This article is the impressive report card of Huobi HTX in the third quarter, showcasing and sharing the many achievements and progress of Huobi HTX in Q3.

In the second half of 2024, the global cryptocurrency market experienced significant fluctuations. With the strong performance of Bitcoin and Ethereum, the market gradually warmed up, and the haze of the crypto winter began to dissipate. Against the trend in Q3, Huobi HTX not only maintained continuous growth in trading volume but also steadily increased its influence in major markets, thanks to its stable product layout and efficient operational strategies.

This article is the impressive report card of Huobi HTX in the third quarter, comprehensively showcasing and sharing the many achievements and progress of Huobi HTX in Q3 in terms of trading volume and user growth, new coin assets, global influence and HTX DAO ecological layout, product features, HTX Ventures investment results, security and customer service data, reserve fund guarantee, etc.

Q3 trading volume and user growth surged against the trend, with the MEME special zone for new coins performing outstandingly

In Q3 2024, Huobi HTX's average daily trading volume increased by 42% compared to the previous quarter, showing impressive performance. Behind this growth is the fact that Huobi HTX has successfully attracted global users with its stable products and high-quality services, demonstrating users' continuous trust and reliance on the Huobi HTX platform.

In addition, in July, Huobi HTX saw an 11.3% month-on-month increase in trading volume and, on July 24th, ranked second globally with a 24-hour trading volume of 2.8 billion USD. This marked the third time in 2024 that Huobi HTX had ranked in the top 2 global trading platforms, indicating its steady development and strong capabilities in the market.

In Q3, Huobi HTX launched a total of 43 new coin assets, with the SUNPUMP and MEME special zones attracting attention. During the initial hype of SUNPUMP, Huobi HTX was the first to fully support the listing of the SUNPUMP series of coins, with the most outstanding coin, SUNDOG, seeing a surge of up to 37 times after listing, demonstrating significant market potential. Additionally, other popular coins such as SUNWUKONG and SUNCAT also received significant support from Huobi HTX.

In support of Ethereum MEME coins, Huobi HTX also led the industry by becoming the first exchange to list the lowercase Neiro ($NEIROCTO). The coin saw a maximum surge of 137 times after being listed on Huobi HTX, providing users with lucrative market wealth opportunities. In September, in support of SOLANA MEME coins, Huobi HTX was also the earliest to support the listing of MOODENG, which surged 4 times in just two days after listing, receiving high praise from the community and users.

Global markets, especially Russia, showed strong growth, and HTX DAO made appearances at industry events such as TOKEN2049

Huobi HTX not only continued to maintain strong momentum in the Asian and European markets but also made significant breakthroughs in the Russian market. In September, Huobi HTX had captured the third largest market share in Russia, accounting for 13.15%. This data fully demonstrates its expansion capabilities in the Russian market and the high level of trust from users in terms of security, liquidity, and innovation. Additionally, Huobi HTX's exchange market share in India and Japan increased by 2% each.

In Q3, HTX DAO completed its second liquidity donation in 2024 and held the HTX DAO x TRON TOKEN2049 Afterparty in Singapore on September 18th. Huobi HTX's global advisor, Justin Sun, stated at the event that they would further strengthen the collaboration between TRON and Huobi HTX to create a complete Web3 ecosystem through a "dual-wheel drive effect."

On September 25th, HTX DAO exclusively sponsored the registration area of the Crypto Summit 2024 conference and made an appearance as a business partner. This provided HTX DAO with an opportunity to showcase its unique decentralized governance model, further expanding its market share and influence in the CIS region, attracting more members of the crypto community, developers, partners, and users to join its ecosystem, thereby strengthening the global community and increasing decentralization.

Balancing internal and external aspects: Product upgrades to enhance user experience, and HTX Ventures accelerates the layout of innovative projects

In terms of product features, Huobi HTX carried out multiple upgrades in Q3 to enhance user trading experience and asset security. The upgrades included Fireblocks custody accounts, Contract Copy 4.0, contract function optimization, asset page redesign, and financial product optimization, among others, comprehensively enhancing user experience and account security.

On September 6th, Huobi HTX grandly launched the new HTX Telegram Mini Program, the first Telegram mini program product to introduce C2C trading functionality, aiming to provide users with a more convenient C2C trading experience. After the launch of the mini program, the number of new bot bindings exceeded 40,000.

In terms of external investments, HTX Ventures continued to increase its investment layout in innovative projects in Q3. In July, HTX Ventures announced investments in Lombard and Redstone and participated in the EthCC event held in Brussels, sharing insights on "heavy staking development" and "how to successfully launch a Web3 ecosystem." In August, HTX Ventures further invested in Corn and Nexio strategically, and in September, HTX Ventures announced investments in Vanilla Finance and BSX, and released a research report titled "Exploring the BTCFI Rabbit Hole from the Perspective of Bitcoin's Programmability," which systematically discusses the potential and challenges of Bitcoin in the decentralized finance (BTCFI) field from the perspective of Bitcoin's programmability and evolution path.

Security upgrades, improved user satisfaction, and reserve fund ratio maintained at over 100%

Huobi HTX significantly improved account, trading, and fund security in Q3, with a cumulative 831,744 user reminders, the prevention of 16 counterfeit websites, interception of 9 transactions to fraudulent addresses, recovery of losses amounting to 127,531 USDT, addition of 9,990 blacklisted addresses, and interception of illegal recharges worth 1,249,876 USDT. Additionally, the customer service team achieved an 82% satisfaction rate, further demonstrating Huobi HTX's emphasis on user needs.

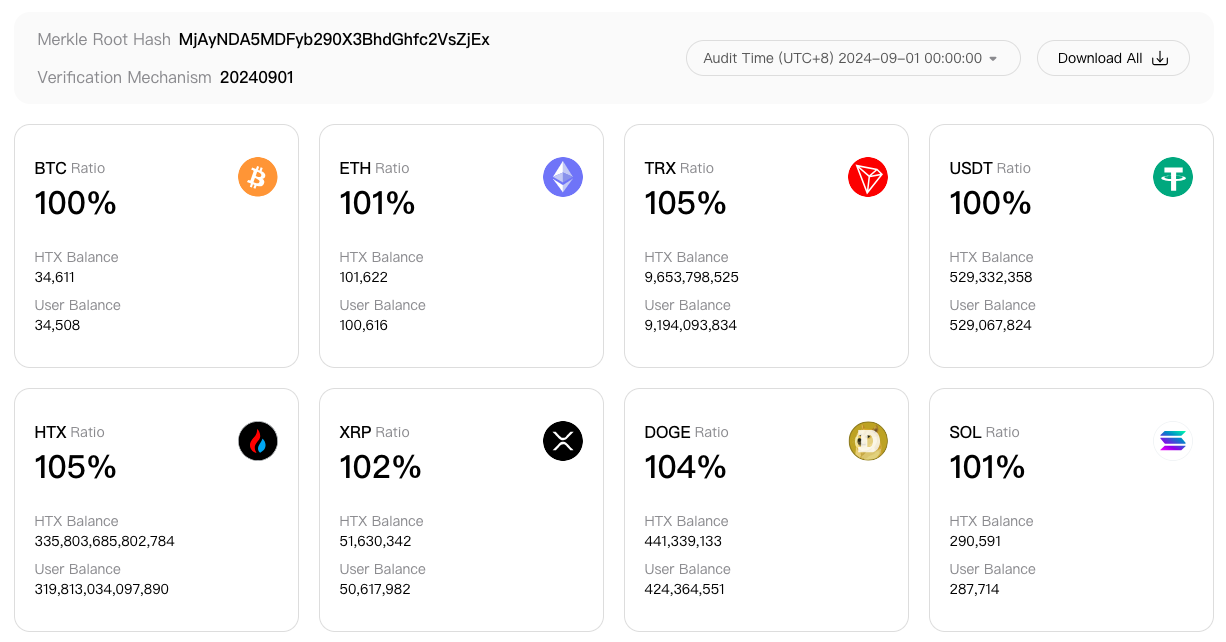

At the same time, Huobi HTX continued to maintain an adequate reserve fund in Q3. The asset proof data of the Merkle tree updated on September 1st showed that its reserve fund ratio remained at over 100%. The specific data is as follows: USDT 100%, BTC 100%, ETH 101%, HTX 105%, TRX 105%. Users can view the relevant reports through the official audit page, and Huobi HTX conducts regular audits to prove the adequacy of its assets.

In Q3 2024, Huobi HTX demonstrated strong development momentum in terms of user growth, new coin listings, and global market expansion. In the future, Huobi HTX will continue to focus on providing higher-quality products and services to create more value for users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。