results from prioritizing product strength, fairness, and sustainability over short-term hype. As the airdrop season progresses, it is clear that protocols wishing to replicate Drift's success should focus on building a strong foundation, fostering genuine user engagement, and maintaining a realistic view of market value.

$ZEND: From Hype to Collapse—A Case of Starknet Airdrop Failure

ZkLend ($ZEND) is now facing a severe decline—its value has plummeted by 95%, with daily trading volume failing to exceed $400,000. This starkly contrasts with its previous market cap of $300 million. Strangely, ZkLend's total value locked (TVL) now exceeds twice its fully diluted valuation (FDV)—an unusual phenomenon in the crypto world, and not a good one.

So, how did a project once highlighted around Starknet (a zk-rollup solution aimed at scaling Ethereum) end up in such dire straits?

Riding the Starknet Wave but Missing the Opportunity

ZkLend's concept is not particularly innovative—it aims to be a lending platform for various assets, leveraging the Starknet narrative. The protocol capitalized on Starknet's momentum, positioning itself as a key player in the cross-chain liquidity ecosystem.

Premise:

Generate a mining network where users can earn rewards across different protocols.

Attract users and liquidity through rewards and cross-chain activities.

However, in practice, the platform ultimately attracted "mercenary" participants—users focused solely on short-term rewards with no commitment to the protocol's long-term development. ZkLend failed to establish a sustainable ecosystem, instead dominated by users seeking rewards, leading to short-lived participation and low user retention.

The Counterproductive Effect of Airdrops

ZkLend's airdrop strategy exacerbated its issues. Before the airdrop, there was a lack of significant product or brand recognition, and the token distribution attracted speculators rather than actual users. This critical misstep—failing to adequately vet participants—resulted in:

A large number of reward hunters eager to cash out quickly.

A lack of loyalty and genuine engagement, with participants showing no long-term commitment.

Rapid decline in token value, as speculators immediately sold their tokens.

The airdrop did not build user stickiness and loyalty; instead, it created a brief spike in activity that quickly faded.

A Cautionary Tale for the Industry

ZkLend's experience offers a profound lesson: while hype and airdrops can attract users, they do not inherently create value, utility, or sustainable communities.

Key Takeaways:

Hype alone is insufficient—building real value requires more than just noise around a hot narrative.

Unvetted airdrop participants invite speculation, destroying value, as ZkLend experienced.

High valuations for new products carry significant risks, especially in the absence of validated use cases.

Conclusion

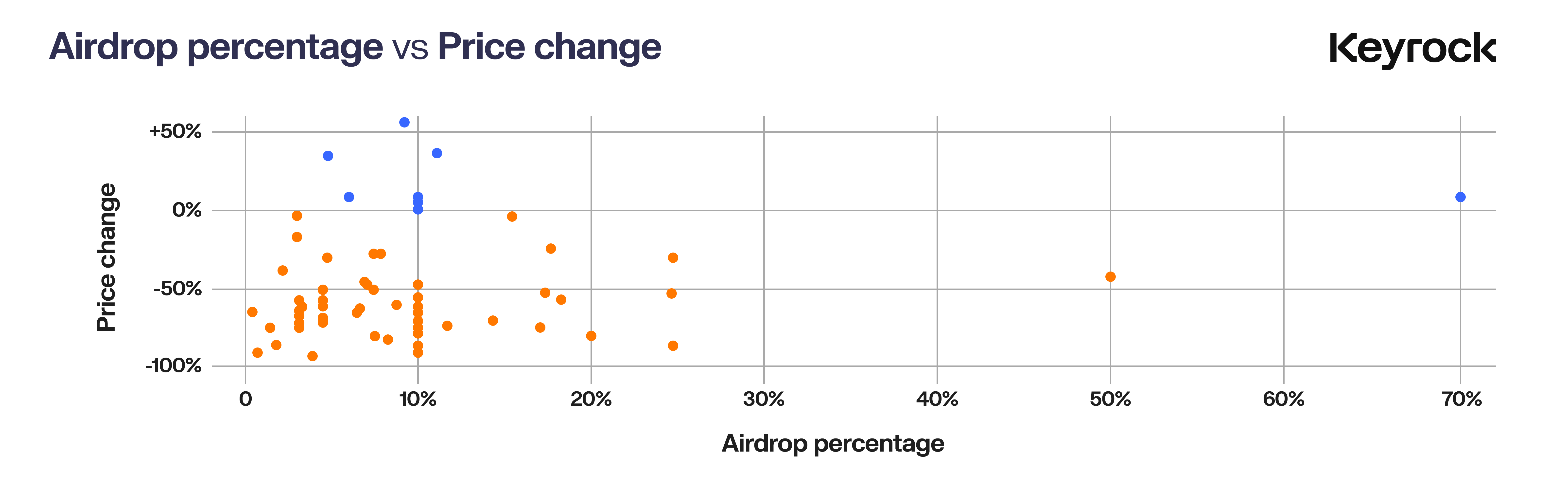

If maximizing returns is the goal, selling on day one is often the best strategy—85% of airdrop tokens will decline in value within months. Solana emerged as the leading blockchain for airdrops in 2024, but overall performance remained relatively strong after market adjustments. Projects like WEN and JUP stood out as success stories, indicating that a strategic approach can still yield substantial returns.

Contrary to common belief, larger airdrops do not always lead to sell-offs. A token with a 70% airdrop allocation achieved positive returns, emphasizing the importance of managing FDV. Overestimating FDV is a serious mistake. High FDV suppresses growth potential and, more importantly, triggers liquidity issues—inflated FDV requires substantial liquidity to maintain, which is often hard to come by. Without sufficient liquidity, airdrop tokens are prone to severe price drops due to inadequate capital to withstand sell-off pressure. Projects with realistic FDV and solid liquidity provision plans are better equipped to handle post-airdrop volatility.

Liquidity is crucial. When FDV is too high, it creates immense pressure. Insufficient liquidity can lead to large sell-offs that depress prices, especially in airdrops, where recipients often sell off quickly. By maintaining manageable FDV and focusing on liquidity, projects can enhance stability and long-term growth potential.

Ultimately, the success of airdrops depends on more than just the scale of distribution. FDV, liquidity, community engagement, and narrative are all important. Projects like WEN and JUP found the right balance, creating lasting value, while others with inflated FDV and shallow liquidity failed to attract investor interest.

In a rapidly changing market, many investors make quick decisions—selling on day one is often the safest choice. But for those focused on long-term fundamentals, there are always quality projects worth holding onto for the long term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。